IASbaba Prelims 60 Days Plan, Rapid Revision Series (RaRe)

Archives

Hello Friends

The 60 Days Rapid Revision (RaRe) Series is IASbaba’s Flagship Initiative recommended by Toppers and loved by the aspirants’ community every year.

It is the most comprehensive program which will help you complete the syllabus, revise and practice tests on a daily basis. The Programme on a daily basis includes

Daily Prelims MCQs from Static (Monday – Saturday)

- Daily Static Quiz will cover all the topics of static subjects – Polity, History, Geography, Economics, Environment and Science and technology.

- 20 questions will be posted daily and these questions are framed from the topics mentioned in the schedule.

- It will ensure timely and streamlined revision of your static subjects.

Daily Current Affairs MCQs (Monday – Saturday)

- Daily 5 Current Affairs questions, based on sources like ‘The Hindu’, ‘Indian Express’ and ‘PIB’, would be published from Monday to Saturday according to the schedule.

Daily CSAT Quiz (Monday – Friday)

- CSAT has been an Achilles heel for many aspirants.

- Daily 5 CSAT Questions will be published.

Note – Daily Test of 20 static questions, 10 current affairs, and 5 CSAT questions. (35 Prelims Questions) in QUIZ FORMAT will be updated on a daily basis.

To Know More about 60 Days Rapid Revision (RaRe) Series – CLICK HERE

60 Day Rapid Revision (RaRe) Series Schedule – CLICK HERE

Important Note

- Comment your Scores in the Comment Section. This will keep you accountable, responsible and sincere in days to come.

- It will help us come out with the Cut-Off on a Daily Basis.

- Let us know if you enjoyed today’s test 🙂

- You can post your comments in the given format

- (1) Your Score

- (2) Matrix Meter

- (3) New Learning from the Test

Test-summary

0 of 35 questions completed

Questions:

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

Information

The following Test is based on the syllabus of 60 Days Plan-2025 for UPSC IAS Prelims 2025.

To view Solutions, follow these instructions:

- Click on – ‘Start Test’ button

- Solve Questions

- Click on ‘Test Summary’ button

- Click on ‘Finish Test’ button

- Now click on ‘View Questions’ button – here you will see solutions and links.

You have already completed the test before. Hence you can not start it again.

Test is loading...

You must sign in or sign up to start the test.

You have to finish following test, to start this test:

Results

0 of 35 questions answered correctly

Your time:

Time has elapsed

You have scored 0 points out of 0 points, (0)

| Average score |

|

| Your score |

|

Categories

- Not categorized 0%

| Pos. | Name | Entered on | Points | Result |

|---|---|---|---|---|

| Table is loading | ||||

| No data available | ||||

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- Answered

- Review

-

Question 1 of 35

1. Question

Which of the following statements about Government Securities (G-Secs) are correct?

Correct

Solution (b)

Explanation:

While the Central Government of India issues Government Securities (G-Secs), State Governments also issue similar securities known as State Development Loans (SDLs). These securities are instruments to finance government borrowing but are not limited to the central government. (Option (a) is incorrect)

Government securities are issued in both short-term and long-term categories. Short-term securities include Treasury Bills (T-Bills) with maturities of less than one year (e.g., 91 days, 182 days, and 364 days), while long-term securities, such as dated government securities, can have maturities of 5 to 40 years. (Option (b) is correct)

Treasury Bills (T-Bills) are short-term instruments issued with maturities of up to one year, specifically 91 days, 182 days, and 364 days. Instruments with maturities longer than one year are called dated securities, not T-Bills. (Option (c) is incorrect)

Government securities, especially those issued by stable governments like India, are considered low-risk instruments due to the government’s ability to repay its debt. However, they are not entirely risk-free. Factors like inflation, interest rate changes, and, in rare cases, sovereign default can affect the returns. Though India’s G-Secs are considered virtually risk-free, global examples of sovereign defaults show that such risk does exist, even if minimal. (Option (d) is incorrect)Incorrect

Solution (b)

Explanation:

While the Central Government of India issues Government Securities (G-Secs), State Governments also issue similar securities known as State Development Loans (SDLs). These securities are instruments to finance government borrowing but are not limited to the central government. (Option (a) is incorrect)

Government securities are issued in both short-term and long-term categories. Short-term securities include Treasury Bills (T-Bills) with maturities of less than one year (e.g., 91 days, 182 days, and 364 days), while long-term securities, such as dated government securities, can have maturities of 5 to 40 years. (Option (b) is correct)

Treasury Bills (T-Bills) are short-term instruments issued with maturities of up to one year, specifically 91 days, 182 days, and 364 days. Instruments with maturities longer than one year are called dated securities, not T-Bills. (Option (c) is incorrect)

Government securities, especially those issued by stable governments like India, are considered low-risk instruments due to the government’s ability to repay its debt. However, they are not entirely risk-free. Factors like inflation, interest rate changes, and, in rare cases, sovereign default can affect the returns. Though India’s G-Secs are considered virtually risk-free, global examples of sovereign defaults show that such risk does exist, even if minimal. (Option (d) is incorrect) -

Question 2 of 35

2. Question

Consider the following statements:

- A rise in global interest rates can lead to increased borrowing costs for Indian firms with existing External Commercial Borrowings.

- Currency appreciation can reduce the repayment burden for firms with foreign currency-denominated debt.

- Higher foreign inflows can lead to domestic currency depreciation, increasing currency risk for borrowers of foreign funds.

Which of the statements given above is/are correct?

Correct

Solution (a)

Explanation:

- When global interest rates rise, particularly in key economies like the US, the cost of servicing foreign debt rises for firms that have borrowed under External Commercial Borrowings (ECBs). This increases the interest payments for Indian companies, leading to higher financial pressure. (Statement 1 is correct)

- Currency appreciation means that the value of the Indian Rupee increases relative to the foreign currency. For firms with ECBs in foreign currencies (such as USD), repayment of loans becomes cheaper when converted to rupees, thereby reducing the repayment burden. (Statement 2 is correct)

Typically, higher foreign inflows strengthen the domestic currency (appreciation) rather than lead to depreciation. Currency depreciation increases the repayment burden of foreign-denominated debt, but higher foreign inflows would not directly cause this depreciation. (Statement 3 is incorrect)

Incorrect

Solution (a)

Explanation:

- When global interest rates rise, particularly in key economies like the US, the cost of servicing foreign debt rises for firms that have borrowed under External Commercial Borrowings (ECBs). This increases the interest payments for Indian companies, leading to higher financial pressure. (Statement 1 is correct)

- Currency appreciation means that the value of the Indian Rupee increases relative to the foreign currency. For firms with ECBs in foreign currencies (such as USD), repayment of loans becomes cheaper when converted to rupees, thereby reducing the repayment burden. (Statement 2 is correct)

Typically, higher foreign inflows strengthen the domestic currency (appreciation) rather than lead to depreciation. Currency depreciation increases the repayment burden of foreign-denominated debt, but higher foreign inflows would not directly cause this depreciation. (Statement 3 is incorrect)

-

Question 3 of 35

3. Question

Consider the following statements:

Statement-I: Quantitative tightening makes many central banks reduce their balance sheets by selling off government bonds.

Statement-II: Quantitative tightening is generally undertaken when central banks aim to combat inflation and normalize monetary policy after quantitative easing.

Which one of the following is correct in respect of the above statements?

Correct

Solution (a)

Explanation:

- In the aftermath of the COVID-19 pandemic, central banks, such as the U.S. Federal Reserve and the European Central Bank, which had previously expanded their balance sheets by purchasing government bonds (quantitative easing), have now begun reducing them through quantitative tightening. This involves selling the bonds back into the market or letting them mature without reinvestment to reduce the money supply. (Statement 1 is correct)

- Central banks typically engage in quantitative tightening to counter the inflationary effects of quantitative easing, where they had previously injected large amounts of liquidity into the economy by purchasing government securities. As inflation rises and economic recovery takes hold, central banks use tightening to reduce excess liquidity and stabilize prices, bringing monetary policy back to normal. (Statement 2 is correct)

- Statement-I describes a factual action that many central banks are take, while Statement-II explains the rationale behind this action, making it the correct explanation for Statement-I.

Incorrect

Solution (a)

Explanation:

- In the aftermath of the COVID-19 pandemic, central banks, such as the U.S. Federal Reserve and the European Central Bank, which had previously expanded their balance sheets by purchasing government bonds (quantitative easing), have now begun reducing them through quantitative tightening. This involves selling the bonds back into the market or letting them mature without reinvestment to reduce the money supply. (Statement 1 is correct)

- Central banks typically engage in quantitative tightening to counter the inflationary effects of quantitative easing, where they had previously injected large amounts of liquidity into the economy by purchasing government securities. As inflation rises and economic recovery takes hold, central banks use tightening to reduce excess liquidity and stabilize prices, bringing monetary policy back to normal. (Statement 2 is correct)

- Statement-I describes a factual action that many central banks are take, while Statement-II explains the rationale behind this action, making it the correct explanation for Statement-I.

-

Question 4 of 35

4. Question

Which of the following statements with reference to the credit ratings are correct?

- Credit rating agencies in India must be registered with the Reserve Bank of India (RBI).

- CRISIL is an Indian credit rating agency that is majority-owned by an international entity.

- CARE Ratings specializes only in rating corporate bonds and not government securities.

Select the correct answer using the code given below:

Correct

Solution (b)

Explanation:

- Credit rating agencies (CRAs) in India are regulated by SEBI under the SEBI (Credit Rating Agencies) Regulations, 1999. SEBI ensures that CRAs follow standards for transparency, accountability, and conflict of interest management. (Statement 1 is incorrect)

- CRISIL (Credit Rating Information Services of India Limited) is an Indian credit rating agency, and a majority stake in CRISIL is owned by S&P Global, a U.S.-based financial services company. CRISIL is one of the largest rating agencies in India. (Statement 2 is correct)

- CARE Ratings (Credit Analysis & Research Ltd) provides ratings for a wide range of securities including corporate bonds, government securities, and other debt instruments. It is not limited to only corporate bonds. (Statement 3 is incorrect)

Incorrect

Solution (b)

Explanation:

- Credit rating agencies (CRAs) in India are regulated by SEBI under the SEBI (Credit Rating Agencies) Regulations, 1999. SEBI ensures that CRAs follow standards for transparency, accountability, and conflict of interest management. (Statement 1 is incorrect)

- CRISIL (Credit Rating Information Services of India Limited) is an Indian credit rating agency, and a majority stake in CRISIL is owned by S&P Global, a U.S.-based financial services company. CRISIL is one of the largest rating agencies in India. (Statement 2 is correct)

- CARE Ratings (Credit Analysis & Research Ltd) provides ratings for a wide range of securities including corporate bonds, government securities, and other debt instruments. It is not limited to only corporate bonds. (Statement 3 is incorrect)

-

Question 5 of 35

5. Question

With reference to the concept of “Legal Tender,” consider the following statements:

- Coins issued by the Government of India have limited legal tender status.

- Cryptocurrencies are recognized as legal tender in some countries, including India.

- Currency notes issued by the Reserve Bank of India are unlimited legal tender.

- Legal tender status can be revoked or altered by legislative action.

Which of the statements given above are correct?

Correct

Solution (d)

Explanation:

- Coins in India can only be used for transactions up to a certain limit, making them limited legal tender. For example, coins up to ₹1,000 in denominations of ₹1, ₹2, ₹5, and ₹10 are considered legal tender for that amount. The Coinage Act, 2011 governs the issuance and legal tender status of coins in India. (Statement 1 is correct)

- Cryptocurrencies are not legal tender in India, though they are recognized as such in countries like El Salvador. In fact, the Reserve Bank of India (RBI) has clarified that cryptocurrencies do not have legal tender status in India. The Supreme Court, while lifting the ban on cryptocurrency trading in 2020, did not give it legal tender status. (Statement 2 is incorrect)

- RBI-issued notes are unlimited legal tender in India and can be used for settling any amount of debt. The RBI governs the issuance of currency notes in India under the Reserve Bank of India Act, 1934. (Statement 3 is correct)

- The government can change or revoke the legal tender status of any currency or coin through legislation, as seen during India’s demonetization in 2016. The legal basis for this comes under the Reserve Bank of India Act, which gives the government the authority to declare notes as no longer legal tender. (Statement 4 is correct)

Incorrect

Solution (d)

Explanation:

- Coins in India can only be used for transactions up to a certain limit, making them limited legal tender. For example, coins up to ₹1,000 in denominations of ₹1, ₹2, ₹5, and ₹10 are considered legal tender for that amount. The Coinage Act, 2011 governs the issuance and legal tender status of coins in India. (Statement 1 is correct)

- Cryptocurrencies are not legal tender in India, though they are recognized as such in countries like El Salvador. In fact, the Reserve Bank of India (RBI) has clarified that cryptocurrencies do not have legal tender status in India. The Supreme Court, while lifting the ban on cryptocurrency trading in 2020, did not give it legal tender status. (Statement 2 is incorrect)

- RBI-issued notes are unlimited legal tender in India and can be used for settling any amount of debt. The RBI governs the issuance of currency notes in India under the Reserve Bank of India Act, 1934. (Statement 3 is correct)

- The government can change or revoke the legal tender status of any currency or coin through legislation, as seen during India’s demonetization in 2016. The legal basis for this comes under the Reserve Bank of India Act, which gives the government the authority to declare notes as no longer legal tender. (Statement 4 is correct)

-

Question 6 of 35

6. Question

With reference to the ‘Deposit Insurance and Credit Guarantee Corporation (DICGC)’, consider the following statements?

- The DICGC insures all bank deposits, such as savings, fixed, current, and recurring deposits.

- The maximum amount insured by the DICGC is ₹5 lakh for each depositor per bank.

- DICGC is a wholly-owned subsidiary of the Reserve Bank of India (RBI).

Which of the above statements is/are correct?

Correct

Solution (d)

Explanation:

- The Deposit Insurance and Credit Guarantee Corporation (DICGC) provides insurance cover to deposits such as savings, fixed deposits, current accounts, and recurring deposits in commercial banks, regional rural banks (RRBs), and cooperative banks. However, some deposits like those of the central or state governments, foreign governments, or any interbank deposits are excluded from insurance coverage. (Statement 1 is correct)

- The DICGC insures each depositor up to ₹5 lakh per bank, including both the principal and interest amount. This limit was increased from ₹1 lakh to ₹5 lakh in 2020 to offer more protection to depositors. (Statement 2 is correct)

- The DICGC was established in 1978 as a wholly-owned subsidiary of the Reserve Bank of India to provide deposit insurance coverage and guarantee credit facilities. (Statement 3 is correct)

Incorrect

Solution (d)

Explanation:

- The Deposit Insurance and Credit Guarantee Corporation (DICGC) provides insurance cover to deposits such as savings, fixed deposits, current accounts, and recurring deposits in commercial banks, regional rural banks (RRBs), and cooperative banks. However, some deposits like those of the central or state governments, foreign governments, or any interbank deposits are excluded from insurance coverage. (Statement 1 is correct)

- The DICGC insures each depositor up to ₹5 lakh per bank, including both the principal and interest amount. This limit was increased from ₹1 lakh to ₹5 lakh in 2020 to offer more protection to depositors. (Statement 2 is correct)

- The DICGC was established in 1978 as a wholly-owned subsidiary of the Reserve Bank of India to provide deposit insurance coverage and guarantee credit facilities. (Statement 3 is correct)

-

Question 7 of 35

7. Question

In India, which one of the following is responsible for regulating the securities market and protecting the interests of investors?

Correct

Solution (c)

Explanation:

- The Reserve Bank of India (RBI) is India’s central bank responsible for regulating the monetary policy, managing currency, and controlling inflation, but it does not regulate the securities market. Its key roles include maintaining monetary stability, regulating banks, and ensuring liquidity in the economy.

- The IRDAI is responsible for regulating and promoting the insurance industry in India. It protects the interests of policyholders, ensures the growth of the insurance sector, and regulates insurance companies. However, it does not regulate the securities market.

- SEBI is the regulator for the securities and commodities market in India. It was established in 1992 to protect investors’ interests, promote the development of the securities market, and regulate the functioning of stock exchanges, mutual funds, and other market intermediaries. (Option (c) is correct)

- The Ministry of Finance formulates fiscal policy, manages public finance, and oversees economic policies, but it does not directly regulate the securities market. Instead, SEBI is the regulatory body for this function.

Incorrect

Solution (c)

Explanation:

- The Reserve Bank of India (RBI) is India’s central bank responsible for regulating the monetary policy, managing currency, and controlling inflation, but it does not regulate the securities market. Its key roles include maintaining monetary stability, regulating banks, and ensuring liquidity in the economy.

- The IRDAI is responsible for regulating and promoting the insurance industry in India. It protects the interests of policyholders, ensures the growth of the insurance sector, and regulates insurance companies. However, it does not regulate the securities market.

- SEBI is the regulator for the securities and commodities market in India. It was established in 1992 to protect investors’ interests, promote the development of the securities market, and regulate the functioning of stock exchanges, mutual funds, and other market intermediaries. (Option (c) is correct)

- The Ministry of Finance formulates fiscal policy, manages public finance, and oversees economic policies, but it does not directly regulate the securities market. Instead, SEBI is the regulatory body for this function.

-

Question 8 of 35

8. Question

With reference to the Open Market Operations (OMO) of Reserve Bank of India (RBI), consider the following methods:

- Imposing Minimum Reserve Requirements

- Moral Suasion

- Purchase and Sale of Government Securities

- Change in the Margin Requirements

Which of the above is/are part of the qualitative methods used by RBI for OMO?

Correct

Solution (b)

Explanation:

- The RBI employs various tools to manage the money supply and liquidity in the economy through Open Market Operations (OMO), which include both quantitative and qualitative methods. Qualitative tools are non-direct tools of monetary control that influence the credit allocation.

- Imposing minimum reserve requirements is not a method used by RBI for OMO. Minimum Reserve Requirements are part of the Statutory Liquidity Ratio (SLR) or Cash Reserve Ratio (CRR) regulations, which are quantitative measures and not qualitative methods of controlling money supply. (Statement 1 is incorrect)

- Moral suasion refers to the RBI’s informal persuasion or guidance to banks regarding their lending and borrowing practices, rather than enforcing strict regulations. This method helps the RBI influence market behavior without direct intervention. (Statement 2 is correct)

- The purchase and sale of government securities are a direct tool under quantitative methods of OMO. The RBI buys or sells government securities in the open market to increase or decrease the money supply. It is not considered a qualitative method. (Statement 3 is incorrect)

- Changing margin requirements is a qualitative measure used to influence the amount of credit extended by banks against securities. Higher margins reduce the credit flow, while lower margins increase it, helping control speculative lending. (Statement 4 is correct)

Incorrect

Solution (b)

Explanation:

- The RBI employs various tools to manage the money supply and liquidity in the economy through Open Market Operations (OMO), which include both quantitative and qualitative methods. Qualitative tools are non-direct tools of monetary control that influence the credit allocation.

- Imposing minimum reserve requirements is not a method used by RBI for OMO. Minimum Reserve Requirements are part of the Statutory Liquidity Ratio (SLR) or Cash Reserve Ratio (CRR) regulations, which are quantitative measures and not qualitative methods of controlling money supply. (Statement 1 is incorrect)

- Moral suasion refers to the RBI’s informal persuasion or guidance to banks regarding their lending and borrowing practices, rather than enforcing strict regulations. This method helps the RBI influence market behavior without direct intervention. (Statement 2 is correct)

- The purchase and sale of government securities are a direct tool under quantitative methods of OMO. The RBI buys or sells government securities in the open market to increase or decrease the money supply. It is not considered a qualitative method. (Statement 3 is incorrect)

- Changing margin requirements is a qualitative measure used to influence the amount of credit extended by banks against securities. Higher margins reduce the credit flow, while lower margins increase it, helping control speculative lending. (Statement 4 is correct)

-

Question 9 of 35

9. Question

Which of the following items are considered assets in the Balance Sheet of the Reserve Bank of India (RBI)?

- Foreign Currency Assets

- Notes issued by RBI

- Loans and Advances to the Government of India

- Gold Reserves

Select the correct answer using the code given below:

Correct

Solution (b)

Explanation:

- In the RBI’s balance sheet, assets are items that represent the economic resources the bank holds, while liabilities are its obligations.

- Foreign currency assets are a part of RBI’s total assets and include its holdings of foreign currencies, which are part of the overall reserves held by the central bank. (Statement 1 is correct)

- Notes issued (currency in circulation) are liabilities, not assets, for the RBI. Currency is considered a liability as it represents the money that the central bank owes to the public holding it. (Statement 2 is incorrect)

- Loans and advances made by the RBI to the central and state governments are considered assets on the RBI’s balance sheet. (Statement 3 is correct)

- Gold reserves held by the RBI are also a part of its assets. The central bank holds gold as part of its reserve management strategy. (Statement 4 is correct)

Incorrect

Solution (b)

Explanation:

- In the RBI’s balance sheet, assets are items that represent the economic resources the bank holds, while liabilities are its obligations.

- Foreign currency assets are a part of RBI’s total assets and include its holdings of foreign currencies, which are part of the overall reserves held by the central bank. (Statement 1 is correct)

- Notes issued (currency in circulation) are liabilities, not assets, for the RBI. Currency is considered a liability as it represents the money that the central bank owes to the public holding it. (Statement 2 is incorrect)

- Loans and advances made by the RBI to the central and state governments are considered assets on the RBI’s balance sheet. (Statement 3 is correct)

- Gold reserves held by the RBI are also a part of its assets. The central bank holds gold as part of its reserve management strategy. (Statement 4 is correct)

-

Question 10 of 35

10. Question

With reference to Developmental Banks in India, consider the following statements:

- The Industrial Development Bank of India was originally established as a subsidiary of the Reserve Bank of India.

- The National Bank for Agriculture and Rural Development focuses exclusively on the credit needs of rural areas and agriculture.

- The Small Industries Development Bank of India provides financial assistance to both small and medium enterprises in India.

How many of the statements given above are correct?

Correct

Solution (b)

Explanation:

- IDBI was established in 1964 as a subsidiary of RBI to provide financial assistance for industrial development in India. In 1976, it was made an independent financial institution. (Statement 1 is correct)

- NABARD’s primary focus is on agriculture and rural development, but it also supports infrastructure development, microfinance, and cottage industries in rural areas. It does not focus exclusively on agriculture. (Statement 2 is incorrect)

- SIDBI is focused on promoting, financing, and developing micro, small, and medium enterprises (MSMEs). It provides a wide range of financial products and services to this sector. (Statement 3 is correct)

Incorrect

Solution (b)

Explanation:

- IDBI was established in 1964 as a subsidiary of RBI to provide financial assistance for industrial development in India. In 1976, it was made an independent financial institution. (Statement 1 is correct)

- NABARD’s primary focus is on agriculture and rural development, but it also supports infrastructure development, microfinance, and cottage industries in rural areas. It does not focus exclusively on agriculture. (Statement 2 is incorrect)

- SIDBI is focused on promoting, financing, and developing micro, small, and medium enterprises (MSMEs). It provides a wide range of financial products and services to this sector. (Statement 3 is correct)

-

Question 11 of 35

11. Question

With reference to monetary policy tools used by the Reserve Bank of India (RBI), consider the following statements:

- When liquidity in the banking system is tight, RBI is likely to conduct a reverse repo operation.

- If inflationary pressures are rising, RBI is likely to increase the repo rate.

- If the rupee is appreciating too fast, RBI is likely to buy foreign currency.

Which of the statements given above are correct?

Correct

Solution (b)

Explanation:

- A reverse repo is a tool used by RBI to absorb excess liquidity from the banking system. When liquidity is tight, RBI is more likely to inject liquidity through repo operations rather than reverse repo. (Statement 1 is incorrect)

- To control rising inflation, the RBI may increase the repo rate. This action makes borrowing more expensive, thus reducing demand and helping to control inflation. (Statement 2 is correct)

When the rupee appreciates too quickly, the RBI may intervene by buying foreign currency, primarily U.S. dollars, to curb excessive rupee strength. This helps maintain export competitiveness. (Statement 3 is correct)

Incorrect

Solution (b)

Explanation:

- A reverse repo is a tool used by RBI to absorb excess liquidity from the banking system. When liquidity is tight, RBI is more likely to inject liquidity through repo operations rather than reverse repo. (Statement 1 is incorrect)

- To control rising inflation, the RBI may increase the repo rate. This action makes borrowing more expensive, thus reducing demand and helping to control inflation. (Statement 2 is correct)

When the rupee appreciates too quickly, the RBI may intervene by buying foreign currency, primarily U.S. dollars, to curb excessive rupee strength. This helps maintain export competitiveness. (Statement 3 is correct)

-

Question 12 of 35

12. Question

Which of the following organisation has implemented National Automated Clearing House (NACH)?

Correct

Solution (c)

Explanation:

-

- SEBI is the regulatory authority for India’s securities markets. It does not manage payment systems or clearinghouses. SEBI primarily oversees stock exchanges, investment funds, and other market intermediaries.

- The Ministry of Finance is responsible for managing India’s public finances, economic policies, taxation, and financial regulations. It does not directly manage clearinghouse or payment systems.

- NPCI has implemented the National Automated Clearing House (NACH) system. NACH is a centralised system for processing high-volume, low-value transactions that are repetitive in nature. It supports bulk payments such as subsidies, salaries, dividends, pensions, and utility bill payments, as well as bulk collections like telephone bills, electricity bills, and loan installments. (Option (c) is correct)

- While RBI is the central regulatory authority that oversees payment systems, it does not directly operate the NACH system. NPCI, which functions under the regulatory supervision of RBI, is responsible for the implementation of NACH.

Incorrect

Solution (c)

Explanation:

-

- SEBI is the regulatory authority for India’s securities markets. It does not manage payment systems or clearinghouses. SEBI primarily oversees stock exchanges, investment funds, and other market intermediaries.

- The Ministry of Finance is responsible for managing India’s public finances, economic policies, taxation, and financial regulations. It does not directly manage clearinghouse or payment systems.

- NPCI has implemented the National Automated Clearing House (NACH) system. NACH is a centralised system for processing high-volume, low-value transactions that are repetitive in nature. It supports bulk payments such as subsidies, salaries, dividends, pensions, and utility bill payments, as well as bulk collections like telephone bills, electricity bills, and loan installments. (Option (c) is correct)

- While RBI is the central regulatory authority that oversees payment systems, it does not directly operate the NACH system. NPCI, which functions under the regulatory supervision of RBI, is responsible for the implementation of NACH.

-

Question 13 of 35

13. Question

Which of the following is NOT a benefit of investing in government treasury bills?

Correct

Solution (c)

Explanations

A government treasury bill, as previously indicated, is issued as a short-term fundraising tool for the government and has the longest maturity duration (364 days). Individuals who want to make short-term gains through safe investments might put their money into these products. Furthermore, such G-Secs can be resold on the secondary market, letting investors turn their holdings into cash in an emergency. (Hence option c is incorrect).

Incorrect

Solution (c)

Explanations

A government treasury bill, as previously indicated, is issued as a short-term fundraising tool for the government and has the longest maturity duration (364 days). Individuals who want to make short-term gains through safe investments might put their money into these products. Furthermore, such G-Secs can be resold on the secondary market, letting investors turn their holdings into cash in an emergency. (Hence option c is incorrect).

-

Question 14 of 35

14. Question

Which of the following statements is correct about Certificate of Deposit?

- The Certificate of Deposit are sold at a higher price than their face value.

- Certificates of Deposit are non-volatile and provides guaranteed rate of return.

- In Certificate of Deposit, early withdrawal prior to maturity result in a penalty.

Select the answer using the code given below:

Correct

Solution (b)

Explanation

Statement 1 Statement 2 Statement 3 Incorrect Correct Correct A certificate of deposit (CD) is a product offered by banks and credit unions that offers an interest rate premium in exchange for the customer agreeing to leave a lump-sum deposit untouched for a set period of time. The CDs are sold at a lower price than their face value. The difference between the issue value and the face value is the return on them. Certificates of Deposit (CD) are a less risky and more conservative investment than stocks and bonds, with less room for growth but a non-volatile, guaranteed rate of return. Almost every bank, credit union, and brokerage firm provide a selection of Certificate of Deposits. Certificate of Deposit (CD) are intended to entice investors to keep their money in the CD until the term ends. As a result, early withdrawal prior to maturity will usually result in a penalty. o Because you can’t withdraw funds as easily as you can with a savings account, this type of asset isn’t considered liquid in the same way that a savings or checking account is. Incorrect

Solution (b)

Explanation

Statement 1 Statement 2 Statement 3 Incorrect Correct Correct A certificate of deposit (CD) is a product offered by banks and credit unions that offers an interest rate premium in exchange for the customer agreeing to leave a lump-sum deposit untouched for a set period of time. The CDs are sold at a lower price than their face value. The difference between the issue value and the face value is the return on them. Certificates of Deposit (CD) are a less risky and more conservative investment than stocks and bonds, with less room for growth but a non-volatile, guaranteed rate of return. Almost every bank, credit union, and brokerage firm provide a selection of Certificate of Deposits. Certificate of Deposit (CD) are intended to entice investors to keep their money in the CD until the term ends. As a result, early withdrawal prior to maturity will usually result in a penalty. o Because you can’t withdraw funds as easily as you can with a savings account, this type of asset isn’t considered liquid in the same way that a savings or checking account is. -

Question 15 of 35

15. Question

Which of the following is not a restriction imposed by the Reserve Bank of India on Certificates of Deposit in India?

Correct

Solution (a)

Explanation

-

- Non-Resident Indians can also issue Certificates of Deposit, but only on a non-repatriable basis. (Hence option a is incorrect)

- Certificates of Deposit are issued in India by scheduled commercial banks and select financial institutions within the limits set by the Reserve Bank of India. Individuals, businesses, corporations, and funds, among others, receive Certificates of Deposit.

- It is important to note that banks and financial institutions cannot make loans in exchange for Certificates of Deposit. Furthermore, banks are not permitted to purchase their own Certificates of Deposit prior to the maturity of the latter. (Hence option b and c are correct)

- The aforementioned norms, however, may be relaxed by the RBI for a limited time. It should be noted that banks must maintain the statutory liquidity ratio and cash reserve ratio on the price of a Certificate of Deposit. (Hence option d is correct)

Incorrect

Solution (a)

Explanation

-

- Non-Resident Indians can also issue Certificates of Deposit, but only on a non-repatriable basis. (Hence option a is incorrect)

- Certificates of Deposit are issued in India by scheduled commercial banks and select financial institutions within the limits set by the Reserve Bank of India. Individuals, businesses, corporations, and funds, among others, receive Certificates of Deposit.

- It is important to note that banks and financial institutions cannot make loans in exchange for Certificates of Deposit. Furthermore, banks are not permitted to purchase their own Certificates of Deposit prior to the maturity of the latter. (Hence option b and c are correct)

- The aforementioned norms, however, may be relaxed by the RBI for a limited time. It should be noted that banks must maintain the statutory liquidity ratio and cash reserve ratio on the price of a Certificate of Deposit. (Hence option d is correct)

-

Question 16 of 35

16. Question

Consider the following statements.

- A Global Depository Receipt is a financial instrument held by a custodian bank in the home country.

- Using Global Depository Receipt, companies can raise capital from investors in countries around the world.

Which of the following statements given above is/are correct?

Correct

Solution (c)

Explanation

Statement 1 Statement 2 Correct Correct A Global Depository Receipt (GDR) is a financial instrument issued by a foreign company and held by a custodian bank in the home country. GDRs make it possible for a company (the issuer) to access investors in capital markets beyond the borders of its own country. Using Global Depository Receipt, companies can raise capital from investors in countries around the world. GDRs can in theory be denominated in any currency, but are nearly always in U.S. dollars. Since GDRs are negotiable certificates, they trade in multiple markets and can provide arbitrage opportunities to investors. Incorrect

Solution (c)

Explanation

Statement 1 Statement 2 Correct Correct A Global Depository Receipt (GDR) is a financial instrument issued by a foreign company and held by a custodian bank in the home country. GDRs make it possible for a company (the issuer) to access investors in capital markets beyond the borders of its own country. Using Global Depository Receipt, companies can raise capital from investors in countries around the world. GDRs can in theory be denominated in any currency, but are nearly always in U.S. dollars. Since GDRs are negotiable certificates, they trade in multiple markets and can provide arbitrage opportunities to investors. -

Question 17 of 35

17. Question

Which of the following statements is correct about the capital market?

- The Indian Equity Markets and the Indian Debt markets together form the Indian Capital markets.

- Capital markets are used to sell financial instruments excluding debt securities.

- Capital markets are informal in nature.

Select the correct answer using the code given below:

Correct

Solution (a)

Explanation

Statement 1 Statement 2 Statement 3 Correct Incorrect Incorrect The capital market is the market for securities, where companies and governments can raise long-term funds. Selling stock and selling bonds are two ways to generate capital and long term funds. Thus bond markets and stock markets are considered capital markets. The capital markets consist of the primary market, where new issues are distributed to investors, and the secondary market, where existing securities are traded. The Indian Equity Markets and the Indian Debt markets together form the Indian Capital markets. Capital markets refer to venues where funds are exchanged between suppliers and those who seek capital. Suppliers in capital markets are typically banks and investors. Those who seek capital are businesses, governments, and individuals. Capital markets are used to sell financial instruments, including equities and debt securities. These markets are divided into two categories: primary and secondary markets. The term “capital market” is a broad one that’s used to describe the in-person and digital spaces in which various entities trade types of financial instruments. Money markets are informal in nature, whereas Capital markets are formal in nature. Incorrect

Solution (a)

Explanation

Statement 1 Statement 2 Statement 3 Correct Incorrect Incorrect The capital market is the market for securities, where companies and governments can raise long-term funds. Selling stock and selling bonds are two ways to generate capital and long term funds. Thus bond markets and stock markets are considered capital markets. The capital markets consist of the primary market, where new issues are distributed to investors, and the secondary market, where existing securities are traded. The Indian Equity Markets and the Indian Debt markets together form the Indian Capital markets. Capital markets refer to venues where funds are exchanged between suppliers and those who seek capital. Suppliers in capital markets are typically banks and investors. Those who seek capital are businesses, governments, and individuals. Capital markets are used to sell financial instruments, including equities and debt securities. These markets are divided into two categories: primary and secondary markets. The term “capital market” is a broad one that’s used to describe the in-person and digital spaces in which various entities trade types of financial instruments. Money markets are informal in nature, whereas Capital markets are formal in nature. -

Question 18 of 35

18. Question

Which of the following is a derivative instrument?

Correct

Solution (c)

Explanation

A derivative is a securitized contract whose value is dependent upon one or more underlying assets. Its price is determined by fluctuations in that asset. A derivative can trade on an exchange or over the counter. Prices for derivatives derive from fluctuations in the underlying asset. There are four main types of derivatives: forward contracts, futures contracts, options contracts, and swap contracts. (Hence option c is correct)

Incorrect

Solution (c)

Explanation

A derivative is a securitized contract whose value is dependent upon one or more underlying assets. Its price is determined by fluctuations in that asset. A derivative can trade on an exchange or over the counter. Prices for derivatives derive from fluctuations in the underlying asset. There are four main types of derivatives: forward contracts, futures contracts, options contracts, and swap contracts. (Hence option c is correct)

-

Question 19 of 35

19. Question

What is the term used to describe a stock market where prices are generally rising?

Correct

Solution (b)

Explanation

Bull market is a market condition where the stock market prices keep increasing or are expected to rise constantly. During such times, investors have high expectations about stock market performance and invest their hard-earned money in this sector. A rising consumer confidence level that consequently hikes cash flow in this sector lets firms increase their yearly turnover, which results in disbursed high profits among shareholders. Even though the term is usually used for bonds, the stock market, commodities, currencies, etc., it can also have a bull market. (Hence option b is correct)

Incorrect

Solution (b)

Explanation

Bull market is a market condition where the stock market prices keep increasing or are expected to rise constantly. During such times, investors have high expectations about stock market performance and invest their hard-earned money in this sector. A rising consumer confidence level that consequently hikes cash flow in this sector lets firms increase their yearly turnover, which results in disbursed high profits among shareholders. Even though the term is usually used for bonds, the stock market, commodities, currencies, etc., it can also have a bull market. (Hence option b is correct)

-

Question 20 of 35

20. Question

With reference to capital market, consider the following statements.

- The secondary markets allow both buying and selling of securities through the stock exchange.

- In primary markets, prices are influenced by the demand and supply of securities.

Which of the following statements given above is/are correct?

Correct

Solution (a)

Explanation

Statement 1 Statement 2 Correct Incorrect Secondary Market refers to a market where securities are traded after being initially offered to the public in the primary market and/or listed on the Stock Exchange. In the primary market, investors can only purchase securities, while the secondary market allows both buying and selling of securities through the stock exchange. Primary market is a market wherein corporates issue new securities for raising funds generally for long term capital requirement. In the primary market, prices are determined by the company’s management. In contrast, in the secondary market, prices are influenced by the demand and supply of securities. Incorrect

Solution (a)

Explanation

Statement 1 Statement 2 Correct Incorrect Secondary Market refers to a market where securities are traded after being initially offered to the public in the primary market and/or listed on the Stock Exchange. In the primary market, investors can only purchase securities, while the secondary market allows both buying and selling of securities through the stock exchange. Primary market is a market wherein corporates issue new securities for raising funds generally for long term capital requirement. In the primary market, prices are determined by the company’s management. In contrast, in the secondary market, prices are influenced by the demand and supply of securities. -

Question 21 of 35

21. Question

Consider the following Wildlife Sanctuaries:

- Bagdara Wildlife Sanctuary

- Gandhi Sagar Wildlife Sanctuary

- Suhelwa Wildlife Sanctuary

- Kheoni Wildlife Sanctuary

- Kishanpur Wildlife Sanctuary

How many of the above Wildlife Sanctuaries are located in Madhya Pradesh?

Correct

Solution (b)

Statement Analysis

Context: Analysing the lineage of cheetahs to “create a strong genetic foundation”, relocating leopards from the predator-proof fenced areas, and augmenting the number of prey animals are part of the Cheetah Action Plan for Gandhi Sagar Wildlife Sanctuary in Madhya Pradesh, ahead of the plans to introduce a batch of cheetahs there next year.

Wildlife Sanctuaries are located in Madhya Pradesh:

- Bagdara Wildlife Sanctuary

- Gandhi Sagar Wildlife Sanctuary

- Kheoni Wildlife Sanctuary

Hence option b is correct.

- Kishanpur Wildlife Sanctuary and Suhelwa Wildlife Sanctuary are located in Uttar Pradesh.

Source: https://indianexpress.com/article/india/from-evaluating-lineages-to-relocating-leopards-the-action-plan-for-madhya-pradesh-next-home-of-the-cheetah-9730767/

Incorrect

Solution (b)

Statement Analysis

Context: Analysing the lineage of cheetahs to “create a strong genetic foundation”, relocating leopards from the predator-proof fenced areas, and augmenting the number of prey animals are part of the Cheetah Action Plan for Gandhi Sagar Wildlife Sanctuary in Madhya Pradesh, ahead of the plans to introduce a batch of cheetahs there next year.

Wildlife Sanctuaries are located in Madhya Pradesh:

- Bagdara Wildlife Sanctuary

- Gandhi Sagar Wildlife Sanctuary

- Kheoni Wildlife Sanctuary

Hence option b is correct.

- Kishanpur Wildlife Sanctuary and Suhelwa Wildlife Sanctuary are located in Uttar Pradesh.

Source: https://indianexpress.com/article/india/from-evaluating-lineages-to-relocating-leopards-the-action-plan-for-madhya-pradesh-next-home-of-the-cheetah-9730767/

-

Question 22 of 35

22. Question

With reference to Grey Junglefowl, consider the following statements:

- It is listed under Schedule I of the Wildlife Protection Act of 1972, providing it with the highest level of legal protection.

- It is native to India, Indo-China, Malaysia, and surrounding regions.

- It is found in diverse habitats like primeval forests, dry scrublands, and secondary-growth woodlands.

Select the correct answer using the codes below:

Correct

Solution (d)

Statement Analysis

Context: Himachal Pradesh Police registered a case of defamation and fake news against unknown persons over a video showing Chief Minister Sukhvinder Singh Sukhu allegedly encouraging his associates to eat ‘Jungli Murga’ (Grey Junglefowl) at a dinner in a remote area surfaced online.

- Grey Junglefowl is listed under Schedule I of the Wildlife Protection Act of 1972, providing it with the highest level of legal protection. Hence statement 1 is correct.

- It is a tropical species of pheasant and a wild ancestor of domestic chicken.

- It is native to India, Indo-China, Malaysia, and surrounding regions. Hence statement 2 is correct.

- It is listed as least concern on the IUCN Red List.

- It is found in diverse habitats like primeval forests, dry scrublands, and secondary-growth woodlands. Hence statement 3 is correct.

Source: https://www.thehindu.com/news/national/himachal-pradesh/himachal-pradesh-cm-sukhu-roasted-over-junglee-murga-defamation-case-filed/article69003072.ece

Incorrect

Solution (d)

Statement Analysis

Context: Himachal Pradesh Police registered a case of defamation and fake news against unknown persons over a video showing Chief Minister Sukhvinder Singh Sukhu allegedly encouraging his associates to eat ‘Jungli Murga’ (Grey Junglefowl) at a dinner in a remote area surfaced online.

- Grey Junglefowl is listed under Schedule I of the Wildlife Protection Act of 1972, providing it with the highest level of legal protection. Hence statement 1 is correct.

- It is a tropical species of pheasant and a wild ancestor of domestic chicken.

- It is native to India, Indo-China, Malaysia, and surrounding regions. Hence statement 2 is correct.

- It is listed as least concern on the IUCN Red List.

- It is found in diverse habitats like primeval forests, dry scrublands, and secondary-growth woodlands. Hence statement 3 is correct.

Source: https://www.thehindu.com/news/national/himachal-pradesh/himachal-pradesh-cm-sukhu-roasted-over-junglee-murga-defamation-case-filed/article69003072.ece

-

Question 23 of 35

23. Question

Consider the following statements regarding the applications of Milkweed Fiber:

- It is used in paper industries.

- It is used as an insulative filling material.

- It is used in water-safety equipment.

- It can be used in damp-proofing materials.

How many of the above statement/s is/are correct?

Correct

Solution (d)

Statement Analysis

Context: With global attention focused on sustainable and traceable practices, the Ministry of Textiles has encouraged Uniqlo to extend its research and development efforts into new natural fibers, including milkweed fiber aligning with India’s own initiatives in this critical area.

Milkweed fiber is the seed fiber obtained from the milkweed plant. The milkweed (Asclepias syriaca L) plant belongs to the genus Asclepias of the family Asclepiadaceae and is also known as stubborn weed. In India, it is found as a wild plant in the states of Rajasthan, Karnataka, and Tamil Nadu.

The applications of Milkweed Fiber:

- It is used in paper industries. Hence statement 1 is correct.

- It is used as an insulative filling material. Hence statement 2 is correct.

- It is used in water-safety equipment. Hence statement 3 is correct.

- It can be used in damp-proofing materials. Hence statement 4 is correct.

- It is used as padding and insulation in upholstery.

- It is used in textile fabrics, including sportswear and technique clothing.

- It can be used to make composites with epoxy resin.

- It can be used to absorb oil.

Source: https://pib.gov.in/PressReleaseIframePage.aspx?PRID=2085099

Incorrect

Solution (d)

Statement Analysis

Context: With global attention focused on sustainable and traceable practices, the Ministry of Textiles has encouraged Uniqlo to extend its research and development efforts into new natural fibers, including milkweed fiber aligning with India’s own initiatives in this critical area.

Milkweed fiber is the seed fiber obtained from the milkweed plant. The milkweed (Asclepias syriaca L) plant belongs to the genus Asclepias of the family Asclepiadaceae and is also known as stubborn weed. In India, it is found as a wild plant in the states of Rajasthan, Karnataka, and Tamil Nadu.

The applications of Milkweed Fiber:

- It is used in paper industries. Hence statement 1 is correct.

- It is used as an insulative filling material. Hence statement 2 is correct.

- It is used in water-safety equipment. Hence statement 3 is correct.

- It can be used in damp-proofing materials. Hence statement 4 is correct.

- It is used as padding and insulation in upholstery.

- It is used in textile fabrics, including sportswear and technique clothing.

- It can be used to make composites with epoxy resin.

- It can be used to absorb oil.

Source: https://pib.gov.in/PressReleaseIframePage.aspx?PRID=2085099

-

Question 24 of 35

24. Question

Consider the following animals:

- Helmeted Water Toad

- Horseshoe Crab

- Amami Rabbit

- Aardvark

How many of the above animal/s is/are called Living Fossils?

Correct

Solution (d)

Statement Analysis

Context: A giant frog species that hopped alongside dinosaurs and is considered a “living fossil” is now losing ground in its native Chile as climate change and human intervention damage its habitat.

Living Fossil refers to an ‘archaic’ species that has survived for a long time, whose anatomy harks back to an early stage in the group’s evolutionary tree, and has remained unchanged for much of that period.

The following animals are considered as Living Fossils:

- Helmeted Water Toad

- Horseshoe Crab

- Amami Rabbit

- Aardvark

- Ginkgo Tree

- Cockroach

- Laotian Rock Rat

- Purple Frog

- Komodo Dragon

- Nautilus

- Duck-billed Platypus

- Goblin Shark

- Coelacanth

Hence option d is correct.

Source: https://www.thehindu.com/sci-tech/energy-and-environment/chiles-giant-living-fossil-frog-faces-threat-from-climate-change-and-humans/article69003614.ece

Incorrect

Solution (d)

Statement Analysis

Context: A giant frog species that hopped alongside dinosaurs and is considered a “living fossil” is now losing ground in its native Chile as climate change and human intervention damage its habitat.

Living Fossil refers to an ‘archaic’ species that has survived for a long time, whose anatomy harks back to an early stage in the group’s evolutionary tree, and has remained unchanged for much of that period.

The following animals are considered as Living Fossils:

- Helmeted Water Toad

- Horseshoe Crab

- Amami Rabbit

- Aardvark

- Ginkgo Tree

- Cockroach

- Laotian Rock Rat

- Purple Frog

- Komodo Dragon

- Nautilus

- Duck-billed Platypus

- Goblin Shark

- Coelacanth

Hence option d is correct.

Source: https://www.thehindu.com/sci-tech/energy-and-environment/chiles-giant-living-fossil-frog-faces-threat-from-climate-change-and-humans/article69003614.ece

-

Question 25 of 35

25. Question

Consider the following ports:

- Dalian

- Ho Chi Minh City

- Shanghai

- Hong Kong

- Chennai

How many of the given port/s is/are part of the Eastern Maritime Corridor (EMC)?

Correct

Solution (d)

Statement Analysis

Context: Midway through 2024, as India surpassed China to become the largest buyer of Russian oil, the operationalization of a new sea route – the Eastern Maritime Corridor – is beginning to play an increasingly significant role in boosting commodity trade between the two countries, especially crude oil shipments to India.

- Eastern Maritime Corridor (EMC) is also known as the Chennai-Vladivostok Sea Route. It connects South India with Russia’s Far East region.

- The corridor significantly reduces cargo transit time by up to 16 days and cuts distance by up to 40%, making it a highly efficient trade route.

- It passes through key waterways, including the Sea of Japan, East China Sea, South China Sea, Malacca Straits, Andaman Sea, and the Bay of Bengal.

- Ports along the route include Dalian, Shanghai, Hong Kong, Ho Chi Minh City, Singapore, Kuala Lumpur, Bangkok, Dhaka, Colombo, and Chennai. Hence option d is correct.

Source: https://indianexpress.com/article/business/india-russia-trade-boost-new-eastern-route-9726640/

Incorrect

Solution (d)

Statement Analysis

Context: Midway through 2024, as India surpassed China to become the largest buyer of Russian oil, the operationalization of a new sea route – the Eastern Maritime Corridor – is beginning to play an increasingly significant role in boosting commodity trade between the two countries, especially crude oil shipments to India.

- Eastern Maritime Corridor (EMC) is also known as the Chennai-Vladivostok Sea Route. It connects South India with Russia’s Far East region.

- The corridor significantly reduces cargo transit time by up to 16 days and cuts distance by up to 40%, making it a highly efficient trade route.

- It passes through key waterways, including the Sea of Japan, East China Sea, South China Sea, Malacca Straits, Andaman Sea, and the Bay of Bengal.

- Ports along the route include Dalian, Shanghai, Hong Kong, Ho Chi Minh City, Singapore, Kuala Lumpur, Bangkok, Dhaka, Colombo, and Chennai. Hence option d is correct.

Source: https://indianexpress.com/article/business/india-russia-trade-boost-new-eastern-route-9726640/

-

Question 26 of 35

26. Question

With regard to Varmam Therapy, consider the following statements:

- It is a unique and traditional healing modality within the Siddha system of medicine.

- It is a drugless, non-invasive, simple therapy used in pain management.

Which of the above statement/s is/are correct?

Correct

Solution (c)

Statement Analysis

Context: The National Institute of Siddha (NIS) has set a Guinness World Record for providing Varmam therapy to 567 individuals simultaneously.

- Varmam Therapy is a unique and traditional healing modality within the Siddha system of medicine. Hence statement 1 is correct.

- Varmam is the vital life energy point located in the human body and was identified as 108 points by the Siddhars.

- It is particularly renowned for its ability to provide rapid relief for musculoskeletal pain, injuries, and neurological disorders.

- It is a drugless, non-invasive, simple therapy used in pain management. Hence statement 2 is correct.

- It is a scientifically grounded therapeutic practice used to treat acute and chronic diseases, including stroke, arthritis, and trauma-related injuries.

Source: https://pib.gov.in/PressReleaseIframePage.aspx?PRID=2085869

Incorrect

Solution (c)

Statement Analysis

Context: The National Institute of Siddha (NIS) has set a Guinness World Record for providing Varmam therapy to 567 individuals simultaneously.

- Varmam Therapy is a unique and traditional healing modality within the Siddha system of medicine. Hence statement 1 is correct.

- Varmam is the vital life energy point located in the human body and was identified as 108 points by the Siddhars.

- It is particularly renowned for its ability to provide rapid relief for musculoskeletal pain, injuries, and neurological disorders.

- It is a drugless, non-invasive, simple therapy used in pain management. Hence statement 2 is correct.

- It is a scientifically grounded therapeutic practice used to treat acute and chronic diseases, including stroke, arthritis, and trauma-related injuries.

Source: https://pib.gov.in/PressReleaseIframePage.aspx?PRID=2085869

-

Question 27 of 35

27. Question

Consider the following statements about Dark Comets:

- They have glowing tails and do not resemble asteroids.

- They follow elongated, elliptical paths that bring them close to the Sun.

- They often spin quite rapidly and disperse escaping gas and dust in all directions.

How many of the above statement/s is/are correct?

Correct

Solution (b)

Statement Analysis

Context: Oumuamua’s speed and path around the Sun don’t match a typical asteroid, but it also has no bright tail or nucleus (icy core) we normally associate with comets.

- Dark Comets do not have glowing tails and resemble asteroids. Hence statement 1 is incorrect.

- The first indication of dark comets came in 2016 when asteroid 2003 RM exhibited unusual orbital deviations.

- They are often small, just a few metres to a few hundred metres wide.

- They have less surface area for material to escape and form into the beautiful tails we see on typical comets.

- They follow elongated, elliptical paths that bring them close to the Sun. Hence statement 2 is correct.

- They fall into two main categories: “outer dark comets,” which have eccentric orbits and are larger, and “inner dark comets,” which are smaller and closer to the Sun, with nearly circular orbits.

- They often spin quite rapidly and disperse escaping gas and dust in all directions. Hence statement 3 is correct.

Source: https://www.thehindu.com/sci-tech/science/what-is-a-dark-comet-a-quick-guide-to-the-new-kids-in-the-solar-system/article68999558.ece

Incorrect

Solution (b)

Statement Analysis

Context: Oumuamua’s speed and path around the Sun don’t match a typical asteroid, but it also has no bright tail or nucleus (icy core) we normally associate with comets.

- Dark Comets do not have glowing tails and resemble asteroids. Hence statement 1 is incorrect.

- The first indication of dark comets came in 2016 when asteroid 2003 RM exhibited unusual orbital deviations.

- They are often small, just a few metres to a few hundred metres wide.

- They have less surface area for material to escape and form into the beautiful tails we see on typical comets.

- They follow elongated, elliptical paths that bring them close to the Sun. Hence statement 2 is correct.

- They fall into two main categories: “outer dark comets,” which have eccentric orbits and are larger, and “inner dark comets,” which are smaller and closer to the Sun, with nearly circular orbits.

- They often spin quite rapidly and disperse escaping gas and dust in all directions. Hence statement 3 is correct.

Source: https://www.thehindu.com/sci-tech/science/what-is-a-dark-comet-a-quick-guide-to-the-new-kids-in-the-solar-system/article68999558.ece

-

Question 28 of 35

28. Question

With reference to the Viraasat Sari Festival, consider the following statements:

- It is an annual event to celebrate and promote the rich heritage of handloom saris from various regions of the country.

- It is organized by the National Handloom Development Corporation Ltd (NHDC) under the Ministry of Culture.

Which of the above statement/s is/are correct?

Correct

Solution (a)

Statement Analysis

Context: The Ministry of Textiles, Government of India is organizing the third edition of the Mega event “Viraasat Sari Festival 2024”, from 15th – 28th December 2024, at Handloom Haat, Janpath, New Delhi.

- Viraasat Sari Festival is an annual event to celebrate and promote the rich heritage of handloom saris from various regions of the country. Hence statement 1 is correct.

- It celebrates the tradition of handloom and handicrafts while providing market access to weavers and artisans.

- It is organized by the National Handloom Development Corporation Ltd (NHDC) under the Ministry of Textiles. Hence statement 2 is incorrect.

- It features Paithani, Kotpad, Kota Doria, Tangail, Pochampally, Kancheepuram, Thirubuvanam, Jamdani, Santipuri, Chanderi, Maheshwari, Patola, Moirangphee, Banarasi Brocade, Tanchoi, Bhagalpuri Silk, Bawan Buti, and Pashmina Sari.

Source: https://pib.gov.in/PressReleaseIframePage.aspx?PRID=2084606#:~:text=Exclusive%20Handloom%20Sari%20Exhibition%20at,Handloom%20Haat

Incorrect

Solution (a)

Statement Analysis

Context: The Ministry of Textiles, Government of India is organizing the third edition of the Mega event “Viraasat Sari Festival 2024”, from 15th – 28th December 2024, at Handloom Haat, Janpath, New Delhi.

- Viraasat Sari Festival is an annual event to celebrate and promote the rich heritage of handloom saris from various regions of the country. Hence statement 1 is correct.

- It celebrates the tradition of handloom and handicrafts while providing market access to weavers and artisans.

- It is organized by the National Handloom Development Corporation Ltd (NHDC) under the Ministry of Textiles. Hence statement 2 is incorrect.

- It features Paithani, Kotpad, Kota Doria, Tangail, Pochampally, Kancheepuram, Thirubuvanam, Jamdani, Santipuri, Chanderi, Maheshwari, Patola, Moirangphee, Banarasi Brocade, Tanchoi, Bhagalpuri Silk, Bawan Buti, and Pashmina Sari.

Source: https://pib.gov.in/PressReleaseIframePage.aspx?PRID=2084606#:~:text=Exclusive%20Handloom%20Sari%20Exhibition%20at,Handloom%20Haat

-

Question 29 of 35

29. Question

The Bordoibam-Bilmukh Bird Sanctuary (BBBS) once a thriving habitat for diverse avian species, has experienced a 72% decline in bird species count over the past 27 years. It is located in which of the following state?

Correct

Solution (b)

Statement Analysis

Context: The study on avian diversity at the Bordoibam-Bilmukh Bird Sanctuary (BBBS) straddling the Dhemaji and Lakhimpur districts was published in the Journal of Threatened Taxa recently.

The Bordoibam-Bilmukh Bird Sanctuary (BBBS) once a thriving habitat for diverse avian species, has experienced a 72% decline in bird species count over the past 27 years. It is located in Assam. It is situated on the boundary of Dhemaji and Lakhimpur districts in Assam and covers an area of approximately 11.25 sq. km and lies at an altitude of 90-95 meters above mean sea level. Hence option b is correct.

Source: https://www.thehindu.com/news/national/assam/assam-bird-sanctuary-records-72-decline-in-bird-species-count-in-27-years/article69009618.ece

Incorrect

Solution (b)

Statement Analysis

Context: The study on avian diversity at the Bordoibam-Bilmukh Bird Sanctuary (BBBS) straddling the Dhemaji and Lakhimpur districts was published in the Journal of Threatened Taxa recently.

The Bordoibam-Bilmukh Bird Sanctuary (BBBS) once a thriving habitat for diverse avian species, has experienced a 72% decline in bird species count over the past 27 years. It is located in Assam. It is situated on the boundary of Dhemaji and Lakhimpur districts in Assam and covers an area of approximately 11.25 sq. km and lies at an altitude of 90-95 meters above mean sea level. Hence option b is correct.

Source: https://www.thehindu.com/news/national/assam/assam-bird-sanctuary-records-72-decline-in-bird-species-count-in-27-years/article69009618.ece

-

Question 30 of 35

30. Question

Consider the following statements regarding the 1st India Maritime Heritage Conclave:

- It was organized by the Ministry of Ports, Shipping, and Waterways.

- It was held under the theme “Towards Understanding India’s Position in Global Maritime History”.

Which of the above statement/s is/are correct?

Correct

Solution (c)

Statement Analysis

Context: The 1st India Maritime Heritage Conclave (IMHC 2024), a landmark event organized by the Ministry of Ports, Shipping and Waterways (MoPSW) was held on December 11-12, 2024. This prestigious gathering celebrated India’s illustrious maritime legacy and its profound contributions to global trade, culture, and innovation.

- The 1st India Maritime Heritage Conclave was organized by the Ministry of Ports, Shipping, and Waterways. Hence statement 1 is correct.

- It celebrated India’s maritime legacy and contributions to global trade while discussing future innovations.

- It was held under the theme “Towards Understanding India’s Position in Global Maritime History”. Hence statement 2 is correct.

- It showcased ancient shipbuilding techniques, navigational tools, and historical trade routes through 20+ stalls.

- Nations such as Greece, Italy, and the UK joined the conclave, emphasizing the global significance of India’s maritime history.

Source: https://pib.gov.in/PressReleaseIframePage.aspx?PRID=2084282

Incorrect

Solution (c)

Statement Analysis

Context: The 1st India Maritime Heritage Conclave (IMHC 2024), a landmark event organized by the Ministry of Ports, Shipping and Waterways (MoPSW) was held on December 11-12, 2024. This prestigious gathering celebrated India’s illustrious maritime legacy and its profound contributions to global trade, culture, and innovation.

- The 1st India Maritime Heritage Conclave was organized by the Ministry of Ports, Shipping, and Waterways. Hence statement 1 is correct.

- It celebrated India’s maritime legacy and contributions to global trade while discussing future innovations.

- It was held under the theme “Towards Understanding India’s Position in Global Maritime History”. Hence statement 2 is correct.

- It showcased ancient shipbuilding techniques, navigational tools, and historical trade routes through 20+ stalls.

- Nations such as Greece, Italy, and the UK joined the conclave, emphasizing the global significance of India’s maritime history.

Source: https://pib.gov.in/PressReleaseIframePage.aspx?PRID=2084282

-

Question 31 of 35

31. Question

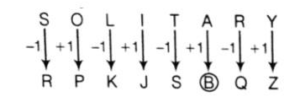

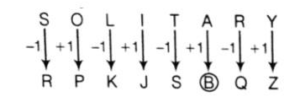

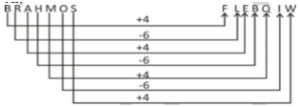

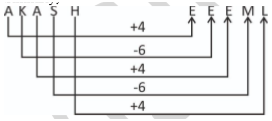

If every alternate letter in the word ‘SOLITARY’ starting from the 1st letter is replaced by the previous letter and each of the remaining letters is replaced by the next letter in the English alphabet, which of the following will be the 3rd letter from the right end after the substitution?

Correct

Solution (b)

Explanation:

After making the change as given in the question, we get the following arrangement

Hence, the 3rd letter from the right end is ‘B’

Incorrect

Incorrect

Solution (b)

Explanation:

After making the change as given in the question, we get the following arrangement

Hence, the 3rd letter from the right end is ‘B’

-

Question 32 of 35

32. Question

Passage – 1

Before examining the determinants of food security, understanding several concepts associated with the definition of food security is necessary. This is because many developing countries continue to suffer from chronic food insecurity and high levels of malnutrition, and they are under constant threats of hunger caused by economic crises and natural disasters. Designing policies and programs to improve nutritional status requires an understanding of the factors that cause malnutrition, knowledge of the pathways in which these factors affect vulnerable groups and households, and an awareness of policy options available to reduce the impact of these factors on hunger and malnutrition.

Q.32) Which one of the following statements best implies the suggestion given by the author of the passage?

Correct

Solution (a)

Explanation:

Option (a) is correct. The lines “Designing policies and programs to improve nutritional status requires an understanding of the factors that cause malnutrition, knowledge of the pathways in which these factors affect vulnerable groups and households, and an awareness of policy options available to reduce the impact of these factors on hunger and malnutrition”, reflect that it is important to design policies based on an understanding of the various factors causing malnutrition.

Option (b) is incorrect. This statement in general is true. However, the context of the passage is not about India. The passage is about developing countries in a broader context, their issues of hunger and malnutrition and the importance of policies for addressing those issues.

Option (c) is incorrect. This option is not covered directly or indirectly. The passage does not mention policies of the developed world related to hunger and whether they could be adopted in developing countries. So, to assume that adoption should be done without any context in the passage will not be correct.

Option (d) is incorrect. This option is beyond the scope of the passage. There is no discussion on the aspect of funding for hunger in the passage.

Incorrect

Solution (a)

Explanation:

Option (a) is correct. The lines “Designing policies and programs to improve nutritional status requires an understanding of the factors that cause malnutrition, knowledge of the pathways in which these factors affect vulnerable groups and households, and an awareness of policy options available to reduce the impact of these factors on hunger and malnutrition”, reflect that it is important to design policies based on an understanding of the various factors causing malnutrition.

Option (b) is incorrect. This statement in general is true. However, the context of the passage is not about India. The passage is about developing countries in a broader context, their issues of hunger and malnutrition and the importance of policies for addressing those issues.

Option (c) is incorrect. This option is not covered directly or indirectly. The passage does not mention policies of the developed world related to hunger and whether they could be adopted in developing countries. So, to assume that adoption should be done without any context in the passage will not be correct.

Option (d) is incorrect. This option is beyond the scope of the passage. There is no discussion on the aspect of funding for hunger in the passage.

-

Question 33 of 35

33. Question

Passage – 2

Today, amphibians enjoy the dubious distinction of being the world‘s most endangered class of animals; it‘s been calculated that the group‘s extinction rate could be as much as forty-five thousand times higher than the background rate. But extinction rates among many other groups are approaching amphibian levels. It is estimated that one-third of all reef-building corals, a third of all freshwater mollusks, a third of sharks and rays, a quarter of all mammals, a fifth of all reptiles, and a sixth of all birds are headed toward oblivion. The losses are occurring all over: in the South Pacific and in the North Atlantic, in the Arctic and the Sahel, in lakes and on islands, on mountaintops and in valleys. If you know how to look, you can probably find signs of the current extinction event in your own backyard.

Q.33) On the basis of the passage given above, the following assumptions have been made:

- Amphibians are keystone species whose extinction can cause secondary extinction of other species.

- Mass Extinction of various species is already happening, with Climate Change as its main driver.

Which of the above assumptions is/are valid?

Correct

Solution (b)

Explanation: