IASbaba's Daily Current Affairs Analysis, IASbaba's Daily Current Affairs January 2016, National, UPSC

Archives

IASbaba’s Daily Current Affairs – 13th January, 2016

ECONOMICS

TOPIC:

- General studies 2: Bilateral, regional and global groupings and agreements involving India and/or affecting India’s interests; Effect of policies and politics of developed and developing countries on India’s interests, Indian diaspora.

- General studies 3: Indian Economy and issues relating to planning, mobilization of resources, growth, development and employment.

Gear up for changes in tax laws, treaties

- The international community led by the G20 had initiated the Base Erosion and Profit Shifting (BEPS) project a few years ago with the aim of ensuring that profits are taxed where economic activities are performed and where value is created.

- Governments, tax authorities and social groups have been voicing their concern over the past decade that multinational enterprises are shifting profits to low tax jurisdictions where there is no or little value-creation, and consequently not paying their fair share of taxes.

- As a member of the G20, India is an active participant in the BEPS project.

What is BEPS?

- Base Erosion and Profit Shifting (BEPS) refers to tax planning strategies that exploit these gaps and mismatches in tax rules to artificially shift profits to low or no-tax locations where there is little or no economic activity, resulting in little or no overall corporate tax being paid.

- BEPS is of major significance for developing countries due to their heavy reliance on corporate income tax, particularly from multinational enterprises (MNEs).

Research undertaken since 2013 confirms the potential magnitude of the BEPS problem. Estimates conservatively indicate annual losses of anywhere from 4 – 10% of global corporate income tax (CIT) revenues, i.e. USD 100 to 240 billion annually.

The most common practices and structures identified by India from a BEPS perspective are:

- Excessive payments to foreign-affiliated companies in respect of interest, service charges and royalties;

- Aggressive transfer pricing, including supply chain restructuring that contractually allocates risks and profits to affiliated companies in low tax jurisdictions;

- Digital enterprises facing zero or no taxation in view of the principle of residence-based taxation;

- Treaty shopping;

- Incentives in the tax laws for attracting investment; and

- Assets situated in India but owned by companies located in low tax jurisdictions with no substance.

What should India do?

- To implement BEPS actions around these issues, India is likely to amend its domestic tax law as well as tax treaties (either through the multilateral instrument being developed as part of the BEPS project, or bilaterally).

- It is important that taxpayers take note of these developments and prepare accordingly.

Way ahead:

- The new BEPS guidance will have a significant impact on Indian taxpayers.

- Taxpayers need to be aware of and constantly monitor the ongoing BEPS Action Plans as well as the changes that India is bringing about in its domestic law and tax treaties.

Background:

- Transfer pricing:

- Transfer pricing is the practice of setting up prices for trading valuables between two entities across different tax jurisdictions.

- The valuables can be tangibles, intangibles, services and financial transactions and the entities can be company divisions and departments, or parent companies and its subsidiaries.

For Example: When a US-based subsidiary of Coca-Cola, buys something from a French-based subsidiary of Coca-Cola. When the parties establish a price for the transaction, this is transfer pricing.

- Transfer pricing is not, in itself, illegal or necessarily abusive.

The Arm’s Length principle:

- If two unrelated companies trade with each other, a market price for the transaction will generally result.

- This is known as “arms-length” trading, because it is the product of genuine negotiation in a market.

- This arm’s length price is usually considered to be acceptable for tax purposes.

- But when two related companies trade with each other, they may wish to artificially distort the price at which the trade is recorded, to minimise the overall tax bill.

- This might, for example, help it record as much of its profit as possible in a tax haven with low or zero taxes.

- This is when transfer pricing becomes illegal or abusive.

- Treaty shopping:

- The practice of structuring a multinational business to take advantage of more favourable tax treaties available in certain jurisdictions.

- A business that resides in a home country that doesn’t have a tax treaty with the source country from which it receives income can establish an operation in a second source country that does have a favorable tax treaty in order to minimize its tax liability with the home country.

- Most countries have established anti-treaty shopping laws to circumvent the practice.

India has now initiated the process of renegotiating some of its existing bilateral tax treaties to combat treaty shopping by inserting anti-abuse rules.

Some of the BEPS suggestions on this aspect are similar and need to be evaluated by taxpayers closely in light of their current structure.

Connecting the dots:

- What do you understand by Base Erosion and Profit Sharing? Explain its impact on global economy with special focus on India.

- Explain the terms transfer pricing and treaty shopping along with measures taken by Indian government to prevent their abuse.

NATIONAL

TOPIC:

- General studies 2: Government policies and interventions for development in various sectors and issues arising out of their design and implementation; Important aspects of governance, transparency and accountability, e-governance- applications, models, successes, limitations, and potential;

- General studies 3: Science and Technology – developments and their applications and effects in everyday life Achievements of Indians in science & technology; indigenization of technology and developing new technology.

National Fibre Optic Network

- Information and communication technology (ICT) is a powerful facilitator for meeting the Millennium Development Goals by facilitating a roll-out of Internet access as an enabler of development

- But some services are dependent upon the availability of other complementary services and provisioning of basic services using ICT is also dependent on the availability of other complementary inputs.

National Optical Fibre Network?

- This is part of the Digital India initiative of the Government of India. NOFN is envisaged as a non- discriminatory Telecom infrastructure which will bridge the gap in rural access.

- NOFN, which is being funded by the Universal Service Obligation Fund (USOF), Department of Telecom, Ministry of Communications & IT, Govt. of India, is envisaged to provide non- discriminatory access to bridge the digital divide across rural India

Universal Service Obligation in the Age of Broadband—

Establishes two criteria that could be used to support the build-out of networks in advance of the ability of target populations to use them

Time to build–

- If ICT infrastructure takes a long time to deploy- then the project needs to be initiated in anticipation of future absorptive capability

- Prove to be a “durable” solution- Once deployed, it would take care of rural connectivity needs for many years to come

Technological Discontinuity-

- The capabilities of the technologies used for providing access develop in a discontinuous, step-wise manner with each step representing discontinuous jumps in access speed per dollar of investment.

- Therefore, rural areas must switch from lower to higher technologies due to the constraint of download speeds (Earlier- Lower the total capital costs of connectivity)

And, thus the expenses

- Fundamental driving force for government intervention- Stems from the role of connectivity as an enabler of development. Hence, the government’s financial obligation needs to be limited to the level of connectivity required to enable the provision of the requisite amount of developmental goods

- The degree of production and demand externalities that accrue after threshold penetration levels are reached; as well as the liabilities in question may also not justify the expenses

- Therefore, the cost should be shared between the public and private sector with the public sector paying for the basic level of connectivity required to provide development inputs and to internalize the positive impact arising from demand and supply externalities (Liability of the government needs to be limited)

- But the lack of a purely commercial venture may lack the conviction to deploy and bear the initial high investment and thus, the government should intervene and pay for the upfront costs of building the network and collect a revenue share for a specified number of years

Basic necessities-

- Need to be provided and a wireless network closely aligned with complementary inputs and the absorptive capacity of the target population should be rolled out to provide basic necessities immediately and prepare the population for the coming of the fibre optic network

- The operating competence of the private sector should be leveraged by tendering projects for building and maintenance through a reverse auction process.

A rural set-up & NOFN

Build-Own-Operate-Transfer model for building the national optical fibre network is not recommended on account of—

Operating challenges of rural networks-

- Being designed as a top-down model with no specific designing implemented for it to be successful on the ground

- Citing the difference between laying and installing optical fibre cable being just one part of the task; breathing life into the cables by having free flow of data is another matter altogether

- Serious lack of planning and strategy to make sure that these are fully functional and available to the people, organisations and government offices

- Panchayat as a base-

- Has not been able to spread connectivity beyond the Panchayat building in many villages when there is a need for each panchayat point of broadband to be fired up, functional, used and distributed

- Only 67% of the panchayats were connected to the fibre-optic backbone in the pilot phase of the NOFN project

- Connected Villages-Average broadband speed was found to be 50Mbps, half of what the government has promised

- Low ability to pay

- Uncertainty regarding the availability of complementary inputs

Infrastructural Challenges of National Optical Fibre Network

- Inadequate Spectrum

- High Price of Spectrum

- Non availability of contagious spectrum

- Non allocation of back haul spectrum

- Government auctioning spectrum in small chunks

IASbaba’s Views:

- There is a need to develop—

- Digital Bharat programme-We usually relate Bharat with our rural folk and since the majority of the population live in rural areas often called Bharat, we actually need a Digital Bharat programme to ensure that Bharat is as connected and digital as India, which lives in its metros and cities.

- Digital India Year- As to realize Digital India, we need a Digital India decade, or even to create and keep the momentum sustainable and action oriented, we need at least a Digital India Year

- There exists a direct correlation between broadband connectivity and GDP growth where broadband would result in bringing best in class of healthcare, education and banking reaching rural masses which would help in elevating poverty and improving standard of livings in the rural India. Therefore, it is imperative that focused; persistent attention is given to each of its pillars so that the big programme does not end up in as a failure.

- To build infrastructure is a small part of its sustained functionality for which the approach has to be well-planned, executed and monitored and following steps can be taken for the same-

- The national optical fibre network should be divided into a number of state-level projects in order to secure the buy-in of state governments, crucial for obtaining right-of-way permissions.

- Vertical integration of the private infrastructure operator and the service provider should be permitted in order to strengthen the business case and trigger operational efficiencies

- A phase-wise roll-out should be planned and the economically well-off subset of the specified set of gram panchayats should be targeted and after demonstrating success in these clusters and incorporating lessons learnt, further roll-out should take place.

Connecting the Dots:

- Discuss how the NOFN Model be implemented in a manner that keeps the absorptive capacity of target regions in mind

- Discuss the potential NOFN captures within it to transform the e-commerce sector of India.

MUST READ

Parrikar’s proposed defence procurement policy breaks new ground- At least 40% of a product must be manufactured in India for it to qualify for the Indian Designed, Developed and Manufactured category

Note: Since the issue is still under discussion, a detailed analysis of this issue will be covered in the coming week

A boon for small players- Mudra is a redesign of policy in order to re-target the audience, restructure processes and, most importantly, rejuvenate the mission of lending to the small, poor budding entrepreneur

Nuts and bolts- The Uttar Pradesh Lokayukta controversy highlights the need for greater attention to anti-corruption systems and processes.

A terror strike, a misdirected debate- Going by this viewpoint, the army is the sole repository of competence and commitment in anti-terror operations in the country.

Sri Lanka: Time to look within, not westwards

Is there a coherent science policy?- Prime Minister Narendra Modi has come out strongly in favour of harnessing science to take forward sustainable development, which will rid India entirely of poverty

We’ve beaten polio, but let’s move on – Lessons from the campaign should have a bearing on other aspects of India’s healthcare system and practices

Related Articles:

Is India actually free of polio?

The sunrise sector – More than capital subsidy, solar power needs superior grid infrastructure

Related Articles:

Solar systems mandatory on roof-tops

MIND MAPS

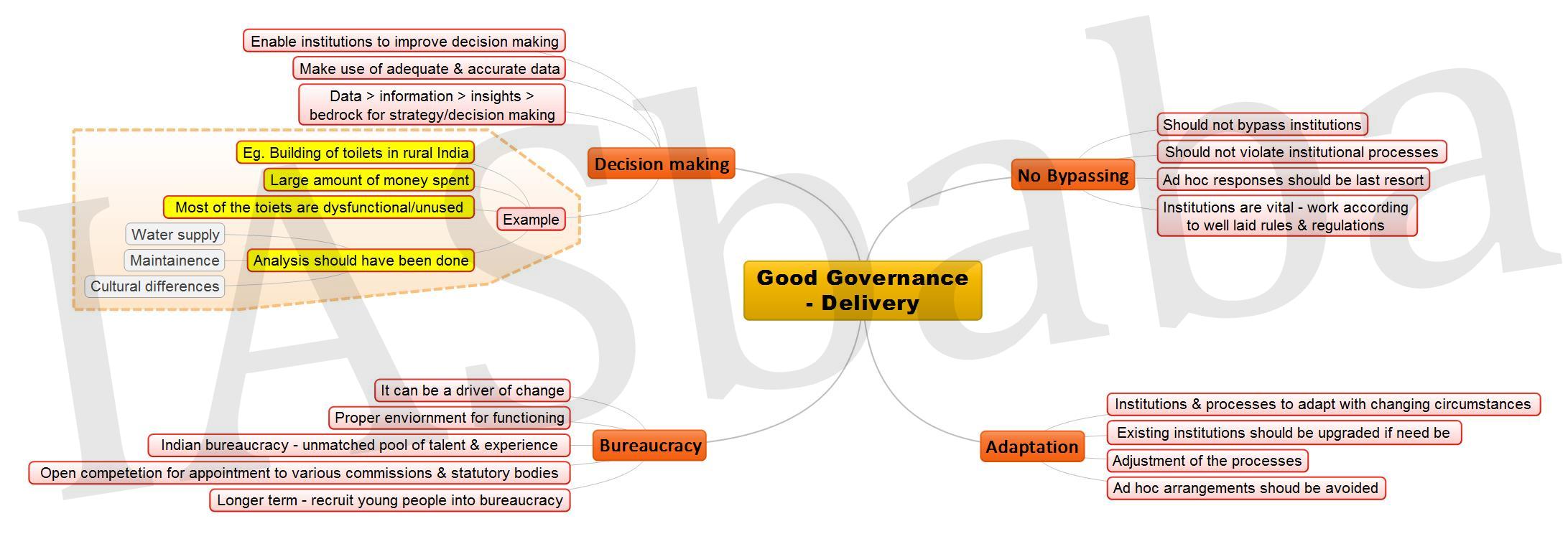

1.Good Governance – Delivery

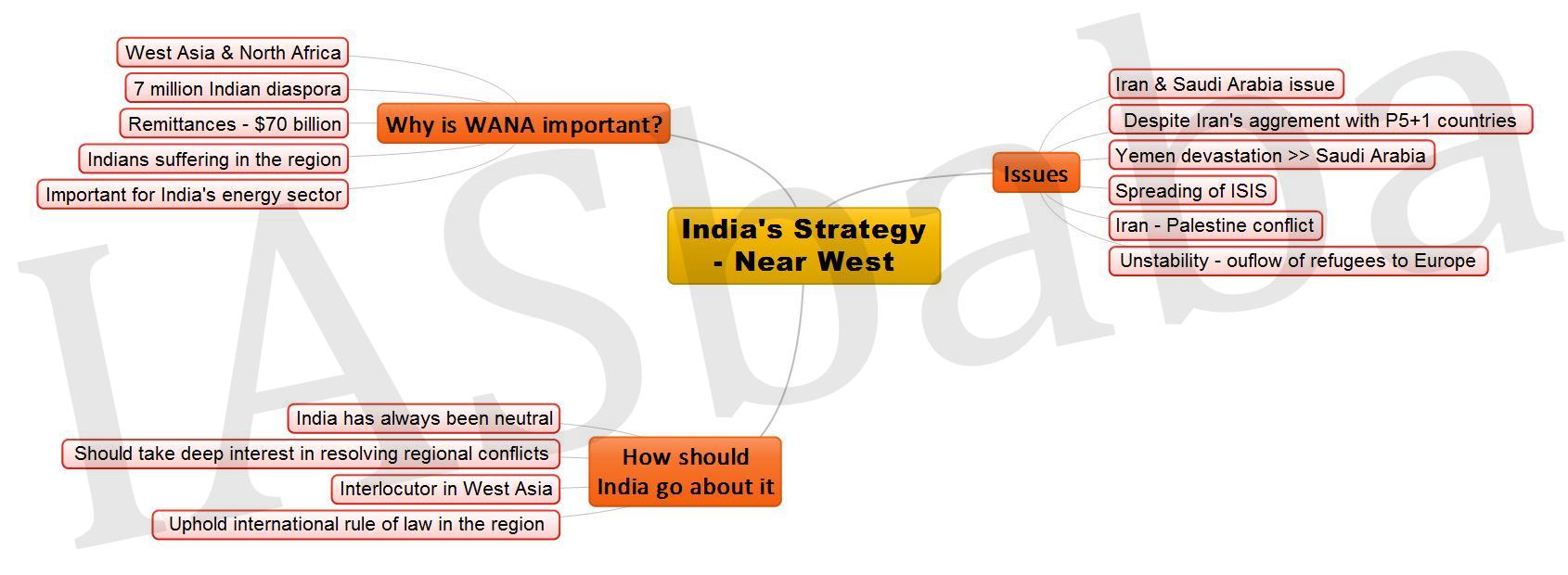

2.India’s Strategy – Near West