UPSC Articles

Bangladesh approves currency swap facility to Sri Lanka

Part of: GS Prelims and GS-II – International Relations & GS-III – Economy

In news

- Bangladesh’s central bank has approved a $200 million currency swap facility to Sri Lanka.

- It will help Sri Lanka in its foreign exchange crisis.

Key takeaways

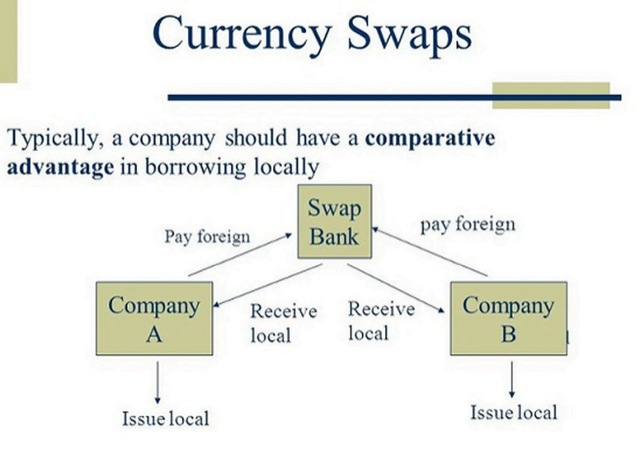

- A currency swap is effectively a loan that Bangladesh will give to Sri Lanka in dollars, with an agreement that the debt will be repaid with interest in Sri Lankan rupees.

- For Sri Lanka, this is cheaper than borrowing from the market.

- The period of the currency swap will be specified in the agreement.

- This may be the first time that Bangladesh is extending a helping hand to another country.

- It is also the first time that Sri Lanka is borrowing from a SAARC country other than India.

Sri Lanka didn’t approach India because

- India-Sri Lanka relations have been tense over Sri Lanka’s decision to cancel a valued container terminal project at Colombo Port.

- The arrangement was not extended.

- RBI has a framework under which it can offer credit swap facilities to SAARC countries within an overall corpus of $2 billion.

- The SAARC currency swap facility came into operation in November 2012.

Related articles