UPSC Articles

ECONOMY/ GOVERNANCE

Topic: General Studies 3:

- Indian Economy and issues relating to planning, mobilization, of resources, growth, development and employment.

COVID-19: Impact on Mutual Funds (Franklin Templeton issue)

Context: Franklin Templeton (FT) Mutual Fund, the ninth largest in India, decided to close its six managed credit funds, which had combined assets under its management of around Rs 28,000 crore (25% of its total assets)

It cited reduced liquidity in the bond markets caused by the COVID-19 pandemic as reason for closure of these MF schemes.

What is Mutual Fund?

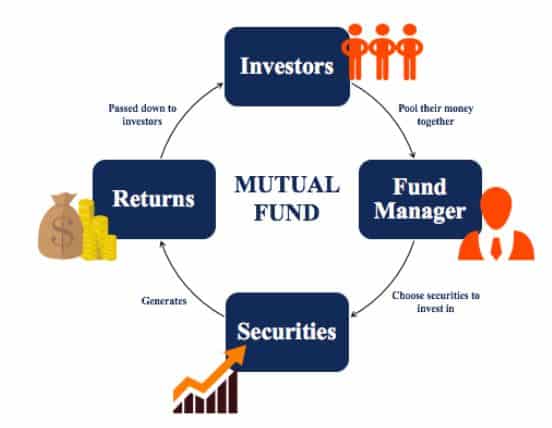

- It is a type of financial vehicle made up of a pool of money collected from many investors to invest in securities like stocks, bonds and other assets.

- Mutual funds are operated by professional money managers, who allocate the fund’s assets and attempt to produce income for the fund’s investors.

Daily Current Affairs IAS | UPSC Prelims and Mains Exam – 25th April 2020

Pic Source: Here

Merits of Mutual Funds

- It is professional managed financial vehicle

- The fund managers invest the pooled money in diversified assets which reduces the risk

- They are liquid enabling investors to sell the Mutual Funds in short time.

Disadvantages of a Mutual Fund

- High and opaque management fees and operating expenses

- Loss of Control by investors

- Mutual Funds are vulnerable to market volatility

Why did FT announce closure of the MF schemes?

- It was because these MF schemes had 65% of the portfolio investment in bonds that are AA rated or below

- These lower rated bonds offer higher return but also carry a higher risk.

- During the times of crisis, these type of bonds are least sought after, meaning their depreciation is quicker

- As a result, the fund managers will not be able to service the interest & principal payment to the investors

What does the closure of Mutual Fund schemes by FT, mean for investors?

- It essentially means that Franklin Templeton MF will first liquidate the assets in the schemes and then return the money to investors

- However, FT may find it difficult to get a buyer for the low-rated assets in the portfolio, so investors may have to wait

- Additionally, if they find a buyer, the sale will happen at reduced valuation meaning loss for investors on their capital investment

Impact of the Franklin Templeton issue

- It is unprecedented indicating the impact of COVID-19 lockdown on financial system

- On Fund managers: They may now prefer the safety of more liquid higher rated paper, leading to further stress in the bond markets

- On Investors: It breaks investor confidence in mutual funds.

- On Saving Habits: It will push people to adopt informal means of saving Ex: Gold purchases, which is not in the long-term interest of circular economy

- On Credit availability: Debt funds are a key source of funding of corporates which might get further squeezed due to such types of stress in system

- On Society: It can create a panic among public leading to distrust on such financial instruments

Way Ahead

- Investors need to look at the quality of the companies where their investments

- Monitoring of the situation and timely action on it by fund managers

- RBI and SEBI must ensure adequate liquidity to intermediaries.

- Awareness among citizens that such cases are isolated ones and there is no threat to MF ecosystem

Connecting the dots:

- Punjab and Maharashtra Cooperative Bank (PMC) Crisis

- IL&FS liquidity crisis

- Yes Bank crisis