IASbaba's Daily Current Affairs Analysis, IASbaba's Daily Current Affairs Aug 2016, UPSC

Archives

IASbaba’s Daily Current Affairs – 25th August, 2016

ENVIRONMENT

TOPIC: General Studies 3

- Conservation, environmental pollution and degradation, environmental impact assessment.

- Inclusive growth and issues arising from it

Forest Land Diversion in India

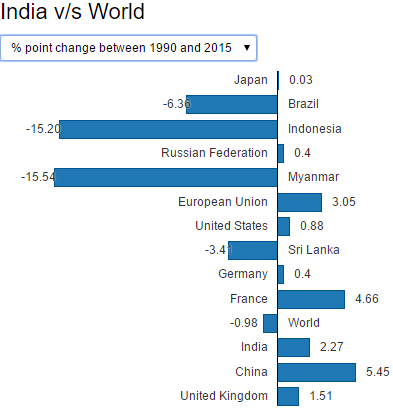

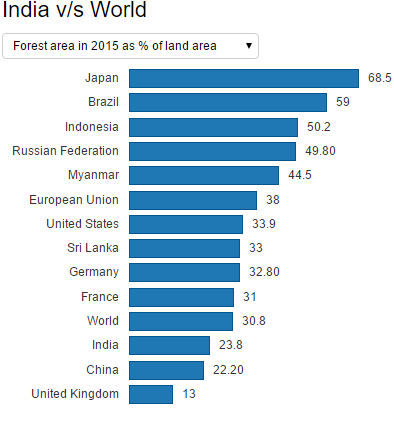

World Bank: India has managed to increase its forest area by 2.27% in the last 25 years. This has put India ahead of the global average in afforestation efforts.

Source credit:

http://data.worldbank.org/indicator/AG.LND.FRST.ZS?end=2015&start=2015&view=map

However, when the forests in India are looked in detail, the picture is not so encouraging.

Forest Survey of India, 2015

- Total forest area in India: 7,01,673 sq. km

- Increase in total forest area by 3,775 sq. km since 2013

- But, in same period, 2,511 sq. km of very dense and mid-dense forests were completely wiped out.

- Cutting down natural forests and replacing them with planted trees in wastelands or non-forest areas is not the same thing.

- Natural forests have complex system of flora and fauna which cannot be absolutely restored by planned forestation.

What is responsible for the destruction of India’s natural forests?

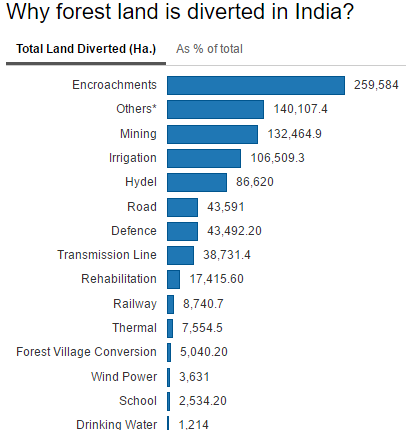

- According to government, encroachment is the biggest reason for forest land diversion in India.

- Between October 1980 and July 2016, India has diverted almost 9,00,000 hectares of forest land for non-forest purposes.

- This is 2% of India’s total forest area as of 2015.

- However, activists working on ground have questioned the encroachment numbers.

- They have cautioned not to take end-use classification of diverted forest land at face value.

- Reason: Many a time, the government might first declare land under cultivation and habitation as forest land and then try to evict the people living there.

- For instance: in states like Odisha, Andhra Pradesh and Telangana, the forest department has been carrying out the policy of ‘aggressively afforesting’ forest land. Here, the government takes away lands under shifting cultivation from Particularly Vulnerable Tribal Groups and carries out plantations without the consent of these communities.

*Others category includes miscellaneous projects not included in the above indicated major categories such as petrol pump, relocation of villages, disputed settlement claims, stone/sand quarrying, construction of residential complex, pipe lines, borehole prospecting etc.

Source credit: http://www.indiaenvironmentportal.org.in/files/file/Ecological%20Impact%20of%20Mining.pdf

Forest Land Diversion in India

- There is 897,698.4 hectares of forest land diverted all over India

- Madhya Pradesh- 27%

- Chhattisgarh- 9.4%

- Gujarat- 7.1%

- Punjab- 7.1%

- Maharashtra- 6.7%

- Odisha- 5.4%

- Madhya Pradesh and Chhattisgarh: huge areas of land have been used up for coal and iron ore mining.

- Arunachal Pradesh (3.6% of forest land diverted): Land is used for hydel power generation.

The case of Punjab

- States with higher proportion of forest land diversion were Punjab, Haryana, Kerala, Gujarat and Madhya Pradesh.

- Punjab is the worst case of land diversion

- 20% of Punjab’s total forest area has been diverted between 1980-2016

- To put in perspective: Haryana is ranked second to Punjab. It has diverted 3.8% of its forest land in same period

- Reason:

- Rapid urbanization, building of roads, bridges, defence installations, etc. are responsible for this drastic erosion

- The government itself uses lot of forest land for building educational institutes, etc. as it is difficult to acquire land, given the complexities of land acquisition

- Also, as Punjab has less forest area vis-à-vis other states in the country, its diversion of forest area also appears high.

Forest Bureaucracy

- It is a product of colonial rule which has seen forests as state property.

- This has often brought conflict between local population residing in forests and bureaucracy. Such conflicts have been going on through generations

- Thus, encroachment accounting for the highest loss in forest area points to an old fight between the forest bureaucracy and forest population of India.

- International experience shows that local population display greater efficiency and stakes in forest conservation as well as afforestation than the efforts given by forest bureaucracy.

- This debate has become relevant with Compensatory Afforestation Fund Bill undertaken by Parliament.

- According to environment experts, this bill seeks to reverse the gains which the Forest Right Act, 2006 conferred on communities living in forests, majority of which as Scheduled Tribes.

Effects of forest diversion

Monoculture Plantations are not Forests

- There is growing evidence that natural forests cannot be replaced by plantations.

- Forests provide for an extremely valuable ecosystem.

- The different forest types across the country are home to an amazing variety of wildlife which are irreplaceable.

Species in danger

- The diversion of forests along the Alaknanda basin in Uttarakhand for building hydro-electric power projects will impact the Himalayan Brown Bear.

- A proposed dam on the Nyamjang Chhu River in Arunachal Pradesh will submerge the wintering habitat of the rare and endangered Black Necked Crane.

- Widening of the NH7 highway running along Maharashtra and Madhya Pradesh will destroy the Pench corridor used by a vast population of

- Due to mining and railways expansion across forest areas, a steady increase has already been witnessed in the incidence of human conflict with elephants.

People lose home and identity

- There are approximately 300 million people staying in around 170000 villages, settlements and habitats in these forests.

- If the forests are ‘reforested’ (euphemism for diversion), the people will lose home, livelihoods and sustenance, culture, traditional bonding with nature and finally, India will lose the distinct identity of protecting diversity.

- Historically it has been noted that the forest dwellers have not been adequately compensated for uprooting their lands, livelihoods and culture.

- For the Schedule Tribes who mainly reside in forests, the enactment of the Scheduled Tribes and Other Traditional Forest Dwellers’ (Recognition of Forest Rights) Act, 2006, also called Forests Rights Act, has not much changed their situation.

- The provision of seeking prior informed consent of local communities in forest areas being diverted has been regularly ignored

Conclusion

- Diversion of forest land for any non-forest purpose should be subject to the most careful examinations by specialists from the standpoint of social and environmental costs and benefits.

- If it becomes necessary for economic development to use the forests for non-forest purpose, then before grant of permission for diversion of forest land, there should be some scheme where under loss occurring due to such diversion can be made up by adopting both short term measures as well as long term measures one of it being a regeneration programme.

- Forests are our source of survival which provide us air, food, wood, habitat for living beings, source of watershed protection and mitigate climate change. If the forests will go, the ecosystem will disappears. Hence, saving forests is saving ourselves.

Connecting the dots:

- What is forest land diversion? Critically analyse the significance of it.

Refer:

Sowing the seeds of a disaster: Compensatory Afforestation Fund Bill, 2015 (CAF Bill)

Conservation of natural resources- Forest (Conservation) Act, 1980

ECONOMY

TOPIC: General Studies 3

- Indian Economy and issues relating to planning, mobilization of resources, growth, development and employment.

- Effects of liberalization on the economy.

Reforming the bilateral investment pacts

Context

- Worldwide, the international investment agreement (IIA) regime is undergoing a change.

- India has been no exception to it.

- India has decided terminate about 57 bilateral investment treaties (BITs) whose initial duration has expired, or is soon to expire.

- For the other BITs that are in force, it will issue joint statements.

- IIA reforms have been seen in many countries including Australia, South Africa, Indonesia as well as EU.

International Investment Agreement

- A type of treaty between countries that address issues relevant to cross-border investments

- It is usually for the purpose of protection, promotion and liberalization of such investments.

- Most IIAs include FDIs and portfolio investments. Though, some don’t have latter.

- Countries that involve in IIAs commit themselves to adhere to specific standards on the treatment of foreign investments within their territory.

- The most common types of IIAs are Bilateral Investment Treaties (BITs) and Preferential Trade and Investment Agreements (PTIAs).

- International Taxation Agreements and Double Taxation Treaties (DTTs) are also considered as IIAs, as taxation commonly has an important impact on foreign investment.

Why bilateral investments not working

- Bilateral Investment Treaties (BITs) deal primarily with the admission, treatment and protection of foreign investment.

- Following the 1991 economic reforms, India signed a number of BITs.

- However, just like other countries, India also did not understand its consequences

What changed India’s approach to BITs

- In 2012, India lost an investor-state arbitration dispute to White Industries.

- White Industries started the proceedings under the India-Australia BIT

- Later, through the ‘most favoured nation’ (MFN) clause, it took advantage of the more favourable investor protections in the India-Kuwait BIT.

- The tribunal held that court delays in India breached the “effective means” standard in the India-Kuwait BIT.

- Thus, India was liable to pay damages + costs + interest to White Industries.

- Learning from this, the new model BIT of 2015 excludes from the purview

- MFN clause

- Taxation

- Compulsory licences

- Intellectual Property Rights

- Also, now onwards controversial provision of investor-state dispute settlement (ISDS), the investor has to first pursue domestic courts for at least five years and then approach international platform.

India is not alone

- At a recent meeting of UNCTAD’s World Investment Forum in Nairobi, developed and developing countries called for the IIA regime to be more balanced between investor protection and host states’ right to regulate and enforce rights and obligations.

- It included countries like Australia, Canada, China, South Africa and EU.

- Many European countries are identifying more possibilities of a permanent multilateral investment court.

- The ISDS system has been called for more transparency, tightened definitions and reforms.

- Some countries don’t find co-relation between the inflow of foreign direct investment and BITs.

- For instance, India and USA do not have a BIT, yet US is the largest source of FDI in India. (If India-US have BIT, it will be strategically advantageous for India.)

Too much confusion

- There is a growing feeling among host countries that BITs is leaning in favour of protection for corporations and it compromises the regulatory space of the governments.

- There is a need to include investor obligations and responsibilities and rights in such agreements.

- Also, there has been an exponential increase in investor-state arbitrations.

- It has been observed that tribunals tend to come out with conflicting opinions.

- Countries have also been sued for the same underlying dispute under more than one BIT.

- The tribunals have given remedies based on potentially more favourable clauses in BITs, other than the one invoked, by incorporating the standard under the MFN clause.

- These arbitrations have alarmed the governments and have made them rethink their strategies.

- It has been also reflected in G20 Guiding Principles for Global Investment Policymaking.

- There has to be a change in approach which

- Affirms a non-discriminatory and predictable investment climate.

- Asserts the right of host governments to regulate investments for legitimate public purpose.

- Supports a robust ISDS system, with safeguards to prevent abuse.

Need to reform ISDS

- If a permanent investment court is feasible or not has to be mooted.

- The permanent courts may have a system of appeals within its framework. Also, it can be only be an appellate tribunal.

- Such a reform will bring some certainty in the system and prevent divergent or conflicting opinions on the same legal provision.

- The challenge is that there are about 3,000 different BITs in force with differing provisions. Hence, there may be a problem of coherence and cross-application of arbitral awards.

Balanced System needed

- Countries can undertake specific commitments to provide speedy adjudication of disputes in domestic courts before invoking international arbitration. This has been also met with resistance.

- They can also negotiate for compulsory alternate dispute settlement mechanisms like mediation in the BITs.

- There has to be research in finding the best possible approaches to BITs that balance investor rights and countries’ regulatory space.

- The new BITs have to be mindful of the sustainable development goals and find ways to encourage responsible investment.

- As the distinctions are fading between strictly capital-importing and capital-exporting states, all countries must proactively seek a more balanced IIA system.

- This requires more cooperation and open-mindedness across the states and investors

- India has already initiated steps to reform IIA regime and it should be the starting point of a larger debate.

Connecting the dots:

- What are BITs? Discuss the problems pertaining to implementation of BITs and how can they be solved?

MUST READ

The new war on piracy

Speaking truth to power

Citizenship without bias

New engagement with an old neighbour

Related article:

Why “looking east” and “acting east” is important?

Surrogacy bill gets the Cabinet nod

Protecting Good Samaritans

Elephant seals to measure changing ocean currents

Deforestation caused reduced rainfall in Ganga Basin, NE India

Theatre of the absurd

Related article:

Sedition: An unconstitutional tool

Health Security At Stake

Defining public interest

Knowing your submarines: Scorpene submarine leak

TB cases in India may be double of estimates: new study

Cabinet clears new India-Cyprus tax treaty

Industry must lead the way in skilling India

Inflation: Risks of global price rise

Scientists find Goldilocks planet in Earth’s galactic backyard

Global human footprint growth slower than rise in population, economy: Report

Perumal Murugan returns

India’s new position at RCEP

India to receive normal rains, not surplus, as La Nina chances fade

India right in flagging Baluchistan

Related article:

Ethanol blend petrol

Calendar concerns

Centre looking at options for GST rollout date