IASbaba's Daily Current Affairs Analysis, IASbaba's Daily Current Affairs May 2016, International, UPSC

Archives

IASbaba’s Daily Current Affairs – 28th May, 2016

ECONOMICS

TOPIC:

General Studies 2:

- Government policies and interventions for development in various sectors and issues arising out of their design and implementation; Governance issues

General Studies 3:

- Indian Economy and issues relating to mobilization of resources, growth, development and employment.

- Government Budgeting

Time for a “new fiscal framework”

Issue:

- Indian fiscal policy suffers from a serious deficit bias

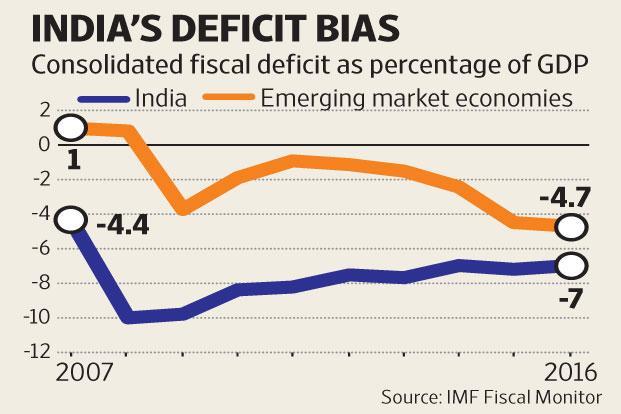

- The consolidated fiscal deficit in India has been far higher than other emerging markets (see chart)

Reasons:

- In India, fiscal profligacy (reckless spending of money) is more of a rule than an exception

- Spending far more than tax collections is seen as an incentive (for political gains)

- The only reason persistently high deficits have not led to a fiscal crisis for the Indian State is that successive governments have inflated away the public debt

- The standard economics textbooks propagate a simple principle: “net government spending should pick up when private spending is weak but should retreat when private spending is strong”. India usually does the opposite. It tends to have pro-cyclical rather than anti-cyclical budgets.

- In other words, fiscal deficits are first too high during economic booms; governments then struggle to cut spending when the private sector is struggling during downturns.

All these would create enormous risks to our long-run fiscal condition by driving interest costs to an intolerable share of revenues.

Hence, there is need for a fiscal law that will impose legal restrictions on the ability of governments to borrow.

Discussions on the need for new fiscal framework:

- The first such discussion is to be found in the constituent assembly debates on Article 292, with R. Ambedkar going so far as to say that he would be surprised if future Indian Parliaments do not impose legislative restrictions on government borrowing to fund the budgetary gap.

Article 292 deals with “Borrowing by the Government of India”

The executive power of the Union extends to borrowing upon the security of the Consolidated Fund of India within such limits, if any, as may from time to time be fixed by Parliament by law and to the giving of guarantees within such limits, if any, as may be so fixed.

- The landmark Fiscal Responsibility and Budget Management (FRBM) Act of 2003 had the same underlying logic (restrictions on the ability of governments to borrow), but it is now time for a fresh look at what fiscal rule India should follow.

- Economists have argued on several occasions that India needs a new fiscal policy framework to complement the new monetary policy framework that has been put in place.

- The Narendra Modi government has now appointed a committee headed by veteran policymaker K. Singh to recommend a new fiscal rule for India.

N.K.Singh Committee to review the working of the Fiscal Responsibility and Budget Management Act and suggest the way forward:

- K. Singh committee may look at replacing the simple fiscal rule imposed by the original FRBM with a more flexible one that sets moving targets based on the stage of the business cycle.

- This is in tune with contemporary thinking about fiscal laws the world over, especially since the economic collapse after the 2008 financial crisis made economists realize that counter-cyclical fiscal policy can become ineffective when there is a rigid fiscal rule.

Key problems the N.K. Singh committee will have to deal with:

The move to a cyclically adjusted fiscal balance—or the fiscal deficit as a percentage of potential output rather than actual output—seems an attractive one, but there are significant challenges in making a credible transition to the new framework. There are two important issues:

- First, it assumes that policymakers have a very good understanding about the nature of the Indian business cycle.

- Second, the estimates of potential output need to be credible if the financial markets are not to assume that the government of the day is manipulating its fiscal targets.

(Remember that potential output is not directly observed but can be a contentious statistical estimate. And that the business cycle tends to change with time)

These are key problems the committee will have to deal with if India has to move to a new system of flexible fiscal targets based on potential output.

Way ahead:

- The most potent solution to the above problem is the creation of an independent fiscal council (on the lines of the bipartisan Congressional Budget Office in the US, which is now being replicated in many countries)

- Such a fiscal council will act as an independent analyst of the fiscal numbers and can also help anchor fiscal expectations.

- If a new fiscal rule and an independent fiscal council can hopefully impose institutional constraints on perverse fiscal policy, some sort of market discipline can also be added by a new monetary policy framework.

For instance, a large reduction in the statutory liquidity ratio will allow the Indian government to automatically access a quarter of household savings in the banking system.

A significant reduction in this captive market will lead to more market discipline on the part of the government, in the sense that sovereign borrowing costs will increase in tandem with high fiscal deficits.

- The move to a flexible fiscal target based on potential output will be welcome, but it will suffer from a major credibility problem unless there is an independent fiscal council that does its own analysis of the budget numbers.

Connecting the dots:

- The consolidated fiscal deficit in India has been far higher than other emerging markets. What are the reasons for this and suggest some strategies for the same.

- There is need for a fiscal law that will impose legal restrictions on the ability of governments to borrow. Do you agree? Comment.

- What do you understand by inflating away the public debt? Will inflating away public debt help in the long run? Discuss. (Note: This question is intended to make you introduce to the concept – ‘inflating away the public debt’)

INTERNATIONAL

TOPIC: General studies 2

- Bilateral, regional , global groupings and agreement involving India and affecting its interest

- Effect of policies and politics of developed and developing countries on India’s interests, Indian Diaspora

The disconnect between India & USA—‘Middle East’

The disconnect

Eagerness of the USA for Indian participation in action in the South China Sea, and its lukewarm approach to an Indian connection in Afghanistan or, for that matter, the Persian Gulf and the Saudi peninsula

Why is the ‘eastward tilt’ significant for India?

Both from the geo-economic and geo-strategic view, areas encompassing Afghanistan, the Persian Gulf and the Saudi peninsula are the most important external region for India’s security

- We source 70 per cent of our oil from there—importance will thus, be directly proportional to the growing energy needs

- 7 million Indian citizens working there send back $30 billion in remittances—their safety is our prime responsibility as in the past, we have had to carry out large-scale evacuations of our nationals because of war-like situations in this region, most recently from Yemen in 2015

Should US be really worried?

The recent proclamation and the push for enhanced military cooperation with India mark remarkable strides in their defence relations of both the countries.

- US has been “looking forward” to enhancing relations with India to ensure that the India-US co-operation are at a level appropriate to enhance engagement between the militaries of the two countries for developing threat analysis, military doctrine, force planning, logistical support, intelligence collection and analysis, tactics, techniques, and procedures, and humanitarian assistance and disaster relief.

- They are issues of consequence for India, security issues that are of consequence to the United States and therefore, this agreement should, as a matter of fact, incorporate the ‘middle east elements’ in its future course of action.

Also, as part of military cooperation, the Indian Ocean does not quite include the northern Arabian Sea and the Persian Gulf— as India has no military capacity, it needs the US as a guarantor of a secure and stable world system, but especially as a security provider in the Persian Gulf region (most vital area of our external interest).

Incorporation of drills, joint exercises or planning with a fleet headquartered in Bahrain, and India for conflict contingencies can be the best way forward.

The ‘China’ Factor:

India needs partnerships and coalitions to maintain a secure periphery and therefore, India joined the balance of power game especially as the best way to boost immunity against threats, the best recipe to advance economic and military strength, and the shortest way for regaining its supremacy. The strategic vision statement is reflective of India’s seriousness in standing stand up against repeated incursions in Ladakh and Arunachal Pradesh, the growing presence of Chinese construction troops in Pakistan-occupied Kashmir and continued arms supplies to a Pakistan that sponsors and propels terrorists across into India—to create compelling pressures on China to stop messing with issues that concerns its core security interests.

India is the only country in Asia that can offset the massive gravitational pull of China (with huge external trade, the biggest loser from any disruption would be China itself) and hence it is important that India figures out its key problem with China and take steps to contain its rise. However, Beijing must find a new intellectual common ground with India that would enable the two to collaborate to stop the division of Asia further. A frank dialogue can build bridges necessary for resolving local conflicts and this should offer India the prospect of considering less confrontation and more cooperation with Beijing.

IASbaba’s Views:

There is a need to do the math and press the co-development, co-production agenda to the extent it is financially viable— India will do well to find a balance between the American relevance in the economic arena and the need to collaborate with China on both economic and cultural revival theory, while filling the huge gap that exists in the ‘middle east’. This is necessary because, as the Russians say, “markets alone cannot substitute for ethics, religion, and civilization.”

Connecting the Dots:

- Why does India-US military cooperation not include northern Arabian Sea and Persian Gulf — a region of great importance for India’s security? Suggest a way ahead.