Governance

In news: Govt commits Rs. 7,385 crores under Fund of Funds for Start-up India Investment scheme for 88 Alternative Investment Funds (AIFs) and 720 start-ups supported by AIFs.

- CAGR of over 21% since launch

- Valuation increases by more than 10 times

- Year on year surge of 100% in amount of drawdowns

- Investments into eligible start-ups is approximately 3.7 times of FFS disbursements; well above minimum stipulated 2 times under the Scheme

About:

- Fund of Funds for Start-ups (FFS) was launched under Start-up India initiative in 2016.

- Small Industries Development Bank of India (SIDBI) is responsible for operationalising the scheme. It has undertaken a series of reforms to expedite the drawdowns.

- Corpus of funds: FFS was announced with a corpus of Rs. 10,000 cr., to be built up

through budgetary support by DPIIT, Ministry of Commerce & Industry

- Methodology: FFS supports SEBI registered AIFs, which in turn invest in start-ups.

Significance:

- FFS has been playing a monumental role in mobilizing domestic capital in Indian start-up ecosystem.

- It has also played a catalytic role in terms of reducing dependence on foreign capital and encouraging home grown and new venture capital funds.

- Innovation created will remain within the country and facilitate generation of employment and creation of wealth.

- Unicorn status (valuation of over USD 1 billion) has been achieved by start-ups funded through FFS like Dunzo, CureFit, FreshToHome, Jumbotail, Unacademy, Uniphore, Vogo, Zostel,Zetwerk etc.,

About Alternative Investment Fund (AIF):

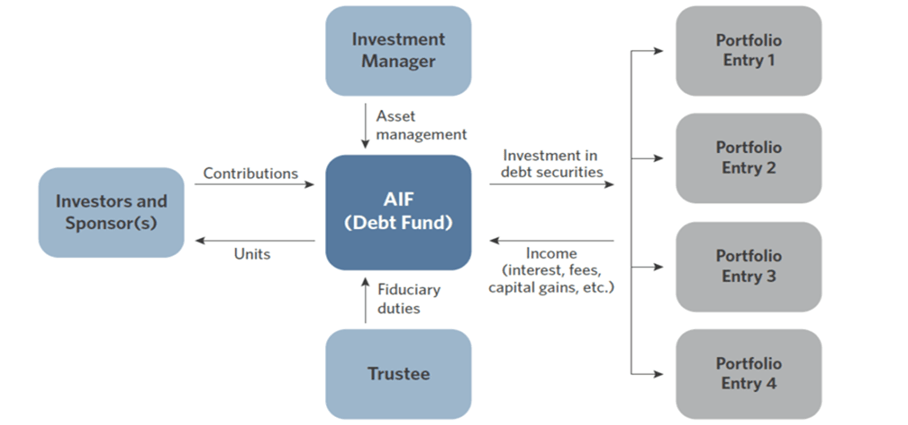

- It means any fund established or incorporated in India which is a privately pooled investment vehicle which collects funds from sophisticated investors, whether Indian or foreign, for investing it in accordance with a defined investment policy for the benefit of its investors.

- Applicants can seek registration as an AIF in one of the following categories,

- Category I AIF: Venture capital funds (Including Angel Funds), SME Funds, Social Venture Funds, Infrastructure funds

- Category II AIF

- Category III AIF

- Fund of Funds is an investment strategy of holding a portfolio of other investment funds rather than investing directly in stocks, bonds or other securities. In the context of AIFs, a Fund of Fund is an AIF which invest in another AIF.

Source: PIB

Previous Year Question

Q.1) What does venture capital mean? (2014)

- A short-term capital provided to industries

- A long-term start-up capital provided to new entrepreneurs

- Funds provided to industries at times of incurring losses

- Funds provided for replacement and renovation of industries