UPSC Articles

ECONOMY/ INTERNATIONAL

- GS-3: Indian Economy and issues relating to planning, mobilization, of resources, growth, development and employment.

- GS-2: Effect of policies and politics of developed and developing countries on India’s interests.

Rising Oil Prices and Stagflation

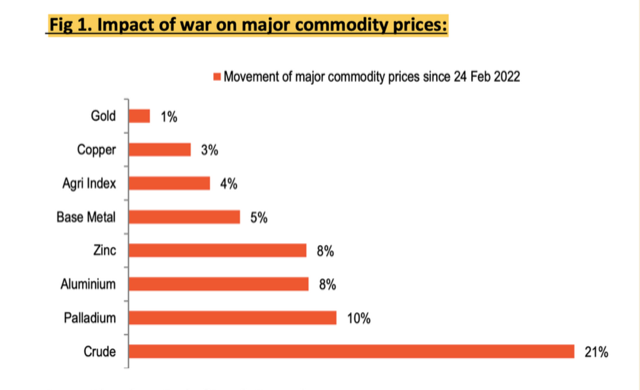

Context: Crude oil prices soared and touched almost $140 per barrel mark, which was around $70 a barrel in December

What is the main reason for increase in oil prices?

- The most immediate trigger for the spike is the decision by USA to ban the purchase of Russian oil in response to the invasion of Ukraine.

- Russia is the world’s second-largest oil producer and, as such, if its oil is kept out of the market because of sanctions, it will not only lead to prices spiking, but also mean they will stay that way for long.

How will India be affected due to rising Oil Prices?

- While India is not directly involved in the conflict, it will be badly affected if oil prices move higher and stay that way.

- India imports more than 84% of its total oil demand and increase in oil prices is going to increase our import bill further widening the Current Account Deficit.

- Rise in crude oil prices will lead to increase in Prices of Petrol & Diesel, if the government doesn’t cut its taxes.

- Higher petro & diesel prices will further increase inflation and raise the general price level (due to increase in transportation costs). A 10% increase in crude oil prices raises wholesale inflation by 0.9% and retail inflation by 0.5%.

- Higher inflation would rob Indians of their purchasing power, thus bringing down their overall demand.

- Private consumer demand is the biggest driver of growth in India, accounts for more than 55% of India’s total GDP.

- Currently, the biggest concern in India’s GDP growth story is the weak consumer demand. Higher prices will further weaken the demand & hurt our economic recovery prospects.

-

- Analysts have been revising their forecasts for India — down for growth (7.9% to 7.7%) and up for inflation (5.8% to 6.3%).

- Also, fewer goods and services being demanded will then disincentivise businesses from investing in new capacities, which, in turn, will exacerbate the unemployment crisis and lead to even lower incomes.

- One big fear is that such a sudden and sharp spike in oil prices may push a relatively vulnerable economy like India into stagflation.

What is stagflation?

- Stagflation is an economic condition of stagnant growth and persistently high inflation.

- Typically, rising inflation happens when an economy is booming — people are earning lots of money, demanding lots of goods and services and as a result, prices keep going up.

- When the demand is down by the reverse logic, prices tend to stagnate (or even fall).

- But stagflation is a condition where an economy experiences the worst of both worlds — the growth rate is largely stagnant (along with rising unemployment) and inflation is not only high but persistently so.

- The best-known case of stagflation is what happened in the early and mid-1970s. The OPEC (Organisation of Petroleum Exporting Countries), which works like a cartel, decided to cut crude oil supply. This sent oil prices soaring across the world; they were up by almost 70%.

- This sudden oil price shock not only raised inflation everywhere, especially in the western economies but also constrained their ability to produce, thus hampering their economic growth.

Is there a threat of stagflation in India due to rising Oil Prices?

- It cannot be denied that if oil prices stay high and for long, the inflation situation will worsen considerably and this would be coming after two years of already raised prices and reduced incomes.

- The other requirement is stalling growth and one of the indicator is unemployment. India is facing the most acute unemployment crisis it has seen in the past five decades

- So, yes, unlikely as it may be, it can be argued that we could be looking at stagflation in the near future.

Conclusion