IASbaba's Daily Current Affairs Analysis

Archives

(PRELIMS Focus)

Category: Polity and Governance

Context:

- Recently, CCI took cognizance of information filed against IndiGo in the context of the recent flight disruptions witnessed in the aviation sector, across various routes.

About Competition Commission of India (CCI):

- Nature: The Competition Commission of India (CCI), constituted under the Competition Act, 2002 serves as India’s principal competition regulator.

- Establishment: It was officially formed on October 14, 2003, and it is operational since May 2009.

- Nodal ministry: It functions as a statutory body under the Ministry of Corporate Affairs.

- Headquarters: Its headquarters is located in New Delhi.

- Objective: The Competition Commission of India (CCI) was established in response to the economic liberalization of 1991, with a mandate to enforce competition laws, foster a competitive market, and prevent anti-competitive practices.

- Significance: Replacing the outdated MRTP Act of 1969, the CCI aligns India’s competition laws with global standards, following recommendations from the Raghavan Committee.

- Major focus area: It works for preventing anti-competitive agreements, curbing abuse of dominance, promoting healthy competition, safeguarding consumer interests, and ensuring freedom of trade.

- Composition: It comprises a Chairperson and six members appointed by the Central Government, ensuring diverse expertise essential for regulating market competition.

- Term: All members are appointed by the Central Government for a five-year term.

- Eligibility: Members must have at least 15 years of professional experience in areas like law, economics, or international trade.

- Recent Amendments: The Competition (Amendment) Act, 2023 introduced critical changes to address modern digital markets:

- Deal Value Threshold: Mandatory CCI approval for mergers with a transaction value exceeding ₹2,000 crore, specifically targeting “killer acquisitions” in tech.

- Global Turnover Penalties: Penalties for anti-competitive behavior can now be based on a company’s global turnover from all products/services, rather than just relevant domestic turnover.

- Settlement & Commitment: Allows companies under investigation to offer “settlements” or “commitments” to resolve cases faster without prolonged litigation.

- Leniency Plus: Encourages companies already disclosing one cartel to reveal another in exchange for additional penalty reductions.

Source:

Category: Science and Technology

Context:

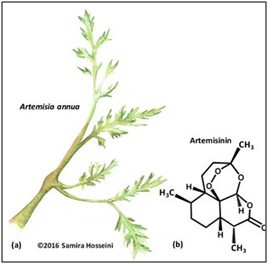

- A new study warns that heavy artemisinin use may trigger resistance hotspots, with resistance markers gradually increasing in parts of Africa.

About Artemisinin:

- Source: It is an antimalarial drug derived from the sweet wormwood plant, Artemisia annua. The process involves drying the leaves and using a solvent to extract the active ingredient.

- Discovery: It was discovered in the 1970s by Tu Youyou (China) as part of “Project 523.” She was awarded the Nobel Prize in Medicine (2015) for this discovery.

- Significance: It offered a new option when the malaria parasite was becoming resistant to older drugs like chloroquine and sulfadoxine-pyrimethamine. It is effective against all the malaria-causing protozoal organisms in the genus Plasmodium.

- Mechanism: It mainly targets the malaria parasite during the blood stage, disrupting the parasite’s ability to replicate within red blood cells. It helps significantly reduce the parasites but doesn’t stay in the body for a long time, being eliminated within hours.

- Derivatives: Its common derivatives include Artesunate (injectable for severe malaria), Artemether, and Dihydroartemisinin.

- Used as a combination drug: It is usually partnered with another drug that eliminates the remaining parasites over a longer period of time.

- Recommended by WHO: The World Health Organization (WHO) recommends artemisinin-based combination therapies (ACTs) as the go-to treatment for Plasmodium falciparum malaria.

Source:

Category: Defence and Security

Context:

- Recently. Indian Coast Guard (ICG) Ship ‘Amulya’, the third in the series of eight new-generation Adamya-class Fast Patrol Vessels, was commissioned in Goa.

About ICG Ship Amulya:

- Nature: It is the third in the series of eight new-generation Adamya-class Fast Patrol Vessels.

- Construction: It is designed and built indigenously by Goa Shipyard Limited (GSL).

- Indigenization: It features more than 60% indigenous content, aligning with the “Make in India” and Atmanirbhar Bharat missions.

- Location: It will be based at Paradip, Odisha, operating under the administrative and operational control of the Commander, Coast Guard Region (North East).

- Design: It integrates modern design philosophy focused on efficiency, endurance, and rapid response capability.

- Functions: It will undertake functions like surveillance, interdiction, Search & Rescue, anti-smuggling operations, and pollution response.

- Propulsion: It is powered by two 3000 KW advanced diesel engines.

- Speed: The ship delivers a top speed of 27 knots and an operational endurance of 1,500 nautical miles.

- Armaments: It is fitted with indigenous state-of-the-art weapons/systems, offering superior manoeuvrability, operational flexibility and enhanced performance at sea.

Source:

Category: Environment and Ecology

Context:

- Recently, a team of government officials visited the encroached areas of land earmarked for compensatory afforestation at Bura Chapori Wildlife Sanctuary.

About Bura Chapori Wildlife Sanctuary:

- Location: It is located on the southern bank of the river Brahmaputra in the Sonitpur district, Assam.

- Area: It covers an area of approximately 44 sq. km.

- Establishment: It was declared a Reserved Forest in 1974, upgraded to a Wildlife Sanctuary in 1995.

- Boundaries: It is located on the north side of Laokhowa Wildlife Sanctuary and shares an integral transboundary landscape of the Laokhowa-Burachapori Wildlife Sanctuary ecosystem.

- Connectivity: It acts as a wildlife corridor connecting Kaziranga and Orang National Parks.

- Buffer Zone: It was notified as a buffer zone of the Kaziranga Tiger Reserve in 2007, which helps in reducing human-wildlife conflict and supporting landscape-level conservation efforts.

- Flooding: Most of the low-lying areas of the sanctuary are vulnerable to flooding during summer.

- Significance: The sanctuary’s unique grassland habitat is vital for grassland-dependent species, especially the Bengal florican, whose global population is critically endangered.

- Flora: It is enveloped and adorned by wet alluvial grasslands, riparian, and semi-evergreen forests. Most of the plant species found here are of great commercial and medical value.

- Fauna: It is a habitat of a wide range of wild animals, including tigers, elephants, wild buffalos, one-horned rhinoceros, hog deer, and wild boar. The avian inhabitants feature species like the Bengal florican, black-necked stork, open-billed stork, white-eyed pochard, mallard, spotbill, large whistling teal, and numerous others.

Source:

Category: Government Schemes

Context:

- According to a report by the International Institute for Population Sciences (IIPS), Jiyo Parsi Scheme has been largely successful in reaching its intended population.

About Jiyo Parsi Scheme:

-

- Nodal Ministry: It is a unique Central Sector Scheme implemented by the Ministry of Minority Affairs for arresting the population decline of the Parsi Community.

- Launch: The scheme was launched in 2013-14.

- Objective: The objective of the scheme is to reverse the declining trend of the Parsi population by adopting a scientific protocol and structured interventions, stabilize their population, and to increase the population of Parsis in India.

- Eligibility: Assistance is tiered based on income. Medical aid is available for couples with an annual income of up to ₹30 lakh, while “Health of Community” benefits apply to those earning up to ₹15 lakh.

- Implementation: The Scheme will be implemented through the State Governments with the assistance of respective Parsi Institutions.

- Use of technology: Eligible Parsi couples would be provided financial assistance under the various components of the schemes through Direct Benefit Transfer (DBT) mode. The State Governments would get the necessary verification, including biometric authentication of all beneficiaries done.

- Components:

-

- Medical Component: to provide financial assistance for medical treatment under standard medical protocol.

- Health of the Community: To motivate Parsi Couples to have more children, financial assistance would be available to couples to take care of their dependent elderly family members and children.

- Advocacy: Enhancing support for Parsi couples with infertility and family-related concerns involves counselling sessions and outreach programmes i.e., seminars, medical camps, publicity brochures, advocacy films, etc.

Source:

(MAINS Focus)

(UPSC GS Paper II – Governance: Judiciary, Statutory bodies)

Context (Introduction)

Recent reportage on mounting delays in consumer courts, despite statutory timelines under the Consumer Protection Act, 2019, exposes deep structural and capacity constraints, raising concerns about access to justice for ordinary consumers.

Scale and Evidence of the Problem

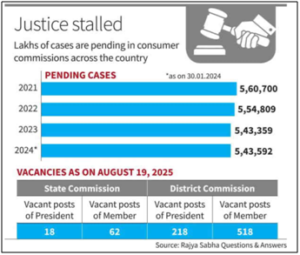

- High and Rising Pendency: As per data tabled by the Ministry of Consumer Affairs in Parliament, 5.43 lakh cases were pending before district, State and national consumer commissions as of January 30, 2024. In 2024, commissions received 1.73 lakh new cases but disposed of only 1.58 lakh, leading to a net addition of nearly 14,900 cases. The trend continued in 2025, with 78,031 fresh filings against 65,537 disposals till July.

- Statutory Timelines Routinely Breached: Section 38(7) of the Consumer Protection Act, 2019 mandates disposal within 3 months (no testing) and 5 months (with testing). Parliamentary answers and Law Commission observations indicate that a large proportion of cases exceed these limits, often stretching into multiple years.

- Human Cost of Delay: Empirical accounts from across States show elderly consumers, small entrepreneurs and rural litigants undertaking repeated long-distance travel to State and National Commissions, often without their matters being heard—transforming low-cost forums into endurance trials.

Structural and Administrative Causes

- Severe Vacancies in Consumer Commissions: As of August 19, 2025, official data shows 18 President posts and 62 Member posts vacant in State Commissions, and 218 Presidents and 518 Members vacant at the district level. The Parliamentary Standing Committee on Consumer Affairs has repeatedly flagged vacancies as the single largest contributor to pendency.

- Infrastructure and Capacity Constraints: CAG audits and departmental reviews have noted limited courtrooms, inadequate registry staff, and uneven implementation of digital case-management systems across States, restricting daily hearings and effective scheduling.

- Procedural Delays Despite Legal Bar: Although the Act discourages adjournments, non-service of notices, delayed affidavits, and repeated requests for additional evidence are routinely allowed. The Department of Consumer Affairs has acknowledged that procedural laxity accounts for a significant share of adjournments.

- Complexity of Modern Consumer Disputes: Insurance claims, medical negligence, financial services and e-commerce disputes require technical expertise. Studies by consumer rights groups highlight that absence of subject-matter specialists forces commissions to seek expert reports, prolonging adjudication.

- Appeal-Driven Backlog: The three-tier structure (District–State–National) allows easy escalation. NCDRC annual reports show a substantial proportion of cases are appeals rather than original complaints, compounding pendency at higher forums.

Governance and Economic Implications

- Erosion of Consumer Confidence: OECD and World Bank consumer policy studies underline that delayed redress weakens market discipline and incentivises unfair trade practices.

- Access to Justice Deficit: Delays disproportionately affect the elderly, informal workers and small entrepreneurs, undermining substantive equality and Article 21’s guarantee of timely justice.

- Impact on Ease of Doing Business: Effective consumer dispute resolution is a key component of contract enforcement and market trust. Chronic delays raise transaction costs and legal uncertainty.

Existing Measures and Their Limits

- E-Daakhil Portal and Virtual Hearings: While digital filing has expanded access, government reviews note uneven digital literacy, infrastructure gaps and hybrid hearing delays limiting impact.

- Legal Provisions Without Enforcement: Statutory timelines and adjournment restrictions exist, but lack of monitoring and accountability mechanisms weakens compliance.

Way Forward

- Time-Bound Filling of Vacancies: Adopt a statutory appointment calendar with central monitoring, as recommended by Parliamentary Committees.

- Capacity and Infrastructure Augmentation: Increase number of benches, registry staff and full-scale digital case-flow management systems, drawing from e-Courts Phase III experience.

- Specialisation and Expert Panels: Create domain-specific benches or accredited expert panels to fast-track technically complex disputes.

- Adjournment Accountability: Mandate written reasons and introduce cost penalties for unwarranted delays, strictly enforcing Section 38 of the Act.

- Appeal Rationalisation: Introduce leave-to-appeal or higher monetary thresholds to reduce frivolous escalation.

- Regional Benches of National Commission: Decentralise the National Consumer Disputes Redressal Commission to reduce litigant travel costs and pendency.

Conclusion

Despite a progressive legal framework, consumer courts are constrained by vacancies, infrastructure deficits and procedural laxity. Data-driven reforms focused on capacity, accountability and specialisation are essential to restore the promise of speedy, affordable consumer justice.

Mains Question

- Despite statutory timelines under the Consumer Protection Act, 2019, consumer courts in India suffer from chronic delays. Analyse the causes of pendency and suggest reforms to ensure speedy consumer justice.(250 words, 15 marks)

Source: The Hindu

(UPSC GS Paper III – Indian Economy: Growth, Investment, Capital Formation)

Context (Introduction)

Despite India recording GDP growth of over 8%, private corporate investment has remained stagnant for more than a decade. Recent analyses highlight that firms are deleveraging and holding financial assets rather than expanding production capacity.

Current Status of Private Investment in India

- Persistent Stagnation in Private Capex: Private corporate investment has hovered around 12% of GDP since 2011–12, according to JP Morgan estimates, showing little responsiveness even during high-growth phases.

- Declining Share in Total Investment: Private sector’s share in Gross Fixed Capital Formation (GFCF) declined to 34.4% in 2023–24, the lowest since 2011–12, even as overall GFCF recovered to 33.7% of GDP in 2024–25.

- Mixed Signals from Alternative Indicators: CareEdge Ratings reports that capex of nearly 2,000 listed non-financial firms rose 11% in 2024–25 to ₹9.4 trillion. However, the Statistics Ministry’s private capex survey shows investment intentions for 2025–26 falling 26%, reflecting weak forward confidence.

- Capacity Underutilisation: The Reserve Bank of India reports manufacturing capacity utilisation struggling to cross 75%, the level considered necessary for fresh investment. Since 2012–13, this threshold was exceeded in only 10 of 53 quarters.

Reasons for Subdued Private Investment

- Excess Capacity and Demand Uncertainty: With existing facilities underutilised, firms see little rationale for expansion. Consumption growth remains uneven, while exports face global slowdown and trade uncertainties.

- Financialisation of Corporate Balance Sheets: A National Institute of Public Finance and Policy study shows that for BSE 500 companies, financial investments accounted for nearly 25% of total assets by 2025, indicating preference for cash and financial assets over physical capex.

- Deleveraging and Risk Aversion: According to Bank of Baroda, the interest coverage ratio of over 3,000 non-financial firms rose from 2.6 in 2020–21 to 5.97 in H1 2025–26, signalling stronger balance sheets but also heightened caution.

- Cost and Regulatory Constraints: The Federation of Indian Chambers of Commerce & Industry cites high land prices, raw material costs, lengthy approvals, non-tariff barriers, and access constraints to advanced machinery as key deterrents.

- Policy and Global Uncertainty: Geopolitical tensions, supply-chain reconfiguration, and shifting trade policies increase uncertainty for long-gestation private investments.

Government Measures to Attract Private Investment

- Corporate Tax Reforms: Reduction of corporate tax to 22% (15% for new manufacturing units) to improve post-tax returns on investment.

- Public Capital Expenditure Push: Central government capex has more than tripled since 2019, aimed at crowding in private investment through infrastructure creation.

- Production Linked Incentive (PLI) Schemes: Covering 14 sectors, PLI aims to reduce risk and improve scale economies, particularly in electronics, pharmaceuticals, and renewables.

- Ease of Doing Business and Financial Reforms: GST implementation, Insolvency and Bankruptcy Code, digitised approvals, and bank recapitalisation to improve credit flow.

- Trade and Manufacturing Support: Logistics reforms, industrial corridor development, and targeted trade agreements to support export-oriented private investment.

Way Forward

- Boost Demand and Capacity Utilisation: Sustain consumption growth through employment generation, rural income support, and urban wage growth.

- Enhance Policy Certainty: Stable tax regimes, predictable regulation, and faster dispute resolution to reduce investor uncertainty.

- Factor Market Reforms: Easier land access, labour flexibility, and time-bound environmental clearances.

- Deepen Global Value Chain Integration: Trade facilitation and export competitiveness to create assured demand for private manufacturers.

- Risk-Sharing and MSME Support: Expand credit guarantees, blended finance, and development finance institutions to de-risk private investment.

Conclusion

India’s growth momentum cannot be sustained without a revival in private investment. Strong corporate balance sheets must translate into capacity expansion, driven by demand revival, policy certainty and structural reforms.

Mains Question

- Despite high GDP growth, private investment in India remains subdued. Analyse its current status, underlying causes, and evaluate government measures to revive private capex. Suggest a way forward.(250 words, 15 marks)

Source: Indian Express