IASbaba's Daily Current Affairs Analysis, IASbaba's Daily Current Affairs July 2015, National, UPSC

Archives

IASbaba’s Daily Current Affairs- 25th July, 2015

NATIONAL

The Energy Elephant

- Modern energy such as electricity or petroleum products plays a crucial role in enhancing quality of life and driving an industrial economy.

- People’s lives are enriched through energy-based conveniences such as lighting, appliances and motorized transport.

- Energy is an important input to most enterprises in the industrial and service sectors, and thus important from the economy’s perspective.

What is the darker side of this Elephant?

- Deteriorating urban air quality, much of which can be attributed to motorized transport, has gained wide attention recently.

- There are also significant social and environmental concerns (such as air and water pollution, deforestation and displacement) around energy-related activities such as coal mining and power generation.

- Subsidies, particularly untargeted subsidies, on petroleum products and electricity are often criticized for their fiscal imprudence and promotion of inefficient consumption.

- Energy-related emissions are the largest contributor to climate change and India is under increasing pressure to take action in this regard as the date for the Paris climate summit approaches.

How can one truly understand the Energy Sector?

It accounts for the positives and negatives of the sector by considering five separate dimensions

- consumption

- supply

- environmental

- social and

- Economic impacts.

Each dimension consists of two indicators and most indicators require a single data point while few require two data points adding up to 13 data points totally.

What are some Interesting facts about the Indian Energy Sector?

- Though the scores for modern energy consumption have improved over the years, the scores are still quite poor, particularly when it comes to the use of modern energy in cooking and rural enterprises.

- India’s energy import exposure is increasing rapidly with about a third of our energy being imported, increasing the geopolitical as well as price risks of our energy system.

- It is unfortunate that even though land is such a politically sensitive topic in India, there is no systematic data collected about the number of people displaced by various projects and subsequently rehabilitated.

- Finally and most damningly, India’s environmental management systems are completely broken with average respirable suspended particulate matter (RSPM) levels in the vicinity of energy projects consistently well above prescribed norms and levels of chemical pollution (various nitrogen and sulphur oxides) also steadily getting worse.

IAS BABA’s View

- These findings clearly indicate there is a need to focus policy action on rapidly increasing access to electricity and modern cooking fuels, having a much more effective and functional environmental management system, reducing energy import exposure and instituting data collection systems for social impacts of energy projects.

- It is imperative to adopt measurement frameworks such as the proposed dashboard to track and understand the sector given the scale and likely impact of such plans.

- Otherwise, there is a real danger of stumbling along haphazardly without being entirely sure of the direction taken by the energy sector.

Connecting the Dots:

- Write a note on Governments ambitious plans for the energy sector.

- What are the Increasing Geopolitical and price risks of our Energy Sector?

Renewable power: the challenges ahead

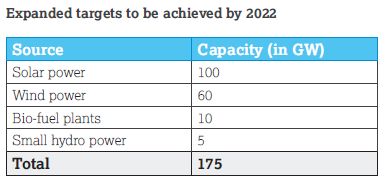

- The target of raising renewable-based capacities to 175GW by 2022 is a

continuation of the generation-centric approach, while neglecting the criticality of the distribution segment.

continuation of the generation-centric approach, while neglecting the criticality of the distribution segment. - The result has been that despite impressive achievements in increasing generation capacity and creation of a state-of-the-art national transmission grid, power sector finances have remained weak, mainly because of distribution companies, or discoms.

Is this target feasible?

- It is five times the current capacity overall; wind-based capacity is set to treble and solar capacity to be practically built from zero.

- It is difficult to imagine the addition of 20GW of renewable capacity year-on-year for the next seven years.

- It should also be remembered that the central government has for many years offered incentives like accelerated depreciation to bring down wind energy prices.

- Solar energy has been supported by bundling it with coal-based electricity to make it affordable to discoms.

Can the central government offer such security for 100GW or any such other alternative?

- Raising funds, both equity and debt, to finance such a huge capacity addition is also fraught with challenges. Developers will be looking for long-tenor, low-cost debt.

- Given the state of finances of discoms detailed earlier, banks and other financial institutions will be hesitant to offer loans.

- Their enthusiasm will be dampened further if the centre does not offer any payment security mechanism.

- Banks and financial institutions will look for power purchase agreements (PPAs) to be signed by the developer with the discoms before considering financing.

IAS BABA’s View

- The government should work to make discoms commercially viable, when the sale of a unit of electricity does not mean loss.

- That is when discoms will embrace renewable targets.

- That is when financial institutions will come forward to support the sector.

- That is when investors will be keen to invest and stay with the sector.

Connecting the Dots:

- Is it fair to force discoms to buy higher cost electricity when they cannot ask for and get cost-reflective tariffs?

- What are power purchase agreements (PPAs)?

ECONOMICS

MAT: Shah panel says ‘no relief’ for FIIs

- The much-awaited AP Shah Panel report on levy of Minimum Alternate Tax (MAT) on foreign institutional investors has not recommended any ‘relief’ to FIIs. This has drawn flak from overseas portfolio players and the Finance Minister as well.

- Depending on the verdict of ‘The Castleton case’ which is slated to be heard by the Supreme Court on August 4, 2015 government will take decision.

- Earlier in 2012, the Income Tax department had sent notices to 68 foreign institutional investors (FIIs) demanding Rs 602 crore as MAT dues of the previous years. Following which a Mauritius-based Castleton had approached the Supreme Court against a ruling by the Authority for Advance Rulings (AAR), which had said the company would have to pay MAT on capital gains arising from sale of shares from a Mauritius entity to a Singapore one.

- Crux of the issue is whether the government will waive MAT prior to April 2015. It should be noted that, FIIs would not be subjected to MAT for transactions undertaken post April 1, 2015

Everything that you need to know about Minimum Alternate Tax (MAT):

Companies find various loop-holes to avoid paying income tax by using several exemptions. MAT is a way of making companies pay a minimum amount of tax.

Direct tax

- Direct tax in lay terms is a tax on income that you have to pay, it cannot be shifted to others. Some of its forms include income tax, wealth tax, Direct taxes are directly levied on individuals, corporations and organisations and collected by way of income tax returns to be filed each year.

Indirect tax

- An indirect tax is collected by an intermediary (such as a retail store) from the person who bears the ultimate economic burden of the tax (such as the customer). Indirect taxes include sales tax, service tax, value-added tax, commodity transaction tax and securities transaction tax among others.

Minimum alternate tax (MAT)

- MAT is a way of making companies pay minimum amount of tax.

- Exclusion: It is applicable to all companies except those engaged in infrastructure and power sectors; Income arising from free trade zones, charitable activities, investments by venture capital companies are also excluded from the purview of MAT.

- However, foreign companies with income sources in India are liable under MAT.

- In the past, a large number of companies showed book profits and declared huge dividends to their shareholders but were not paying any tax, as they reported either nil or negative income under provisions of the Income-Tax Act . These companies are popularly known as ‘zero tax’ companies.

- The Indian Income-Tax Act allows a large number of exemptions from total income. Besides exemptions, there are several deductions permitted from the gross total income.

- The result of such exemptions, deductions, and other incentives under the Income-Tax Act in the form of liberal rates of depreciation is the emergence of zero tax companies, which in spite of having high book profit are able to reduce their taxable income to nil.

- In order to bring such companies under the Income Tax net, Section 115JA was introduced from assessment year 1997-98. Now, all companies having book profits under the Companies Act shall have to pay a minimum alternate tax at 18.5%.

- For example: Suppose book profit before depreciation of a company is Rs. 8 lakh. After claiming depreciation and other exemptions, gross taxable income comes to Rs. 4 lakh. The income tax applicable Rs. 1.5 lakh at a rate of 30% = Rs. 45,000 . However, if MAT is applicable then company would be paying a tax of 1.48 lakh (Rs. 8 lakh at 18.5%).

Connecting the Dots:

- Will the retrospective amendment to the Income Tax Act, discourage foreign investors investing in India?

- Link this with the Vodafone Tax issue. What was the issue ? How was it resolved?

- Are the corporates undermining the law of the country and the public good for the sake of private profit?