IASbaba's Daily Current Affairs Analysis, IASbaba's Daily Current Affairs Oct 2016, National, UPSC

Archives

IASbaba’s Daily Current Affairs – 19th October, 2016

ECONOMY

TOPIC: General Studies 3

- Indian Economy and issues relating to planning, mobilization of resources, growth, development and employment.

- Government Budgeting.

FRBM Act and Committee to review FRBM targets

Background:

- In 1980s, India saw a sharp deterioration of the fiscal situation, which ultimately culminated in the balance of payments crisis of 1991.

- Within a decade of economic liberalisation, the fiscal deficit and debt situation again seemed to head towards unsustainable levels around 2000. At that time, a need was felt to institutionalize a new fiscal discipline framework.

- The FRBM Bill 2000 was introduced by previous NDA government in the parliament to institutionalize the fiscal discipline at both the centre and state level. However, the bill took three years to become an act.

- The act was passed to make the central government and finance minister accountable to parliament for fiscal discipline.

However, due to lack of an autonomous Fiscal Management Review Committee (as proposed originally) the act more or less became like a Directive Principle of State policy which is not enforceable via courts. Its mandate was diluted and even today we find both revenue deficit and fiscal deficits in budget documents.

Govt sets up FRBM committee on fiscal deficit range

- The government on May 17, 2016 formed a five-member committee under former revenue secretary N K Singh to review the working of the 12-year old FRBM Act and examine the feasibility of a fiscal deficit range instead of a fixed target.

- The Fiscal Responsibility and Budget Management (FRBM) committee will shortly submit its report to the government (within this month).

So, let us know about –

What is Fiscal Responsibility and Budget Management (FRBM) Act? What are the amendments to it?

- The FRBM Act is a fiscal sector legislation enacted by the government of India in 2003, aiming to ensure fiscal discipline for the centre by setting targets including reduction of fiscal deficits and elimination of revenue deficit. It is a legal step to ensure fiscal discipline and fiscal consolidation in India.

- The targets set under the Act was postponed several times in later years though some other goals of the Act including phasing out of government borrowing from the RBI were implemented.

What the FRBM says?

The FRBM rule set a target reduction of fiscal deficit to 3% of the GDP by 2008-09. This will be realized with an annual reduction target of 0.3% of GDP per year by the Central government. Similarly, revenue deficit has to be reduced by 0.5% of the GDP per year with complete elimination by 2008-09. Later, the target dates were reset and Budget 2016-17 aims to realise the 3% fiscal deficit target by March 2018.

The Act gives slight flexibility to the government regarding the realisation of the target as well. It gives the responsibility to the government to adhere to these targets. The Finance Minister has to explain the reasons and suggest corrective actions to be taken, in case of breach.

Following are the provisions of the Act in detail.

- The government has to take appropriate measures to reduce the fiscal deficit and revenue deficit so as to eliminate revenue deficit by 2008-09 and thereafter, sizable revenue surplus has to be created.

- Setting annual targets for reduction of fiscal deficit and revenue deficit, contingent liabilities and total liabilities.

- The government shall end its borrowing from the RBI except for temporary advances.

- The RBI not to subscribe to the primary issues of the central government securities after 2006.

- The revenue deficit and fiscal deficit may exceed the targets specified in the rules only on grounds of national security, calamity etc.

Though the Act aims to achieve deficit reductions prima facie, an important objective is to achieve inter-generational equity in fiscal management. This is because when there are high borrowings today, it should be repaid by the future generation. But the benefit from high expenditure and debt today goes to the present generation. Achieving FRBM targets thus ensures inter-generation equity by reducing the debt burden of the future generation.

Other objectives include: long run macroeconomic stability, better coordination between fiscal and monetary policy, and transparency in fiscal operation of the Government.

Amendments to the FRBM Act

Amendments to the Act were made after its initial version in 2003. This include revision of the target realisation year and introduction of the concept of effective revenue deficit.

In 2012 and 2015, notable amendments were made. As per one provision of the amendment, a “Medium-term Expenditure Framework” statement should be prepared which will set a three-year rolling target for expenditure indicators.

As per the amendments in 2012, the Central Government has to take appropriate measures to reduce the fiscal deficit, revenue deficit and effective revenue deficit to eliminate the effective revenue deficit by the 31st March, 2015 and thereafter build up adequate effective revenue surplus and thereafter as may be prescribed by rules made by the Central Government.

As per Finance Act 2015, the target dates for achieving the prescribed rates of effective deficit and fiscal deficit (3% fiscal deficit) were further extended by 3 years to March 2018.

Working of FRBM act and its reality check:

- The combined fiscal deficit (fiscal expansion) and credit growth (monetary expansion) as a percentage of GDP has halved from 17.4 per cent in 2009-10 to 8.8 per cent, which is less than nominal GDP growth.

- Three things are obvious. Money supply growth has reduced. Credit expansion has fallen. And even fiscal deficit and credit growth put together have declined, all pointing to the growing economy being starved of the needed money needed, in which the FRBM Act has also lent its hand.

- If bank credit growth falls, fiscal deficit may need to go up. If bank credit growth rises, fiscal deficit should reduce. This is particularly true for a growing economy like India.

- Had the fiscal deficit not been above the FRBM ideal limit of 3 per cent in the last four years, the growth would have suffered even more. It does not need a seer to say that the FRBM law as it stands harms the economy. Thus need of the hour is to review FRBM act, and if necessary, amend it significantly.

Committee to review FRBM targets

As per the Union Budget 2016-17, the government constituted a Committee to review the implementation of the FRBM Act. This was after a widely held view among experts that instead of fixed fiscal deficit targets, it may be better to have a fiscal deficit range as the target. This will help the government to meet specific situations like recessions which demand high government expenditure. There is also a suggestion that fiscal expansion or contraction should be aligned with credit contraction or expansion respectively, in the economy. While remaining committed to fiscal prudence and consolidation, Budget stated that a review of the FRBM Act is necessary in the context of the uncertainty and volatility in the global economy.

There is a need for a fiscal policy council on the lines of recently formed monetary policy committee, which will now be accountable for monetary policy. Such a council will strengthen the hands of the finance ministry, which otherwise is the sole guardian of fiscal prudence. It would also enhance coordination between monetary and fiscal policies, which otherwise tend to be confrontational.

Connecting the dots:

- Critically discuss the effectiveness of Fiscal Responsibility and Budget Management (FRBM) Act 2003 in meeting its objectives.

- Recently there was a suggestion to amend FRBM act and to review the fiscal consolidation path. Throw light on the short fall of the current FRBM act and what needs to done to bring more fiscal discipline?

NATIONAL

TOPIC:

General Studies 2

- Government policies and interventions for development in various sectors and issues arising out of their design and implementation.

General Studies 3

- Disaster and disaster management

Fire accidents in India- the increased frequency and way forward

In news: Two fire accidents on consecutive days–one in a hospital in Bhubaneswar, and the second in a high rise in Mumbai–have again raised questions on violation of fire safety norms across the country and what possible should be done to prevent such incidents.

Recent incidents

Bhubaneshwar SUM Hospital

- The ICU and dialysis unit of SUM hospital was engulfed in fire outbreak which resulted in loss of more than 20 lives.

- Cause of fire: Short circuit

Maker Tower fire, Mumbai

- Fire due to short-circuit in high rise tower of Mumbai caused death of two people.

Thus, this issue requires prominent attention as fire hazards are slowly finding more place as ‘recurring incidents’ in a year.

History repeats

- In 2011, a fire broke out in Advanced Medical Research Institute (AMRI) Hospitals, Kolkata which claimed 90 lives, mostly due to choking.

- Cause of fire: The basement where the fire started housed a pharmacy, a central storeroom and the biomedical department, all containing inflammable articles.

- Reason for such high toll: The building was centrally air-conditioned, and there was no ventilation channel for the smoke to come out. The staff was unable to provide police and firefighters with the building’s plan, especially the locations of emergency exit and staircase, thus hampering rescue.

- Other major previous incidents: Uphaar cinema, Delhi (1997); A school in Kumbakonam, TN (2004); A multi-storey market place in Kolkata (2013).

Facts and figures:

- Fire is a state subject and has been included as municipal function (Art 243-W) in the XIIth Schedule of Indian Constitution.

- Directorate General Civil Defence, Ministry of Home Affairs is the nodal office responsible for providing Advisories to State Governments on Fire Prevention, Fire Protection, Fire Legislation and Training matters.

- As per National Crime Records Bureau (NCRB) data, Fire accidents accounts for 4.3% of the total deaths reported due to natural, un-natural and other causes of accidents in 2014.

- About 19,513 people died in accidental fires in 2014.

- Electrical short circuit incidents increased 6% to 1,764 in 2014 from 1,661 in 2013.

- Odisha had reported the maximum fires in commercial buildings (40) in 2014.

Reasons for poor fire disaster response

Ill-equipped states and lack of funds

- Several studies have found that many states have not provided enough resources to fire safety. There have been complaints of lack of funds and staff in the fire departments.

- Most of the states do have fire stations. However the lack of equipment is one major concern. Equipment like turn table ladders, crash tenders and rescue vehicles are clearly missing in many of the fire stations across the country.

- The manpower shortage is another problem with reported shortage of 96.28% firemen according to the National Disaster Response Force and Civil Defence.

- Urban fire services suffer deficiencies of 72.75% in fire stations, 78.79% in man power and 22.43% in firefighting and rescue vehicles.

- The existing set-up of fire services in the country is rather heterogeneous and not conducive to effective protection against increasing incidents of fires

Blatant violation of rules

- In the 2011 AMRI hospital case, there was an illegal storeroom in the hospital’s basement which was packed with inflammable articles like chemicals and medical waste. In addition, the hospital lacked adequate fire-fighting equipment.

- There is a ban imposed by the Supreme Court of India on bursting crackers after 10 PM. However at the Puttingal temple (Kerala), the firecracker show took place at 3 AM which was clearly in violation of the Supreme Court order.

- Further it has been found that in most cases the authorities do not take the permission of the fire department before bursting crackers in crowded places where several thousands of people gather.

- A no-objection certificate is a must from the fire department, but in nine out of ten cases it is not sought.

- A comprehensive National Building Code has been provided but hardly its specifications are adhered which increases the chances of fire accidents.

Non adherence to National Building Code Part 4

- The code specifies construction, occupancy and protection features that are necessary to minimise danger to life and property from fire.

- It mentions topics such as fire alarm system, height of buildings, escape lighting and staircase infrastructure, fire lift and fire exit etc.

- The National Building Code is specific, requiring hospitals to have horizontal evacuation exits for bedridden patients and sprinkler systems for structures of specified height, which would cover most medical institutions.

- AMRI Hospital’s construction plan violated the National Building Code, 2005. The 500-bed hospital did not have a proper ventilation system, which caused many patients to suffocate to death.

- The National Building Code says the area around a hospital must be kept clear to allow easy movement of fire tenders. The AMRI tragedy was exacerbated because the narrow lane leading to the hospital delayed the operations of the fire brigade.

- Though detailed description of fire safety has been provided, but most often, authorities do not even take note when buildings violate this code.

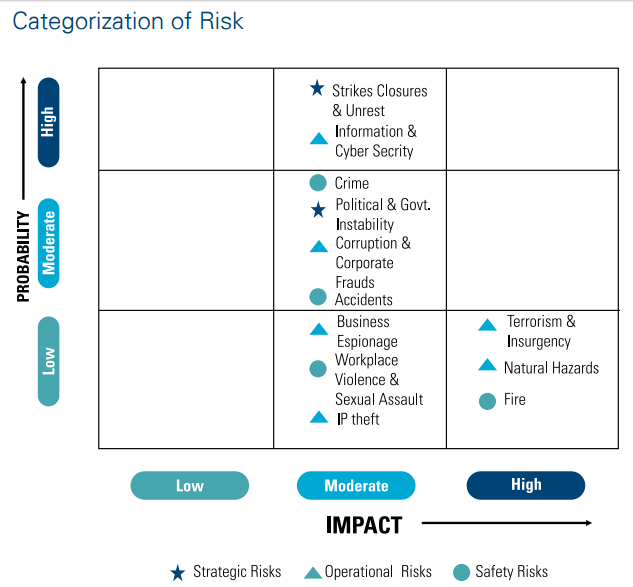

- This proves that fire safety is low on the list of our priorities as attested by the India Risk Survey of 2015.

Picture credit: http://ficci.in/SEDocument/20348/India-Risk-Survey-2016.pdf

Who is responsible?

- The centre sees prevention of fires and emergency response as a municipal function under State governments. Hence, it is not in its priority area.

- With a steady decline in the enforcement of urban regulations and building plans, fire risks have multiplied in public buildings.

- The SUM hospital lost its accreditation with the National Accreditation Board for Hospitals & Healthcare Providers (NABH) two months ago. It was found lacking quality standards, including measures to deal with fire. Yet, it was allowed to be functional by the concerned authorities.

- It is also believed that during fire incidents in both hospitals, there were not enough ambulances available to shift the patients out. However, such evacuation is not the responsibility of the hospital alone but also of the local administration’s. It is responsibility of administration which has to see that infrastructure maintains the prescribed safety standards.

What next?

- Enormous political will and active judicial oversight to enforce best practices and rein in violators is required.

- Meanwhile, patients and visitors could get little risk protection and suitable compensation if all institutions offering any form of medical care are compulsorily required to be insured against disasters.

- Such a regulation would make a hospital insurable only if it installs good quality fire warning and control systems.

- Looking ahead, the Centre and State governments should address fire risk in medical institutions as well as buildings as a top order priority.

- This can be achieved by understanding the hazard, adopting the right infrastructure, enforcing the building code and holding frequent fire drills to do things correctly in an emergency.

- Conducting regular fire safety audits and trainings is found to be an effective tool for assessing fire safety standards in an organisation. Further, more attention needs to be drawn to the lack of funds and equipment at the state level to deal with fire incidents.

- The NDRF has specified a detailed and dedicated ‘Fire Cell’ which takes care of all the issues pertaining to fire safety in India. It is required that the concerned level of government takes note of it and implements the standards.

- Though fires are caused either due to the actions of individuals, which may be accidental or deliberate, or through their failure to take necessary precautions for curbing fire incidents, such as regular inspections, maintenance and repair of defective equipment, etc., it is important to note that fires start when source of ignition comes into contact with any combustible material. If one can identify and control the possible sources of ignition or eliminate its contact with combustible materials, one can greatly reduce the possibility of accidental fire.

Connecting the dots:

- Why is there an increase in number of fire accidents in India? How can it be curbed to the best possible extent? Examine.

Related articles:

When populism trumps public safety

MUST READ

Reinventing old links

Changing the course of the planet

Easing the debt burden

Law panel seeks 1-year jail for parents who ‘abduct’ kids to foreign country

Big Pharma’s India shadow

GST: Make haste slowly

A mother’s nightmare that is Bihar

Were interest rates cut on a whim?