IASbaba's Daily Current Affairs Analysis, IASbaba's Daily Current Affairs July 2016, International, UPSC

Archives

IASbaba’s Daily Current Affairs – 11th July, 2016

INTERNATIONAL

TOPIC: General Studies 2

- India and its neighborhood and International – relations.

- Bilateral, regional and global groupings and agreements involving India and/or affecting India’s interests

- Effect of policies and politics of developed and developing countries on India’s interests, Indian diaspora.

India and Maldives Relations

A friend in need:

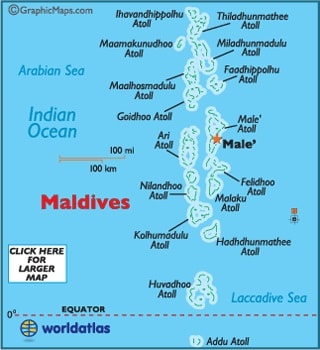

- Maldives is a strategically important Indian Ocean archipelago

- Indian Army’s ‘Operation Cactus’ foiled a coup in Maldives that was attempted by a pro-Eelam group in 1988.

- India maintains a naval presence in Maldives, at the request of the Maldives, since 2009 . President Yameen, in an interview had said, “If they [Indian Army] had not come to our rescue, we would have lost independence during the past 50 years.”

- Indian Coast Guard’s Dornier was the first to land at the Ibrahim Nasir Airport with relief and supplies after the tsunami of December 26, 2004.

- Maldives has pledged its support to India as a permanent member of an expanded UN Security Council.

- In 2014, India dispatched “water aid” to the Maldivian capital of Male, after a fire destroyed the generator of its biggest water treatment plant.

Concerns:

- Turbulent Maldivian politics: Maldives continues its descent into political anarchy with democratic institutions facing an unabated onslaught under the authoritarian regime of President Abdulla Yameen

The Yameen government stands accused of stifling democracy, riding roughshod over the country’s 2008 constitution, reducing its majlis (parliament) where his party has a majority to a mere rubber stamp, and weakening the judiciary.

Unfair persecution and imprisonment of political rivals, rampant corruption and severe curbs on press freedom are other charges.

- Maldives growing “closeness” with China: Both China and Pakistan stepping up their strategic inroads into the Maldives

- Religious radicalization: The island-nation (Maldives) is being radicalized by the Saudi funds and influence

The continuing money flow from Saudi Arabia for the construction of mosques and madarsas which now dot the archipelago is also worrying as they emerge as hubs for religious radicalisation and indoctrination.

The Saudis along with Pakistan and Egypt are seen as fuelling extremist religious views through the scholarships they are offering to Maldivian youth who are returning radicalised after having travelled to these countries.

- ISIS threat: Growing Islamic radicalisation in the tiny island-nation of about four lakh people once known for its tolerant practices has many foreign governments, including India, deeply concerned. While the Maldivian government says only 49 of its citizens have joined ISIS, unofficial figures pitch the number at about 250-300.

- GMR issue: Relations between India and Maldives came under a strain after Male had terminated the agreement it entered into with GMR in 2010 for the modernisation of the Ibrahim Nasir International Airport. The airport was taken over by the Maldives Airports Company Limited after a high-voltage legal tussle in which GMR.

The quantum of damages to be paid by the Maldives is yet to announced by the arbitration tribunal in Singapore.

India has, for some time, chosen to maintain a studied silence on what’s happening in this troubled tourists’ paradise.

India can no longer afford to be a mere spectator.

India seems to be fast ceding its traditional space for effective diplomatic influence in the archipelago.

Proceed with caution

- India’s cautious dealings with the Yameen regime followed a period of strained bilateral ties after Mohamed Nasheed — he was the first democratically elected president of the archipelago in 2008 — was ousted in 2012.

- Unwilling to be seen as aligning with any political faction, India has engaged in outreach to the entire political spectrum in the archipelago.

- New Delhi is also unlikely to accede to the request of the Maldives United Opposition (MUO) — a broad coalition of political parties seeking restoration of democracy — to directly intervene or impose sanctions to arm-twist the Yameen regime.

- The MUO that has Nasheed as an advisor, was launched in early-June at London with a 25-member shadow cabinet. Some of its members were in New Delhi recently to seek India’s support to “bring back democracy to the Maldives” and ensure the elections which are still two years away are “free and fair” by having a “transitional arrangement” in place after Yameen’s removal.

- However, as India walks the middle path, what remains worrying is the Yameen’s regime’s “deep involvement” with China.

- The contract for the $500-million Male international airport modernisation project bagged by GMR was unilaterally terminated once Nasheed was ousted.

- India’s loss was China’s gain with the latter bagging the contract for the airport and the China-Maldives Friendship Bridge project that will link Male to the airport.

Conclusion:

- Amid all these concerns, the window for Indian diplomatic intervention seems to be closing. In seeking to balance its geo-strategic interests along with the need to remain engaged with the Yameen government, India cannot afford to trust Yameen’s enunciation of an ‘India First’ approach. Especially when at stake is India’s influence in the Indian Ocean region.

- New Delhi will need to step up pressure on the government in Male if it is to safeguard its own strategic and security interests in the archipelago that straddles important sea lanes in the Indian Ocean Region. Quiet persuasion is what India has been engaging in so far, but it may need to rally international opinion against the repressive regime, possibly through the Commonwealth Ministerial Action Group (CMAG).

Connecting the dots:

- Critically analyze the relations and growing concerns between India and Maldives. Also discuss the importance of this island-nation for India with regard to strategic and security perspective.

ECONOMICS

TOPIC: General Studies 3

- Indian economy and issues relating to planning, mobilization of resources, growth, development and employment

India needs a robust corporate bond market

Background:

The financial condition of Indian banks has deteriorated in tandem with the economic cycle since 2013. A 2013 report by India Ratings and Research, an arm of Fitch Ratings, predicted further deterioration—Rs.1.26 trillion of bank loans may potentially be in distress over the next 12 to 24 months.

What is bond market?

Corporates, governments and individuals rely on various sources of funding to meet their capital requirements. Specifically, corporates use either internal accruals or external sources of capital to finance their business. The capital raised by companies through debt instruments is broadly referred to as corporate debt.

Corporate debt consists of broadly two types –

Bank borrowings: consist of project loans, syndicated loans, working capital, trade finance, etc. for various business purposes and for varying durations through non-standardized and negotiated bank loans.

Bond: Corporate bonds are transferable debt instruments issued by a company to a broad base of Investors.

- Corporate bonds are issued to the public (similar to equity instruments)

- Listed on stock exchanges and traded in secondary markets

- Are transferable

- Possess a broad base of issuers (ranging from small companies to conglomerates and multinationals) and investors (including retail participants)

- Are under the additional purview of the regulators of the securities market other than the central bank.

There are three main pillars that make up the corporate bond market ecosystem:

- Institutions: securities market regulator, the banking regulator, the credit rating agencies, clearing houses, stock exchanges and the regulations and governance norms prescribed by these institutions

- Participants: The market players- investors on the demand side and issuers on the supply side.

- Instruments: indicate the form and features of securities issued in the corporate bond market. Interest rate and currency derivatives and government securities

Vibrant, deep and robust corporate bond markets are essential to enhance stability of financial system of a country, mitigate financial crises and support the credit needs of corporate sector, which is vital for the growth of an economy. However, a sudden expansion of corporate bond markets without the necessary support structures is unsustainable and can cause strain on the financial system if the prevailing credit quality of corporate bonds is compromised or companies overleverage their balance sheets.

Why bonds over banks?

Non-performing loans have been climbing and the problem of restructured assets has also been increasing over recent quarters. Such restructured loans as well as the usual bad loans now weigh down bank balance sheets. The deterioration in the asset quality of banks is an important challenge for the Indian economy when India continues to have a financial system that is dominated by banks.

Reasons for opting a bond market includes:

- Indian banks are currently in no position to rapidly expand their lending portfolios till they sort out the existing bad loans problem.

- The heavy demands on bank funds by large companies in effect crowd out small enterprises from funding.

Thus, India needs to eventually move to a financial system where large companies get most of their funds from the bond markets while banks focus on smaller enterprises.

India and bond market

Luengnaruemitchai and Ong (2005) opine that crowding out by government bonds is one of the potential obstacles to healthy corporate bond markets. A high level of public debt crowds out corporate borrowing by reducing the appetite of financial institutions. This increases the cost of borrowing for corporates making bond markets an unviable source of funding (A?ca and Celasun, 2009). On the contrary, Raghavan and Sarwano (2012) conclude that in case of India, unlike economies like Korea, the development of the government bond market has in fact had a positive effect on the corporate bond market.

In the Indian context, Mitra (2009) focuses on the supply side issues hampering the development of corporate debt markets in India and lists the lack of diversity in instruments as a major factor.

Indian bond market

- Primarily dominated by fixed rate coupon bonds

- The average age of the bonds issued by Indian corporations is only 5 to 7 years

Role of RBI:

- RBI has added an important new element to this debate in its new Financial Stability Report, which has a section on the optimal configuration of a financial system, or how much of funding is through banks and how much through the bond market.

- According to the central bank, “with banks undertaking the much needed balance sheet repairs and a section of the corporate sector coming to terms with deleveraging, the onus of providing credit falls on the other actors”.

- Under pressure from the Reserve Bank of India (RBI), public sector banks have begun to admit the extent of their bad loan problem. Over the past year, the Reserve Bank of India has stepped up pressure on big corporate debtors to pay up, despite the absence of an effective national bankruptcy law. Stressed assets accounted for an estimated 14 per cent of India’s total banking system as of September, according to the RBI.

- A government source said that in the past, promoters [controlling shareholders] had a tremendous amount of leverage in the system who were able to get fresh loans as well as ‘evergreen’ [extend] existing loans. And hence, the bankruptcy code will be a game-changer, strengthening the hand of creditors.

World Bank says—

From the perspective of a developing economy, the World Bank (2000) observes that “the corporate bond market in a country can substitute part of the bank loan market, and is potentially able to relieve the stressed banking system in a developing country of unbearable burden.” Development of corporate debt markets needs strong institutional and regulatory support. The World Bank (2000) specifically identifies seven necessary developmental components for the effective functioning of vibrant bond markets. Any “absence, deficiency or inefficiency” of any of these components can potentially stall the development process. These components are:

- Disclosure and information system

- Credit rating system

- Effective bankruptcy laws

- Market intermediaries

- Institutional investors

- Trading system and clearing platform

- Depository system

Way Ahead

- India’s corporate bond market needs liquidity, transparency, safe and sound market infrastructure, appropriate institutional structure, etc.

- Regulatory efforts are on to enable wider participation in the market and create scope for market making. This would facilitate the growth of the corporate bond market, which would directly cater to the needs of the real economy and the financial sector.

- Corporate bond market is still shallow in India, issuance concentrated in few highly rated firms. Securitisation is at its minimal level. Hence diversification and awareness among the investors can increase the investor base in this market. Therefore, a collaborative effort of all stake holders including RBI, SEBI, Finance Ministry and co-operation of market participants can develop Indian debt market.

Connecting the dots:

How can the bankruptcy code boost the corporate bond market? Discuss the limitations, if any.

Refer:

Non-performing assets and recent steps to clean them up

The problem of debt concentration

Fashioning a Banking Turn- Public Sector Banks

Indradhanush Plan for Public Sector Banks (PSBs)

MUST READ

It’s time for an urban upgrade

Storm in the South China Sea

Related Articles:

China factor in India Maldives relation: an analysis

Ending impunity under AFSPA

Police, power, patriarchy

A battle for supremacy

Being unneighbourly

Booms and busts in oil prices

Green cards for tech graduates? Yes, but take care

Uniform civil code: One nation, one law

Related Articles:

Uniform civil code : Need of the hour

Seven failures of economic liberalization

Banks are stressed: What do we do?

Formalizing India’s informal economy

Food for Thought

Genesis of NPAs