IASbaba's Daily Current Affairs Analysis, IASbaba's Daily Current Affairs May 2017, IASbaba's Daily News Analysis, Security, UPSC

IASbaba’s Daily Current Affairs – 16th May 2017

Archives

SECURITY

TOPIC:

General Studies 2

- Government policies and interventions for development in various sectors and issues arising out of their design and implementation.

General Studies 3

- Challenges to internal security through communication networks, role of media and social networking sites in internal security challenges;

- Basics of cyber security

Ransomware

Introduction

With technology increasingly becoming the global lifeline of government and businesses across it is important to build a safe network. It is further important to build a secure and rule based framework with across the board stakeholder consultation.

Ransomware

- Ransomware is a type of malware that prevents or limits users from accessing their system, either by locking the system’s screen or by locking the users’ files unless a ransom is paid.

- More modern ransomwarefamilies, collectively categorized as crypto-ransomware, encrypt certain file types on infected systems and forces users to pay the ransom through certain online payment methods to get a decrypt key.

- Ransom prices vary depending on the ransomware variant and the price or exchange rates of digital currencies.

- Thanks to the perceived anonymity offered by crypto currencies, ransomware operators commonly specify ransom payments in bitcoins.

- Recent ransomware variants have also listed alternative payment options such as iTunes and Amazon gift cards.

- It should be noted, however, that paying the ransom does not guarantee that users will get the decryption key or unlock tool required to regain access to the infected system or hostaged files.

Issue:

- The phenomenon that users of computers and researchers in cyber security were witness to from Friday, May 13 has raised many questions of vulnerability.

- It is comforting to know that by the afternoon of Monday, May 15, the speed of the attack was somewhat curtailed by counter-measures.

- But we still have to keep our fingers crossed for there is no knowing if the aggressors have more tools in their possession to cause further damage.

- The good news for us is that there are no reports of any major intrusion into computers or systems in India.

- What is abominable is that the criminals tampered with the systems of public health services — particularly the NHS of the UK.

Understanding:

The intrusion was a phishing attack — persuading a user to open a mail sent by a motivated intruder, an act which, on the face of it, appears to be from a genuine and authorised source, and the result of a malware (WannaCrypt 2.0) assembled, not at one place, but in several centres across the globe.

- A traditional modus operandi is to send a dubious link in a mail, which the recipient accesses.

- In the latest instance, however, it is said that the ‘explosive’ was in the form of an attachment, which an unwary user opened.

- In such a case, the immobilisation of a system is invariably caused by the encryption of files, folders and drives, and it takes a while for the victim to realise he/she has been attacked.

- The fears are subsequently confirmed by messages demanding a specified ransom for releasing the system.

- Launched by a group styled Shadow Brokers (whose exact identity is yet to be unravelled), the ransom demanded in each instance was $300 to be paid in Bitcoin — a digital currency which renders the beneficiary anonymous and is difficult to locate.

- One rough estimate is that the ransom-seekers will eventually net $1 billion, and that they have already received about $33,000 until the weekend.

- These are figures are dubious but we cannot ignore them as there is no means to cross-check.

Worrisome aspects

There are two aspects to the outrageous attack that are worrisome.

- The first is that the holes in the older version of Windows were known to Microsoft for quite some time, but it did not do much to patch them up, except for customers who paid to remove the deficiencies.

- Then there is the other theory that customers who were aware of the risk did not bother to act because of the costs involved and the problems related to adapting to upgrades.

Security Concern:

- Perhaps the graver of the revelations surfacing now is that the malware was possibly stolen from a stockpile of weapons which the National Security Agency (NSA) had built up over the years as a counter-offensive to cyber-attacks on the US and its allies by nations such as Russia, China and North Korea.

- Justifying this, certain sources allege that, since last summer, Shadow Brokers had started posting online certain tools they had stolen from the NSA ‘armoury’.

- This is a serious insinuation that, if proved, could trigger international condemnation of the US and its spy agencies.

- It revives memories of Stuxnet, a worm that both the US and Israel used against Iran’s nuclear programme more than five years ago.

- While there is no corroboration to the charge levelled against the NSA, it is interesting that a few former intelligence officers have taken the stand that the tools used in the latest episode were indeed from the NSA’s ‘Tailored Access Operations’

Remedies:

- The question is whether anything can be done to predict or prevent a similar attack.

- There is marked pessimism here. Repeated exhortation not to open attachments received from unknown sources has fallen on deaf ears.

- The advice to opt for complex passwords and exhortations not to share it with anyone has also met with the same fate.

Conclusion:

An eye for an eye will make the world blind was Gandhiji’s wise words. Country’s should tread a careful path especially in a field with such large implications. The only way is to minimize damage through encryption of vital, if not all the data in the hardware or system. There is no case for despair. But there is certainly one for prudence and caution in day-to-day handling of systems and data.

Connecting the dots:

- Cyber Space is a borderless world and so regulation is as difficult as the spread is. Elaborate on the threats and the counter measures in light of recent incidents.

ENVIRONMENT

TOPIC: General Studies 3:

- Environment and Ecology, Bio diversity – Conservation, environmental degradation, environmental impact assessment, Environment versus Development.

- Climate Change implications and mitigation strategies.

Carbon tax/Cap-and-tax: as a Climate Change mitigation policy

Introduction:

World stands today on the brink of a long-term anthropogenic and ecological change, caused mainly due to our own exploitation of the planet’s resources.

There is compelling evidence that there is a large chance of a global average temperature rise exceeding 2ºC by the end of this century.

Implications:

- Any such warming of the planet will lead to increased natural calamities such as floods and cyclones, declined crop yields and ecological degradation.

- A large increase in global temperatures correlates with an average 5% loss in global GDP, with poor countries suffering costs in excess of 10% of GDP.

Mitigation policy

- Global warming is the greatest environmental threat facing the planet and the simple truth is that if we do not act boldly and quickly these problems will only get much worse in the years to come. Averting a planetary disaster will require some major radical steps such as adopting a multilaterally coordinated imposition of a carbon tax as a potent mitigation policy, reducing greenhouse gas emissions, reducing burning of coal, oil and other fossil fuels.

- A global and immediate policy response is urgently required in the above mentioned areas.

- Climate Change Mitigation refers to efforts to reduce or prevent emission of greenhouse gases. Mitigation can mean using new technologies and renewable energies, making older equipment more energy efficient, or changing management practices or consumer behavior. It can be as complex as a plan for a new city, or as a simple as improvements to a cook stove design.

Concept of Carbon Tax

Pricing carbon emissions through a carbon fee is one of the most powerful incentives that governments have to encourage companies and households to pollute less by investing in cleaner technologies and adopting greener practices.

- A carbon tax is a way to make users of carbon fuels pay for the climate damage caused by releasing carbon dioxide into the atmosphere. If set high enough, it becomes a powerful monetary disincentive that motivates switches to clean energy across the economy, simply by making it more economically rewarding to move to non-carbon fuels and energy efficiency.

- A shift by households, businesses and industry to cleaner technologies increases the demand for energy-efficient products and helps spur innovation and investment in green solutions.

- Under this system, the price to pollute sets the strength of the economic signal and determines the extent to which green choices are encouraged. For example, a stronger price on emissions will lead to more investment in cleaner energy sources such as solar and wind power. And although a carbon fee makes polluting activities more expensive, it makes green technologies more affordable as the price signal increases over time. Most importantly, a carbon tax gets green solutions into use.

Therefore, carbon tax must be a central part of our strategy for dramatically reducing carbon pollution, a view shared by economists and ecologists.

Basically, a carbon tax would put a price on greenhouse gas emissions (GHG) to encourage a faster changeover to clean energy. This isn’t a new idea; carbon pricing programs have been around for decades.

For example, Sweden has used a carbon tax to reduce greenhouse gas emissions since 1991. Denmark instituted a carbon tax in 1992 and according a study, emissions per person in Denmark went down between 1990 and 2005 by 15 percent.

However, carbon tax regimes will only be effective if harmonised internationally. Different country-wise policies could lead to ‘carbon leakages’ where energy-intensive businesses will most likely move to less strict national regimes.

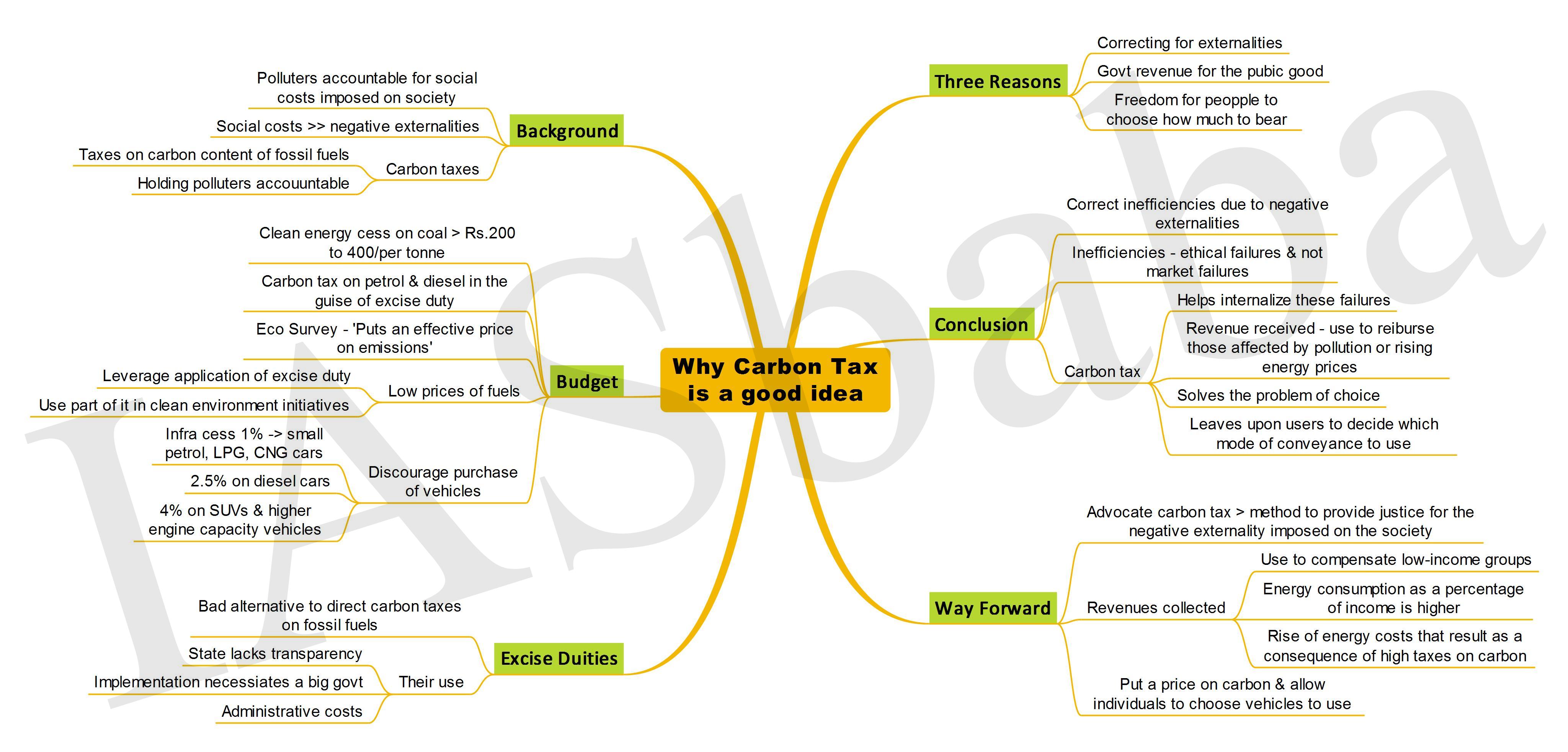

Why Carbon Tax is a good idea?

Link: http://iasbaba.com/wp-content/uploads/2016/03/Why-Carbon-Tax-is-a-good-idea-IASbaba.jpg

Advantages of harmonized carbon tax:

- A carbon tax regime avoids the problems related to choosing a baseline. In a price approach, the natural baseline is a zero carbon tax.

- A carbon tax policy will be better able to adapt to the element of uncertainty which pervades the science of climate change. Quantity limits on emissions are related to the stocks of greenhouse gas emissions, while the price limits are related to the flow of emissions.

- Quantity limiting policies are often accompanied by administrative arbitrariness and corruption through rent-seeking. This sends off negative signals to investors. In a price-based carbon tax, the investor has an assured long-term regulation to adapt to and can weigh in the costs involved.

- The most contentious issue in any international negotiation on climate change mitigation either at the level of the World Trade Organisation (WTO) or at the United Nations Framework Convention on Climate Change has been the issue of equity between high-income and low-income countries. The price-based approach in the form of carbon taxes makes it easier to implement such equity-based international adjustments than the quantity-based approach.

Challenges/issues:

- The political consensus in favour of a direct carbon tax will be difficult to achieve in low and middle income countries that have developmental priorities and lack the capacity to administer such regimes.

- A general tax on energy consumption combined with a technology-centric policy that promotes entrepreneurs and investors who develop low-energy intensive products can be a good starting point from where they can gradually move towards a direct carbon tax.

- Another near-term approach can be a ‘cap-and-tax’ which combines the strengths of both quantity and price approaches. Cap-and-tax might also address the concerns of environmentalists that a price-based approach does not impose hard constraints on emissions.

Cap-and-tax system:

In a cap-and-trade system, government puts a firm limit, or cap, on the overall level of carbon pollution from industry and reduces that cap year after year to reach a set pollution target. As the cap decreases each year, it cuts industry’s total greenhouse gas emissions to the limit set by regulation, and then forces polluters that exceed their emissions quota to buy unused quota from other companies.

The way ahead:

There is much discussion about whether a carbon tax or a cap-and-trade system is the best way to put a price on greenhouse gas pollution.

The simple answer is that it depends on how each system is designed. The design will determine the environmental and economic effectiveness. If both approaches are well-designed, the two options are quite similar and could even be used in tandem.

What’s important is that the price on carbon pollution provides an incentive for everyone, from industry to households, to be part of the solution. Ultimately, the critical factor in reducing heat-trapping emissions is the strength of the economic signal. A stronger carbon price will kick-start more growth in clean, renewable energy and will encourage adoption of greener practices.

Carbon taxes are the easiest and clearest way to reduce fossil fuel use and they also conform to the “free market” philosophy of minimal government interference and regulation. They also conform to two other norms: that people pay for the goods or services they want or need, and that The Polluter Pays.

Countries must negotiate and share policy experiences and researches in this area. They also must decide upon the appropriate forum to discuss and implement any such mitigation policy. The WTO could be the preferred forum, given the important nexus between international trade and climate change.

Connecting the dots:

- What is a carbon tax? Examine how carbon tax can give a fillip to Climate Change mitigation.

- Is there a need to incorporate carbon tax or cap-and-tax system in our climate change mitigation strategy? Discuss.

- What is a carbon tax? What are the problems faced by India in adopting a high carbon tax regime in India?

- ‘The future of climate change mitigation rests on successfully enacting comprehensive carbon tax or cap-and-tax system’. Do you agree? Examine.

MUST READ

Off the road: India cannot sit out B&RI

Triple talaq not fundamental to Islam

The ‘public’ in public health

Raja Mandala: The politics of territory

Letting Down The Law

Feeling blue

Is ‘Make in India’ beginning to bear fruit?

An evolving risk paradigm in the power sector

Is it time for a new Fiscal Responsibility Act?

Need for rational, constructive voices