IASbaba Prelims 60 Days Plan, Rapid Revision Series (RaRe)

Archives

Hello Friends

The 60 Days Rapid Revision (RaRe) Series is IASbaba’s Flagship Initiative recommended by Toppers and loved by the aspirants’ community every year.

It is the most comprehensive program which will help you complete the syllabus, revise and practice tests on a daily basis. The Programme on a daily basis includes

Daily Prelims MCQs from Static (Monday – Saturday)

- Daily Static Quiz will cover all the topics of static subjects – Polity, History, Geography, Economics, Environment and Science and technology.

- 20 questions will be posted daily and these questions are framed from the topics mentioned in the schedule.

- It will ensure timely and streamlined revision of your static subjects.

Daily Current Affairs MCQs (Monday – Saturday)

- Daily 5 Current Affairs questions, based on sources like ‘The Hindu’, ‘Indian Express’ and ‘PIB’, would be published from Monday to Saturday according to the schedule.

Daily CSAT Quiz (Monday – Friday)

- CSAT has been an Achilles heel for many aspirants.

- Daily 5 CSAT Questions will be published.

Note – Daily Test of 20 static questions, 5 current affairs, and 5 CSAT questions. (30 Prelims Questions) in QUIZ FORMAT will be updated on a daily basis.

To Know More about 60 Days Rapid Revision (RaRe) Series – CLICK HERE

60 Day Rapid Revision (RaRe) Series Schedule – CLICK HERE

60 Day Rapid Revision (RaRe) Series Questions & Solutions DAY 33– CLICK HERE

Important Note

- Comment your Scores in the Comment Section. This will keep you accountable, responsible and sincere in days to come.

- It will help us come out with the Cut-Off on a Daily Basis.

- Let us know if you enjoyed today’s test 🙂

- You can post your comments in the given format

- (1) Your Score

- (2) Matrix Meter

- (3) New Learning from the Test

Test-summary

0 of 30 questions completed

Questions:

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

Information

The following Test is based on the syllabus of 60 Days Plan-2023 for UPSC IAS Prelims 2022.

To view Solutions, follow these instructions:

- Click on – ‘Start Test’ button

- Solve Questions

- Click on ‘Test Summary’ button

- Click on ‘Finish Test’ button

- Now click on ‘View Questions’ button – here you will see solutions and links.

You have already completed the test before. Hence you can not start it again.

Test is loading...

You must sign in or sign up to start the test.

You have to finish following test, to start this test:

Results

0 of 30 questions answered correctly

Your time:

Time has elapsed

You have scored 0 points out of 0 points, (0)

| Average score |

|

| Your score |

|

Categories

- Not categorized 0%

| Pos. | Name | Entered on | Points | Result |

|---|---|---|---|---|

| Table is loading | ||||

| No data available | ||||

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- Answered

- Review

-

Question 1 of 30

1. Question

Consider the following statements:

- Fiscal deficit is the difference between the government’s total expenditure and its total receipts excluding borrowing.

- A large share of revenue deficit in fiscal deficit indicates that a large part of borrowing is being used to meet its consumption expenditure needs rather than investment.

Which of the above given statements is/are correct?

Correct

Solution (c)

Explanation:

- Fiscal Deficit: Fiscal deficit is the difference between the government’s total expenditure and its total receipts excluding borrowing. (Hence statement 1 is correct).

- Gross fiscal deficit = Net borrowing at home + Borrowing from RBI + Borrowing from abroad

- Net borrowing at home includes that directly borrowed from the public through debt instruments (for example, the various small savings schemes) and indirectly from commercial banks through Statutory Liquidity Ratio (SLR). The gross fiscal deficit is a key variable in judging the financial health of the public sector and the stability of the economy. From the way gross fiscal deficit is measured as given above, it can be seen that revenue deficit is a part of fiscal deficit (Fiscal Deficit = Revenue Deficit + Capital Expenditure non-debt creating capital receipts). A large share of revenue deficit in fiscal deficit indicated that a large part of borrowing is being used to meet its consumption expenditure needs rather than investment. (Hence statement 2 is correct)

Incorrect

Solution (c)

Explanation:

- Fiscal Deficit: Fiscal deficit is the difference between the government’s total expenditure and its total receipts excluding borrowing. (Hence statement 1 is correct).

- Gross fiscal deficit = Net borrowing at home + Borrowing from RBI + Borrowing from abroad

- Net borrowing at home includes that directly borrowed from the public through debt instruments (for example, the various small savings schemes) and indirectly from commercial banks through Statutory Liquidity Ratio (SLR). The gross fiscal deficit is a key variable in judging the financial health of the public sector and the stability of the economy. From the way gross fiscal deficit is measured as given above, it can be seen that revenue deficit is a part of fiscal deficit (Fiscal Deficit = Revenue Deficit + Capital Expenditure non-debt creating capital receipts). A large share of revenue deficit in fiscal deficit indicated that a large part of borrowing is being used to meet its consumption expenditure needs rather than investment. (Hence statement 2 is correct)

-

Question 2 of 30

2. Question

Consider the following statements:

- Revenue receipts create liabilities for the government.

- Capital receipts increases an asset of the government.

Which of the above given statements is/are correct?

Correct

Solution (d)

Explanation:

- Revenue receipts do not create any liability for the government. For example, taxes received by the government, unlike borrowings, do not create any liabilities for it. No asset reduction: Revenue receipts do not lead to any reduction in the government’s assets. (Hence statement 1 is incorrect)

- Capital receipts are all those money receipts of the government that either creates a liability for the government or reduce an asset of the government. Therefore, capital receipts include small savings, market loans and provident funds. Capital receipts increases mainly because of Disinvestment Hence it reduces the Asset of the government. (Hence statement 2 is incorrect)

Incorrect

Solution (d)

Explanation:

- Revenue receipts do not create any liability for the government. For example, taxes received by the government, unlike borrowings, do not create any liabilities for it. No asset reduction: Revenue receipts do not lead to any reduction in the government’s assets. (Hence statement 1 is incorrect)

- Capital receipts are all those money receipts of the government that either creates a liability for the government or reduce an asset of the government. Therefore, capital receipts include small savings, market loans and provident funds. Capital receipts increases mainly because of Disinvestment Hence it reduces the Asset of the government. (Hence statement 2 is incorrect)

-

Question 3 of 30

3. Question

Consider the following statement with respect to the difference between Revenue Deficit and Primary Deficit:

- Revenue Deficit is an excess of revenue expenditure over revenue receipts whereas Primary Deficit is an excess of total revenue expenditure over total receipts.

- Revenue Deficit occurs when the government is not able to meet its regular and recurring expenditures whereas Primary Deficit talks about the borrowing requirements of the government for various purposes except for interest payment.

Which of the above given statements is/are correct?

Correct

Solution (b)

Explanation:

Difference between Revenue Deficit and Primary Deficit

Revenue Deficit Primary Deficit It is when there is an excess of revenue expenditure over revenue receipts. It is the difference between the fiscal deficit of the current year and the interest payment of the previous fiscal year. It occurs when the government is not able to meet its regular and recurring expenditures. It talks about the borrowing requirements of the government for various purposes except for interest payment. It is calculated by deducting revenue expenditure from revenue receipts It is calculated by deducting fiscal deficit from the interest payments Incorrect

Solution (b)

Explanation:

Difference between Revenue Deficit and Primary Deficit

Revenue Deficit Primary Deficit It is when there is an excess of revenue expenditure over revenue receipts. It is the difference between the fiscal deficit of the current year and the interest payment of the previous fiscal year. It occurs when the government is not able to meet its regular and recurring expenditures. It talks about the borrowing requirements of the government for various purposes except for interest payment. It is calculated by deducting revenue expenditure from revenue receipts It is calculated by deducting fiscal deficit from the interest payments -

Question 4 of 30

4. Question

Which of the following is/are the objectives of the Indian Budget?

- To manage and properly distribute resources.

- To reduce inequalities in income and wealth.

- To achieve social stability.

- Decrease regional differences.

Select the correct answer using the code given below:

Correct

Solution (a)

Explanation:

Objectives of Government Budget

- Reallocation of resources – It helps to distribute resources, keeping in view the social and economic aspects of the country. (Hence statement 1 is correct)

- Minimise inequalities in income and wealth – In an economic system, income and wealth inequality is an integral part. So, the government aims to bring equality by imposing a tax on the elite class and spending extra on the well-being of the poor. (Hence statement 2 is correct)

- Economic stability – The budget is also utilised to avoid business fluctuations to accomplish the aim of financial stability. Policies such as deficit budget during deflation and excess budget during inflation assist in balancing the prices in the economy.

- Manage public enterprises – Many public sector industries are built for the social welfare of people. The budget is planned to deliver different provisions for operating such business and imparting financial help.

- Economic growth – A country’s economic growth is based on the rate of investments and savings. Therefore, the budgetary plan focuses on preparing adequate resources for investing in the public sector and raising the overall rate of investments and savings.

- Decrease regional differences – It aims to diminish regional inequalities by implementing taxation and expenditure policy and promoting the installation of production units in underdeveloped regions. (Hence statement 4 is correct)

Incorrect

Solution (a)

Explanation:

Objectives of Government Budget

- Reallocation of resources – It helps to distribute resources, keeping in view the social and economic aspects of the country. (Hence statement 1 is correct)

- Minimise inequalities in income and wealth – In an economic system, income and wealth inequality is an integral part. So, the government aims to bring equality by imposing a tax on the elite class and spending extra on the well-being of the poor. (Hence statement 2 is correct)

- Economic stability – The budget is also utilised to avoid business fluctuations to accomplish the aim of financial stability. Policies such as deficit budget during deflation and excess budget during inflation assist in balancing the prices in the economy.

- Manage public enterprises – Many public sector industries are built for the social welfare of people. The budget is planned to deliver different provisions for operating such business and imparting financial help.

- Economic growth – A country’s economic growth is based on the rate of investments and savings. Therefore, the budgetary plan focuses on preparing adequate resources for investing in the public sector and raising the overall rate of investments and savings.

- Decrease regional differences – It aims to diminish regional inequalities by implementing taxation and expenditure policy and promoting the installation of production units in underdeveloped regions. (Hence statement 4 is correct)

-

Question 5 of 30

5. Question

Consider the following statements with respect to ‘Zero-Based Budgeting’:

- It is an approach to planning and preparing the budget from zero bases.

- It is a method of budgeting in which all expenses must be justified for each new period.

- The process of zero-based budgeting involves the review and justification of each ministry’s expenditure to receive funding at the beginning of each financial year.

Which of the above given statements are correct?

Correct

Solution (d)

Explanation:

Zero-based budgeting

- “Zero-based budgeting” is an approach to planning and preparing the budget from the beginning.

- As the name suggests, it refers to planning and preparing the budget from scratch or ‘zero bases’. (Hence statement 1 is correct)

- Plays a vital role as an emerging budgeting concept that is introduced with the aim of subsisting with the demerits of the traditional budgeting system.

- It is a reverse of traditional planning and decision-making with respect to budgeting.

- Zero-based budgeting (ZBB) is basically a systematic cost management process that prioritizes the efficient allocation of income to fixed expenditure, variable expenses, and savings in order to nullify the difference between income and expenditure.

- A method of budgeting in which all expenses must be justified for each new period. (Hence statement 2 is correct)

- The process of zero-based budgeting involves the review and justification of each and every ministry’s expenditure to receive funding at the beginning of each financial year. (Hence statement 3 is correct)

Incorrect

Solution (d)

Explanation:

Zero-based budgeting

- “Zero-based budgeting” is an approach to planning and preparing the budget from the beginning.

- As the name suggests, it refers to planning and preparing the budget from scratch or ‘zero bases’. (Hence statement 1 is correct)

- Plays a vital role as an emerging budgeting concept that is introduced with the aim of subsisting with the demerits of the traditional budgeting system.

- It is a reverse of traditional planning and decision-making with respect to budgeting.

- Zero-based budgeting (ZBB) is basically a systematic cost management process that prioritizes the efficient allocation of income to fixed expenditure, variable expenses, and savings in order to nullify the difference between income and expenditure.

- A method of budgeting in which all expenses must be justified for each new period. (Hence statement 2 is correct)

- The process of zero-based budgeting involves the review and justification of each and every ministry’s expenditure to receive funding at the beginning of each financial year. (Hence statement 3 is correct)

-

Question 6 of 30

6. Question

Consider the following statements with respect to ‘Financial Stability and Development Council’ (FSDC):

- It is a statutory body established by the recommendations of Raghuram Rajan Committee.

- It is under the Ministry of Finance.

- It helps Coordination of India’s foreign interactions with financial sector organisations.

Which of the above given statements are correct?

Correct

Solution (a)

Explanation:

The Financial Stability and Development Council (FSDC) is an autonomous agency established by the Government of India. The Raghuram Rajan Committee proposed the formation of such a super regulatory organisation in 2008. It is an autonomous agency founded in December 2010 with the purpose of strengthening and institutionalising the system for preserving financial stability, promoting inter-regulatory collaboration, and supporting financial sector growth.

Financial Stability and Development Council

- Financial Stability and Development Council is an autonomous non-apex body that was established by executive order. (Hence statement 1 is incorrect)

- It is under the Ministry of Finance. (Hence statement 2 is correct)

- It monitors various macro-prudential activities of the Indian economy and is also responsible for the promotion of financial inclusion and literacy among the masses.

- It is an independent institution with the mission of strengthening and institutionalising the mechanism for maintaining financial stability, improving inter-regulatory cooperation, and fostering financial sector development.

- The FSDC was established to improve cooperation among financial market authorities.

- It emphasises financial knowledge and inclusivity.

- Coordination of India’s foreign interactions with financial sector organisations such as the Financial Action Task Force (FATF) and the Financial Stability Board (FSB). (Hence statement 3 is correct)

Incorrect

Solution (a)

Explanation:

The Financial Stability and Development Council (FSDC) is an autonomous agency established by the Government of India. The Raghuram Rajan Committee proposed the formation of such a super regulatory organisation in 2008. It is an autonomous agency founded in December 2010 with the purpose of strengthening and institutionalising the system for preserving financial stability, promoting inter-regulatory collaboration, and supporting financial sector growth.

Financial Stability and Development Council

- Financial Stability and Development Council is an autonomous non-apex body that was established by executive order. (Hence statement 1 is incorrect)

- It is under the Ministry of Finance. (Hence statement 2 is correct)

- It monitors various macro-prudential activities of the Indian economy and is also responsible for the promotion of financial inclusion and literacy among the masses.

- It is an independent institution with the mission of strengthening and institutionalising the mechanism for maintaining financial stability, improving inter-regulatory cooperation, and fostering financial sector development.

- The FSDC was established to improve cooperation among financial market authorities.

- It emphasises financial knowledge and inclusivity.

- Coordination of India’s foreign interactions with financial sector organisations such as the Financial Action Task Force (FATF) and the Financial Stability Board (FSB). (Hence statement 3 is correct)

-

Question 7 of 30

7. Question

Consider the following statements with respect to Securities and Exchange Board of India (SEBI):

- SEBI is a statutory organisation formed on April 1992.

- SEBI is a quasi-legislative and quasi-judicial agency with the authority to write rules, conduct investigations, issue judgements, and apply fines.

- SEBI can now regulate any money pooling arrangement of Rs. 100 crore or more and seize assets in situations of non-compliance.

- Ajay Tyagi is the current Chairman of SEBI.

Which of the above given statements are correct?

Correct

Solution (b)

Explanation:

- Securities and Exchange Board of India (SEBI) is a statutory organisation formed on April 12, 1992, in compliance with the requirements of the Securities and Exchange Board of India Act, 1992. (Hence statement 1 is correct).

- The Securities and Exchange Board of India’s primary duties are to safeguard the interests of investors in securities and to promote and regulate the securities market. It is headquartered in Mumbai, has four regional offices in Ahmedabad, Chennai, Delhi, and Kolkata.

- Ms Madhabi Puri Buch is the current SEBI Chairman, having been selected to take up the chairmanship on March 2, 2022, succeeding outgoing chairman Ajay Tyagi. (Hence statement 4 is incorrect)

SEBI – Powers and Functions

- SEBI is a quasi-legislative and quasi-judicial agency with the authority to write rules, conduct investigations, issue judgements, and apply fines. (Hence statement 2 is correct)

- It fulfils the standards of three categories –

- Issuers – By creating a marketplace for issuers to boost their financing.

- Investors – By assuring the security and availability of precise and accurate information.

- Intermediaries – By creating a competitive professional intermediary market.

- SEBI can now regulate any money pooling arrangement of Rs. 100 crore or more and seize assets in situations of noncompliance under the Securities Laws (Amendment) Act, 2014. (Hence statement 3 is correct)

- SEBI Chairman can authorise “search and seizure operations”. The SEBI board may also request information, such as telephone call data records, from any person or entity in connection with any securities transaction under investigation.

- SEBI is responsible for the registration and regulation of venture capital funds and collective investment plans, including mutual funds.

- It also aims to promote and regulate self-regulatory bodies, as well as to ban fraudulent and unfair trading activities in the securities markets.

Incorrect

Solution (b)

Explanation:

- Securities and Exchange Board of India (SEBI) is a statutory organisation formed on April 12, 1992, in compliance with the requirements of the Securities and Exchange Board of India Act, 1992. (Hence statement 1 is correct).

- The Securities and Exchange Board of India’s primary duties are to safeguard the interests of investors in securities and to promote and regulate the securities market. It is headquartered in Mumbai, has four regional offices in Ahmedabad, Chennai, Delhi, and Kolkata.

- Ms Madhabi Puri Buch is the current SEBI Chairman, having been selected to take up the chairmanship on March 2, 2022, succeeding outgoing chairman Ajay Tyagi. (Hence statement 4 is incorrect)

SEBI – Powers and Functions

- SEBI is a quasi-legislative and quasi-judicial agency with the authority to write rules, conduct investigations, issue judgements, and apply fines. (Hence statement 2 is correct)

- It fulfils the standards of three categories –

- Issuers – By creating a marketplace for issuers to boost their financing.

- Investors – By assuring the security and availability of precise and accurate information.

- Intermediaries – By creating a competitive professional intermediary market.

- SEBI can now regulate any money pooling arrangement of Rs. 100 crore or more and seize assets in situations of noncompliance under the Securities Laws (Amendment) Act, 2014. (Hence statement 3 is correct)

- SEBI Chairman can authorise “search and seizure operations”. The SEBI board may also request information, such as telephone call data records, from any person or entity in connection with any securities transaction under investigation.

- SEBI is responsible for the registration and regulation of venture capital funds and collective investment plans, including mutual funds.

- It also aims to promote and regulate self-regulatory bodies, as well as to ban fraudulent and unfair trading activities in the securities markets.

-

Question 8 of 30

8. Question

Consider the following statements with respect to latest FRBM targets:

- The Central Governments must ensure that the general Government debt does not exceed 60%.

- The Central Government should not give additional guarantees with respect to any loan on security of the Consolidated Fund of India in excess of 0.5% of GDP, in any financial year.

- The Central Government debt should not exceed 40%. of GDP by the end of financial year 2024-2025.

Which of the above given statements are correct?

Correct

Solution (d)

Explanation:

- The Fiscal Responsibility and Budget Management (FRBM) Act, 2003 is an act to provide for the responsibility of the Central Government to ensure intergenerational equity in fiscal management and long-term macro-economic stability by removing fiscal impediments in the effective conduct of monetary policy.

- The Act sets a target for the government to establish financial discipline in the economy, improve public funds management and reduce fiscal deficit.

- Latest FRBM targets

- Fiscal Deficit: The Central Government shall take appropriate measures to limit the fiscal deficit up to 3% of GDP by the 2021.

- The Central Government shall also ensure that the general Government debt does not exceed 60%. (Hence statement 1 is correct)

- The Central Government does not give additional guarantees with respect to any loan on security of the Consolidated Fund of India in excess of 0.5% of GDP, in any financial year. (Hence statement 2 is correct)

- The Central Government debt should not exceed 40%. of GDP by the end of financial year 2024-2025. (Hence statement 3 is correct)

Incorrect

Solution (d)

Explanation:

- The Fiscal Responsibility and Budget Management (FRBM) Act, 2003 is an act to provide for the responsibility of the Central Government to ensure intergenerational equity in fiscal management and long-term macro-economic stability by removing fiscal impediments in the effective conduct of monetary policy.

- The Act sets a target for the government to establish financial discipline in the economy, improve public funds management and reduce fiscal deficit.

- Latest FRBM targets

- Fiscal Deficit: The Central Government shall take appropriate measures to limit the fiscal deficit up to 3% of GDP by the 2021.

- The Central Government shall also ensure that the general Government debt does not exceed 60%. (Hence statement 1 is correct)

- The Central Government does not give additional guarantees with respect to any loan on security of the Consolidated Fund of India in excess of 0.5% of GDP, in any financial year. (Hence statement 2 is correct)

- The Central Government debt should not exceed 40%. of GDP by the end of financial year 2024-2025. (Hence statement 3 is correct)

-

Question 9 of 30

9. Question

Consider the following statements with respect to Disinvestment:

- Disinvestment is the sale or the liquidation of assets by the government.

- The funds generated from disinvestment helps in increasing the debt to GDP ratio.

- It helps to reduce political interference in non-essential services.

Which of the above given statements is/are incorrect?

Correct

Solution (b)

Explanation:

- Disinvestment is the sale or the liquidation of assets by the government, usually the central and state public sector enterprises, projects, or other fixed assets. (Hence statement 1 is correct)

- The funds generated from disinvestment helps in reducing public debt and decreasing the debt to GDP ratio. (Hence statement 2 is incorrect)

- According to the Budget 2022-23, the disinvestment target for 2022-23 is Rs 65,000 crore.

- Goals of Disinvestment Policy in India

- Decrease the financial burden from the sick, loss-making PSU’s

- To help improve public finances.

- Introduce competition and market discipline amongst enterprises.

- Help in the funding of various social sector welfare initiatives.

- To encourage a wider share of ownership

- Reduce political interference in non-essential services (Hence statement 3 is correct)

Incorrect

Solution (b)

Explanation:

- Disinvestment is the sale or the liquidation of assets by the government, usually the central and state public sector enterprises, projects, or other fixed assets. (Hence statement 1 is correct)

- The funds generated from disinvestment helps in reducing public debt and decreasing the debt to GDP ratio. (Hence statement 2 is incorrect)

- According to the Budget 2022-23, the disinvestment target for 2022-23 is Rs 65,000 crore.

- Goals of Disinvestment Policy in India

- Decrease the financial burden from the sick, loss-making PSU’s

- To help improve public finances.

- Introduce competition and market discipline amongst enterprises.

- Help in the funding of various social sector welfare initiatives.

- To encourage a wider share of ownership

- Reduce political interference in non-essential services (Hence statement 3 is correct)

-

Question 10 of 30

10. Question

Consider the following statements with regarding to measures taken by the government to revamp Special economic zones (SEZs)?

- Recently the government constituted a committee to study the existing SEZs of India and prepare a policy framework to adopt strategic policy measures headed by Mr Nachiketh Mor.

- This committee recommended a framework shift of SEZs from export growth to broad-based employment and economic growth.

Which of the above given statements is/are correct?

Correct

Solution (b)

Explanation:

The government constituted a committee headed by Mr Baba Kalyani, in 2018 to study the existing SEZs of India and prepare a policy framework to adopt strategic policy measures. (Hence statement 1 is incorrect)

Recommendations of the Baba Kalyani committee

- Rename SEZs in India as 3Es- Employment and Economic Enclave (Hence statement 3 is correct)

- Framework shift from export growth to broad-based employment and economic growth (Hence statement 2 is correct)

- Separate rules and procedures for manufacturing and service SEZs

- Ease of Doing Business (EoDB) in 3Es such as one integrated online portal for new investments

- Extension of Sunset Clause and retaining tax or duty benefits

- Unified regulator for IFSC

- Dispute resolution through arbitration and commercial courts

Incorrect

Solution (b)

Explanation:

The government constituted a committee headed by Mr Baba Kalyani, in 2018 to study the existing SEZs of India and prepare a policy framework to adopt strategic policy measures. (Hence statement 1 is incorrect)

Recommendations of the Baba Kalyani committee

- Rename SEZs in India as 3Es- Employment and Economic Enclave (Hence statement 3 is correct)

- Framework shift from export growth to broad-based employment and economic growth (Hence statement 2 is correct)

- Separate rules and procedures for manufacturing and service SEZs

- Ease of Doing Business (EoDB) in 3Es such as one integrated online portal for new investments

- Extension of Sunset Clause and retaining tax or duty benefits

- Unified regulator for IFSC

- Dispute resolution through arbitration and commercial courts

-

Question 11 of 30

11. Question

Consider the following statements with respect to the Pigouvian taxes:

- It is imposed on negative externalities and it is common instrument to control externalities.

- A Pigouvian tax on carbon ensures that the cost of emitting GHGs is reflected in the price of the commodity or service.

Which of the above given statements is/are correct

Correct

Solution (c)

Explanation:

- The idea dates to 1920 to Arthur Pigou in his book ‘The Economics of Welfare’. A Pigouvian tax is a per-unit tax on a good, thereby generating negative externalities equal to the marginal externality at the socially efficient quantity. Some Pigouvian taxes, such as the gas tax or cigarette tax, are regressive because they are flat, or the same for everyone. They end up taking take a greater percentage of income from people who make less money.

- Imposition of a Pigouvian tax leads to a competitive equilibrium, taking account of the tax, which is efficient. In the case of a positive externality, a subsidy can be used to obtain efficiency. Taxes and subsidies are common instruments to control externalities. (Hence statement 1 is correct)

- A Pigouvian tax on carbon ensures that the cost of emitting GHGs is reflected in the price of the commodity or service. (Hence, statement 2 is correct).

Incorrect

Solution (c)

Explanation:

- The idea dates to 1920 to Arthur Pigou in his book ‘The Economics of Welfare’. A Pigouvian tax is a per-unit tax on a good, thereby generating negative externalities equal to the marginal externality at the socially efficient quantity. Some Pigouvian taxes, such as the gas tax or cigarette tax, are regressive because they are flat, or the same for everyone. They end up taking take a greater percentage of income from people who make less money.

- Imposition of a Pigouvian tax leads to a competitive equilibrium, taking account of the tax, which is efficient. In the case of a positive externality, a subsidy can be used to obtain efficiency. Taxes and subsidies are common instruments to control externalities. (Hence statement 1 is correct)

- A Pigouvian tax on carbon ensures that the cost of emitting GHGs is reflected in the price of the commodity or service. (Hence, statement 2 is correct).

-

Question 12 of 30

12. Question

Consider the following statements about GST council:

- Every decision of the GST Council shall be taken by a majority of not less than three-fourths of the weighted votes of the members present and voting.

- Union and State legislatures have equal and unique power to make laws on GST.

Which of the above given statements is/are correct

Correct

Solution (c)

Explanation:

GST council

- It is a constitutional body under Article 279A.

- It makes recommendations to the Union and State Government on issues related to Goods and Service Tax and was introduced by the Constitution (One Hundred and First Amendment) Act, 2016.

- The GST Council is chaired by the Union Finance Minister and other members are the Union State Minister of Revenue or Finance and Ministers in charge of Finance or Taxation of all the States.

- It is considered as a federal body where both the centre and the states get due representation.

- Every decision of the Goods and Services Tax Council shall be taken at a meeting by a majority of not less than three-fourths of the weighted votes of the members present and voting. (Hence statement 1 is correct)

- The vote of the Central Government shall have a weightage of one-third of the total votes cast, and the votes of all the State Governments taken together shall have a weightage of two-thirds of the total votes cast, in that meeting.

- The Supreme Court in a judgment championing the importance of “cooperative federalism” for the well-being of democracy held that Union and State legislatures have “equal, simultaneous and unique powers” to make laws on Goods and Services Tax (GST) and the recommendations of the GST Council are not binding on them. (Hence statement 2 is correct)

Incorrect

Solution (c)

Explanation:

GST council

- It is a constitutional body under Article 279A.

- It makes recommendations to the Union and State Government on issues related to Goods and Service Tax and was introduced by the Constitution (One Hundred and First Amendment) Act, 2016.

- The GST Council is chaired by the Union Finance Minister and other members are the Union State Minister of Revenue or Finance and Ministers in charge of Finance or Taxation of all the States.

- It is considered as a federal body where both the centre and the states get due representation.

- Every decision of the Goods and Services Tax Council shall be taken at a meeting by a majority of not less than three-fourths of the weighted votes of the members present and voting. (Hence statement 1 is correct)

- The vote of the Central Government shall have a weightage of one-third of the total votes cast, and the votes of all the State Governments taken together shall have a weightage of two-thirds of the total votes cast, in that meeting.

- The Supreme Court in a judgment championing the importance of “cooperative federalism” for the well-being of democracy held that Union and State legislatures have “equal, simultaneous and unique powers” to make laws on Goods and Services Tax (GST) and the recommendations of the GST Council are not binding on them. (Hence statement 2 is correct)

-

Question 13 of 30

13. Question

Which of the following correctly describes the term ‘tax expenditure’?

Correct

Solution (a)

Explanation:

- Tax expenditures are a departure from the normal tax code that lower the tax burden of individuals or businesses. through an exemption, deduction, credit, or preferential rate.

- Expenditures can result in significant revenue losses to the government and include provisions such as the earned income tax credit, child tax credit, deduction for employer health-care contributions, and tax-advantaged savings plans.

- When the tax burden increases to such an extent that it impacts the sustenance of a sector the relaxations are given for the sector to flourish constitute tax expenditure. These can be given in the form of lower rates of tax as compared to normal rates.

- It is often regarded by many as wasteful, like subsidies.

- For instance, under the income tax act, every taxpayer can obtain a rebate of Rs. 12500 which is the tax expenditure for the government.

Incorrect

Solution (a)

Explanation:

- Tax expenditures are a departure from the normal tax code that lower the tax burden of individuals or businesses. through an exemption, deduction, credit, or preferential rate.

- Expenditures can result in significant revenue losses to the government and include provisions such as the earned income tax credit, child tax credit, deduction for employer health-care contributions, and tax-advantaged savings plans.

- When the tax burden increases to such an extent that it impacts the sustenance of a sector the relaxations are given for the sector to flourish constitute tax expenditure. These can be given in the form of lower rates of tax as compared to normal rates.

- It is often regarded by many as wasteful, like subsidies.

- For instance, under the income tax act, every taxpayer can obtain a rebate of Rs. 12500 which is the tax expenditure for the government.

-

Question 14 of 30

14. Question

_________of the taxes adds to the deadweight loss.

Correct

Solution (b)

Explanation:

- Taxation over taxes or cascading-effect of the taxes adds to the deadweight loss i.e., slump in total surplus of the supply chain consisting of the supplier, manufacturer, retailer, and consumer. Due to cascading tax imposition leads to a disproportionate increase in prices by an extent more than the rise in the tax.

- Tax buoyancy explains the relationship between the changes in government’s tax revenue growth and the changes in GDP. It refers to the responsiveness of tax revenue growth to changes in GDP. When a tax is buoyant, its revenue increases without increasing the tax rate.

Incorrect

Solution (b)

Explanation:

- Taxation over taxes or cascading-effect of the taxes adds to the deadweight loss i.e., slump in total surplus of the supply chain consisting of the supplier, manufacturer, retailer, and consumer. Due to cascading tax imposition leads to a disproportionate increase in prices by an extent more than the rise in the tax.

- Tax buoyancy explains the relationship between the changes in government’s tax revenue growth and the changes in GDP. It refers to the responsiveness of tax revenue growth to changes in GDP. When a tax is buoyant, its revenue increases without increasing the tax rate.

-

Question 15 of 30

15. Question

Consider the following statements with respect to Regressive tax:

- It affects people with low incomes more severely than people with high incomes.

- The burden of the tax increases as income rises.

- The tax rate decreases as income increases.

Which of the above given statements is/are incorrect?

Correct

Solution (b)

Explanation:

- A regressive tax is a tax applied uniformly, taking a larger percentage of income from low-income earners than from middle- and high-income earners. It is in opposition to a progressive tax, which takes a larger percentage from high-income earners. With a regressive tax, the tax burden decreases as income rises. (Hence statement 2 is incorrect)

- Some examples of a regressive tax include sales tax, gas tax, and payroll tax.

- A regressive tax affects people with low incomes more severely than people with high incomes because it is applied uniformly to all situations, regardless of the taxpayer. (Hence statement 1 is correct)

- A regressive tax system is one in which the tax rate decreases as the taxpayer’s income increases. A progressive tax system, on the other hand, is one in which the tax rate increases as the taxpayer’s income increases.(Hence statement 3 is correct)

Incorrect

Solution (b)

Explanation:

- A regressive tax is a tax applied uniformly, taking a larger percentage of income from low-income earners than from middle- and high-income earners. It is in opposition to a progressive tax, which takes a larger percentage from high-income earners. With a regressive tax, the tax burden decreases as income rises. (Hence statement 2 is incorrect)

- Some examples of a regressive tax include sales tax, gas tax, and payroll tax.

- A regressive tax affects people with low incomes more severely than people with high incomes because it is applied uniformly to all situations, regardless of the taxpayer. (Hence statement 1 is correct)

- A regressive tax system is one in which the tax rate decreases as the taxpayer’s income increases. A progressive tax system, on the other hand, is one in which the tax rate increases as the taxpayer’s income increases.(Hence statement 3 is correct)

-

Question 16 of 30

16. Question

Which ‘Five Year Plan’ prioritized eradication of poverty and providing employment opportunities.

Correct

Solution (b)

Explanation:

- The main objective of Fifth Five-year plan was to eradicate poverty and provide employment opportunities and justice. It has also focused on self-reliance in terms of Agricultural and defence requirements. There have been some changes since the second five-year plan, most notably the change in Prime Minister from Jawaharlal Nehru to Indira Gandhi.

Incorrect

Solution (b)

Explanation:

- The main objective of Fifth Five-year plan was to eradicate poverty and provide employment opportunities and justice. It has also focused on self-reliance in terms of Agricultural and defence requirements. There have been some changes since the second five-year plan, most notably the change in Prime Minister from Jawaharlal Nehru to Indira Gandhi.

-

Question 17 of 30

17. Question

Which of the following statements is/are correct with respect to Niti Aayog?

- It is an executive body.

- The main function of the Aayog is to develop mechanisms to formulate credible plans at the village level and aggregate these progressively at higher levels of government.

- Gujarat has topped the NITI Aayog’s India Innovation Index 2022.

Select the correct code:

Correct

Solution (d)

Explanation:

- NITI Aayog was formed via a resolution of the Union Cabinet on 1 January 2015.NITI Aayog is a non-constitutional and non-statutory body. It is an executive body. (Hence statement 1 is correct)

- Major functions of NITI Aayog:

- To develop mechanisms to formulate credible plans at the village level and aggregate these progressively at higher levels of government. (Hence statement 2 is correct)

- To pay special attention to the sections of our society that may be at risk of not benefitting adequately from economic progress

- To ensure, on areas that are specifically referred to it, that the interests of national security are incorporated in economic strategy and policy

- Feedback for constant innovative improvements

- To mainstream external ideas into Government policies, through collaboration with national and international experts

- To be the Government’s link to the outside world, outside experts and practitioners

- NITI Aayog India Innovation Index –2022- Karnataka Top Rank: Karnataka has topped the NITI Aayog’s India Innovation Index, 2022, which ranks sub-national innovation capacities and ecosystems. The state has ranked first in the Major States category in all three editions of the Index. (Hence statement 3 is incorrect)

Incorrect

Solution (d)

Explanation:

- NITI Aayog was formed via a resolution of the Union Cabinet on 1 January 2015.NITI Aayog is a non-constitutional and non-statutory body. It is an executive body. (Hence statement 1 is correct)

- Major functions of NITI Aayog:

- To develop mechanisms to formulate credible plans at the village level and aggregate these progressively at higher levels of government. (Hence statement 2 is correct)

- To pay special attention to the sections of our society that may be at risk of not benefitting adequately from economic progress

- To ensure, on areas that are specifically referred to it, that the interests of national security are incorporated in economic strategy and policy

- Feedback for constant innovative improvements

- To mainstream external ideas into Government policies, through collaboration with national and international experts

- To be the Government’s link to the outside world, outside experts and practitioners

- NITI Aayog India Innovation Index –2022- Karnataka Top Rank: Karnataka has topped the NITI Aayog’s India Innovation Index, 2022, which ranks sub-national innovation capacities and ecosystems. The state has ranked first in the Major States category in all three editions of the Index. (Hence statement 3 is incorrect)

-

Question 18 of 30

18. Question

Consider the following statements with respect to tax haven:

- A tax haven is a country that offers foreign businesses and individuals minimal or no tax liability for their bank deposits in a politically and economically stable environment.

- Tax havens encourage foreign depositors by offering tax advantages to corporations and the wealthy.

- Depositing money in a tax haven is legal as long as the depositor pays the taxes required by the home jurisdiction.

Which of the above given statements are correct?

Correct

Solution (d)

Explanation:

- A tax haven is a country that offers foreign businesses and individuals minimal or no tax liability for their bank deposits in a politically and economically stable environment. They have tax advantages for corporations and for the very wealthy and obvious potential for misuse in illegal tax avoidance schemes. (Hence statement 1 is correct)

- Tax havens encourage foreign depositors by offering tax advantages to corporations and the wealthy. (Hence statement 2 is correct)

- Many have secrecy laws that block information on their deposits from foreign tax authorities.

- Depositing money in a tax haven is legal if the depositor pays the taxes required by the home jurisdiction. (Hence statement 3 is correct)

Incorrect

Solution (d)

Explanation:

- A tax haven is a country that offers foreign businesses and individuals minimal or no tax liability for their bank deposits in a politically and economically stable environment. They have tax advantages for corporations and for the very wealthy and obvious potential for misuse in illegal tax avoidance schemes. (Hence statement 1 is correct)

- Tax havens encourage foreign depositors by offering tax advantages to corporations and the wealthy. (Hence statement 2 is correct)

- Many have secrecy laws that block information on their deposits from foreign tax authorities.

- Depositing money in a tax haven is legal if the depositor pays the taxes required by the home jurisdiction. (Hence statement 3 is correct)

-

Question 19 of 30

19. Question

If Company “ABC” recently issued new shares to the public for the second time in past 5 years. What will be such an issue called:

Correct

Solution (c)

Explanation:

- A follow-on public offer (FPO) is an issuing of shares to investors by a company that is already listed on an exchange. An FPO is essentially a stock issue of supplementary shares made by a company that is already publicly listed and has gone through the IPO process.

Incorrect

Solution (c)

Explanation:

- A follow-on public offer (FPO) is an issuing of shares to investors by a company that is already listed on an exchange. An FPO is essentially a stock issue of supplementary shares made by a company that is already publicly listed and has gone through the IPO process.

-

Question 20 of 30

20. Question

Consider the following statements with reference to ‘Global Corporate Minimum Tax’:

- The UN has published detailed rules to assist the implementation of Global Corporate Minimum Tax.

- This tax will help in counter rising global inequality.

- It will prevent the unilateral imposition of domestic laws by the developed world over the developing countries.

Which of the statements given above are correct?

Correct

Solution (b)

Explanation

- The OECD published detailed rules to assist in the implementation of a landmark reform to the international tax system, which will ensure Multinational Enterprises (MNEs) will be subject to a minimum 15% tax rate from 2023. However, the rules are not legally binding. (Hence statement 1 is incorrect)

- As many as 136 countries entered into an agreement earlier to redistribute taxing rights and impose a global minimum corporate tax on large multinational corporations.

- The tax will help in counter rising global inequality by making it tougher for large businesses to pay low taxes by availing the services of tax havens. (Hence statement 2 is correct)

- It will prevent the unilateral imposition of domestic laws by the developed world over the developing countries. (Hence statement 3 is correct)

Incorrect

Solution (b)

Explanation

- The OECD published detailed rules to assist in the implementation of a landmark reform to the international tax system, which will ensure Multinational Enterprises (MNEs) will be subject to a minimum 15% tax rate from 2023. However, the rules are not legally binding. (Hence statement 1 is incorrect)

- As many as 136 countries entered into an agreement earlier to redistribute taxing rights and impose a global minimum corporate tax on large multinational corporations.

- The tax will help in counter rising global inequality by making it tougher for large businesses to pay low taxes by availing the services of tax havens. (Hence statement 2 is correct)

- It will prevent the unilateral imposition of domestic laws by the developed world over the developing countries. (Hence statement 3 is correct)

-

Question 21 of 30

21. Question

Consider the following statements about Sarsa Rivulet

- The Sarsa originates in the Shivalik hills in Himachal Pradesh.

- It enters Punjab and eventually flows into River Sutlej.

- It is associated with the life of Guru Gobind Singh, the Sikh leader.

Choose the correct code:

Correct

Solution (a)

Explanation:

- The Sarsa originates in the Shivalik hills in Himachal Pradesh. Hence statement 1 is correct.

- It flows through Solan district that borders Punjab, enters Rupnagar district in Punjab and eventually flows into the Sutlej. Hence statement 2 is correct.

- The Sarsa was where the Guru’s family got separated in the winter of 1704, never to be together again.

- The rivulet is thus important in Sikh consciousness. Hence statement 3 is correct.

Source: CLICK HERE

Incorrect

Solution (a)

Explanation:

- The Sarsa originates in the Shivalik hills in Himachal Pradesh. Hence statement 1 is correct.

- It flows through Solan district that borders Punjab, enters Rupnagar district in Punjab and eventually flows into the Sutlej. Hence statement 2 is correct.

- The Sarsa was where the Guru’s family got separated in the winter of 1704, never to be together again.

- The rivulet is thus important in Sikh consciousness. Hence statement 3 is correct.

Source: CLICK HERE

-

Question 22 of 30

22. Question

Consider the following statements regarding ‘Rules of Origin’

- Rules of origin are the criteria needed to determine the national source of a product

- General Agreement on Tariffs and Trade (GATT) has specific rules governing the determination of the country of origin of goods in international commerce.

- Customs (Administration of Rules of Origin under Trade Agreements) Rules, 2020 which govern rules of origin exempts countries with which India has signed Free Trade Agreements from its ambit

Choose the correct answer using the code given below

Correct

Solution (c)

Explanation:

- Rules of origin are the criteria needed to determine the national source of a product. Their importance is derived from the fact that duties and restrictions in several cases depend upon the source of imports. Hence statement 1 is correct.

- GATT has no specific rules governing the determination of the country of origin of goods in international commerce. Each contracting party was free to determine its own origin rules, and could even maintain several different rules of origin depending on the purpose of the particular regulation. Hence statement 2 is not correct.

- Customs (Administration of Rules of Origin under Trade Agreements) Rules, 2020 implements the commitment to protect the domestic industry from misuse of Free Trade Agreements (FTAs) As per the revised rules, the country importing goods will have to present evidence of the country of origin. Hence statement 3 is not correct.

- This will support the importer to correctly ascertain the country of origin, properly claim the concessional duty and assist customs authorities in ensuring smooth clearance of legitimate imports. Stricter rules have been laid down for timelines for initiating and expeditious conclusions of origin related verification.

Source: CLICK HERE

Incorrect

Solution (c)

Explanation:

- Rules of origin are the criteria needed to determine the national source of a product. Their importance is derived from the fact that duties and restrictions in several cases depend upon the source of imports. Hence statement 1 is correct.

- GATT has no specific rules governing the determination of the country of origin of goods in international commerce. Each contracting party was free to determine its own origin rules, and could even maintain several different rules of origin depending on the purpose of the particular regulation. Hence statement 2 is not correct.

- Customs (Administration of Rules of Origin under Trade Agreements) Rules, 2020 implements the commitment to protect the domestic industry from misuse of Free Trade Agreements (FTAs) As per the revised rules, the country importing goods will have to present evidence of the country of origin. Hence statement 3 is not correct.

- This will support the importer to correctly ascertain the country of origin, properly claim the concessional duty and assist customs authorities in ensuring smooth clearance of legitimate imports. Stricter rules have been laid down for timelines for initiating and expeditious conclusions of origin related verification.

Source: CLICK HERE

-

Question 23 of 30

23. Question

With reference to ‘Green Methanol’, consider the following statements

- It is a high-carbon fuel that can be made from either biomass gasification or renewable electricity and captured carbon dioxide (CO2)

- It can be used for storing renewable electricity and also as a substitute fuel for maritime fuel applications

Select the correct statement(s)

Correct

Solution (b)

Explanation:

- Green methanol is methanol that is produced renewably and without polluting emissions, one of its variants being generated from green hydrogen. It is a low-carbon fuel that can be made from either biomass gasification or renewable electricity and captured carbon dioxide (CO2). Hence statement 1 is not correct.

- Green Methanol has a wide range of applications, including serving as a base material for the chemical industry, storing renewable electricity, and even as a transportation fuel. It is also considered as a substitute fuel for maritime fuel applications. Hence statement 2 is correct.

Source: CLICK HERE

Incorrect

Solution (b)

Explanation:

- Green methanol is methanol that is produced renewably and without polluting emissions, one of its variants being generated from green hydrogen. It is a low-carbon fuel that can be made from either biomass gasification or renewable electricity and captured carbon dioxide (CO2). Hence statement 1 is not correct.

- Green Methanol has a wide range of applications, including serving as a base material for the chemical industry, storing renewable electricity, and even as a transportation fuel. It is also considered as a substitute fuel for maritime fuel applications. Hence statement 2 is correct.

Source: CLICK HERE

-

Question 24 of 30

24. Question

Consider the following statements with respect to ‘Srimukhalingam Temple’

- This temple was built in Kalinga architectural style by the founder of the Eastern Ganga dynasty -Anantavarman Chodaganga

- Initially dedicated to Lord Shiva, Saint Ramanuja is said to have converted Srimukhalingam into a Vaishnavite temple

- The temple lying on the banks of river Vamsadhara has the Trinity of Madhukeswara, Someswara and Bheemeswara Temples

Choose the correct answer using the code given below

Correct

Solution (d)

Explanation:

- This temple is built in Kalinga architectural style. The main temple of Srimukhalingam is believed to have been built by Eastern Ganga Dynasty King Kamaranava deva II, great grandfather of Anantavarman Chodaganga Deva of Kalinga. Hence statement 1 is not correct.

- Srikurmam is the only Indian temple in the world where Vishnu is worshiped in his Kurma avatar. Initially dedicated to Shiva and referred to as Kurmeswara temple, Ramanuja is said to have converted Srikurmam into a Vaishnavite temple in the 11th century AD. Hence statement 2 is not correct.

- The Trinity of Madhukeswara, Someswara and Bheemeswara Temples are a testimony to the Magnificent architectural skills of Kalinga Kings. Sri Mukhalingam, which is on the banks of River Vamsadhara, was the capital of Kalinga Ganga Kings for over 600 years. Hence statement 3 is correct.

Source: CLICK HERE

Incorrect

Solution (d)

Explanation:

- This temple is built in Kalinga architectural style. The main temple of Srimukhalingam is believed to have been built by Eastern Ganga Dynasty King Kamaranava deva II, great grandfather of Anantavarman Chodaganga Deva of Kalinga. Hence statement 1 is not correct.

- Srikurmam is the only Indian temple in the world where Vishnu is worshiped in his Kurma avatar. Initially dedicated to Shiva and referred to as Kurmeswara temple, Ramanuja is said to have converted Srikurmam into a Vaishnavite temple in the 11th century AD. Hence statement 2 is not correct.

- The Trinity of Madhukeswara, Someswara and Bheemeswara Temples are a testimony to the Magnificent architectural skills of Kalinga Kings. Sri Mukhalingam, which is on the banks of River Vamsadhara, was the capital of Kalinga Ganga Kings for over 600 years. Hence statement 3 is correct.

Source: CLICK HERE

-

Question 25 of 30

25. Question

‘Lachin Corridor’ recently seen in news connects

Correct

Solution (d)

Explanation:

- The Lachin corridor is a mountain road that links Armenia and the enclave of Nagorno-Karabakh. Being the only road between these two territories, it is has been often described as a “lifeline” for the residents of Nagorno-Karabakh.

- The corridor is de jure in the Lachin District of Azerbaijan, but is under the control of a Russian peacekeeping force as provided for in the 2020 Nagorno-Karabakh armistice agreement.

Source: CLICK HERE

Incorrect

Solution (d)

Explanation:

- The Lachin corridor is a mountain road that links Armenia and the enclave of Nagorno-Karabakh. Being the only road between these two territories, it is has been often described as a “lifeline” for the residents of Nagorno-Karabakh.

- The corridor is de jure in the Lachin District of Azerbaijan, but is under the control of a Russian peacekeeping force as provided for in the 2020 Nagorno-Karabakh armistice agreement.

Source: CLICK HERE

-

Question 26 of 30

26. Question

To gain 10% on selling sample of milk at the cost price of pure milk, the quantity of water to be mixed with 50kg of pure milk is

Correct

Solution (b)

Explanation:

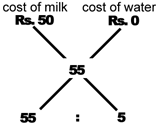

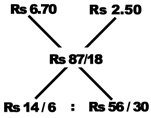

1st Method (Method of Alligation):

Let the quantity of water to be mixed is x kg.

Let cost of milk be Rs. 1 per kg.

Then SP of 50 kg of milk with gain 10% = Rs. 55 [As Cost of 50 kg milk = Rs. 50, then SP = (50 + 10% of 50)]

Then, water to be mixed is 5 kg, As the selling price of the milk is Rs. 1 per kg. Seller has to have 10% gain on 50 kg milk, he must have to add 5 kg water to 50 kg milk.

2nd Method (Simple Method):

Let the quantity of water mixed be x kg.

Let CP of 1 kg of pure milk = Rs. 1.

Hence,

% gain = x * 100/50

10 = 100x/50

Or, 2x = 10

or, x = 5 kg.

Incorrect

Solution (b)

Explanation:

1st Method (Method of Alligation):

Let the quantity of water to be mixed is x kg.

Let cost of milk be Rs. 1 per kg.

Then SP of 50 kg of milk with gain 10% = Rs. 55 [As Cost of 50 kg milk = Rs. 50, then SP = (50 + 10% of 50)]

Then, water to be mixed is 5 kg, As the selling price of the milk is Rs. 1 per kg. Seller has to have 10% gain on 50 kg milk, he must have to add 5 kg water to 50 kg milk.

2nd Method (Simple Method):

Let the quantity of water mixed be x kg.

Let CP of 1 kg of pure milk = Rs. 1.

Hence,

% gain = x * 100/50

10 = 100x/50

Or, 2x = 10

or, x = 5 kg.

-

Question 27 of 30

27. Question

A lump of two metals weighing 18g is worth Rs.87 but if their weight is interchanged, it would be worth Rs. 78.60. If the price of one metal be Rs. 6.70 per gram, find the weight of the other metal in the mixture.

Correct

Solution (a)

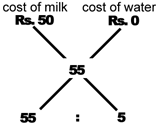

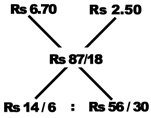

Explanation:

Cost of (18g of 1st metal + 18g of 2nd metal) = Rs. 165.60

Cost of (1g of 1st metal + 1g metal of 2nd metal) = Rs. 9.20

Hence cost of 1g of 2nd metal,

= 9.20 – 6.70

= Rs. 2.5

Mean price = Rs. 87/18

Now, quantity of 1st metal/quantity of 2nd metal = 14/6 : 56/30 = 5 : 4

Quantity of 2nd metal = (18*4)/9 = 8g

Incorrect

Solution (a)

Explanation:

Cost of (18g of 1st metal + 18g of 2nd metal) = Rs. 165.60

Cost of (1g of 1st metal + 1g metal of 2nd metal) = Rs. 9.20

Hence cost of 1g of 2nd metal,

= 9.20 – 6.70

= Rs. 2.5

Mean price = Rs. 87/18

Now, quantity of 1st metal/quantity of 2nd metal = 14/6 : 56/30 = 5 : 4

Quantity of 2nd metal = (18*4)/9 = 8g

-

Question 28 of 30

28. Question

One quantity of wheat at Rs 9.30 per kg is mixed with another quality at a certain rate in the ratio 8:7. If the mixture so formed be worth Rs. 10 per kg, what is the rate per kg of the second quality of wheat?

Correct

Solution (b)

Explanation:

Let the rate of second quality be Rs. x per Kg.

C.P of 1 Kg wheat of 1st kind = 930 p

C.P of 1 Kg wheat of 2nd kind = 100x p

Mean price = 1000 p

By rule of alligation we have required ratio 8 : 7

930 x / (Mean Price) (1000) / (x-10) : 0.7

So we get required ratio, (x-10) : 0.7 :: 8 : 7

⇒ x = 10.80 per Kg

Incorrect

Solution (b)

Explanation:

Let the rate of second quality be Rs. x per Kg.

C.P of 1 Kg wheat of 1st kind = 930 p

C.P of 1 Kg wheat of 2nd kind = 100x p

Mean price = 1000 p

By rule of alligation we have required ratio 8 : 7

930 x / (Mean Price) (1000) / (x-10) : 0.7

So we get required ratio, (x-10) : 0.7 :: 8 : 7

⇒ x = 10.80 per Kg

-

Question 29 of 30

29. Question

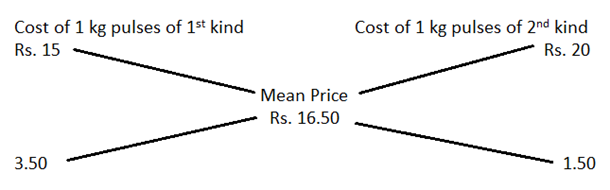

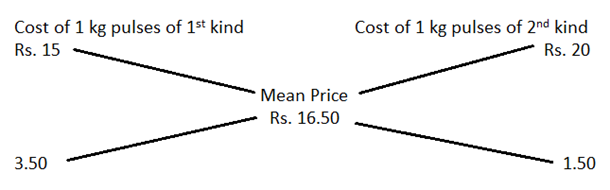

In what ratio must a grocer mix two varieties of pulses costing Rs.15 and Rs.20 per kg respectively so as to get a mixture worth Rs.16.50 kg?

Correct

Solution (c)

Explanation:

By the rule of alligation, we have:

∴ Required rate = 3.50 : 1.50 = 7 : 3

Incorrect

Solution (c)

Explanation:

By the rule of alligation, we have:

∴ Required rate = 3.50 : 1.50 = 7 : 3

-

Question 30 of 30

30. Question

Read the following passage and answer the item that follow. Your answer to these items should be based on the passages only

Passage 1

India has a history of neglect in breaking the intergenerational cycle of malnutrition. About one in five women (18.7 per cent) of reproductive age (15-49 years) in India are thin, with a body mass index (BMI) of less than 18.5 kilograms per square metre. This proportion is higher in rural areas (21.2 per cent) than in urban areas (13.1 per cent). Almost a quarter of women (23.3 per cent) are married before turning 18.

Under-nourished women, in all likelihood, become under-nourished mothers with a greater chance of giving birth to low birth-weight babies more prone to infections and growth failure. In India, every third child is under-weight (32.1 per cent) or stunted (35.5 per cent) and 19.3 per cent children are wasted (weak), according to 2019-21 National Family Health Survey-5 (NFHS-5) data.

Despite impressive gains in the past decades in reducing marriages among children below 18, there is stagnation in early marriage and a marginal reduction in teenage pregnancies. This is a cause of concern. It indicates rise in complications at birth, low birth weight, and higher maternal and child mortality rates.

Which of the following is/ are true in the context of the passage?

- The proportion of women who are thin are more in urban areas than in rural India

- Reduction in marriage of girls below 18 age seems to have greater impact on the issue of early teenage pregnancies

- As per NFHS-5 data every third child is wasted and every fifth child is stunted

Choose the correct code

Correct

Solution (b)

Explanation:

Statement 1 is incorrect as the proportions of women who are thin are more in rural areas than in urban India

Statement 2 is incorrect as the reduction in marriage of girls below 18 ages seems to have only marginal impact on the issue of early teenage pregnancies

Statement 3 is wrong because as per NFHS-5 data every third child is stunted and every fifth child is wasted.

Incorrect

Solution (b)

Explanation:

Statement 1 is incorrect as the proportions of women who are thin are more in rural areas than in urban India

Statement 2 is incorrect as the reduction in marriage of girls below 18 ages seems to have only marginal impact on the issue of early teenage pregnancies

Statement 3 is wrong because as per NFHS-5 data every third child is stunted and every fifth child is wasted.

All the Best

IASbaba