IASbaba's Daily Current Affairs Analysis, IASbaba's Daily Current Affairs June 2016, National, UPSC

Archives

IASbaba’s Daily Current Affairs – 30th June, 2016

NATIONAL

TOPIC: General studies 2

- Governance, Polity, Rural Development, Local Self Government and related issues

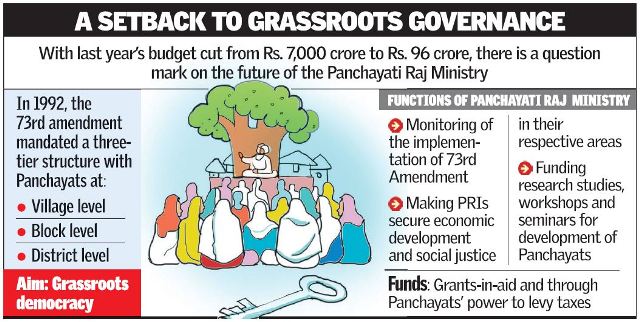

Parched Panchayati Raj Ministry on verge of closure

The future of the Panchayati Raj Ministry under the NDA regime continues to look bleak.

(Reasons)

- Panchayati Raj Ministry faced a massive budget cut last year: These cuts left such an impact on the Ministry that it lost confidence in empowering panchayats nationwide.

- Reduced mandate: In view of the budget cuts, the Ministry recently “realigned” its mandate from financing panchayats to capacity-building and training.

- Two of its key programmes — the Backward Regions Grants Fund (BRGF) and the Rajiv Gandhi Panchayat Sashaktikaran Abhiyan (RGPSA) — were shuttered.

- The Ministry’s role has been reduced to a mere advisory or advocacy group.

Several officials at the Ministry feel that the Panchayati Raj Ministry would soon be closed down and turned into a department under the Ministry of Rural Development.

Background:

- It was during the Congress regime (over a decade ago), under the then Panchayati Raj Minister Mani Shankar Aiyar, the new Panchayati Raj Ministry was formed.

- In the UPA-I and UPA-II regimes, since the Ministry was well-funded with BRGF and Rajiv Gandhi Panchayat Sashaktikaran Abhiyan schemes, it was able to address district-wise inequality, pumping money into the panchayats of the backward ones, helping them build panchayat ghars (offices) and training the functionaries in drafting annual plans to increase their upward mobility.

- There were plans to hire junior-level engineers and data entry operators in panchayats to turn all the panchayats e-governance friendly. But with the budget cuts, everything has come to a standstill.

- The Ministry has recently “realigned” its mandate from financing panchayats to capacity-building and training.

- The centre also rolled back the BRGF scheme because it asked state government to “increase their own funding resources” to empower Panchayats.

Congress leaders criticized the BJP’s intention to turn the ministry into a department, and alleged that by recent cuts and government unable to utilize huge funds for the promotion of Panchayats, the NDA is killing the Panchayati Raj institution.

A de-democratising move

Panchayati Raj Ministry took various initiatives for strengthening panchayat empowerment.

- One among them was the ‘Index of Devolution’ – This index was prepared by independent experts and was geared towards rewarding States that over the previous year had made the most incremental progress towards more effective devolution in terms of the Constitution and their own State legislation.

- Many States that had been slow starters, including Bihar, Tripura, Chhattisgarh, Haryana, and Rajasthan, found their scores rising and were appropriately recognised.

However, recently there are several de-democratizing moves:

- Gujarat ran a system under which democracy at the village level was discouraged by financially incentivising panchayats elected without contest.

- Rajasthan, and now Haryana, have followed suit by placing regressive restrictions on less educated and poorer candidates, particularly Dalit women, from even contesting panchayat elections.

This de-democratisation of local self-government will be aggravated if a Cabinet Minister for Panchayati Raj is not available to advocate and promote the cause with Chief Ministers and his counterparts in the States.

In addition, the 73rd amendment, incorporated as part IX of the Constitution, is the joint responsibility of the Union and the States, calls for high-level coordination to promote and protect the provisions of the longest and most detailed amendment ever carried out to the Constitution.

Importance of the 73rd Amendment

It was passed virtually unanimously in December 1992 as representing the consensus among Central and State stakeholders. This consensual method must be persisted with by

- bringing State ministers together;

- convening academic experts and field-level NGOs;

- promoting feedback from and best practices among elected panchayat representatives;

- monitoring the special interests of women representatives, Dalits and tribals;

- maintaining and updating data-banks on all aspects of panchayat raj;

- commissioning expert studies and preparing periodic reports such as the biannual State of the Panchayats reports

These are among the key activities undertaken by the Ministry.

Providing such an all-India perspective will be seriously diluted or even entirely lost without an independent Ministry for the subject.

Moreover, merging or subordinating panchayat raj under rural development amounts to a grossly inadequate reading of the Constitution, in particular the Eleventh Schedule that lists the proposed jurisdiction (“powers, authority and responsibilities”) of national-level panchayati raj.

The constitutional mandate

The Eleventh Schedule contains a wide range of entries, covers virtually the entire gamut of development and welfare in rural India ranging from schemes such as –

- MGNREGA, rural housing, NRLM, Pradhan Mantri Gram Sadak Yojana to agriculture, including agricultural extension and also animal husbandry, dairying and poultry and fisheries – that are the responsibility of the Agriculture Ministry

- Minor irrigation, water management and watershed development – that falls under the Ministry of Water Resources

- Social forestry and farm forestry, minor forest produce – that jointly concern the Ministry of Environment, Forest and Climate Change and the Ministry of Tribal Affairs

- Drinking water, sanitation including the much-hyped Swachh Bharat Abhiyan, are the responsibility of the Ministry of Drinking Water and Sanitation

- The Eleventh Schedule goes on to detail small scale industries, including food processing industries and khadi, village and cottage industries that fall respectively under the Ministry of Micro, Small and Medium Enterprises, the Ministry of Food Processing Industries and the Ministry of Textiles

- Likewise, the 11th schedule also covers wide entries that belong to Ministries such as – Ministry of Health and Family Welfare, Human Resource Development Ministry, Ministry of Skill Development and Entrepreneurship, Ministry of Culture, Ministry of Social Welfare and the Ministry of Tribal Affairs, Ministry of Food and Public Distribution etc

Conclusion:

- With such a wide constitutional remit, confining panchayati raj to just the Ministry of Rural Development will be a conceptual infringement, an emasculation of the constitutional role envisaged for panchayati raj institutions.

- What the 73rd amendment sought to do was a radical reorganisation of last-mile delivery of public goods and services to the panchayats by devolving “such powers and authority as may be necessary to enable them to function as institutions of self-government” (Article 243G).

- Note, “self-government” not “self-governance”: the fundamental mandate was to establish the panchayati raj system as the third tier of government, not to make these institutions implementing agencies for State departments or Union Ministries. This was to be achieved by endowing these “institutions of self-government” with the required functions, finances and functionaries (the three Fs).

- Quietly, considerable progress has been made in the last 25 years. Panchayati raj has been made ineluctable, irremovable and irreversible, but much remains to be accomplished. To disrupt the process by downgrading the Ministry of Panchayati Raj and making it an adjunct of some other Ministry would be the most retrograde step in democratic decentralisation in over a quarter century.

Connecting the dots:

- There have been recent efforts to close down the Panchayati Raj Ministry and turn it into a department under the Ministry of Rural Development. Can this approach to grass-roots democracy result in grass-roots development? Critically comment.

- Off recently, there are allegations that Panchayati Raj Ministry is on verge of closure. Discuss the reasons which have made it a bleak and weak Ministry. What efforts can be taken to rescue the Ministry from dissolution?

ECONOMICS

TOPIC: General Studies 3

- Indian Economy and issues relating to planning, mobilization of resources, growth, development and employment.

7th Pay Commission—Hit’s & Misses

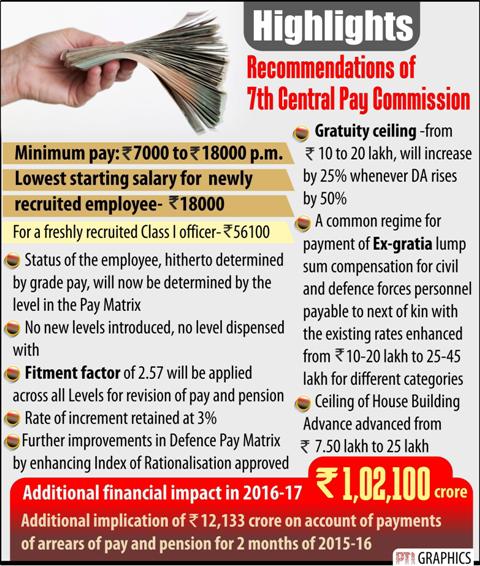

Recommendation: A 23.55 per cent increase in overall emoluments for employees

- The hike — at around 14 per cent — is the lowest in 70 years

- Estimated to put an additional burden of Rs. 1.02 lakh crore on the exchequer annually or nearly 0.7 per cent of GDP

Is this trend welcome— Yes; Would limit the inflationary impact of the pay revisions— The 6th Pay Commission had recommended a hike of 20 per cent which was doubled by the time it was implemented and eventually amounted to about 54 per cent. It was immediately followed by a period of higher expenditure and higher inflation

Other recommendations:

- Minimum Pay: Based on the Aykroyd formula, the minimum pay in government is recommended to be set at Rs 18,000 per month

- The Commission recommends abolishing 52 allowances; another 36 allowances subsumed in existing allowances or in newly proposed allowances

- One Rank One Pension proposed for civilian government employees on line of OROP for armed forces

- Ceiling of gratuity enhanced from Rs 10 lakh to Rs 20 lakh; ceiling on gratuity to be raised by 25 percent whenever DA rises by 50 percent

- Military Service Pay (MSP), which is a compensation for the various aspects of military service, will be admissible to the defence forces personnel only

- Short service commissioned officers will be allowed to exit the armed forces at any point in time between 7 to 10 years of service

- New Pay Structure: With a view to bring in greater transparency, the present system of pay bands and grade pay has been dispensed with and a new pay matrix has been designed. Grade Pay has been subsumed in the pay matrix. The status of the employee, hitherto determined by grade pay, will now be determined by the level in the pay matrix.

More money in the hands of people—

- Lead to more money in the hands of the consumers— huge consumption boost to the economy (around Rs 45,000 crore or 0.3 per cent of GDP)

- There will also be an increase in the growth rate of household savings— welcome in a year when bank deposits have touched a 53-year low and the impending FCNR (B) redemptions could also lead to outflows from banks in September (an increase of around Rs 30,000 crore or 0.2 per cent of GDP)

- Growth in—

- Will have a positive impact on stock markets

- Consumption growth: urban demand will spur after implementation and this will increase demand for discretionary products (consumer products)

Inflation— Will have a relatively mild impact on the overall inflation

- Retail inflation & global oil prices— may start inching up

- Consumer price inflation may inch up due to higher prices of services, but impact on wholesale price index is likely to be muted due to the counter balance provided by the deflation in commodity prices and the availability of excess capacity in several manufacturing sectors. (new consumer price index being different than its predecessors)

- Demand push inflation could definitely occur when there is too much money chasing not much supply because factories are not producing more. But the over-capacity because of lack of demand and the capacity utilisation being around 70 per cent provide a major cushioning effect. A rise in demand is likely to not only increase capacity utilisation but may also help revive the investment cycle earlier than expected

Fiscal Deficit—

- Will have an impact on the fiscal deficit for the current financial year— the hike in emoluments will be effective from January 2016 and all arrears will be paid out in the current year itself.

- To meet the fiscal deficit targets: Compromise on the capital expenditure (which is important to promote growth)

- There will be an increase in tax revenue from more income tax collection (due to higher salaries) and excise duty collections – or GST– from increased consumption

Find out:

- Constituents of Capital Expenditure

- What do you mean by fiscal deficit & read up on types of fiscal deficit, if any.

- What is the time-period of pay commission revisions?

- Do all state governments follow the Central Pay Commission recommendations?

- What do you mean by Inflation and Deflation?

- Differences between CPI & WPI?

MUST READ

Mutual funds in India need a Jan Dhan moment

Supreme Court cannot exercise power of pardon vested with President, Governor

Explosive trail mail

Why we need to talk about a basic income

Related Articles:

Waging a minimum wage battle in the labour market

Crime and economics

The right remedy

Time has come for ‘Move India’

Related Articles:

Goods and Service Tax (GST) Logjam: GST by another name

The Big Picture – GST Bill: Why is it Still Not Passed?