UPSC Articles

ECONOMY

TOPIC: General Studies 3:

- Indian Economy and issues relating to planning, mobilization of resources, growth, development and employment.

Indian economy is losing its growth momentum (Part 2)

Daily Current Affairs IAS | UPSC Prelims and Mains Exam – 19th December 2019

Before reading this read part 1 : Link

| GDP = C + G + I + (NX)

In other words, four drivers determine a country’s GDP. These are: C – the total expenditure (demand) by private individuals G – the total expenditure (demand) by the Government I – the total expenditure (demand) on investments made businesses in the country NX – the net effect of imports and exports |

Derailed Indian economy in 2016 and 2017

| Two reasons & 4 Balance sheets problem

1. The unresolved TBS problem 2. The fall of NBFCs and the real estate sector Together, they make for the Four Balance Sheet Challenge for the Indian economy |

Reason for the failure of NBFCs : collapse of ILFS in 2018, with Rs 90,000 crores of debt

Reason 1 : NBFCs relied on raising short-term funds ,This leads to a situation called an asset-liability mismatch. For example, an NBFC raises money by selling 6-month debt papers and on-lends this as a car loan with a tenure of 5 years. This leads to a situation where the NBFC has to roll over (or renew) the 6-month debt paper or raise fresh loans to repay the debt paper. In good times, this happens as a matter of course. But when times are tough, this cycle is broken.

Reason 2 : The cycle was broken by a default of some firms of the IL&FS group. There were fears that this would turn out to be a contagion. Simply put, banks, mutual funds and their investors were afraid that more such entities wouldn’t default. As this fear took hold, many institutions refused to give money to NBFCs. The cost of funds rose by as much as 150 basis points for NBFCs.

Impacts of the NBFCs Failure on Indian economy :

- NBFCs are playing an increasingly important part in the economy. Their share of credit has increased because they were lending in sectors where banks refused to go or did not want to go.

- Now that NBFCs are finding it difficult to raise money or having to pay a huge cost for doing so, this will choke the flow of credit to the economy.

- It will hit the MSME sector which is already suffering from the twin blows of demonetisation and the goods and services tax.

- It will hit consumption demand in the economy( consumption was the primary engine driving the economy).

- A reduction in credit further adds to economic slowdown pressures, which are already visible.

- Slowdown in credit could lead to another pile of non-performing assets in sectors such as commercial real estate and infrastructure, which could have economy-wide knockdown effects

Real estate story:

- Builders launched numerous projects since the start of mid-2000s in the hope that these flats would be sold

- But after the Global Financial Crisis, the demand for flats as well as bank funding for builders collapsed.

- The NBFCs took the lead in lending to the real estate sector.

- By June-end 2019, the real estate sector reached a breaking point with close to 10 lakh unsold units (as against an annual demand of just 2 lakh units) in just the top 8 cities in the country.

- Real estate sector was unable to pay back to the NBFCs , which, in turn, started defaulting.

Conclusion:

- India’s GDP has been affected by different factors at different times.

- After Global Financial Crisis, private consumption bailed India out. However, this component – “C” – has become progressively weaker since 2017 and is today the main worry.

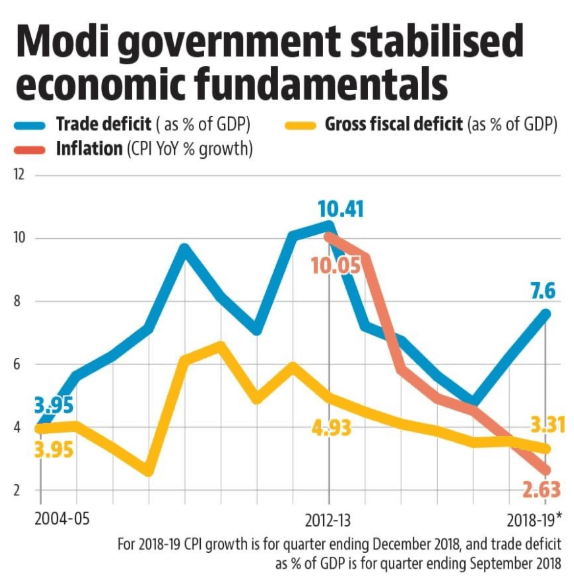

- G or government spending bailed out the GDP but at the cost of hiding the true fiscal deficit.

- The “I” or business investment component has been weak since the GFC

- sharp repo rate cuts and corporate tax cuts appear ineffective in the short term.

- The net exports or “NX” component has remained weak all through since the GFC

Connecting the dots:

- Do you think Demonetisation and GST contributed to Indian Economic distress?

- How do you think Indian economy can be recovered from the distress?