IASbaba's Daily Current Affairs Analysis, IASbaba's Daily Current Affairs October 2015, International, UPSC

Archives

IASbaba’s Daily Current Affairs – 8th October, 2015

INTERNATIONAL

Trans-Pacific Partnership (TPP) & India

- Trans-Pacific Partnership, which accounts for 40% of the global economy and a total of 800 million people, comprises of the major powerhouses and thus has become the largest regional trade agreement to take place in the present time.

- The ‘21st century issues’ sprawling across the boundaries, will be looked into and addressed, setting high standards for resolving and eliminating existing barriers.

- This coherence will have a direct impact on the issues of intellectual property rights, foreign investment, environment and climate change negotiations, labour, e-commerce, trade barriers, bottlenecks in healthcare technology and pharmaceuticals, regulatory clearances and other issues.

- Impetus to ‘’Made in America’ exports will also be provided thereby, advancing trade and investment interests in the Asia Pacific region while extending economic commitments to its partners and allies.

India should take note:

Exports & Competitiveness:

If India does not Join TPP

- India might witness diversions in trade and foreign investments, as well as decline in the outsourcing of services from India.

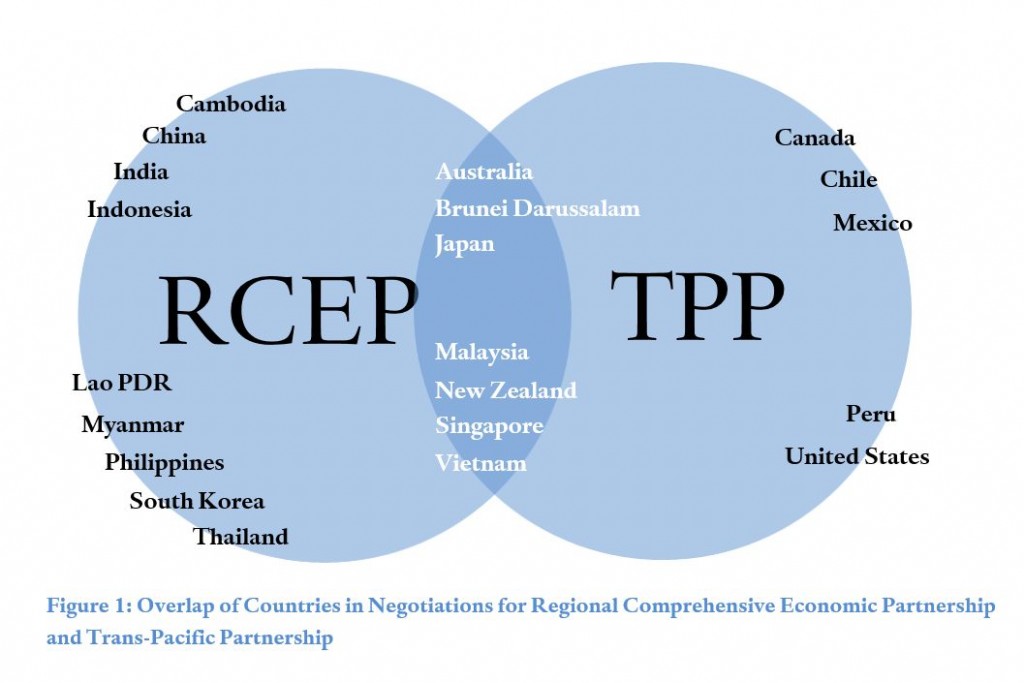

- The ‘Yarn Forward Rule’ rules out inclusion of any other countries outside that of the trade agreement, for availing duty preference. This will make India uncompetitive and thus, India should take onus to speed up the process of RCEP Negotiations to store some advantages for itself in Asia.

- This will hurt the ‘market access’ benefit and have an adverse impact on other products such as processed food, heavy manufacturing, crops, sugar, vegetables, fruits, etc.

- Also, companies might be interested in reaping benefits of an open and inviting market of TPP-member countries.

If India joins TPP or Free Trade Area of the Asia Pacific (FTAAP):

- There are chances of India experiencing export gains but in the longer run.

- Also, countries with which India has signed FTA’s may not suffer tariff disadvantage.

- It is estimated that if India doesn’t join TPP- it will lose out on about 0.3% ($3-7 billion) of exports by 2025.

- India’s output may also increase lending the employment generating sector like textile, leather, fish, dairy, etc., a higher impetus to grow and expand.

High Global Standards:

- TPP works on the principles of simplification and elimination of barriers that serve as bottlenecks in the growth and development of the economy but at the same time follows a strict regime of quality and standard of the products.

- India needs to spearhead in its method of revitalizing and inducing efficiency in its manufacturing sector with the globally accepted standards, procedures, processes and an adaptation of a balanced approach, necessary to instill confidence in both citizens and investors.

IPR:

- Joining TPP for India would be equal to accepting US standards for IPR. This would mean ever-greening of patents which will directly delay the entry of Generic medicines, defeating the socially inclusive pattern of governance followed by India.

- Ever-greening would also lead to rise in prices of the drugs but for India losing out on a few dollars would make much sense than turning away from its responsibilities.

Strict domain of USA:

- Loss of flexibility and decision-taking ability related to important policy matters and key issues

- Bargaining power of India might get overshadowed by the ‘big-brother’ attitude of US

Getting her Act Together:

India-EU Bilateral Trade and Investment Agreement

- The negotiations have been going on since 2007 and India needs to conclude these agreements to gain market access and leverage her outsourcing capabilities to suit the requirements of the member-countries. By safeguarding its core interests, India might revive some part of the export losses that it may experience while staying away from TPP.

Broad-Based Trade and Investment Agreement (BTIA)

- India has taken a step ahead and has resumed its talks with the EU but India needs to understand the wide implication of not complying with the standards set up by the TPP and should make a genuine attempt, to re-design its policies and help its companies compete globally.

Competitiveness of Products:

- India should focus on increasing the competitiveness of its export products while employing standard processes and a robust supply-chain and operational procedures in place

IASbaba’s Views:

- Restructuring of domestic policies of India is the need of the hour to acquire a certain amount of preparedness and improvement, both in terms of capability and capacity.

- The global trade rules should not be left with the provisions influencing TPP/RCEP otherwise the roots of the ever-growing economic inequality as well as insecurity may expand, terribly hurting the lesser developed countries.

Connecting the Dots:

- Can there exist, an alternate template for global trade rules than that which is backed by the developed countries. Justify your stand.

- Is India ready for big-ticket agreements? Discuss.

ECONOMICS

India’s shaky ‘sovereign wealth fund’

The investment division of the finance ministry has finally approved setting up of the National Investment and Infrastructure Fund (NIIF).

- The Fund is likely to be operational from the end of this year.

- Finance Minister Arun Jaitley in his recent visit to Singapore and Hong Kong pitched to the pension and wealth funds there to invest in the NIIF, touted to be India’s own version of a sovereign wealth fund (SWF).

- The Fund will receive an initial allocation of20,000 crore as seed money, which will be used to lend equity/quasi-equity/debt support to commercially viable green-field and brown-field infrastructure projects, including stalled ones.

- The Fund is also mandated to provide equity/quasi-equity support to non-banking finance companies and financial institutions involved in infrastructure financing, and to nationally important projects in the core sector

The basic motivation of creating this new entity is to bridge the glaring infrastructure financing deficit in India.

Funding:

- India’s current infrastructure spending is around 4.5 per cent of GDP. This is relatively lower than other emerging market economies.

- Indian infra would need at least 26 lakh crore over the next five years considering the government’s ambitious plans such as Make in India, Smart Cities and Digital India.

- It is projected that 70 per cent of this required amount is likely to be debt financed, with banks being the largest source of finance, while 14 per cent will come from external commercial borrowings (ECBs). The rest is likely to be financed by bonds.

The bulk of the financing needs in the infrastructure sector shall be catered to by commercial banks.

- It may be difficult for the banks to play the same supportive role, particularly considering that stressed loans is are growing.

- As of March 2015, stressed loans account for 14 per cent of gross advances ($161 billion). Significantly, 30 percent of the growth in stressed loans are in the infrastructure sector, particularly, power.

The sovereign fund

- The NIIF will be established as one or more alternate investment funds (AIFs), regulated by the Securities and Exchange Board of India (Alternative Investment Funds) Regulations, 2012.

- With such an insignificant budgetary allocation, and financing model hinging too heavily on the Fund’s ability to attract external long-term finance, one wonders how such a complex objective function can be sustainably achieved.

Related issue:

For each entity set up as an AIF, fixing the government’s share at 49 per cent, while making it non-obligatory for partners to infuse similar funds to maintain their equity holdings, seems problematic.

Future need:

- The NIIF is expected to bridge the existing financing gap, and ease the pressure on banking.

- Guarantee of sovereign participation in NIIF may, in the short-run, attract overseas participation. The recently announced UAE-India Infrastructure Investment Fund with a corpus of $75 billion

- Foreign SWFs, mostly guided by strategic and commercial objectives, are unlikely to co-invest in the Fund unless India’s growth potential remains robust, and unless forward-looking concomitant reforms are initiated, particularly the ones that can remove impediments for infrastructure development in the country.

- Unless the government corrects the basic underlying conditions that would ensure a decent return on their investments, we are unlikely to see big-ticket investments in NIIF from foreign SWFs.

Conclusion:

Around the world, SWFs are normally established out of trade surpluses, official foreign currency operations, and fiscal surpluses. None of these conditions is favourable for India and, therefore, raises doubts about the long-run capability of NIIF to fulfill the objectives for which it is being created.

The success of NIIF will hinge upon the extent to which it is able to rope in overseas strategic institutional partners. But that, in turn, will depend on India’s growth story.

Connecting the dots:

- With what objectives is the National Investment and Infrastructure fund created? How is fund mobilized for the NIIF?

- How can NIIF help India in creation of infrastructure and attracting investment? What can be done to attract fund from foreign investors?

- Why India needs huge fund for infrastructure? Is the setting up of NIIF will alone the huge demand?

You can find a comprehensive article on ‘Net Neutrality’ in our Monthly (April) Magazine

http://iasbaba.com/babas-monthly-magazine/