IASbaba's Daily Current Affairs Analysis, IASbaba's Daily Current Affairs April 2017, IASbaba's Daily News Analysis, Minority Report, UPSC

IASbaba’s Daily Current Affairs – 7th April 2017

Archives

MONETARY POLICY

TOPIC: General Studies 3

- Indian Economy and issues relating to planning, mobilization of resources, growth, development and employment.

- Inclusive growth and issues arising from it

April 2017 Monetary policy review

Introduction

Monetary policy is a crucial economic policy tool for the economy. It controls credit flow and hence regulates growth. Inflation targeting is the main idea of the policy with the new Monetary Policy Framework agreement signed. The first monetary policy statement in the new financial year has important signals for the government.

About the new Monetary Policy Agreement:

- Monetary Policy Framework Agreement is an agreement reached between Government and the central bank in India – The Reserve Bank of India (RBI) – on the maximum tolerable inflation rate that RBI should target to achieve price stability.

- The Reserve Bank of India and Government of India signed the Monetary Policy Framework Agreement on 20 February 2015 which made inflation targeting and achieving price stability the responsibilities of RBI. Subsequently, the government, while unveiling the Union Budget for 2016-17 in the Parliament, proposed to amend the Reserve Bank of India (RBI) Act, 1934 for giving a statutory backing to the aforementioned Monetary Policy Framework Agreement and for setting up a Monetary Policy Committee (MPC)

- As per the agreement, RBI would set the policy interest rates and would aim to bring inflation below 6 per cent by January 2016 and within 4 per cent with a band of (+/-) 2 per cent for 2016-17 and all subsequent years. Hence the second statement goes wrong.

Issue:

Following its decision to shift from an accommodative to a neutral monetary policy stance in February no change in policy stance was expected from the RBI.

- The Monetary Policy Committee chaired by Reserve Bank of India Governor Urjit Patel has, in fact, decided to raise the rate at which the central bank borrows funds from banks (the reverse repo rate) by 25 basis points, from 5.75% to 6%, while leaving other policy rates untouched.

- This marginal change is aimed at sucking out from the system excess liquidity that remains a lingering concern, despite coming off its peak in the aftermath of the demonetisation exercise.

Inflation targeting and concerns:

- The RBI has also proposed a new liquidity management tool (SDF) that awaits government approval, making the draining of surplus liquidity a critical priority all through this year.

- The central bank also promised to have a more effective liquidity management tool in a new instrument called a standing deposit facility (SDF) at the earliest.

- The efficacy of the RBI’s liquidity management toolkit will impinge on another key concern: inflation, which is expected to climb to 5% by the second half of this fiscal.

- The RBI says achieving the stated target of 4% inflation even next year could be challenging, with no disinflationary expected, such as benign commodity and oil prices.

- It has also pointed to a one-time upside risk to inflation with the implementation of the Goods and Services Tax.

RBI and Growth concerns:

- The RBI is quite optimistic about an uptick in the economy this year, projecting 7.4% growth in Gross Value-Added, compared to 6.7% in 2016-17.

- Along with improved prospects for the world economy a rebound in discretionary consumer spending at home is likely, in line with the “pace of remonetisation” and investment demand on account of lowered interest rates.

- The Governor RBI has raised 4 key issues:

- First, the need to urgently resolve the surge of bad loans on bank books, for which the RBI will unveil a new Prompt Corrective Action framework by the middle of this month. Without this, a virtuous cycle of healthy credit growth necessary for investment and job creation will remain elusive.

- Second, the RBI has reminded the government there will be “clearly more demand for capital” in the coming days. The government’s allocation of Rs.10,000 crore to recapitalise public sector banks is obviously inadequate.

- Third, while banks have reduced lending rates, the RBI has pointed out there is room for more cuts if rates on small savings schemes are corrected.

- Most important, the government must not ignore Mr Patel’s categorical call to eschew loan waivers of the kind just announced in Uttar Pradesh. This, he warned, would crowd out private investments and dent the nation’s balance sheet.

Conclusion:

Fiscal policy and monetary policy have to go hand in hand. Especially with the new framework and wide ranging consultations monetary policy will be accommodative. But the crucial concerns raised by the policy should be heeded to and populism should not be the sole driver of politics. Good politics can sustain with good economics only.

Connecting the dots:

- Critically analyse the new monetary policy framework and the impact of the same on inflation and growth concerns of the economy.

ECONOMY/AGRICULTURE

TOPIC:

General Studies 2:

- Government policies and interventions for development in various sectors and issues arising out of their design and implementation.

- Welfare schemes for vulnerable sections of the population by the Centre and States and the performance of these schemes; mechanisms, laws, institutions and Bodies constituted for the protection and betterment of these vulnerable sections.

General studies 3:

- Major crops cropping patterns in various parts of the country, different types of irrigation and irrigation systems storage, transport and marketing of agricultural produce and issues and related constraints; e-technology in the aid of farmers.

Pradhan Mantri Fasal Bima Yojana: Assessment

Last January, Prime Minister Narendra Modi introduced a new crop insurance scheme with the aim of bringing 50 per cent of the country’s farmers under insurance cover in three years.

Narendra Modi led National Democratic Alliance government had claimed that – “The new Crop Insurance Scheme is in line with One Nation – One Scheme theme. It incorporates the best features of all previous schemes and at the same time, all previous shortcomings / weaknesses have been removed. The PMFBY will replace the existing two schemes National Agricultural Insurance Scheme as well as the Modified NAIS.”

Objectives:

- To provide insurance coverage and financial support to the farmers in the event of failure of any of the notified crop as a result of natural calamities, pests & diseases.

- To stabilise the income of farmers to ensure their continuance in farming.

- To encourage farmers to adopt innovative and modern agricultural practices.

- To ensure flow of credit to the agriculture sector.

Highlights of the scheme:

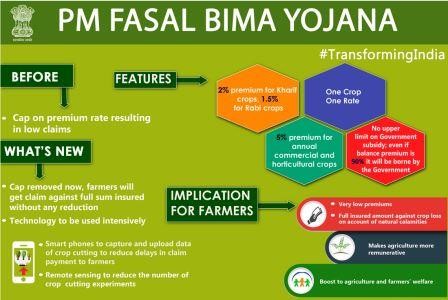

- There will be a uniform premium of only 2% to be paid by farmers for all Kharif crops and 1.5% for all Rabi crops. In case of annual commercial and horticultural crops, the premium to be paid by farmers will be only 5%. The premium rates to be paid by farmers are very low and balance premium will be paid by the Government to provide full insured amount to the farmers against crop loss on account of natural calamities.

- There is no upper limit on Government subsidy. Even if balance premium is 90%, it will be borne by the Government.

- Earlier, there was a provision of capping the premium rate which resulted in low claims being paid to farmers. This capping was done to limit Government outgo on the premium subsidy. This capping has now been removed and farmers will get claim against full sum insured without any reduction.

- The use of technology will be encouraged to a great extent. Smart phones will be used to capture and upload data of crop cutting to reduce the delays in claim payment to farmers. Remote sensing will be used to reduce the number of crop cutting experiments.

- PMFBY is a replacement scheme of NAIS / MNAIS, there will be exemption from Service Tax liability of all the services involved in the implementation of the scheme. It is estimated that the new scheme will ensure about 75-80 per cent of subsidy for the farmers in insurance premium.

Link: http://vikaspedia.in/agriculture/agri-insurance/pmfby.jpg

Assessment: The below article assesses the performance of Fasal Bima Yojana

As we read above, bringing down the premium rates substantially in the new scheme, the government had targeted covering 50 per cent of farmers in three years.

The old schemes of the government — the National Agriculture Insurance scheme (NAIS) introduced in 1999, the Modified NAIS (mNAIS) introduced in Rabi 2010-11 — have not succeeded.

As per official data, in 2015, only a fifth of the country’s farm land was under crop insurance.

The limited risk coverage under these policies was a dampener, say experts. In mNAIS, the premium was capped at 8-12 per cent of sum insured to limit the government’s subsidy outgo.

So, in crops where actuarial rates were higher, the insurance company reduced the sum insured proportionally and many a time it was not sufficient even to cover the farmer’s cost of production.

What has changed?

In the Pradhan Mantri Fasal Bima Yojana, the cap on premium has been removed.

Kharif 2016 was the first season of Pradhan Mantri Fasal Bima Yojana. A release of the Ministry of Agriculture in December says 366.64 lakh farmers (26 per cent of the total) were covered under crop insurance, an increase of 18.5 per cent from kharif 2015. The area under insurance coverage increased 15 per cent and the sum insured jumped 104 per cent. This is good progress for the first year. However, numbers from Agriculture Insurance Company (AIC) show that the increase has mainly come from farmers who had an outstanding crop loan.

Problems

- The Prime Minister’s pet scheme has not been received well by farmer associations. There are many reasons for this. One, while loanee farmers get mandatorily enrolled in the scheme, there is not enough effort taken to cover the non-loanee farmers.

- The non-loanee farmers are usually tenant farmers or share croppers who also pay huge lease rents. Tenant farmers in most States don’t have access to institutional credit in the first place and now that the Centre’s insurance scheme is implemented through the banking channel, they are being effectively ignored.

- Farmer associations are also opposed to banks debiting premium from farmers’ account without their consent and they allege that banks have actually taken insurance for a wrong crop and it has been of no use to the farmers.

- The manner in which the yield of a crop is calculated to estimate the loss is also a cause for concern. In crop cutting experiments, which are done to estimate the yield of a crop, the unit area is a village and not an individual farm. But there is variation in weather events even within a village and this way of loss assessment would not help all, lament farmers.

- As the mandate is to do four crop-cutting experiments in each village, for the 2.5 lakh-odd gram panchayats, assuming three different varieties of crops, a total of 30 lakh crop cutting experiments should be done, estimates a senior official with AIC. The revenue departments of States don’t have the manpower for this, say experts.

- Farmer groups allege that more than them, insurance companies have benefited from the FBY scheme. “Expenditure on premium increased to ?13,240 crore but covered only 26.5% of farmers. All this money went to insurance companies. There is no mention of how much claims the farmers got in return.”

Experts say that PMFBY if implemented properly across the country would mitigate farm distress to a large extent especially when the erratic climates have become a norm rather than exception.

These loopholes are to be addressed along with making steps to improve the insurance coverage.

Connecting the dots:

- Discuss the objectives and design of Pradhan Mantri Fasal Bima Yojana. Examine how different is it from earlier Agri-Insurance schemes.

- Given the vulnerability of Indian agriculture to vagaries of nature, discuss the need for crop insurance and bring out the salient features of the Pradhan Mantri Fasal Bima Yojana (PMFBY).

- Was Pradhan Mantri fasal BIma yojana (PMFBY) launched as NAIS able to serve its purpose? What are the changes in PMFBY in comparison to NAIS and discuss the drawback in the PMFBY?

MUST READ

RBI monetary policy: Growth, with caveats

Friendship is a flowing river: Sheikh Hasina writes for The Hindu

Is India a racist country?

Failing the student

The banality of evil

Behind Tawang row, two nations enslaved by history

Working out the true impact of demonetisation

India is not moving to counterforce doctrine

The economics of happiness

Toppling the top

The road ahead for Indo-Bangla relations