UPSC Articles

Greece Crisis De-mystified

Note– This article will also feature into Baba’s Monthly Magazine to be published in few days. We request our followers to have patience since IASbaba is already working on every possible dimensions to ease your preparation 🙂

Imagine there is a guy X who has borrowed money from your father and bought an iPhone with it; again he borrows money from your mother to buy expensive clothes; again he borrows money from your brother/sister to buy utilities. The money that he is borrowing is being lent at low rates and not adjusted for, in terms of inflation. Now this guy X asked a guy Y to borrow a bigger amount from your father, your father lent him that money which in turn was lent to X; who bought a Car for himself. So, in the eyes of the society, X is leading a lavish life. Now your father/mother/brother have stopped lending more money and this has made X not-adjustable to his expenditures and all. WHY? Because this lifestyle is not fuelled by income but by taxes.

Here:

X : Greece

Father: EU (Read Germany)

Mother: IMF

Brother/Sister: Some other Creditor

Y: Greek Banks

The above mentioned story is what happened in Greece. Basically there are some macro reasons as well like Corruption, Ill-Governance, Politics etc. , but the above factor is the most crucial i.e. “The growth & development of Greece was not fuelled by Taxes but through debt”

Here is the Timeline:

In the 1980s, Greece was a poor country and wasn’t doing very well economically. But Greece got major Financial institutions to conceal & dissimulate debt & other payables (like pensions etc.) & got access to European Communities(and subsequently EU). This allowed it to borrow loans at low rates and not adjusted for inflation. Greeks started to splurge on this money. They started invested heavily and mindlessly in infrastructure projects like Athens Olympics , they started to have huge military expenditures, totally uncalled for; considering it to be a small country and it’s threat perceptions all this while dealing with the High-Levels of Corruption, Bad Governance , Low Tax Compliance which had(has) crippled the nation to generate some income, on the back of which they were botching up the financial books to show it(Greece) in Good Health & to gain more loans so as to keep up the growth & developmental works and also to pay back the previous debts.

All this was going on well till the 2008 Crisis. WHY?

Because the mortgage security crisis put a lot of pressure on the creditors which all of a sudden were unwilling or unable to lend to the Greek Government and with the sudden cut-off of this air-supply like debt; Greek Economy started to choke. And with the Greek Govt. looking insolvent, banks became insolvent and the money stopped flowing in Greece and because the govt. had internal liabilities as well it infuriated the masses which further worsened the already worsened Economy of Greece.

So, How Bad was (is) it?

Imagine that you own a Hotel in Greece and 99% of your Guests are foreigners then you’re okay else you are not, which means there is no money in Greece on (of) it’s own.

So, what’s the Way out?

The troika i.e. IMF, ECB, Juncker Commission issued the first of the two international bail-outs for the Greece for about €110 Billion+ €130 Billion. But it came with certain conditions like:-

- Harsh Austerity terms; deep budget cuts &steep tax increases

- Streamlining the Govt.

- Ending Tax Evasion

- Making Greece a better place to do business

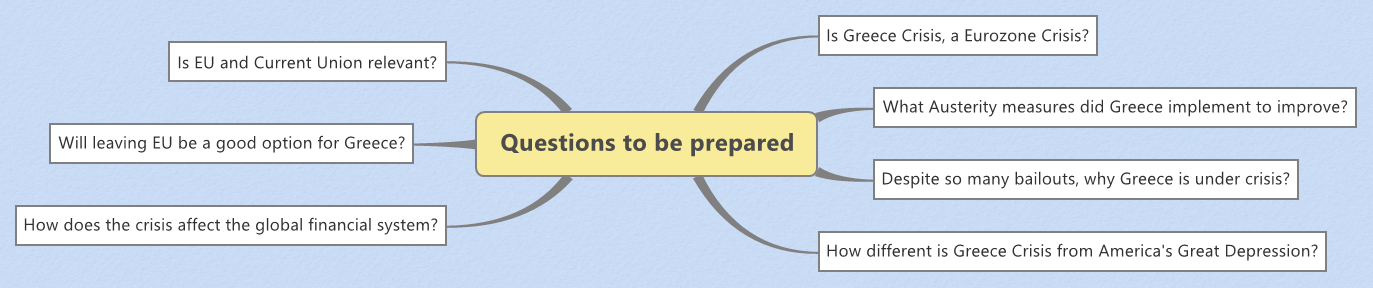

But this happened sometime back? Why hasn’t the conditions improved much?

They say “To make Money, you need Money”

Same is happening here. Much of the bail-out money goes off towards paying off Greece’s international loans, rather than making in-roads into the country’s economy.

Now, a deadlock arose between the Greeks and the Creditors over the bail-out conditions as many felt that the austerity measures were(are) inhumane and this had lead to the repeated violent protests all over Greece in the past some time.

To overcome this, a plebiscite was proposed by the Greek Govt., which was held on 05/07/2015; in which 61% of the people rejected the conditions. This prompted another round of deliberations between the Creditors and Greek Govt. and on 13/07/2015, they stroked a deal for € 86 Billion over three years, but it came with a condition that it must be approved by all the parliaments of Eurozone Countries.

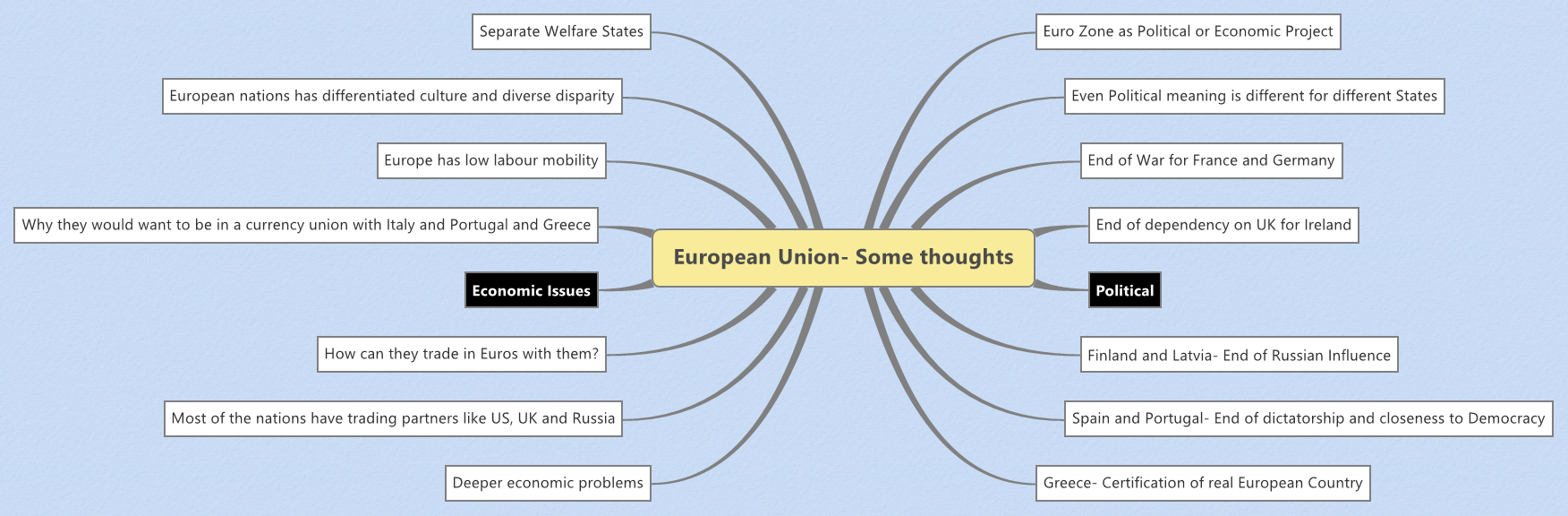

How did Greece and the EU get into this mess in the first place?

The seeds were sown back in 2001, when Greece adopted the euro as its currency. Greece had been an EU member since 1981, but its annual budget deficit was never low enough to satisfy the eurozone’s Maastricht Criteria.

All went well for the first several years. Like other eurozone countries, Greece benefited from the power of the euro, which meant lower interest rates and an inflow of investment capital and loans.

However, in 2004, Greece announced it had lied to get around the Maastrict Criteria. Surprisingly, the EU imposed no sanctions! Why not? There were three reasons.

France and Germany were also spending above the limit at the time. They’d be hypocritical to sanction Greece until they imposed their own austerity measures first.

There was uncertainty on exactly what sanctions to apply. They could expel Greece, but that would be highly disruptive and possibly weaken the euro itself.

The EU wanted to strengthen, not weaken, the power of the euro in international currency markets. A strong euro would convince other EU countries, like the UK, Denmark, and Sweden, to adopt the euro.

As a result, Greek debt continued to rise until the crisis erupted in 2009. Now, the EU must stand behind its member or face the consequences of either Greece leaving the eurozone, or even worse, a Greek default.

Is anything to worry for India?

No direct affect as far as Greece crisis is concerned since India is not exposed to any trade relations with Greece on larger extent. Though, it may affect India if the crisis is spilled to other EU nations.

Europe is India’s one of the largest trading partners. The exports of India may get affected if other EU nations fall into any crisis of this sort. It may also affect the capital inflows and outflows. With over USD 355 billion foreign exchange reserves and the country promising to grow at the fastest rate in the world, India can withstand any pressure from Greek crisis.

India is responding to the Greek crisis in line with other global economies. So far, there is no cause of worry on Greece development

On 30/06/2015, Greece became the 1st Advanced Economy to default on an IMF payment.

P.S: On 20/07/2015, Greece re-paid two loans to IMF & ECB.

Since for past some days, Situation has improved a bit.

Share your feedback and thoughts 🙂