IASbaba's Daily Current Affairs Analysis

IAS UPSC Prelims and Mains Exam – 25th June 2019

Archives

(PRELIMS + MAINS FOCUS)

‘Defaulter count in PSBs has risen 60% since FY15’

Part of Prelims and Mains GS III Indian Economy

In news

- The number of wilful defaulters in nationalised banks has increased by more than 60% to 8,582 to March 2019 from 2014-15.

- By the end of the 2014-15 fiscal, the figure had stood at 5,349.

Wilful defaulter

A wilful defaulter is an entity or a person that has not paid a loan back despite the ability to repay it.A wilful defaulter is an entity or a person that has not paid a loan back despite the ability to repay it.

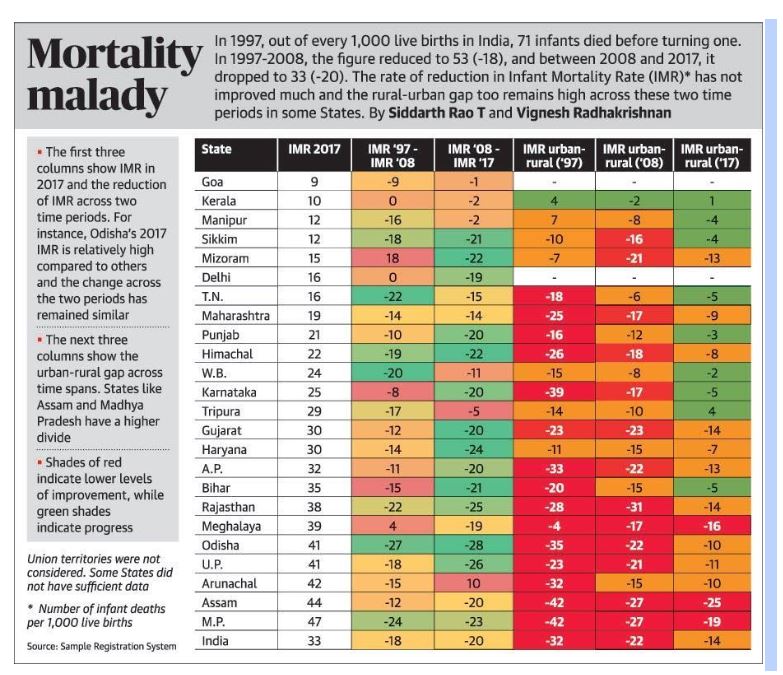

Mortality malady

Part of Prelims and Mains GS II Governance and public health

In news

https://epaper.thehindu.com/Home/ShareImage?Pictureid=GU8625SDK.1

Do you Know?

Some of the targets to be achieved under SDG 3:

- By 2030, reduce the global maternal mortality ratio to less than 70 per100,000 live birth

- By 2030, end preventable deaths of newborns and children under 5 years ofage, with all countries aiming to reduce neonatal mortality to at least as lowas 12 per 1,000 live births and under-5 mortality to at least as low as 25 per1,000 live births

- By 2030, reduce by one third premature mortality from non-communicablediseases through prevention and treatment and promote mental health andwell-being

- Achieve universal health coverage, including financial risk protection,access to quality essential health-care services and access to safe, effective,quality and affordable essential medicines and vaccines for all

Terminology

- Infant mortality rate (IMR) is the number of deaths per 1,000 live births of children under one year of age.

- Neonatal mortality rate: is the number of deaths per 1,000 live births of children under 28 days of life.

- Under-Five Mortality (U5MR) or child mortality is the number of deaths per1,000 live births of children under five year of age.

- Maternal mortality rate: The number of registered maternal deaths due to birth- or pregnancy-related complications per 100,000 registered live births.

- According to the just released SRS (Sample Registration System) bulletin, IMR of India has declined, from 37 per 1000 live births in 2015 to 33 per 1000 live births in 2017.

Reasons for high mortality rates: Which accounted for 62% of all child deaths

- Pneumonia

- Prematurity, low birth weight

- Diarrhoeal diseases

- Neonatal infections

- Birth asphyxia & birth trauma

(MAINS FOCUS)

NATIONAL

TOPIC: General Studies 2:

- Functions and responsibilities of the Union and the States, issues and challenges pertaining to the federal structure, devolution of powers and finances up to local levels and challenges therein.

Strengthening Fiscal Federalism

Background:

India’s Constitution-makers thought of India as a union of States with a centripetal bias, done, advisedly, to preserve the unity and integrity of a newly fledged nation. Since then, the Indian economy, polity, demography and society have undergone many changes.

It is in this context that India’s fiscal federalism needs to be re-visited.

Imbalances in India’s fiscal federalism:

- A vertical imbalance arises because the tax systems are designed in a manner that yields much greater tax revenues to the Central government when compared to the State or provincial governments; the Constitution mandates relatively greater responsibilities to the State governments.

For example, in India, post the advent of Goods and Services Tax (GST), the share of States in the public expenditure is 60% while it is 40% for the Centre to perform their constitutionally mandated duties. - The horizontal imbalances arise because of differing levels of attainment by the States due to differential growth rates and their developmental status in terms of the state of social or infrastructure capital.

Traditionally, Finance Commissions have dealt with these imbalances in a stellar manner.

Way ahead: Removing the imbalance

Strengthening NITI Aayog:

In the past, the Planning Commission used to give grants to the States as conditional transfers using the Gadgil-Mukherjee formula. Now with the Planning Commission disbanded, there is a vacuum especially as the NITI Aayog is primarily a think tank with no resources to dispense, which renders it toothless to undertake a “transformational” intervention. On the other hand, it is too much to expect the Union Finance Commission to do the dual job.

There is an urgent need for an optimal arrangement.

- NITI Aayog 2.0 should receive significant resources to promote accelerated growth in States that are lagging, and overcome their historically conditioned infrastructure deficit, thus reducing the developmental imbalance.

In short, the NITI Aayog should be engaged with the allocation of “transformational” capital in a formulaic manner. - NITI Aayog 2.0 should also be mandated to create an independent evaluation office which will monitor and evaluate the efficacy of the utilisation of such grants. In doing so, it should not commit the mistake of micro-management or conflicts with line departments.

It must be also accorded a place at the high table of decision-making as it will need to objectively buy-in the cooperation of the richer States as their resources are transferred to the poorer ones.

Ushering in decentralisation:

The above perspective will have to be translated below the States to the third tier of government. This is crucial because intra-State regional imbalances are likely to be of even greater import than inter-State ones. Decentralisation, in letter and spirit, has to be the third pillar of the new fiscal federal architecture.

- De jure and de facto seriousness has to be accorded to the 73rd and 74th constitutional amendments.

- The missing local public finance must be birthed. One of the ways for this is through the creation of an urban local body/panchayati raj institutions consolidated fund. The Centre and States should contribute to the consolidated fund of the third tier.

- Further, the State Finance Commissions should be accorded the same status as the Finance Commission and the 3Fs of democratic decentralisation (funds, functions and functionaries) vigorously implemented. This will strengthen and deepen our foundational democratic framework.

Fine-tuning the GST:

It is to the credit of our democratic maturity that the GST Bill was passed unanimously by Parliament; but in its present form, it is far from flawless.

- It needs further simplification and extended coverage.

- We need to achieve the goal of a single rate GST with suitable surcharges on “sin goods,” zero rating of exports and reforming the Integrated Goods and Services Tax (IGST) and the e-way bill.

- The GST Council should adopt transparency in its working, and create its own secretariat with independent experts aas its staff. This will enable it to undertake further reforms in an informed and transparent manner.

Conclusion:

NITI Aayog can play an important role in refreshing India’s fiscal federalism. It is time we reboot the institution.

Connecting the dots:

- India’s fiscal federalism needs to be re-visited in order to check the imbalances between the states and also between centre on one hand and states on the other. Comment.

SCIENCE AND TECH/DEFENCE

TOPIC: General studies 3:

- Achievements of Indians in science & technology; indigenization of technology and developing new technology.

- Defence and Security issues

India as a space power

Introduction:

Space has undoubtedly become a military theatre. The US, Russia, China and, since March, India, have shown that they have the capability to physically destroy satellites in orbit. The post-Cold War space arms race is underway.

What does it mean to be a space power?

It is “the ability to use space while denying reliable use to any foe”. India already has significant ability to use space. But our ability to deny its use to an adversary is, understandably, negligible.

The exceptional route India took:

The US, Russia, China and Europe developed space capabilities for military purposes first, and then put those technologies to civilian use.

India’s space quest, on the other hand, was focused on civilian use—weather forecasting, broadcast, telecommunications and remote sensing. It was only in the mid-1980s that technology from the Indian Space Research Organisation’s (Isro) Satellite Launch Vehicle-3 was employed in the Agni ballistic missile.

When it comes to satellites, India has a handful of military satellites in operation, compared to over 40 civilian ones. Our first dedicated military satellite was launched only in 2013.

Rethinking our approach:

Just like India was late to militarize space, it has been late to weaponize it. That’s not a bad thing, but in the changed circumstances of the 21st century, it is time to rethink our approach.

India’s unstated space doctrine is to use space to promote development and the well-being and prosperity of its people. What we must do now is to include the word “security” in that sentence. In doing so, the policy goal will change from having a space presence to being a space power.

Way ahead:

- India must protect and secure two kinds of space assets—those that belong to us and those that are crucial to our economy and national security. Future designs of satellites must certainly factor in the risk of attack by hostile forces.

- In order to effectively defend our space assets, India must have the most reliable and accurate capabilities to track space objects, from debris and spacecraft to celestial bodies. This crucial capability must be developed indigenously.

- For space defence to be effective, India must acquire a minimum, credible offensive capacity across the various types of space weapons, physical, electronic and cyber.

- Our broader space policy must acquire a new seriousness in improving launch capabilities and spacecraft design. The ability to place large satellites in geostationary orbits should become highly reliable. ISRO’s budgets must be enlarged. Also, private entrants must be encouraged in everything from launches to specialized payloads.

Conclusion:

The government’s decision to set up a Defence Space Agency (DSA) with command over the space assets of the Army, Navy and Air Force is the most significant development in India’s defence establishment since the operationalization of the nuclear arsenal around 15 years ago.

It is time the DSA starts working on the path of making India a space power.

Connecting the dots:

- Space has undoubtedly become a military theatre. India’s policy goal should change from having a space presence to being a space power. Discuss.

(TEST YOUR KNOWLEDGE)

Model questions: (You can now post your answers in comment section)

Note:

- Featured Comments and comments Up-voted by IASbaba are the “correct answers”.

- IASbaba App users – Team IASbaba will provide correct answers in comment section. Kindly refer to it and update your answers.

Q.1) SDG 3 is related to

- Health

- Education

- Sanitation

- None of the above

Q.2) Consider the following statements

- The Peace to Prosperity economic workshop held in Bahrain under the leadership of US.

- Palestine agreed to accept the peace plan to be drawn at the workshop.

Select the Correct statements

- Only 1

- Only 2

- Both 1 and 2

- Neither 1 nor 2

MUST READ

A sound foundation