IASbaba's Daily Current Affairs Analysis, IASbaba's Daily Current Affairs January 2016, National, UPSC

Archives

IASbaba’s Daily Current Affairs – 12th January, 2016

NATIONAL

TOPIC:

- General studies 2: Government policies and interventions for development in various sectors and issues arising out of their design and implementation.

- General studies 3: Conservation, environmental pollution and degradation, environmental impact assessment.

What needs to be done to upgrade to BS-VI?

- Four years from now, the government wants to leap directly to BS-VI auto emission norms from the existing BS-IV, skipping BS-V.

- But the challenges, before both oil companies and automakers, are enormous.

What is the issue?

- Recently the government took a decision after a meeting of the Ministers for Road Transport, Petroleum, Heavy Industries, and Environment to bring forward the nationwide rollout of BS-VI vehicular emission norms.

- The decision is in line with promises made by India at the Climate Change Conference in Paris last month, and indicates a step against the dangerously high levels of air pollution in major Indian cities like Delhi etc.

Bharat Stage (BS) Emission Norms:

- The Bharat Stage emission standards are norms instituted by the government to regulate the output of air pollutants from internal combustion engine equipment, including motor vehicles.

- India has been following the European (Euro) emission norms, though with a time lag of five years.

- BS-IV norms are currently applicable in 33 cities in which the required grade of fuel is available; the rest of India still conforms to BS-III standards.

An historical outlook into emission norms:

- India introduced emission norms first in 1991, and tightened them in 1996, when most vehicle manufacturers had to incorporate technology upgrades like catalytic converters to cut exhaust emissions.

- Fuel specifications based on environmental considerations were notified first in April 1996, to be implemented by 2000, and incorporated in BIS 2000 standards.

- Following the landmark Supreme Court order of April 1999, the Centre notified Bharat Stage-I (BIS 2000) and Bharat Stage-II norms, broadly equivalent to Euro I and Euro II respectively.

- BS-II was for the NCR and other metros; BS-I for the rest of India.

- From April 2005, in line with the Auto Fuel Policy of 2003, BS-III and BS-II fuel quality norms came into existence for 13 major cities, and for the rest of the country respectively.

- Subsequently, BS-IV and BS-III fuel quality norms were introduced from April 2010 in 13 major cities and the rest of India respectively.

Emission norms for future:

- As per the roadmap in the auto fuel policy, BSV and BS-VI norms were to be implemented from April 1, 2022, and April 1, 2024, respectively.

- But in November 2015, the Ministry of Road Transport issued a draft notification, advancing the implementation of BSV norms for new four-wheel vehicle models to April 1, 2019, and for existing models to April 1, 2020.

- The corresponding dates for BS-VI norms were brought forward to April 1, 2021, and April 1, 2022, respectively.

But the government’s unanimous decision to leap-frog to BS-VI directly from 01/04/2020, has skipped the BS-V stage all together.

The challenges:

The government could face two key challenges in implementing the decision

- There are questions about the ability of oil marketing companies to quickly upgrade fuel quality from BS-III and BS-IV standards to BS-VI, which is likely to cost upwards of Rs 40,000 crore.

- More challenging is the task of getting auto firms to make the leap.

- Automakers have clearly said that going to BS-VI directly would leave them with not enough time to design changes in their vehicles, considering that two critical components — diesel particulate filter and selective catalytic reduction module — would have to be adapted to India’s peculiar conditions, where running speeds are much lower than in Europe or the US.

Fuel Quality Costs:

The government has been unable to move completely to BS-IV because refiners have been unable to produce the superior fuel in the required quantities.

BS-IV petrol and diesel essentially contains less sulphur, a major air pollutant. Sulphur also lowers the efficiency of catalytic converters, which control emissions.

- Broadly, BS-IV petrol and diesel have 50 parts per million (ppm) of sulphur, as compared to 150 ppm for petrol and 350 ppm for diesel under BS-III standards.

- Oil companies are learnt to have put in Rs 30,000 crore between 2005 and 2010 to upgrade; the auto industry has made investments of a similar size.

- Oil firms will have to invest another about Rs 40,000 crore to upgrade fuel quality to BS-VI; additional investments by automakers to upgrade will inevitably raise the prices of vehicles.

Practical industry arguments:

- The auto industry argues that the huge improvements in vehicular technology since 2000 have had little impact in India due to Indian driving, road and ambient conditions.

- BS-V diesel vehicles were to have engine upgrades, particulate filters, lots of sensors, and electronic control.

- Petrols were to have catalyst and electronic control upgrades.

- Industry estimates of required investment to upgrade from BS-IV to BS-V are to the tune of Rs 50,000 crore.

Case of DPF (Diesel Particulate Filter):

- Vehicles must be fitted with DPF (diesel particulate filter).

- DPF is a cylindrical object mounted vertically inside the engine compartment.

- In India, where small cars are preferred, fitting DPF in the limited bonnet space would involve major design and re-engineering work.

- Bonnet length may have to be increased, which would make vehicles longer than 4 metres, and attract more excise duty under existing norms.

Case of SCR (Selective Catalytic Reduction):

- BS-VI vehicles also have to be equipped with an SCR (selective catalytic reduction) module to reduce oxides of nitrogen, which would be cumbersome and needs extra work by the auto engineers.

Way ahead:

- At every stage, the technology is getting more complex.

- To attain the specified super low emissions, all reactions have to be precise, and controlled by microprocessors.

- If BS-V were to be skipped entirely, then both DPF and SCR would need to be fitted together for testing, which, auto firms say, would make it extremely difficult to detect which of the technologies is at fault in case of errors in the system.

- Ideally, the technologies must be introduced in series, and then synergised.

- So, even if oil companies manage to leap, auto firms claim they need 6-7 years to switch to BS-VI.

Overall this is a good move by government considering the amount of air pollution in Indian cities.

Connecting the dots:

- Write a note on Bharat stage emission norms in India.

- Recently the government’s decision tries to introduce Bharat stage VI emission norms by 2020 skipping stage V norms from present stage IV norms. Critically examine the impact of above decision on air pollutions levels in India.

ECONOMICS

TOPIC:

General Studies 2:

- Indian Economy and issues relating to planning, mobilization of resources, growth, development and employment.

- Inclusive growth and issues arising from it. Investment models.

General Studies3:

- Important International institutions, agencies and fora- their structure, mandate.

- Government policies and interventions for development in various sectors and issues arising out of their design and implementation.

Improve the Investment Climate

When we talk about the growth rate that has been projected by the International Monetary Fund (IMF) being 3.1 per cent, we understand that the end of 2015 has not only ended at an all-time-low but has also exhibited the crying need to be corrected as early as possible.

What does the figure say—

- Advanced economies are growing at around 2 per cent

- Developing economies are growing at 4 per cent

Stumbling Blocks—

- Economic crisis of Greece (Europe)

- Sharp decline in oil prices (Oil-exporting countries)

- Countries which had gained as a consequence of a fall in crude oil prices have not been able to exhibit faster growth as well

- Concerns regarding China and Yuan Devaluation (Competitive Devaluation)

Let’s talk about 2016

IMF: Projected the global growth rate for 2016 to be 3.6 per cent with

- Advanced economies growing at 2.2 per cent

- Developing economies growing at 4.5 per cent

World Bank Report: Shows lower numbers for both 2015 and 2016

United States:

- Recent decision to hike the policy rate by the Fed is some indication that monetary policymakers believe that the U.S. economy is on a recovery path

- But the Fed has not yet relaxed its accommodative posture, which indicates that the recovery is fragile

- Since oil prices are not expected to rise (oil-producing countries will continue to deal with losses), concerns regarding China will continue (though ‘Shale’ might come to the rescue)

- Hiking the Policy Rate might spell out its own effects on capital flows to developing economies and lead to financial markets witnessing greater volatility

Can India show a better performance—

BRICS Block- India is the only country that has shown a good performance

Mid-year economic analysis estimates India’s growth rate in 2015-16 to be between 7 and 7.5 per cent

Concerns—

Supply Side Indicators like agriculture maynot contribute much in enhancing the growth rate and with the erratic weather playing spoil-sport in 2015; this scenario is quite likely to repeat itself in 2016.

Services sector:

- There will not be much difference in the growth rate but ‘concentration and efforts’ in the industrial sector carries the possibility of carrying the growth rate forward

- Index of Industrial Production (IIP) for April-October 2015 shows a distinct improvement but external demand, as reflected in the performance of exports, has been weak and overall, exports during the period of April-October declined by 17.6 per cent

- The decline is mostly due to the decline in the export of petroleum products, by more than 50 per cent

- Also, non-oil exports have declined by 8.7 per cent during this period and this does not auger well for many industries

- Good Signs:

- Private Consumption could pick up partly because of the benefit accruing to consumers due to the fall in petroleum prices

- Consumption goods sector of IIP has done well and Public sector investment has shown a rise

- Capital expenditure of the Central government during the period April-October 2015 rose by 31 per cent

Public Sector Enterprises

Bulk of the public investment came from the public sector enterprises but public investment alone will not be able to reverse the current trend falling in the negative end of the scale

In 2015-16:

Revenue Growth: Close to budgetary expectations (despite a lower-than-expected growth in nominal GDP)

Expenditure Side: Subsidy burden came down because of a fall in crude prices

Government expenditures:

- Stayed at budgeted levels

- Could stick to the fiscal consolidation path

- Witnessed the rise in Capital expenditures substantially

Burden of the Pay Commission’s Promises:

The additional burden imposed by the Seventh Pay Commission is substantial and can pose to be a real hurdle—

Expenditure on pay and pension: Will increase by 20 per cent and will amount to a burden of 0.4 per cent of GDP, after taking into account the additional tax revenue on the increased emoluments.

Ability of the government to raise money for capital expenditures is limited and relaxing the fiscal consolidation path is not a solution-Why: Larger fiscal deficit will not only take up a greater share of the available pool of savings but also cause an increase in the interest rates. (Not conductive to a growth in private sector investment)

Rise in Private consumption: Because of the additional income in the hands of government employees, thus the behaviour of private corporate investment or private investment in general will be witnessing an increase from their end.

Private Corporate Investment:

While there has been some improvement in relation to stalled projects, there is no strong pick up in the new projects

Issues:

- Slow growth in nominal sales revenue

- High levels of debt

IASbaba’s Views:

- A strong recovery is possible in 2016 with growth rate exceeding 7.5 per cent but that is contingent on private investment, particularly private corporate investment, showing substantial improvement.

- Government needs to adopt a pro-active approach in creating a proper investment climate:

- Enhance investors’ confidence in the system

- Removal of cumbersome rules and procedures

- Toning up the delivery system

MUST READ

India’s strategy for the near west

Disability is not divinity

Related Articles:

Disability Law & the Invisible People

Delhi Air Pollution: Trying and testing the car formula

Related Articles:

Delhi’s traffic experiment – Will this reduce the Emission Levels?

Clearing the Air: An alarming rise in pollution levels

The Peshawar, Paris, Pathankot link

Related Articles:

Save security from the establishment

Transfer pricing rules with wider ambit soon- Changes in I-T Act likely to curb tax evasion by multinational companies

Centre plans trash cleaning machines, law on Ganga rejuvenation – The legislation will be for riparian states to rejuvenate the national river & also lay down a common water diversion plan

The Kelkar Committee finally grabs the public-private partnership bull by the horns

Related Articles:

Kelkar panel to revive PPP in infra projects

Air India – If you can’t fix it, shrink it- Let it gradually pull itself out of international routes and focus on linking remote towns and cities

Related Articles:

Draft National Civil Aviation Policy (NCAP) 2015

Russia In The Frame- Perceptions that the Modi government has moved Westwards are misplaced

Related Articles:

Does India need Russia anymore?

India Russia ties: New energy in old friendship

Working together to solve global problems

State finance ministers must watch out for 2017- State government finances could come under significant strain due to the twin burdens of UDAY scheme and 7th Pay Commission

MIND MAPS

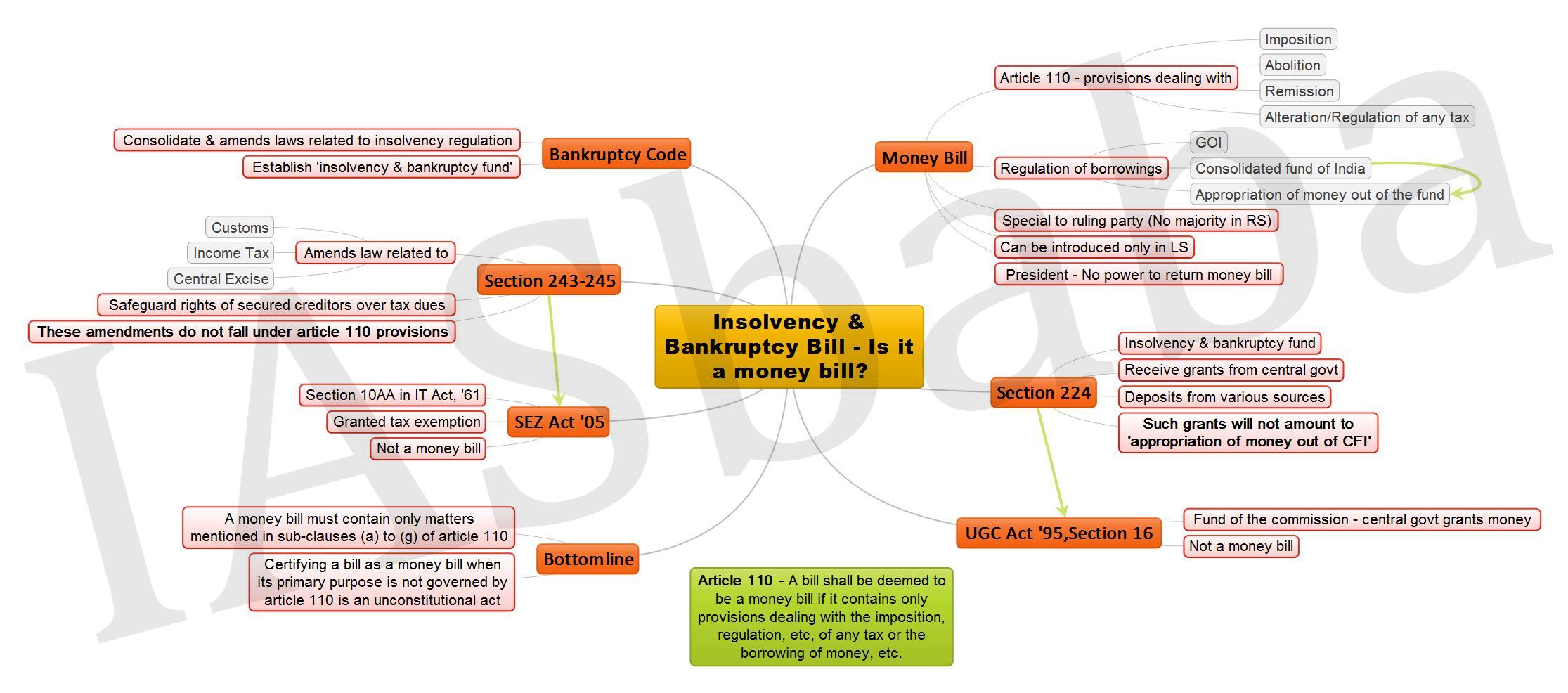

1. Insolvency & Bankruptcy Bill – Is it a Money Bill?

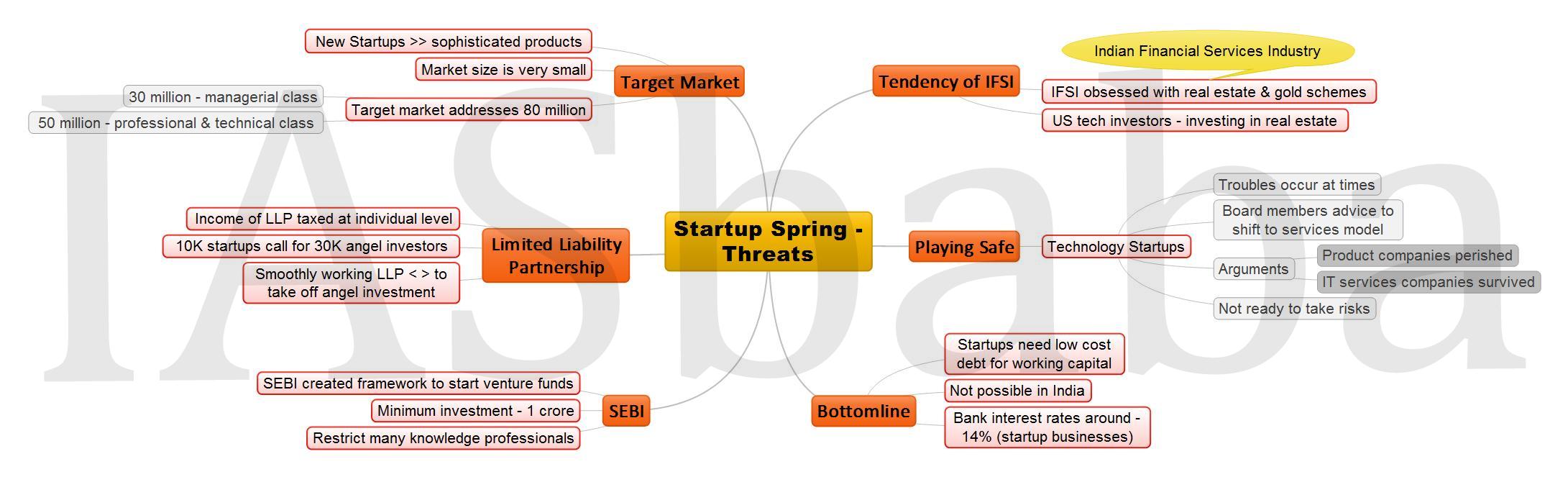

2. Startup Industry – Threats