IASbaba's Daily Current Affairs Analysis, IASbaba's Daily Current Affairs January 2016, International, National, UPSC

Archives

IASbaba’s Daily Current Affairs – 19th January, 2016

INTERNATIONAL

TOPIC:

- General studies 2:

- Bilateral, regional and global groupings and agreements involving India and/or affecting India’s interests.

- Effect of policies and politics of developed and developing countries on India’s interests, Indian diaspora.

- Important International institutions, agencies and fora- their structure, mandate.

India Iran relations:

- India-Iran relations span centuries marked by meaningful interactions.

- The two countries shared a border till 1947 and share several common features in their language, culture and traditions.

- Both South Asia and the Persian Gulf have strong commercial, energy, cultural and people-to-people link.

Why in news now?

The economic sanctions imposed by US,EU and the UN on Iran due to its nuclear programme against the international norms has been lifted now following an IAEA’s compliance report with the terms of last years historic nuclear deal.

It will be more an extended tightrope walk for Iran:

- Iran’s long march forward now will be more an extended tightrope walk — proved by US imposition of fresh sanctions over Iran’s missile programme, pertaining to the test-fire of a precision-guided ballistic missile capable of delivering a nuclear warhead in October 2015.

- Moreover, the US has only suspended its nuclear-related sanctions; it hasn’t terminated them.

- Non-nuclear economic sanctions imposed by the US remain in place, forbidding American citizens and firms from trading with Iran.

- As a result, foreign companies may still not feel confident about dealing with Tehran.

What Iran expects to be doing now?

Despite so many qualifiers, Iran is now back in the global market, ready to raise its production and export of oil, gain access to capital and investment, and utilise its own $100 billion of assets that are being unlocked.

India Iran relations: An outlook

- Economic:

- India-Iran enjoys economic and commercial ties covering many sectors.

- However, the trade relations have traditionally been buoyed by Indian import of Iranian crude oil resulting in overall trade balance in favour of Iran.

- The India-Iran bilateral trade during the fiscal 2012-13 was USD 14.95 billion.

- India imported US$ 11.6 billion worth of goods manly crude oil and exported commodities worth US$ 3.35 billion.

- India’s export to Iran during the period April November 2013 stood at USD 3.21 billion.

- The unilateral economic sanctions imposed on Iran have had an adverse effect on the bilateral trade as the international banking channels have gradually become non-existent.

- India’s exports to Iran include petroleum products, rice, machinery & instruments, manufactures of metals, primary and semi finished iron & steel, drugs/pharmaceuticals & fine chemicals, processed minerals, manmade yarn & fabrics, tea, organic/inorganic/agro chemicals, rubber manufactured products, etc.

- Other developmental initiatives:

- India and Iran are in discussions for the setting up of a number of projects such as the IPI (Iran Pakistan India) gas pipeline project, a long term annual supply of 5 million tons of LNG, development of the Farsi oil and gas blocks, South Pars gas field and LNG project, Chahbahar container terminal project and Chahbahar-Zaranj railway project, etc.

- Both countries have set up joint ventures such as the Madras Fertilizer Company and the Chennai Refinery.

- Indian companies such as ESSAR, OVL, etc have a presence in Iran.

- The State Bank of India (SBI) has a representative office in Tehran.

- India is also a member of the International North-South Corridor project.

- The two countries are in the process of finalizing a Bilateral Investment Promotion & Protection Agreement (BIPPA) and a Double Taxation Avoidance Agreement (DTAA).

Sanctions free Iran: How will it help India?

- India will have easy access to Iran’s crude oil again.

- India, the world’s fourth largest oil importer, can look forward to the prospect of cheaper crude oil with the world’s fifth largest producer returning to the world market.

- A decline in crude oil price is positive for the current account deficit as India imports about 80 per cent of its crude oil requirement.

- According to rating agency ICRA, every one dollar decline in international crude oil price reduces the import bill by about Rs 6,500 crore and the gross under-recoveries by Rs 800-900 crore.

- There lie the prospects of an overseas market that could well help Indian businesses counter sluggish domestic demand – from auto-components, machine tools, fertilisers, pharmaceuticals and capital goods equipment to commodities such as rice and tea, for both of which India was once a monopoly supplier.

Way ahead:

- India should take the signal from the lifting of sanctions.

- A peaceful, stable Iran is vital for its interests, particularly for energy security and connectivity.

- India should get Iran on board, again.

Connecting the dots:

- Critically examine the importance of Iran in order to promote energy security in India.

- Critically evaluate the role played by Iran in the geo politics of Middle East.

INTERNATIONAL

TOPIC:

General studies 2:

- Bilateral, regional and global groupings and agreements involving India and/or affecting India’s interests.

General studies 2:

- Science and Technology – developments and their applications and effects in everyday life Achievements of Indians in science & technology; indigenization of technology and developing new technology.

- Conservation, environmental pollution and degradation, environmental impact assessment.

Building the International Solar Alliance

- The International Solar Alliance (ISA) is an exciting initiative marked by India’s pro-activeness and forward-looking leadership on climate change; launched on the first day of the COP21 climate negotiations in Paris, jointly with France with its domestic principles serving as a strong foundation.

- India has been on the forefront of working for the development of sustainable solutions as well as understanding the need for transition to a less carbon-intensive growth trajectory.

- With the resolutions undertaken and a consistent leap towards mainstreaming the technology, India is slated to be one of the largest markets for developing and deploying solar energy, with its domestic policy (to build 100 gigawatts) sending out clear signals to developers and financiers

Big to Bigger—

ISA—An inter-governmental institution

Aims of ISA

- Reducing financial risk across a larger global market,

- Encouraging cooperation on technology,

- Building capacity,

- Increasing energy access

Let’s chart a roadmap for ISA

Selection of a Director General (DG) with a secretariat: A dynamic DG can

- Draw attention to the alliance

- Build relationships with member states and other international institutions

- Interact with the media regularly

- Develop a strategic plan to grasp the potential that ISA holds

Creation of a core ISA Coordination Group: A dedicated inter-ministerial group needs to be deployed to-

- Distribute the workload

- Allocate funds

- Maintain contact with member states

- Prepare related documents.

Issuing a White Paper on ISA Governance: ISA is an inclusive multilateral institution and therefore, it demands clarity on—

- Governance structure

- Decision making ways

- Role of contributions in Voting Rights

- Outlining alternative governance models

- Advancements of the needs of advanced and emerging economies and those of smaller member states as well as ways to balance them out

Launching an ISA website: The website should feature-

- The ISA declaration,

- List of members and observers,

- Minutes of meetings,

- Proposed activities,

- A meeting calendar,

- Governance structure,

- Details of the studies being undertaken

- Briefs and Reports of the studies being carried out

- Outcomes of ISA activities

Issuing monthly ISA briefings:

- A regular open channel for press briefings and monthly updates to all ISA member countries would build support and invite genuine deliberations over important matters.

- The ‘social marketing’ to spread awareness needs to be undertaken periodically as the more ISA is in the news, the more its activities and potential will get attention.

Assessing all proposals through a “value-add” lens: There will come forth a plethora of ideas, for example—

On what other institutions (private, public and inter-governmental) could do to shape ISA’s agenda, such as-

- mobilising investments

- deploying projects in member countries

ISA thus, needs to adopt an approach that would not just leverage its position in the world but also save its own time by avoiding any overlaps of activities and thus, a measured approach needs to be undertaken with a “value-add” perspective

Time is ripe to kick-start bold initiatives: ISA will do well to launch one or two bold initiatives capturing the imagination of ISA members and triggers interest in pitching high by the innovators, project developers, bankers and other investors

- “Energy Storage Prize”- To promote cross-country research and development collaborations

- “Solar Rooftop Financing Initiative”- A financing challenge common to many countries

Establishing Formal links with Private Sector platforms: ISA can distinguish itself by establishing strong links with the private stakeholders—

- By giving private sector consortia observer or associate member status,

- Encouraging them to design and implement ISA programmes,

- Building long-term relationships for targeted investments

Announcing an ISA Summit and Expo: An annual or biennial summit and expo would draw further interest; wherein it can serve as a connector of dots between all the stakeholders and countries leading the initiative

Building an ISA headquarters in New Delhi: For the need of a

- Recognisable location,

- Strong branding and

- True identity

25 January: Prime Minister Modi and President Hollande of France will jointly lay the foundation stone of the ISA building

Headquarters’ design should convey ISA’s—

- Vision,

- Open and inclusive governance,

- Emphasis on practical solutions and scale, and

- Purpose of delivering clean energy access to millions

MUST READ

In god and guns they trust

Death of a Dalit scholar

A Road To Bastar- New mobile towers, better roads are making a difference in a troubled region.

Essential start-up lessons- Risk taking, experimentation and teamwork must also infect government machinery

Related Articles:

http://iasbaba.com/2016/01/iasbabas-daily-current-affairs-18th-january-2016/

http://iasbaba.com/2015/12/startup-india-standup-india/

Yes, Delhi, it worked- The odd-even pilot reduced hourly particulate air pollution concentrations by 10-13 per cent. But for the longer run, a congestion-pricing programme may be better

Related Articles:

Delhi’s traffic experiment – Will this reduce the Emission Levels?

Clearing the Air: An alarming rise in pollution levels

Right track- Connecting the northeastern capitals by rail will produce enormous dividends.

Reduction in interest burden could possibly prevent more companies heading towards bankruptcy- The ‘tight fiscal, easy monetary’ policy mix can better address problems that plague private investment.

Related Articles:

Dealing with Failure: Bankruptcy Code

Debt recovery tribunals: More pain than gains for banks- Experts suggest that the law should be strengthened to ensure mandatory time bound disposal of cases

MIND MAPS

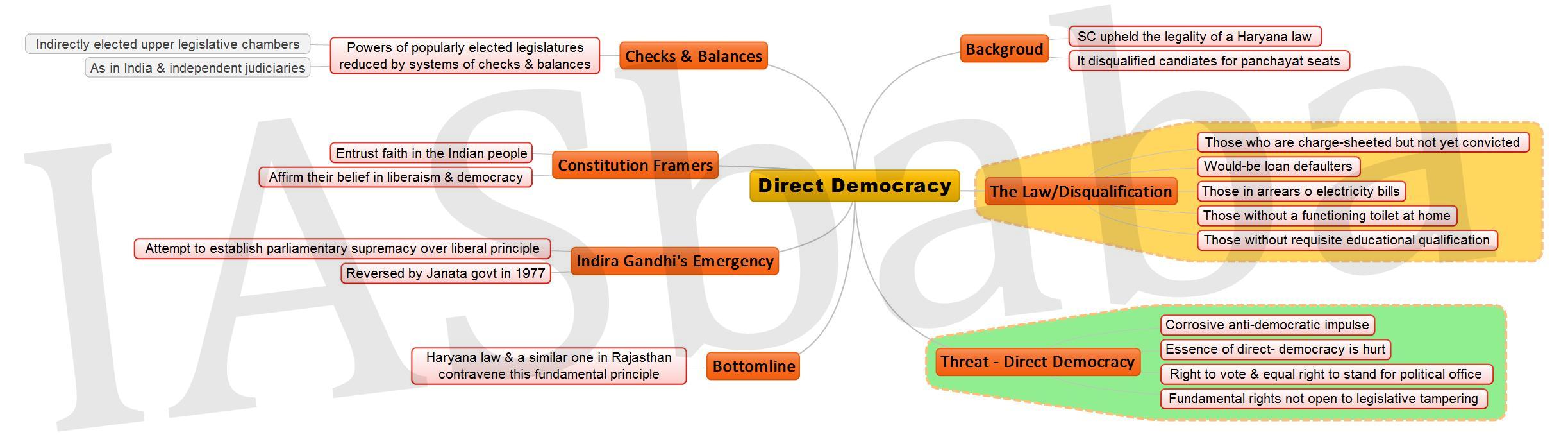

1. Direct Democracy

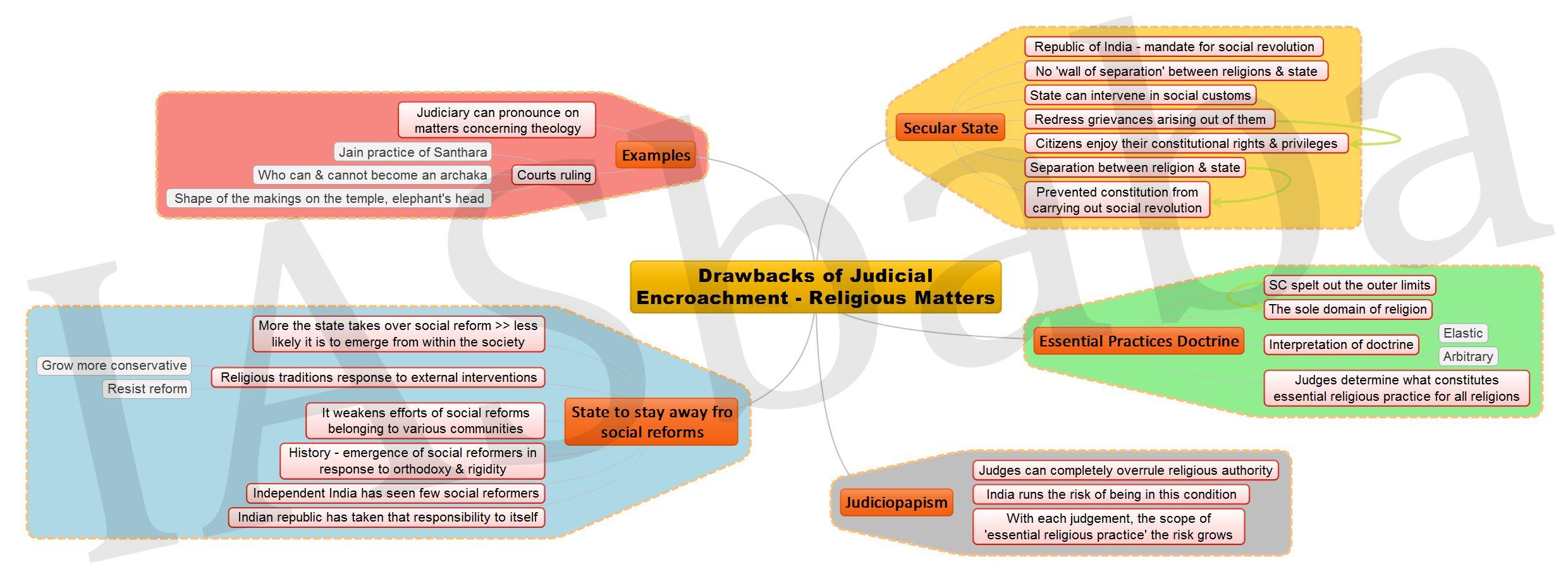

2. Drawbacks of Judicial encroachment – Religious Matters