IASbaba's Daily Current Affairs Analysis, IASbaba's Daily Current Affairs March 2016, International, National, UPSC

Archives

IASbaba’s Daily Current Affairs – 3rd March, 2016

INTERNATIONAL

TOPIC:

General Studies 2:

- Bilateral, regional and global groupings

- Effect of policies and politics of developed and developing countries on India’s interests, Indian Diaspora.

- Important International institutions, agencies and fora- their structure, mandate

General Studies 3:

- Inclusive growth and issues arising from it;

- Effects of liberalization on the economy

- Infrastructure: Energy (Renewable), Conservation, environmental pollution and degradation, environmental impact assessment.

WTO: The much talked about Solar panel Dispute

Issue: The domestic content requirement imposed under India’s national solar programme is inconsistent with its treaty obligations under the global trading regime; leading it to be described as archaic trade rules trumping important climate imperatives

India’s National Solar Programme

Launched in 2010

Aim: To “establish India as a global leader in solar energy, by creating the policy conditions for its diffusion across the country as quickly as possible”

To incentivise the production of solar energy within the country:

- The government enters into long-term power purchase agreements with solar power producers, effectively “guaranteeing” the sale of the energy produced and the price that such a solar power producer could obtain

- Then it would sell such energy through distribution utilities to the ultimate consumer

Eligibility of a solar power producer to participate under the programme:

Required compulsorily to use certain domestically sourced inputs(solar cells and modules) for certain types of solar projects (if requirement not satisfied- the government will not ‘guarantee’ the purchase of the energy produced)

Violation of the Global Trading Rules

2013: U.S. brought a complaint before the WTO arguing that the domestic content requirement imposed under India’s national solar programme is in violation of the global trading rules (unfavourable discriminating against imported solar cells and modules)

Origin: Discrimination was done between solar cells and modules on the basis of the national ‘origin’ of the cells and modules (a clear violation of its trade commitment)

Domestic content requirement (DCR) measures violated core norms of-

- Trade-related investment provisions,

- National treatment provisions for treating imported products on a par with domestically manufactured products

- Financial subsidy rules

India’s Stand:

- Was principally relying on the ‘government procurement’ justification, which permitted countries to derogate from their national treatment obligation provided that the measure was related to “the procurement by governmental agencies of products purchased for governmental purposes and not with a view to commercial resale or use in production of goods for commercial sale”

- The measure is justified under the general exceptions since it was necessary to secure compliance with its domestic and international law obligations relating to ecologically sustainable development and climate change.

The panel speaks up:

Violation: India had violated its national treatment obligation (mandatory domestic content requirement)

Inconsistency with the product: The product being subject to the domestic content requirement was solar cells and modules, but the product that was ultimately procured or purchased by the government was electricity (not an instance of “government procurement”)

No specific issue: India failed to point out any specific obligation having “direct effect in India” or “forming part of its domestic legal system”, which “obligated” India to impose the particular domestic content requirement (bereft of the general exception)

Clean Energy Syndrome?

Ruling of the WTO-panel: Has come under intense criticism for undermining India’s efforts towards promoting the use of clean energy

If Objective: To produce more clean energy, then

Free to choose: Solar power producers should be free to choose energy-generation equipment on the basis of price and quality

Burdening the consumer: By making it mandatory for the producers to buy locally, the government is imposing an additional cost, usually passed on to the ultimate consumer, for the production of clean energy

Is it possible to give preferential treatment to clean energies?

Yes, in the form of tax rebates for solar power producers

Wrong move by India:

- During its submissions before the WTO, India did not invoke the general exceptions under article XX(b) or (g) of the General Agreement on Tariffs and Trade (utilized by parties seeking to protect their domestic regulations on ‘environmental’ or ‘health’ grounds)

- Thus, India had no proven perspective in place regarding the local content requirement under the programme (imposed for the ‘conservation’ of ‘clean air’ or green energy)

Resist the temptation of adopting protectionist measures:

- Domestic content measures, despite their immediate political gains, have a tendency to skew competition and therefore, manufacturers must remain free to select inputs based solely on quality and price, irrespective of the origin

- Need to work towards building a business and regulatory environment which is conducive to manufacturing which will require systemic changes in the form of simpler, transparent and consistent laws and effective dispute resolution mechanisms

The road ahead—

- India might propose to opt for the usage of the domestic content requirement measures for buying solar panels for its own consumption such as by the railways and defence and would decide not to sell the power generated from such subsidized panels for commercial use.

- It has the capacity to hinder India’s solar power programme and will hold consequences for other countries planning to embark on renewable energy programmes. The initiative has driven dramatic growth of India’s solar capacity that has the capacity to reduce its reliance on dirty coal and spur the development of new clear energy jobs

- US-India ties at risk?

- US has consistently offered India to utilize its technologies to achieve its clean energy goals faster and more cost-effectively.

- But keeping the in mind the launch of the ambitious International Solar Alliance, with the aim of switching “sunshine nations” in tropical areas to solar energy, India might not let US take the entire credit.

- Moreover, US should be applauding and encouraging India to scale up solar energy and not striking it down with WTO.

- Both the countries need to remember that an important part of any maturing trade relationship is effectively addressing the range of issues on our trade and investment agenda, including in areas where we might disagree and therefore, exercising restraint and employing diplomacy while keeping the perspective of ‘climate change’ in mind will help effectively solve the issue.

NATIONAL

TOPIC:

General Studies 3:

- Indian Economy and issues relating to planning, mobilization of resources, growth, development and employment.

- Government Budgeting, Taxation & its impact

General Studies 2:

- Government policies and interventions for development in various sectors and issues arising out of their design and implementation.

Employees’ Provident Fund (EPF) Tax- Is it a Healthy proposal?

A retirement benefit scheme

Structured to: Provide financial security to employees of factories and other establishments post-retirement

Administered by: The Employees’ Provident Fund Organisation (EPFO) whose highest body is the Central Board of Trustees, with representation from the government, employers and employees

Process:

- Employees (earning up to Rs 15,000 per month) contribute 12% of the basic salary and dearness allowance

- Employer needs to contribute (12%) mandatorily in case of all employees

- Employer’s component is split into—

- EPF (3.67%)

- Employees’ Pension Scheme (8.33%)

Deciding Factor: Decided by the government every year

Investment in the EPF: Tax-free at all the three stages of (EEE:Exempt-Exempt-Exempt)—

- Investing

- Interest accumulation

- Withdrawal

Budget’s Proposal:

- Taxing the fully tax-exempt EPF corpus at retirement; putting the tax on 60% of the corpus, leaving 40% tax-free (both under recognised Provident Fund and NPS)

- EPFO raised the age for withdrawal from 55 to 58 years

- Contributions made until March 31, 2016 will attract no tax at the time of withdrawal

- Applicable- On contributions made on or after April 1, 2016

6 million “highly-paid” private sector employees in EPF who earn more than Rs.15,000 a month and have accepted EPF voluntarily—

- At retirement, 40% of the corpus will be tax-free

- If the rest, that is 60%, is used to buy an annuity, there is no tax

- Income from the annuity will be taxed each year at slab level (no change in this)

- But

- if the rich EPF subscriber wants his 60% as a lump sum, there will be a tax on it

- the entire corpus will be tax free, if invested in annuity

An ambiguous act—

- If the entire 60% corpus is taxed at a top slab rate of 30.9%, the average tax on the entire corpus comes to 18.54%

- If just the interest on 60% of the contribution gets taxed, then the tax will be small

Mostly: It will be just the interest that will be taxed and not the full 60% corpus

How would the tax look like?

- Suppose a person joins in the next fiscal and sees a salary growth of 10% a year for the next 40 years

- Assume that EPF interest remains a steady 8% over this 40-year period (an assumption)

- A tax on the interest corpus at 30.9% works out to an average tax rate of 12% on the entire corpus.

In favour—

- Disproportionate gainers: Since Independence, the richest Indians have been disproportionate gainers of government subsidies and tax breaks (on cooking, automobile fuel, higher education and housing, opportunities of economic liberalisation)

- Urgent competing demands on the Budget-There is an urgent need for the government to control expenditure

- Balancing Act: To bring greater parity in the tax treatment of different types of pension plans

E.g.: EPFO on a par with the National Pension System (NPS), as NPS has been languishing because of the differential tax treatment

- To encourage more number of private sector employees to go for pension security after retirement instead of withdrawing the entire money from the Provident Fund Account

- Allow investors to choose a product based on the returns they generate and the risk exposure they carry, and not on the basis of the tax benefit they offer

- Allows investments to be routed to equity markets that have the potential to generate higher returns. Since the money can be routed to equity markets, it will free up the capital, and can be used in the growth of the economy

Youthful India enjoying a demographic dividend:

- India’s dependency ratio: Improved from 71.5 per cent in 1990 to 53.1 per cent in 2014

- The incidence of additional taxation is relatively small; being an opportune time to get wage-earners used to the minor rigours of taxation in stages

Against the Proposal:

Religious Sentiments attached—

- Making the EPFO partially taxable is unjust—As India lacks a social safety net and most employees do not get pensions

- With fathers getting their daughters married by breaking their PF before retirement or the sons relying on their dads’ PF accounts to start businesses; or right from running the house to having a little bit of hope in old-age—this forced compulsory saving was transformed into a true partner in times of crisis

Paying Twice-the-Tax (TtT)—

- An imposition of tax at the time of withdrawal will rob them of a sizeable portion of their long-term savings

- Since the contribution to EPF goes from tax-paid income, if the government imposes tax at the time of withdrawal, it will be like taxing them twice on the same income

Way Ahead:

- The entire retirement landscape needs to be viewed at a conceptual level, taking care of the observations by the behavioural economists to make it an opt-out product, with a default opt-in (you are automatically put into a pension plan unless you opt out); making the opt-out effective and on-going.

- Formulating the portability options and ways between the National Pension System (NPS) and EPF (safe and effective transitions)

- Need to develop the annuity market for a viable choice as it is still undeveloped with a poor choice set

Connecting the Dots:

- What is the EPF, and why does the salaried class consider it a reliable social security net?

- Why does the government want to take it out of the Exempt-Exempt-Exempt (EEE) category and make it Exempt-Exempt-Tax (EET)? What is the government’s rationale for making the change?

MUST READ

The loss of hope : Recent suicides – The vulnerability of youth

Wait for the good days got longer – A government in the middle of its term could have taken bold decisions. The Budget leaves room for neither private borrowing nor public investment

Related Articles:

‘Dalit movement has to see itself as part of a class-wide movement’

Related Articles:

Death of a Dalit scholar: Ancient Prejudice, Modern Inequality

The promise of Dalit capitalism

Blow for reformists in Iran

Getting our goats- We need to make goat farming organised, tie it to agriculture and animal husbandry.

Related Articles:

Animal husbandry and Indian Economy

The economics of Cow Slaughter

IISc start-up builds world’s first food grade DNA/RNA stain-Azooka Life Sciences claims the patent pending nucleic acid gel stain developed from an undisclosed plant source is the safest in the world market

Union budget 2016: Implications for ease of doing business

A new paradigm for agriculture?-A growth-first approach may work in the short-term, but India needs to prioritize sustainability simultaneously

Union budget 2016: Implications for ease of doing business- Government’s focus in terms of ease of doing business has been not just for corporate entities but also for ordinary people

MIND MAPS

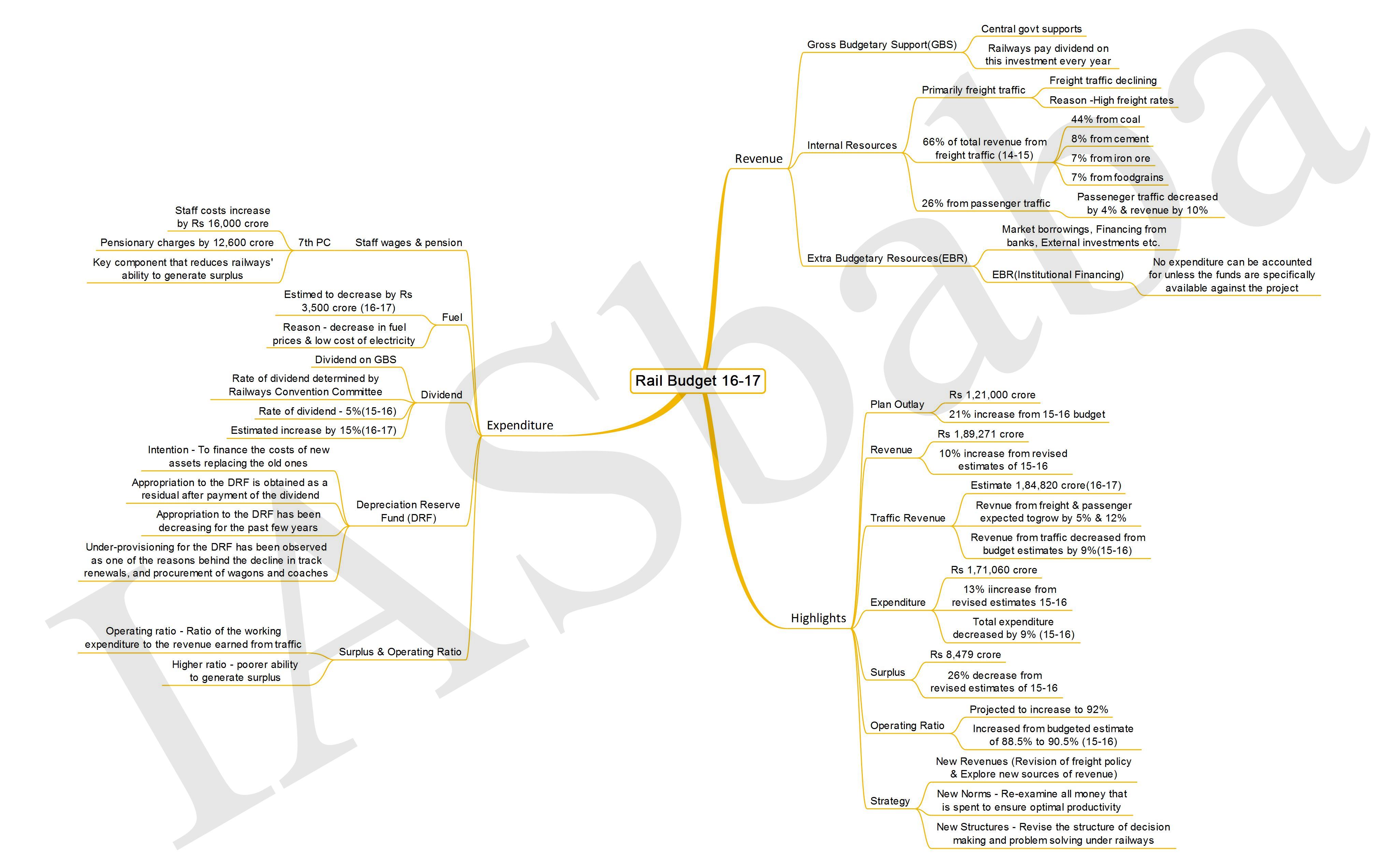

1. Railway Budget 2016-2017