UPSC Articles

“Transparent Taxation — Honouring the Honest” platform

Part of: GS Prelims and Mains II and III – Govt policies and initiatives; Economy – Taxation

In news:

- “Transparent Taxation — Honouring the Honest” platform was launched recently.

- The platform provides faceless assessment, faceless appeal and a taxpayers’ charter.

Faceless Assessment:

- Under faceless assessment, the scrutiny of returns of a taxpayer will be done by a tax officer selected at random and not necessarily from the same jurisdiction.

- This will do away the need for any face-to-face contact between the taxpayer and tax official, thereby reducing the chances of coercion and rent-seeking.

- The move is expected to ease the compliance burden for assessees and reward the “honest taxpayer”, who plays a big role in nation-building.

- A faceless tax system would give the taxpayer confidence on fairness and fearlessness.

- It helps to maintain the privacy and confidentiality of income taxpayers.

- The assessment system seeks to eliminate corrupt practices by doing away with the territorial jurisdiction of income-tax offices.

Faceless appeal facility:

- This facility would be available to all citizens from September 25 (Deen Dayal Upadhyaya’s birth anniversary)

- A faceless appeal system would allow the taxpayer to appeal against a tax official’s decision without the need of making a physical representation.

Taxpayers’ charter

- The taxpayers’ charter was announced in the Union Budget for fiscal year 2020-21 by the Finance Minister.

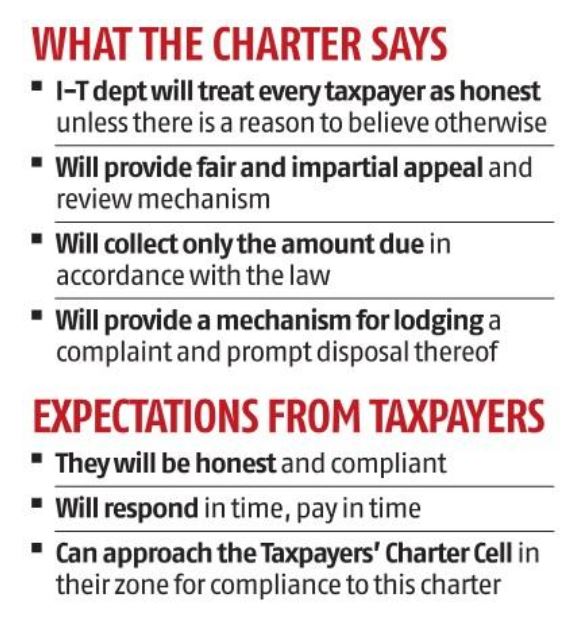

- The charter outlines the rights and duties of an honest taxpayer.

- It also defines the commitment of the tax department and the expectations from the taxpayers.

- It is a step towards bringing together rights and duties of the taxpayer and fixing the government’s responsibilities towards the taxpayer

Do you know?

- All these above reforms are likely to empower citizens by ensuring time-bound services by the Income Tax Department.

- PM appealed to those not paying taxes, despite having the ability, to come forward and commit themselves to the cause of making the country self-reliant.