IASbaba's Daily Current Affairs Analysis, IASbaba's Daily Current Affairs June 2016, International, UPSC

Archives

IASbaba’s Daily Current Affairs – 9th June, 2016

INTERNATIONAL

TOPIC: General studies 2

- India and its neighborhood relations, International relations.

- Bilateral, regional and global groupings and agreements involving India and/or affecting India’s interests.

- Effect of policies and politics of developed and developing countries on India’s interests, Indian diaspora.

- Important International institutions, agencies and fora- their structure, mandate.

India to become 35th member of MTCR

MTCR, NSG, Australia Group and the Wassenaar Arrangement – are the four nuclear regimes – aim to restrict the proliferation of items that could lead to the spread of, among others, weapons of mass destruction and chemical and biological weapons.

India has continuously put efforts to gain entry into these nuclear regimes. It has taken a number of steps to align its export regulations with what these regimes specify.

Finally, India to join the missile treaty club, as the countries belonging to the 34-member Missile Technology Control Regime (MTCR) raised no objection to India’s membership later this year.

(Note: Before going to read further, it is important to know some basics.)

Basics:

Nuclear proliferation

- Nuclear proliferation is the spread of nuclear weapons, fissionable material, and weapons-applicable nuclear technology and information to nations not recognized as “Nuclear Weapon States” by the Treaty on the Nonproliferation of Nuclear Weapons, also known as the Nuclear Nonproliferation Treaty or NPT.

Non-Proliferation Treaty (NPT)

- The Treaty on the Non-Proliferation of Nuclear Weapons, commonly known as the Non-Proliferation Treaty or NPT, is an international treaty whose objective is to prevent the spread of nuclear weapons and weapons technology, to promote cooperation in the peaceful uses of nuclear energy, and to further the goal of achieving nuclear disarmament and general and complete disarmament

Missile Technology Control Regime (MTCR)

- The Missile Technology Control Regime (MTCR) is an informal and voluntary partnership among 34 countries to prevent the proliferation of missile and unmanned aerial vehicle technology capable of carrying a 500 kg payload for at least 300 km.

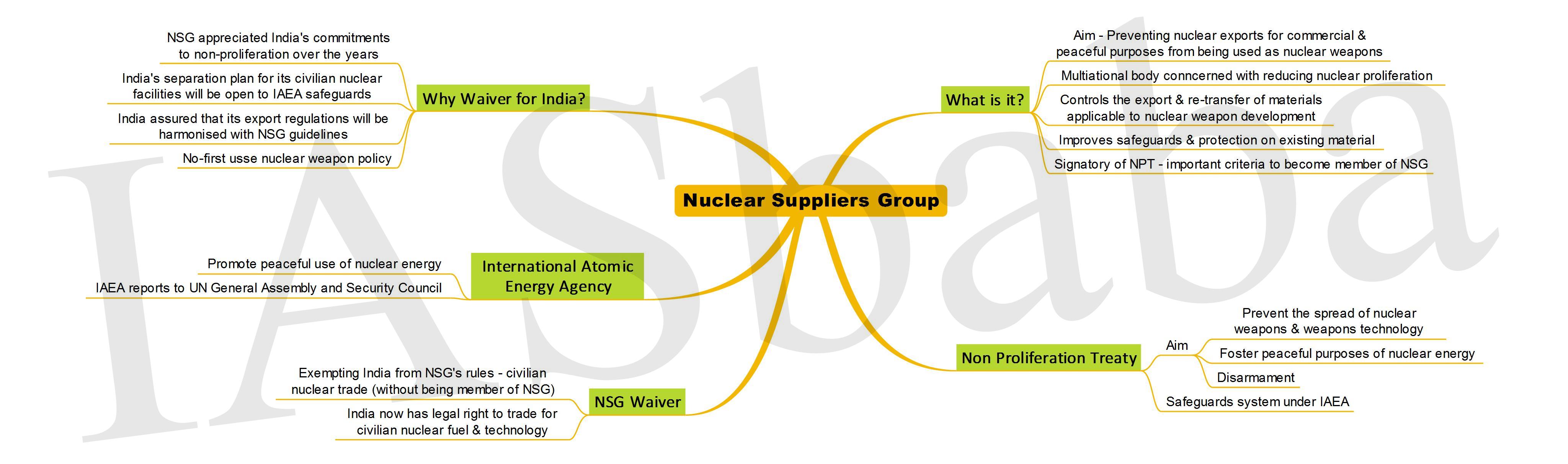

Nuclear Suppliers Group (NSG)

- Nuclear Suppliers Group (NSG) is a group of nuclear supplier countries that seek to prevent nuclear proliferation by controlling the export of materials, equipment and technology that can be used to manufacture nuclear weapons.

- It is a 48-nation club that governs trade in commercial nuclear technology and was originally set up in response to India’s first atomic weapons test in 1974.

Australia Group

- The Australia Group is an informal group of countries (now joined by the European Commission) established in 1985 (after the use of chemical weapons by Iraq in 1984) to help member countries to identify those exports which need to be controlled so as not to contribute to the spread of chemical and biological weapons.

Wassenaar Arrangement

- The Wassenaar Arrangement (not to be confused with the Wassenaar Agreement), (full name: The Wassenaar Arrangement on Export Controls for Conventional Arms and Dual-Use Goods and Technologies) is a multilateral export control regime (MECR) with 41 participating states.

- The Wassenaar Arrangement was established to contribute to regional and international security and stability by promoting transparency and greater responsibility in transfers of conventional arms and dual-use goods and technologies, thus preventing destabilizing accumulations.

- Participating States seek, through their national policies, to ensure that transfers of these items do not contribute to the development or enhancement of military capabilities which undermine these goals, and are not diverted to support such capabilities.

Courtesy (image)- http://ouic.kaist.ac.kr/eng/images/sub/compliances_img03.gif

The first step

- India to join first of the four nuclear regimes it is trying to gain entry into.

- The members of the Missile Technology Control Regime, a key anti-proliferation grouping, have agreed to admit India.

- None of the 34-nation group objected to India’s admission.

- India’s entry into the MTCR comes days after India announced that it is subscribing to the Hague Code of Conduct against ballistic missile proliferation, which is considered to be complementary to the MTCR.

- The MTCR is one of four international non-proliferation regimes that India — which in recent decades has gone from being a non-aligned outsider to a rising nuclear-weapons power — has been excluded from.

- In general, MTCR is a missile control group, which was set up in 1987 to limit the spread of unmanned systems capable of delivering weapons of mass destruction.

- Membership of the MTCR would require India to comply with rules — such as a maximum missile range of 300 km (186 miles) — that seek to prevent arms races from developing.

What would be the benefits for India in becoming MTCR member?

- Admission to the MTCR would open the way for India to buy high-end missile technology, also making more realistic its aspiration to buy state-of-the-art surveillance drones such as the US Predator, made by General Atomics.

- It would allow India to become a significant arms exporter for the first time. (helps India to export its supersonic cruise missile, the Brahmos, which is built through joint venture with Russia)

- India is also hopeful of building on the MTCR entry with membership to the Nuclear Suppliers Group.

- India wants to be part of the rule-making groups rather than being out of them and on the sidelines. India’s entry into the Missile Technology Control Regime (MTCR) will open the gateways for India’s membership in other nuclear regimes as well.

Challenges in joining NSG:

- Nuclear Suppliers Group (NSG) is a 48-nation club that governs trade in commercial nuclear technology and was originally set up in response to India’s first atomic weapons test in 1974.

- Joining the NSG will be much more difficult because China is a member and has backed the membership aspirations of Pakistan, its ally and India’s arch-rival.

- Beijing has cited India’s refusal to sign The Treaty on the Non-Proliferation of Nuclear Weapons (NPT) as a reason to oppose India’s membership of the NSG.

- However, NPT is no prerequisite to apply for NSG membership.

India’s present status:

- India has taken a number of steps to align its export regulations with what these regimes specify.

- It has now cracked MTCR and already fulfils all the criteria for NSG.

- India has also made significant progress in harmonising its Special Chemicals, Organisms, Materials, Equipment and Technology (SCOMET) export list with the control lists of the Australia Group and the Wassenaar Arrangement.

- India has also committed to adhering to future NSG guidelines despite not being a member.

- It is a proponent for finalizing a verifiable and non-discriminatory Fissile Material Cut-off Treaty.

- In addition, India has been a consistent votary of non-discriminatory disarmament efforts—one of the three pillars of non-proliferation regimes, along with civil nuclear cooperation and non-proliferation itself.

However, India with the breakthrough on the MTCR, improved its chances of ending its nuclear pariah status and joining the elite Nuclear Suppliers Group (NSG)

Now all eyes are on India’s pitch to join the NSG, preliminary discussions for which will begin next week in Vienna.

Connecting the dots:

- India wants to be part of the rule-making groups rather than being out of them and on the sidelines. Examine the statement keeping in view the steps and efforts taken by India to gain entry into the missile treaty club.

- India’s entry into the Missile Technology Control Regime (MTCR) will open the gateways for India’s membership in other nuclear regimes as well. Substantiate.

ECONOMICS

TOPIC: General studies 3

- Indian Economy and issues relating to planning, mobilization of resources, growth, development and employment

Winding up FIPB

- The Foreign Investment Promotion Board (FIPB) was set up as a government body that offers a single window clearance for proposals on Foreign Direct Investment (FDI) in India that are not allowed access through the automatic route (Department of Economic Affairs, Ministry of Finance)

- Over a decade ago, former finance Minister Jaswant Singh had proposed the regulatory reform, saying that the FIPB bureaucracy was losing its relevance with the liberalisation of the investment regime (Automatic route accounting for almost 90 per cent of the foreign investment proposals)—the challenge really was not about deregulation but de-bureaucratisation, and moving in that direction purposefully would help greater flow of foreign investment.

How FIPB has become a hurdle to easy investing into India

Everything Online: Right from the applications to the clarifications as well as consultations—everything is online. Also, the body lacks the pre-requisites of what to be looked for and what effects to be measured precisely. Interpretation of the vague guidelines, thus open up new avenues of misconduct and hurdles. For example, the case of equity warrants which were not permitted and were still given a go ahead, with investors investing, converting and making exits post the process.

Lack of a forum to appeal against FIPB: With the absences of written rules and regulations and the lurking ‘cronyism’, it has become difficult to appeal against the decision taken by the government of the day. ‘Press Notes’ (statements of policy intent) are the way via which govt. has controlled the terms of foreign investment into India—completely dependent upon government’s will and not ‘rules’. This also marks a fertile growth for more problems for the aggrieved without a clear sense of conduct for relief. Being non-statutory, it does not have checks and balances to scrutinize its own outcomes

Press Notes: It said that any multinational that wanted to come on its own would have to convince the FIPB that it wouldn’t hurt its existing collaborations—leading the bureaucrats become the arbiters of this rule.

Behavioural Issues: It testifies to the notion of “rent-seeking” behaviour.

- More sectors are now under the automatic route where investors only need to inform the Reserve Bank of India (RBI) that regulates capital flows through the Foreign Exchange Management Act (FEMA). Therefore, just getting a stamp of “approval”, makes no sense when all it does is—increases the ambiguity and elongates the process.

- Long drawn out process increase time cost and cost overrun to delays

- Bureaucratic inertia and scope for bureaucratic corruption by means of red tapism and complex rules

Perceived Benefits of dismantling FIPB—

- To move towards more opening up and to have more process driven activities and methods

- Putting more sectors under the automatic route – which means investors only have to inform RBI once they invest

- To further ease rules on foreign investments and allow new instruments that go beyond the traditional equity shares to boost the start-up eco-system (Ease of doing Investment—Aligning itself with the objective of “minimum government, maximum governance)

- Facilitation of quick job creation—Further push to Start Up India, Stand Up India Scheme and Make In India Scheme

- Reduction in the compliance costs of start-ups

- Time cost due to delays will be reduced

- Enabling regulatory environment, will boost start ups

- Single window online operations enabling minimum government and maximum governance

Concerns to take care of—

- Oversight of sensitive sectors like defence and telecommunication owing to the “security considerations” in the long run

- Study of Indian economy vulnerability with respect to the external shocks:

- Domestic sector investments getting reduced while facing stiff competition

- Unplanned and unsustainable development

- Monopoly of big players in the market

Way Forward—

- All FDI approvals must be made automatic to enable the government swiftly wind up the FIPB along with the scrapping of the sectoral caps, except in areas such as media where foreign control can skew public discourse, and freely allow foreign capital in all other sectors.

- An institutional arrangement should be in place to review any foreign investment proposal that could be a threat to national security. For example in Australia—There exists a legal framework, the Foreign Acquisitions and Takeovers Act 1975—Investment decisions are made by the treasurer, based on the advice of the foreign investment review board. The treasurer has the power to block investment proposals if they are a threat to national security.

Connecting the Dots:

- Enumerate the major reforms required w.r.t ‘Foreign Investment’ in order to boost the ease of doing business in India and to further promote ‘Make in India’ and ‘Start-up India’ initiatives.

MUST READ

Quest for another holy grail

The rights of the terminally ill

Related Articles:

Missing the point

Falling for the popular

Related Articles:

Right to Education (RTE) Act: It’s working and Challenges

Would you like to live in a cognitive city?

For Detailed Analysis on ‘Smart Cities’, refer the below links

http://iasbaba.com/2015/09/iasbabas-daily-current-affairs-16th-september-2015/

http://iasbaba.com/2015/09/iasbabas-monthly-yojana-september-smart-city/

http://iasbaba.com/2015/05/big-picture-smart-cities/

What we need is digital disruption

Related Articles:

Digital India: Its challenges and opportunities

India’s digital transformation

Water woes

MIND MAPS

1. Nuclear Suppliers Group