IASbaba's Daily Current Affairs Analysis, IASbaba's Daily Current Affairs July 2015, National, UPSC

Archives

IASbaba’s Daily Current Affairs- 24th July, 2015

NATIONAL

Repeal of Archiac Laws

- As part of the government’s efforts to repeal obsolete laws and reform India’s

legal system, the government had introduced The Appropriation Acts (Repeal) Bill in April, 2015 and has recently cleared a proposal to introduce a bill Repealing and Amending (Fourth) Bill, 2015 in the parliament.

legal system, the government had introduced The Appropriation Acts (Repeal) Bill in April, 2015 and has recently cleared a proposal to introduce a bill Repealing and Amending (Fourth) Bill, 2015 in the parliament. - This is the first time since the year 2001 that such an exercise has been undertaken by the law Ministry. Between 1950 as well as 2001, around 100 acts were repealed.

Courtesy (Image)- http://www.bharatniti.in/public/article/31/31.jpg

The Appropriation Acts (Repeal) Bill, 2015:

- With the Appropriation Acts (Repeal) Bill, 2015, over 700 Appropriation Acts which have lost relevance and are clogging the statute will be repealed.

- It will do away with 758 appropriation laws, including railways appropriation acts, and 111 State appropriation acts enacted by Parliament between 1950 and 1976. These Acts provide budgetary support to states and were enacted when the states were under President’s Rule. After 1976, the right to repeal such Appropriation Acts was given to states.

What are Appropriation Acts?

- Appropriation Acts are intended to operate for a limited period of time – authorising expenditures for the duration of one financial year or less, for example in the case of Vote on Account Bills.

- Though these Acts/Laws are not usually included in any list of Central Acts, either by the Ministry of Law and Justice, or elsewhere, these laws still technically remain on the books.

Why should these laws be repealed?

- Laws don’t suddenly become useless. It is due to a very serious change of circumstances in a country’s culture, economic needs, or political dispensation that some laws need to be amended.

- In India, we have over an estimated 3000 central statutes which are obsolete, redundant or have outlived their purpose. Over the years, Government’s policies have changed, it doesn’t serve meaningful purpose now and many have been superseded by modern laws.

- There are over 300 colonial-era enactments in force in India which are redundant and not implemented. Some of these British-era laws are even derogatory to a particular group in India, and hence reminds of the days of slavery. Others pertain to (a few examples)partition and post-independence reorganisation, unnecessary levies and taxes, redundant nationalisation, outmoded labour relations, restrictive business and economic regulations, ineffective governance and administration, obstructive civil and personal interference.

- Doing away with these laws would also make the governance more effective by repealing obsolete laws and reforming India’s legal system.

- Also, many unnecessary laws corrupt ordinary citizens who find it expensive and time-taking to go through lengthy legal process and hence prefer to give bribes.

- Red tape have been the talk of the town since the Prime Minister promised ‘red carpet and not red tape’ to businessmen in Japan. This red tapism has been the major cause of crony capitalism. The other repercussion is that people and firms prefer to stay away from engaging with the law and economic institutions respectively. Hence, denial of justice to many and deceleration of economic growth.

Will it have any cascading effect on the actions taken by the Government hitherto?

- Repealing these will not cause any negative impact on actions that were validly taken under these laws. It will, however, clean up the statute books.

EXAMPLES:

Laws which have become obsolete or unwanted or redundant

- Reserve Bank of India Act, 1934: The preamble to the act governing the Reserve Bank of India confers on India’s central bank a “temporary” status, that continues even now.

- The Official Secrets Act of 1923: Any civilian or bureaucrat can be sent behind bars for up to 14 years if he/she shares information related to government offices.

- Section 309 of IPC: Attempt to commit suicide in India – a person committing suicide is legal but if the person fails to do so, then attempting suicide is illegal! The person can be arrested for committing the crime.

- Bengal Suppression of Terrorist Outrages (Supplementary) Act, 1932 – The law was enacted to suppress the Indian freedom movement.

Doesn’t serve meaningful purpose now

- The Sarais Act, 1867 – Under this Act, a “sarai” has to offer passers-by free drinks of water. A Delhi five-star hotel was harassed under the clause, though not prosecuted, for not doing so.

- The Research and Development Cess Act, 1986 – The Act levies a 5 % cess on all technology imported from overseas. This cess hinders the flow of technology into the nation and poses a barrier to trade.

Have outlived their purpose

- The Foreign Recruiting Act, 1874 – This law was enacted with the interests of the British Raj in mind, to prevent colonial subjects from serving any rival European power.

- The Resettlement of Displaced Persons (Land Acquisition) Act, 1948 – The Act was enacted to provide relief to persons displaced from their place of residence (in areas now comprising of Pakistan) on account of the Partition, and subsequently residing in India.

Derogatory to a particular group

- The Santhal Parganas Act, 1855 – This Act, introduced to serve the needs of the British colonial administration, exempted districts inhabited by the Santhal tribe from the operation of general laws and regulations. The purpose was to curb tribal uprisings by isolating tribal populations.

Have been superseded by a modern law

- The Companies (Donation to National Funds) Act, 1951 – The Act’s purpose can be achieved through the Companies Act, 2013. The 1951 Act empowers any company to make donations to the Gandhi National Memorial Fund, the Sardar Vallabhabhai Memorial Fund or any other fund established for a charitable purpose and approved by the central government by reason of its national importance.

Background:

The Repealing and Amending Bill, 2014

- The Repealing and Amending Bill, 2014 was introduced in the Lok Sabha in August, 2014 by the Minister of Law and Justice, Mr. Ravi Shankar Prasad.

- On May 05, 2015 the Bill has been passed by both the houses of the Parliament.

- The Bill seeks to repeal about 36 laws and pass amendments to two laws.

- Repealing of certain laws: Indian Fisheries Act, 1897, The Foreign Jurisdiction Act, 1947, The Employment of Manual Scavengers and Construction of Dry Latrines (Prohibition) Act, 1993 etc.

- Amendment of certain laws: The Bill amends some provisions of The Prohibition of Manual Scavengers Act, 2013, and The Whistle Blowers Protection Act, 2011. These rectify typographical and certain patent errors, like the year of enactment respectively.

- The recently introduced Repealing and Amending (Fourth) Bill, 2015 is the 4th such Bill continuing with government’s efforts to repeal obsolete laws and reform India’s legal system.

Connecting the Dots:

All possible dimensions relating to the Archiac or the obsolete laws have been dealt comprehensively in this article. So we advice you to read this article 2-3 times, this will give not only give you complete analysis and multi-dimensional view point, but also bring in more clarity.

Also think over these issues:

- How relevant is the provisions of Indian Penal Code (IPC), 1860 in the context of streamlining of Criminal Justice system (or Police Reforms) in India?

- Does Official Secrets Act, 1923 have relevance to the modern times?

ECONOMICS

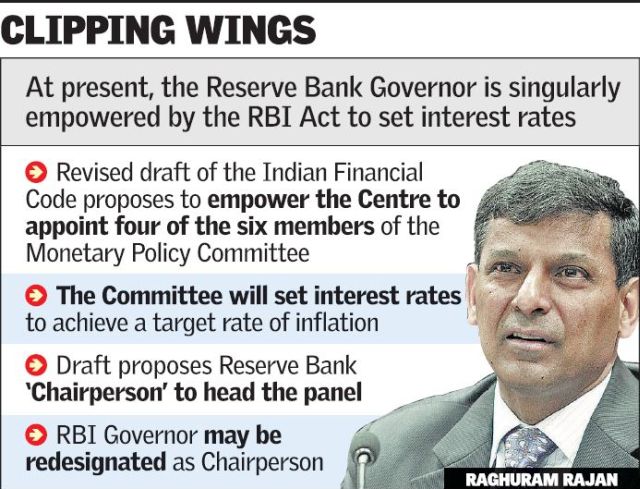

Clipping RBI’s wings: On deciding monetary policy

- Government proposes to take away RBI governor’s veto power in deciding monetary policy

- Revised draft Indian Financial Code proposes to give RBI governor an additional vote in case of a tie in the monetary policy committee meeting

What does the new draft says?

- The MPC will be chaired by the RBI governor

- It will also comprise a member of the RBI board and an RBI employee

- Decisions at MPC meetings will be taken by a majority vote of the members present and voting

- The previous draft had suggested the RBI governor have the power to supersede any MPC decision

- Each member of the MPC will have to state the reasons for voting in favour of or against proposed resolutions

What is the proposed shift in the structure?

- At present, the monetary policy is framed by the central bank after factoring in the recommendations of an expert advisory committee, assessing multiple economic indicators in domestic and global markets and, finally, consulting with the finance minister on the broader policy direction.

- The final decision, however, rests with the governor.

- But, under the proposed framework, RBI governor will be one of the several members of the committee and the government will dictate the policy.

- In effect, the power to decide the country’s monetary policy will be shifted from an independent, credible institution to the political interests of the government, for whom monetary policy will then be among the many tools under disposal to work operate in line with its political agenda.

What are the Possible Conflicts of the new proposal?

- This will give room to major conflict of interests in the functioning of the MPC. For instance, a government-controlled MPC can push for a rate cut, even if the RBI is not fully convinced with the signals emanating from the inflation-front.

- The RBI will then be forced to sing the same tune of the finance ministry.

- This can put the economy in serious trouble in the long term.

IAS BABA’s View

- Sidelining the central bank according to political whims and fancies of politics, the government will risk making India’s economy a black spot in the eyes of rest of the world with no credible, independent monetary policy framework.

- An RBI, with little control on the monetary policy, will not be a favorite in the eyes of global investors and international rating agencies, which would do no good for India, which is aspiring to become a global economic power.

Connecting the Dots:

- Is the Government undermining the RBI’s Independence?

- Write a note on Urjit Patel committee recommendation on MPC.

Time to abolish the MRP

The fixed maximum retail price is an archaic and dysfunctional mechanism that hurts both retailers and the consumers it seeks to protect.

What is MRP?

- The maximum retail price (MRP) that is printed on all packaged commodities that consumers purchase was introduced in 1990 by the Ministry of Civil Supplies, Department of Legal Metrology, by making an amendment to the Standards of Weights and Measures Act (Packaged Commodities’ Rules) (1976).

- It was meant to prevent tax evasion and protect consumers from profiteering by retailers.

Why MRP system in India is remarked as Dysfunctional?

- The MRP applies only to commodities and not services.

- Most essential commodities are not packaged and, thus, do not fall under the MRP rule.

- Even packaged commodities are not usually sold at MRP. It is not uncommon to pay a price much higher than the MRP

- Many shops charge for ‘services’ that are not covered by the MRP,

- Producers sometimes print an MRP so ridiculously high that the product can be sold at an actual price that is up to 90 per cent discounted.

Do retailers have right to sell his product at any price?

- Just as a consumer has the right to buy a product at a particular price, the retailer should have a right to sell his product at any price.

- If he charges a higher price, the customer is free to go to another store.

- Retail density in India is high enough for the market mechanism to function properly, as the OECD 2007 Report on India notes.

- Even in places that do not have high retail density, if retailers charge very high prices in the absence of an MRP, other retailers will soon enter the market and the resulting competition will eventually reduce prices.

IAS BABA’s View

- While the intention to protect consumers in a pre-liberalised India can be lauded, continuing the system today does not make any sense.

- The practice of MRP in India is unique, archaic and dysfunctional.

- India is perhaps the only country in the world to have such a system, where it is punishable by law to charge a price higher than the printed maximum retail price.

- In most countries, the system of having a universally enforceable printed price is viewed as being akin to price fixing and is thus prohibited as being anti-competitive.

Connecting the Dots:

- Do you agree with the MRP rule “the greatest good of the greatest number”?

- Write a note on the pitfalls of following the MRP system in India?