IASbaba's Daily Current Affairs Analysis, IASbaba's Daily Current Affairs July 2015, National, UPSC

Archives

IASbaba’s Daily Current Affairs- 18th July, 2015

NATIONAL

GST legislation & Issues

- The government is preparing model draft legislations to implement the proposed national goods and services tax (GST).

- The three legislations – Central GST (CGST), State GST (SGST) and integrated GST (iGST) – will have to be approved by the respective legislatures for nationwide rollout of the single rate GST.

Why has the central government introduced GST?

- According to current tax structure, tax on the goods and services is levied at different points from manufacturing to retail outlet. This increases the price of the service.

- On the other hand GST will be levied only at the destination point and will be backed by the robust IT infrastructure.

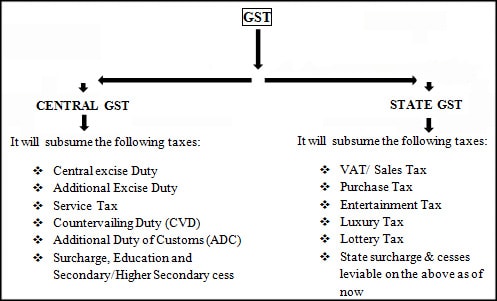

- The GST will subsume all indirect taxes levied on the goods and services by the state and the central government.

- Under the GST the taxation burden will be divided equitably between manufacturing and services, the tax rate will be low.

- The GST will broaden the tax base and will minimize the exemptions.

What are the PROS of GST?

- GST will replace a plethora of indirect taxes like central and state excise, VAT, Octroi, Service tax and so on with a single tax.

- This will simplify tax compliance for businesses and lead to greater efficiency in tax administration. It will unify the entire country into one single market with a uniform rate of indirect tax for most goods and services.

- In the long run, this is expected to boost Economic Growth.

What are the CONS of GST?

- There are no real cons, but in short run, come states particularly those that are major producers of goods and services may witness a drop in revenues as their share in the GST collection may not be enough to offset the loss from doing away with state levies.

- That’s why states are proposed to be compensated for potential loss.

What Points are causing the stalemate?

- The states want compensation for the revenue they will lose. They have demanded to insert the clause on compensation into the bill.

- State’s demand that fuel and liquor to be put out of the GST.

- State’s demand that entry tax should be kept out of GST.

Why some states are against the GST bill?

- The GST would result in another un-understandable and much abused formula of sharing between the Centre and the states like the Gadgil-Mukherjee formula.

- And the possibility of richer states, which are contributing a larger chunk to indirect taxation (which previously would have gone into their state kitties), opposing doles and special payments out of the GST collections to specific states is distinct and would also be a valid objection.

- The autonomy of a state to face an economic challenge or initiate a new social welfare scheme will be severely strained under a GST regime.

IAS BABA’s View

- GST is good for the country.

- Most problematic issues have been ironed out with the states.

- Government and Think Tanks must rise above partisan politics to do what’s right.

Connecting the Dots:

- What are the salient features of the Constitution (One Hundred and Twenty-Second Amendment) Bill, 2014?

- How will the implementation of the GST boost the Indian economy?

ECONOMICS

RBI inks pact with Sri Lanka’s Central Bank

- Recently, the Reserve Bank of India (RBI) signed a currency swap agreement with the Central Bank of Sri Lanka.

- Under this agreement, Sri Lanka can draw a maximum of $1.1 billion for a period of up to six months.

- The agreement is in addition to the existing framework on currency swap arrangement for the SAARC member countries, an arrangement by which SAARC members can draw currency $100 million-$400 million, with a total limit of $2 billion, from an RBI financing facility set up for this purpose.

What do you understand by Currency Swap?

- A swap that involves the exchange of principal and interest in one currency for the same in another currency. It is considered to be a foreign exchange transaction and is not required by law to be shown on a company’s balance sheet.

- For example, suppose a Indian-based company needs to acquire U.S. dollars and a U.S.-based company needs to acquire Indian rupee. These two companies could arrange to swap currencies by establishing an interest rate, an agreed upon amount and a common maturity date for the exchange. Currency swap maturities are negotiable for at least 10 years, making them a very flexible method of foreign exchange.

Courtesy- Investopedia

ADVANTAGES of having currency swap agreement

- Currency swaps have emerged as an important derivative tool after the global financial crisis of 2008 to hedge the exchange rate risks.

- Currency swap agreements will help countries during periods of tight liquidity or balance of payments and liquidity crises.

- Borrowing under unforeseen economic situation : In a currency-swap arrangement, India will be able to use the reserves of the country with which it has entered into an agreement should it need foreign exchanges. This could be dollar line or in the currency of that country. The arrangement allows India access to US dollar in an unforeseen economic situation from Bank of Japan, which it can return at a later date.

- Stability to the Rupee (Indian context) – through a swap, a country can boost its dollar or other hard currency reserves if it faces speculative pressure on its currency.

- It would help in increasing exports and bring down trade deficit, which is putting pressure on the rupee. For example– A dollar swap arrangement, it further said, would help India in supporting the rupee, which has depreciated significantly against the US currency over the past few months due to various global and domestic factors.

Connecting the Dots:

- What are the advantages and disadvantages of Currency Swap agreements?

- A general idea on the countries with which India has signed Currency Swap Agreements; How are these agreements helping India?

- Will the agreement bring stability in the global market? Yes or No. Justify.

Did you know?

Vyapam Scam

- The ongoing VyavsayikPareeksha Mandal scam in Madhya Pradesh (commonly known by its Hindi acronym Vyapam) has seen the deaths of a number of people under suspicious circumstances.

- The rising body count has caused a national furore, forcing the government to hand over the case to the Central Bureau of Investigation to look further into the admissions and recruitment scandal that has been rocking the country.

- The scam involves students who paid bribes to officials to get high marks in entrance tests to get government jobs and coveted slots in medical schools.

Solar Scam

- In 2013, a fraudulent solar energy company, Team Solar, in Kerala, India, used two women to create political contacts with links even to the Chief Minister’s office, duped several influential people to the tune of 70 million Rupees.

- They had collected advance amounts from large number of people and investors by offering to make them business partners, or in the guise of installing alternate sources of energy (solar power units) and failed to deliver the goods.