IASbaba's Daily Current Affairs Analysis, IASbaba's Daily Current Affairs July 2016, UPSC

Archives

IASbaba’s Daily Current Affairs – 22nd July, 2016

ECONOMICS

TOPIC:

General Studies 3

- Indian economy and issues relating to planning, mobilization of resources, growth, development and employment

General Studies 2

- Important International institutions, agencies and fora- their structure, mandate.

How misinvoicing is robbing developing countries of export earnings

About: According to Global Financial Integrity (GFI) December 2015 report

- Trade misinvoicing was revealed to be the largest component of illicit financial flows (IFF) from developing countries

- It accounted for 83.4% of all illicit flows

Figures say it all:

$1.1 trillion that flowed illicitly out of developing countries in 2013 was greater than what they received by the combined foreign direct investment (FDI) and net official development assistance (ODA).

Context:

- Increasing exports form one of the most important routes to develop fortunes of a developing country.

- But, there is a possibility that what the developing countries might rightfully gain through trade may get usurped by others through various means and methods.

- Trade misinvoicing is an important route contributing to it.

Hence, UNSDGs has incorporated curbing IFFs into its framework.

What is trade misinvoicing?

Invoice: An invoice shows what a buyer has to pay to the seller.

Misinvoicing: The amount actually paid or obtained may be higher or lower than the amount indicated in the invoice.

How it works?

Country A exports $100 item to Country B.

Country B shows amount in its books after making adjustments as there would be a calculating difference

Difference would exist as:

- Export calculated on Free on Board (fob) basis

- Import calculated on Cost, Insurance and Freight (cif) basis

Trade misinvoicing happens when there is a difference in the amount even after factoring the basic calculations.

There might be underinvoicing by exporters or overinvoicing by importers.

- Export underinvoicing– value of exports for exporting country is less than what the importing country reports as imports after adjusting for cif.

- Exporter reports invoice of $100 for goods worth $120. In reality, he will deposit the $100 officially and $20 will go into his personal account.

- Import overinvoicing– adjusted value of imports for importing country is more than what the exporting country reports as exports.

- Importer reports invoice of $120 for goods worth $100. He pays $100 in reality and the remaining amount is deposited in his foreign accounts.

Another example

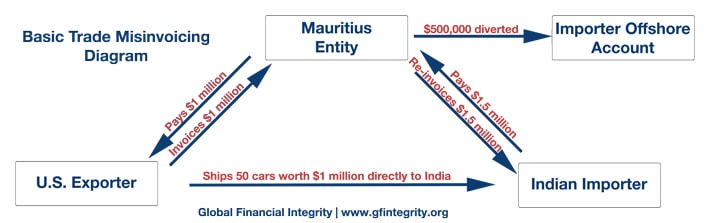

Picture Credit http://www.gfintegrity.org/issue/trade-misinvoicing/

- Although the Indian importer is buying $1 million worth of cars from the U.S. exporter, he uses a Mauritius intermediary to re-invoice the amount up to $1,500,000.

- The U.S. exporter gets paid $1 million.

- The $500,000 that is left over is then diverted to an offshore bank account owned by the Indian importer. This is case of import overinvoicing

Reasons for trade misinvoicing

- Money laundering

- Tax evasion-To maximise the profits by tax evasion in either of the countries.

- Dodging Capital Controls- Many developing countries have restrictions on the amount of capital that a person or business can bring in or out of their economies. Investors attempting to break these capital controls often misinvoice trade transactions as an illegal alternative to getting money in or out of the country.

- Bureaucratic bypass– To circumvent bureaucratic hurdles to speed up execution and settlement of transactions

Such activities often take place along with legitimate trade, which provides a good cover.

Extent of trade misinvoicing in developing countries

Preventing trade misinvoicing requires to first identify the countries and its exact products.

UNCTAD study: Developing countries exporting primary products have reportedly high levels of trade misinvoicing.

Study countries: Chile, Côte d’Ivoire, Nigeria, South Africa and Zambia

Primary products exported:

- Oil and gas

- Minerals, ores and metals (copper, gold, iron ore, silver and platinum)

- Agricultural commodities (cocoa).

Why these countries: exports of these commodities constitute a large part of their total exports. They are also called Commodity Dependent Developing Countries (CDDCs).

UNCTAD study results:

- Though significant export misinvoicing was reported, there was extreme variations across countries and trading patterns.

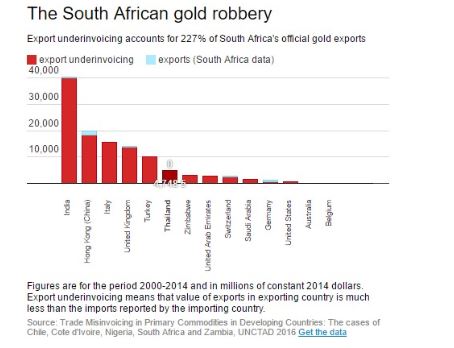

South Africa’s gold export:

- For 14 selected partners, South Africa’s official trade data shows gold exports worth just $3.17 billion (in 2014 constant dollars),

- Whereas partners’ data shows the value of exports from South Africa to be $ 117.12 billion.

- India is the biggest trade partner of South Africa in gold exports.

- China is present on almost every selected country’s export misinvoicing list which suggests that many countries are losing a lot of money in exports to it.

Picture credit: http://www.livemint.com/

India not immune to trade misinvoicing

- The IFF outflows via trade misinvoicing is not confined to African countries

- A 2014 report estimated that a total of $186 billion worth of IFF went out from India through trade misinvoicing route.

- For comparison: India’s total exports in 2015-16 were worth $262 billion

Conclusion

- These statistics show how despite significant exports, developing countries are failing to realise the gains from trade.

- Nearly 90 developing countries are losing commodity export earnings worth billions of dollars in valuable foreign exchange earnings, taxes and income that might otherwise be spent on development.

- In India, through encouraging exports via Make in India, there seems to be considerable scope for tapping illegal flow of funds.

- India has been a recent signatory to the agreements facilitating autonomous exchange of tax information between countries and is much better placed to tackle the menace.

Connecting the dots:

- Curbing trade misinvoicing is imperative to stop global illicit financial flows. Explain

Related Articles:

Tackling off Shore Tax Evasion

MUST READ

Lengthening shadow over South Asia

Living in a warmer country

Drugged to denial

Related Articles:

A strategic diaspora security policy

What Swachh Bharat should have addressed

The name’s bond, Gold Bond

Related Articles: