IASbaba's Daily Current Affairs Analysis, IASbaba's Daily Current Affairs June 2016, National, UPSC

Archives

IASbaba’s Daily Current Affairs – 21st June, 2016

ECONOMICS

TOPIC:

General studies 2

- Government policies and interventions for development in various sectors and issues arising out of their design and implementation.

- Issues relating to development and management of Social Sector or Services relating to Health, Education, Human Resources

General studies 3

- Indian Economy and issues relating to planning, mobilization of resources, growth, development and employment

The India Labour and Employment Report 2016

Indian labour market—

Organized Sector (only 17% of total employment):

- Regular formal employment (9%): Contractual, with full protection of labour rights, high wages and perks

- Regular but informal employment: No full contractual protection of labour rights and lower wages

- Casual employment: Higher underemployment or fewer days of actual available work per worker

(Can you identify the segregation both in the unorganised as well as across different sectors in the economy?)

Statistically:

- Self-employment, and casual wage employment, the bottom layers of the labour market, still account for 78% of total employment

- Low-productivity employment in agriculture still accounts for 43% of total employment

- High incidence of underemployment

- High incidence of poverty— India still accounts for the largest number of the world’s poor in absolute numbers.

Unemployment number:

- 13 million people in the workforce, available for work but presently unemployed—30% of them women

- 52 million people, 65% of them women— “disguised unemployment”

- 52 million, all women, who are not in the labour force but would be available for work if there were adequate opportunities for productive employment

- 117 million people, 78% of them women— need to be absorbed into new and more productive jobs

- 6-8 million young people who will be entering the labour force each year for the next decade

Significant improvement in the employment conditions

High growth elasticity of employment at 0.7

- Aggressive growth of employment in the organized sector

- Movement to better-quality jobs: from informal to formal, casual to regular, and from the unorganized sector to the organized sector

- Rise in real wages

- Decrease in underemployment— faster rise in income per worker than real wages, (lowered poverty incidence)

- Rise in productivity (all sectors—faster in the unorganized sector)

- Decline in the dualism—the differences in productivity and real wages between the organized and unorganized sectors

Demolition of myths and misconceptions

- Presence in the labour force of the country

- The labour force participation rate (LFPR) measures the proportion of people in the working-age group who are actually available for work

- Not all people in the working age population are in the labour force— At present (2015-16) India has a stock of 511 million workers—

- 38 million subsidiary (part-time) workers

- 39 million elderly workers

- About 2 million child workers

- But core workforce of 433 million— 22% are women

- Rate of labour force growth

The stock is growing at 1.5% per year, adding about 5.5 million people to the workforce every year (lower than the growth rate witnessed at the end of the 20th century)—

- Declining population since 1980s

- Declining incidences of child labour & the elderly

- Drop in labour force participation in the working-age group among women

- Increasing preference of higher education in men

- Declining poverty is leading to less number of women and child labour to become a part of the country’s labour

3. Decline in the women’s labour force participation (lowest in the world)

Trend:

- Declined the most among the poorest households & illiterate/least educated (decline in poverty—no need to take up jobs that are not paid properly and are least in quality)

- Increased in the case of better-off households & with higher levels of education

4. Rise in the Dependency Ratio— No demographic dividend

- Increase in the share of the young in the working-age population

- Decline in the share of the young who are actually in the workforce

(Henceforth, we are providing a list of initiatives to ‘READ UP’— will be useful for preparation from Prelims P.O.V)

Policy Suggestions—

- India’s growth has to be led by manufacturing, not services

- Employment elasticity is higher in manufacturing

- Lack of education in a large section of the labour force

- Difficulty in skilling them— lack of basic education

- Easy absorption in low-skill jobs in the manufacturing sector

- Urgency of education policy reform

- An underlying foundation of basic education is important for any kind of job as well as skilling people

- Compromised quality of education at the primary level limits the access to basic education

Read up: Digital Gender Atlas, National Scholarship Portal, Beti Bachao Beti Padhao, No detention Policy, Geeta Bhukkal Committee Report, Devnani Committee Report

- Need for Vocational Education

- Effective way of developing skills for improving the employability of the population

- Shatter the perception of vocational education being a low-paying and not a respectable job

Read up: NSDC, NSQF, NSDM, STAR Scheme, NAP for skill training, ITE concept of vocational training, PMKVY, DDU-GKY

- Reforms in the Labour Market

- To catalyse job creation and ensuring ease of doing business in the country

- Promote compliance; multiplicity of it is the largest impediment of industrial development

- Safeguard safety, health and social security of all workers

- To break the cycle of distress— labour-intensive industrialization

Read up: The Payment of Bonus (Amendment) Act 2015, National Career Services Portal, Shram Suvidha Portal, Universal Account Number, Pradhan Mantri Rojgar Protsahan Yojana, Changes in the Minimum Wages to contract workers & Contract Labour Act, National Social Security Authority, Release methodology of Employment Data, Industrial Relations Bill, Bonus Act, Child Labour (Protection and Regulation) Amendment Bill, The Small Factories (Regulation of Employment and Conditions of Services) Bill

Connecting the Dots:

- Discuss the reasons behind low LFPR. What has the Indian government done to arrest the same?

- What are the serious impediments that bleak the possibility of a proper labour framework to be developed for India? Suggest the way ahead

Must Read:

Women at Work

http://iasbaba.com/2016/01/iasbabas-daily-current-affairs-14th-january-2016/

http://iasbaba.com/wp-content/uploads/2016/04/Unemployment-Stagnant-Economy-IASBaba.jpg

NATIONAL

TOPIC: General Studies 2

- Issues and challenges pertaining to the federal structure, devolution of powers and finances up to local levels and challenges therein.

- Statutory, regulatory and various quasi-judicial bodies

- Important aspects of governance, transparency and accountability

Local Self Government: The true devolution of power

The desire of Maharashtra government to be in the forefront among business friendly states (8th in World bank’s ranking) to implement central government’s big ticket schemes (Smart cities, AMRUT, Housing for all etc.,) has come at the expense of constitutional responsibility to strengthen local governance.

- The State’s priorities towards the implementation these schemes demands greater revenue generation and sustained efforts for overall improvement from its urban local bodies and Panchayat raj institutions.

- In this endeavour state government has taken away the PRIs and ULBs key sources of income (local body tax and Octroi) for business reasons.

Persisting problems with the local bodies

- Inefficient civic services of ULBs and PRIs have discouraged citizens from paying taxes on time. And the government has done very little to improve the quality of basic services.

- ULBs and PRIs heavily dependent on government for revenue receipts owing to the slow growth in their own revenues and increased liabilities.

- Instead of pushing the local bodies towards the road map of growth laid out by FFC, the state has been rendered a mere guarantor to banks and central agencies on behalf of them.

Hence, it is unfair to expect the ill-equipped local bodies to rise to the occasion and support major urban schemes launched by union government.

Reasons for the current state of local bodies

- The state government has failed to put safeguards against misuse of funds in PRIs.

- A weak city and village level leadership (Political and bureaucratic) has led to little/no accountability in the amount spending over the years.

- Both Urban and rural development departments have failed to collect utilization certificates. This indicates – the funds are just lying in the bank accounts or have been misused.

- Ignored the horizontal devolution formula recommended by FFC

- The state machinery is reluctant to pass on its powers to ‘Purchase’ at the micro level, while it continues to suffer from an obsession to procure goods and services at every possible opportunity.

Finance commission (FC) recommends ‘the measures needed to augment the Consolidated Fund of a State to supplement the resources of the Panchayats and Municipalities in the state.

The FCs horizontal devolution formula takes into account the population, size and geography of urban and rural areas while making budgetary provisions for local bodies.

14th FC recommendations

- FFC has recommended distribution of grants to States for local bodies using 2011 population data with weight of 90% and area with weight of 10%.

- The grants to States will be divided into two, a grant to duly constituted Gram Panchayats and a grant to duly constituted Municipal bodies, on the basis of rural and urban population.

- It recommends grants in two parts; a basic grant, and a performance grant, for duly constituted Gram Panchayats and municipalities.

- The ratio of basic to performance grant is 90:10 with respect to Panchayats and 80:20 with respect to Municipalities.

The top down approach to push schemes without laying foundation for them goes against the spirit of 74th Constitutional Amendment.

Way ahead:

For greater and better participation of ULBs and PRIs in central schemes,

- Their powers and responsibilities must be strengthened.

- All the existing multiple legislations should be brought under one act.

- Bring greater accountability in spending at village and panchayat level.

- Facilitate the ease of procurement at lowest levels.

- State must fully and effectively devolve funds and functions to local bodies, even if this means giving up on its all-important power to procure and purchase. This will mean true devolution of power.

- Implement the finance commission’s recommendations.

Finance commission:

- Article 280; Quasi-Judicial body; Chairman+4 members; Constituted once in 5 years; Submits report to President.

- Recommends the distribution of the net proceeds of taxes of the Union between the Union and the States (vertical devolution); and the allocation between the States of the respective shares of such proceeds (horizontal devolution).

- Recommends the principles governing grants-in-aid of the States’ revenues, by the Centre.

Connecting the dots:

- Do you think the Panchayat Raj institutions and Urban local governments have a significant role in transforming India towards a developed country? Substantiate.

- The key to successful implementation of any big ticket projects of central/state governments lies in the strength of local bodies. Examine.

MUST READ

Do not break away, Britain

It’s about propriety, not constitutionality

Related Articles:

Appointing MLAs as parliamentary secretaries weakening the watchdog?

Getting around the U.S.’s Persian block

The Centre’s big reform push

Related Articles:

Babus without rights

Thought for food

Raja Mandala: Delhi’s new diplomatic chutzpah

Solving India’s problem of jobless growth

Related Articles:

Women in the workplace: Not yet a better balance

Related Articles:

Time has come—Feminist Economics

We’d better not miss the bus

All you want to know about Income Declaration Scheme 2016

The global ‘new normal’ is still a big, big worry

MIND MAPS

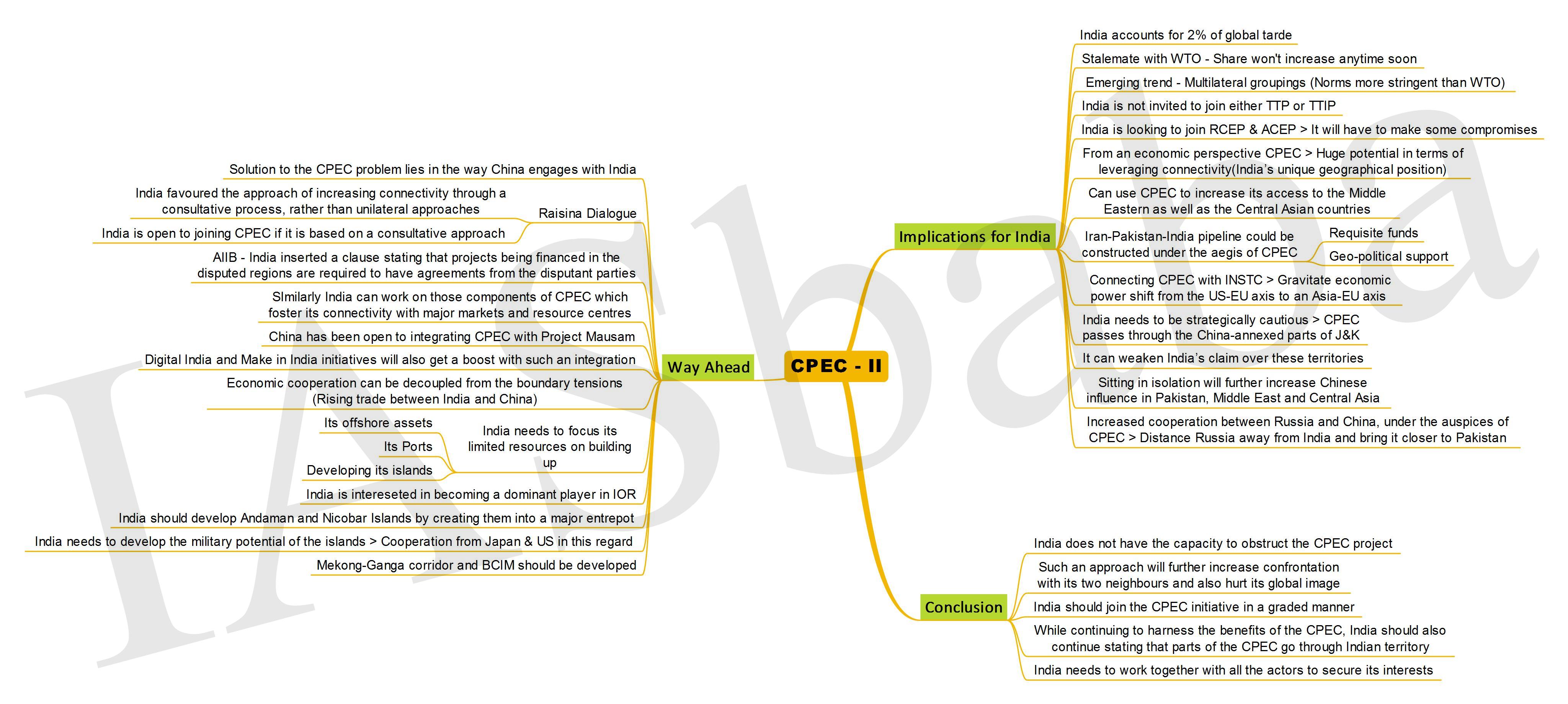

1. CPEC – II