IASbaba's Daily Current Affairs Analysis, IASbaba's Daily Current Affairs Sep 2016, UPSC

Archives

IASbaba’s Daily Current Affairs – 19th September, 2016

ECONOMY

TOPIC: General Studies 3

- Issues related to direct and indirect farm subsidies and minimum support prices

- Major crops cropping patterns in various parts of the country

CEA panel report:- “Incentivising Pulses Production through MSP and other policies”

In news: The government constituted a committee under CEA to address the policy issues that would help address this volatility in acreage, production and prices in pulses.

Background

- In the wake of two successive years of weak monsoons in 2014 and 2015 and the resulting mismatch between demand and supply, prices of pulses rose sharply.

- It led to higher inflation and straining the purchasing power of consumers all over India.

- However, the situation has been reversed in current kharif season (2016) as there has been sharp increase in domestic production combined with a surge in global production of pulses.

- This has threatened to affect farmers’ incomes and livelihoods.

Importance of pulses in India

Dietary choice-

- Pulses are going to be increasingly important in the dietary habits of Indian consumer as the average Indian under-consumes protein. They are more affordable than other sources of protein like milk, eggs and fish.

Increase in demand-

- For the evolving dietary pattern, there should not be larger demand-supply mismatch for pulses. The import of pulses is not a correct and sustainable policy measure to arrest the demand-supply mismatch of pulses.

- Farmers need to be encouraged to grow more pulses because demand is projected to rise by roughly 50% between 2016 and 2024.

Environmentally safe-

- Pulses help in soil rejuvenation and naturally fixing atmospheric nitrogen, without consuming much water.

Thus, in the existing scenario, the committee under CEA reviewed Minimum Support Prices (MSPs) and related policies to incentivize the cultivation of pulses.

Recommendations of the CEA panel

MSP and procurement

- The government should procure pulses on a “war footing” as there is likely to be a bumper production and prices might fall below MSP.

- A High Level Committee should be set up to monitor the procurement at highest level because pulses procurement has generally been ineffective in the past.

- Communication is important to engender credibility that government is backing up its policies with effective follow-up action. Thus, Reporting must include real time online data on procurement with geo-coding of all procurement centres and also physical verification of pulses procurement (via videoconference).

- Building a buffer stock in pulses of 2 million tons with targets for individual pulses, especially tur (3.5 lakh tonne) and urad (2 lakh tonnes). These stocks should be built up gradually but opportunistically, buying when prices are low as in the current year (2016).

- Instruct Commission for Agricultural Costs and Prices to comprehensively review its MSP-setting framework to incorporate risk and social externalities.

- Risk- inherent risk in agriculture because of weather, pest, and price shocks

- Externalities- over-use of inputs in north-west India and the resulting drop in the water table, the increased incidence of disease and erosion of soil quality, and deterioration of the environment (especially from burning of rice straws)

Other price management policies

- Lifting export bans and stock limits to prevent further declines in prices; at the very least limits on wholesalers should be eliminated.

- Greater the limits on procurement by the governmentà greater the urgency to take these actions to ensure that market prices stabilize above the MSP.

- The worst case scenario for farmers is weak procurement and stock limits which force farmers to sell most of their output at market prices that are well below MSP. Though it will benefit consumers in short run, it will negatively affect next year’s production.

- Encourage states to delist pulses from their APMCs.

- Review Essential Commodities Act, 1955 and futures trading of agricultural commodities with a view to preserving objectives but finding more effective and less costly instruments for achieving them.

Institutions for procurement-stocking-disposal

- More PPP institutions with a variety of governance structures for pulses.

- The more successful is procurement, the greater will be the need for policies to ensure effective stocking, warehousing, processing and disposal. Hence, with the immediate priority of procurement, there will also be a need to dispose of procured stocks.

- There have been earlier precedents of such institutional arrangements in agriculture such as the NCML, which was a subsidiary of NCDEX.

Minimizing adverse impact

- Pulses research attracts less public attention than research on cereals.

- A prerequisite for increasing yields in pulses is to clearly signal the openness and encouragement to GM technologies.

- In pulses, breeding is limited both by the narrow genetic base of varieties and their high susceptibility to pest and disease attacks.

- Promoting GM would be a way of promoting Create in India.

- Progress made: GM pod borer insect pest-resistant chana and arhar have been developed by Assam Agricultural University and ICRISAT respectively, both public institutions. These should be quickly cleared once they are ready for use.

Conclusion

- Enhancing domestic productivity and production rapidly and sustainably is the only reliable way of minimizing volatility in prices of pulses, and safeguarding the interests of farmers and also consumers.

- The current crisis offers a rare opportunity to show that government intervention, especially procurement, can be effective beyond rice and wheat. It is also a rare opportunity for pulses to get the policy attention it deserves. To this end, especially as prices decline, government procurement must be on war footing.

Connecting the dots:

- How can pulses production and productivity be increased and sustained? Enumerate

- Is MSP the only important policy measure to regulate production and prices of pulses. Critically analyse.

Related articles:

Steps to control price rise of pulses

ECONOMY

TOPIC: General Studies 3

- Indian Economy and issues relating to planning mobilization of resources, growth, development, and employment.

- Inclusive growth and issues arising from it.

- Monetary Policy reforms.

Institutionalizing Monetary Policy Committee

Monetary policy decisions by central banks can have far-reaching implications for the economy, investors, savers and borrowers. Hence, the decisions taken should be carefully crafted. Therefore, globally many governments have appointed a separate committee for this job.

However in India the job of monetary policy-making was in the hand of RBI.

Recently on 27th June, 2016, the Government amended the RBI Act to hand over the job of monetary policy-making in India to a newly constituted Monetary Policy Committee (MPC).

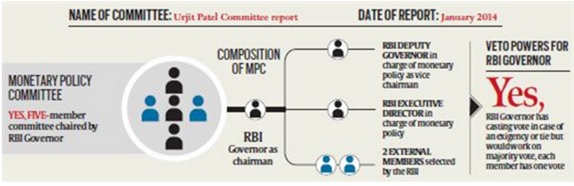

Composition of MPC

MPC is to be a six-member panel that is expected to bring “value and transparency” to rate-setting decisions.

- 3 members from the RBI — the Governor, a Deputy Governor and another official.

- 3 independent members to be selected by the Government.

A search committee (yes, another committee!) will recommend three external members, experts in the field of economics, banking or finance, for the Government appointees.

The MPC will meet four times a year to decide on monetary policy by a majority vote. And if there’s a tie between the ‘Ayes’ and the ‘Nays’, the RBI governor gets the deciding vote.

Why is it important?

Until recently, India’s central bank used to take its monetary policy decisions based on the multiple indicator approach. Its rate decisions were expected to take into account inflation, growth, employment, banking stability and the need for a stable exchange rate.

As we can see, this is a tall order. Thus, RBI (with the Governor as the focal point) would be subject to hectic lobbying ahead of each policy review and trenchant criticism after it. The Government would clamour for lower rates while consumers sorrow over high inflation. Bank chiefs would want rate cuts, but pensioners would want high rates. RBI ended up juggling all these objectives and focussing on different indicators at different points in time.

Urjit Patel Committee to revise the monetary policy framework:

- To resolve above problems, RBI set up an Expert Committee under Urijit Patel to revise the monetary policy framework, and it came up with its report in January 2014.

- It suggested that RBI abandon the ‘multiple indicator’ approach and make inflation targeting the primary objective of its monetary policy.

- It also mooted having an MPC so that these decisions could be made through majority vote. Having both Government and RBI members on the MPC was suggested for accountability.

- The Government would have to keep its deficit under check and RBI would owe an explanation for runaway inflation.

B N Srikrishna headed Financial Sector Legislative Reforms Commission (FSLRC) also suggested framing a MPC to meet the challenge of the growing complex economy.

The MPC will ensure that decisions on interest rates are made through debate by a panel of experts. The many-heads-are-better-than-one approach may also help ensure that the decision isn’t easily influenced by bias or lobbying.

The MPC may put a stop to the public skirmishes between the Government and the RBI.

Connecting the dots:

- Government of India recently amended the RBI Act to hand over the job of monetary policy-making in India to a newly constituted Monetary Policy Committee (MPC). Discuss the composition and importance of this newly institutionalized MPC.

Related articles:

Tightrope walk—for the new RBI Governor

MUST READ

A blow for the right to knowledge

An overlapping roadmap

Coherence in the neighbourhood

‘Judicial innovation’ helps SC avoid awarding death penalty

Aiming for a ‘no spoilage-no spill’ balance

Illusion of legality

Equal opportunity for women will boost growth

Globalization’s failures: the age of discontent

Know about FCNR (B) outflows

Game for agri-commodities?