UPSC Articles

Major stimulus package for MSMEs and other sectors announced

Part of: GS Prelims and GS-III – Economy

In News:

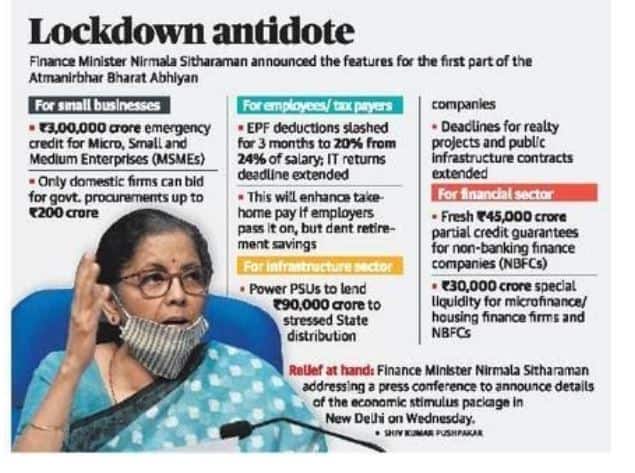

Several relief measures and packages were announced for MSMEs, salaried workers, contractors recently as part of Atma-Nirbhar Bharat Abhiyaan.

Key takeaways:

- ₹3 lakh crore collateral free loan schemes for businesses, especially MSMEs.

- For 2 lakh NPAs/stressed MSMEs, ₹20,000 crore as subordinate debt will be facilitated.

- A ₹50,000 crore equity infusion through an MSME fund of funds with a corpus of ₹10,000 crore.

- The definition of an MSME is being expanded to allow for higher investment limits and the introduction of turnover-based criteria.

For salaried workers and taxpayers

- Income tax returns for financial year 2019-20 have been extended with new due date being November 30, 2020.

- The rates of tax deduction at source (TDS) and tax collection at source (TCS) have been cut by 25% for the next year.

- Statutory provident fund (PF) payments have been reduced from 12% to 10% for both employers and employees for the next three months.

NBFCs, housing finance companies and microfinance institutions

- ₹30,000 crore investment scheme fully guaranteed by the Centre.

- Partial credit guarantee scheme worth ₹45,000 crore. First 20% of losses will be borne by the Centre.

- ₹90,000 crore liquidity injection

Contractors

- 6 month extension from all Central agencies

- Partial bank guarantees to ease cash flows

Registered real estate projects

- 6-month extension, with COVID-19 to be treated as a “force majeure” event

Employee Provident Fund

- EPF provided to low-income organised workers under the PMGKY will be extended for another three months.

- Mandatory EPF contributions are also being reduced from 12% to 10% for both employees and employers in all other establishments.

Important value additions:

Employee Provident Fund

- It is a scheme for providing a monetary benefit to all salaried individuals after their retirement.

Tax deduction at source (TDS)

- As per the Income Tax Act, any company or person making a payment, is required to deduct tax at source if the payment exceeds certain threshold limits.

Tax collection at source (TCS)

- It is the tax payable by a seller which he collects from the buyer at the time of sale.

Collateral

- It means a property or something valuable that one agrees to give to somebody if he/she cannot pay back money that he/she has borrowed.

Subordinate debt

- It is debt which ranks after other debts if a company falls into liquidation or bankruptcy.

- Such debt is referred to as ‘subordinate’, because the debt providers have subordinate status in relationship to the normal debt.

Statutory provident fund

- It is meant for employees of Government or Universities or Educational Institutes affiliated to University.

Equity

- It is the value of the shares issued by a company.

Image source: The Hindu