IASbaba's Daily Current Affairs Analysis, IASbaba's Daily Current Affairs Nov 2016, UPSC

Archives

IASbaba’s Daily Current Affairs – 1st November, 2016

ETHICS

TOPIC: General Studies 4

- Corporate Governance and Ethical Governance

Corporate Governance: TATA SONS Issue

What is Corporate Governance?

Corporate governance is the system of rules, practices and processes by which a company is directed and controlled and involves balancing the interests of a company’s many stakeholders, such as shareholders, management, customers, suppliers, financiers, government and the community. Corporate governance also provides the framework for attaining a company’s objectives and hence encompasses practically every sphere of management, from action plans and internal controls to performance measurement and corporate disclosure.

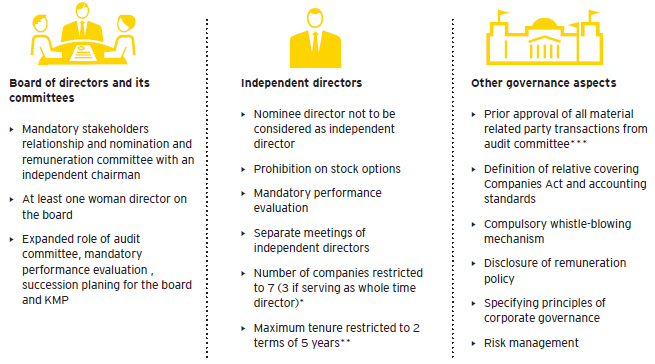

Various initiatives have been taken in the past by the Ministry of Corporate Affairs (MCA) and Securities and Exchange Board of India (SEBI) for corporate governance. As a result, SEBI came out with proposed changes, shown in the image below, to be made in the organisations to ensure effective corporate governance.

The recent spat between the TATA Sons and the ousted chairman Cyrus Mistry has once again brought the corporate governance compliances by various companies under the scanner. Unfortunately fingers pointing towards a reputed name such as TATA Sons raises concerns about the level of compliances in smaller organisations with a lesser reputation.

Ownership v/s Management – Challenges

The main intent behind effective corporate governance is differentiation between the management and shareholders. This is done to allow autonomy to the management and prevent dominance by the owners.

The Board of Directors are the direct stakeholders influencing corporate governance. Directors are elected by shareholders or appointed by other board members, and they represent shareholders of the company. The board is tasked with making important decisions, such as appointments, compensation and dividend policy.

Boards are often comprised of inside and independent members. Insiders are major shareholders, founders and executives. Independent directors do not share the ties of the insiders, but they are chosen because of their experience managing or directing other large companies. Independents are considered helpful for governance, because they dilute the concentration of power and help align shareholder interest with those of the insiders.

With respect to this the clear message out in open, as a result of the TATA Sons fiasco, is that whoever controls the dominant shareholding is responsible for taking major decisions and has a strong influence on those decisions.

Such shareholders act as alternative power centres without any accountability or formal responsibility. India is full of family-controlled companies with dominant shareholdings and hence it becomes really difficult to have a Board that can discipline the dominant shareholders from whom the Board derives all its powers. Power in a company depends upon the block of shares you control and hence the the concept of shareholder democracy seems fictitious.

Additionally, the TATA sons issue also bring in the open the fact the the guidelines on corporate governance merely serve as a fig leaf to hide the brute reality of the exercise of power within companies. The compliance of these guidelines is not taken very seriously and manipulations are carried out. Practical adherence is way below the theoretical compliance as shown in audit reports etc to mislead the stakeholders.

Window dressing is done and rosy pictures are drawn through reports and awards on corporate governance. However, the true picture is not so beautiful as it seems as witnessed in various recent cases such as the Satyam, Sahara and the Shardha scam.

All these problems are not endemic to India alone and plague even the most advanced economies such as the US. In recent instances banks in the US have rushed to pay huge fines to the authorities so that they could avoid prosecution.

Corporate Governance in India

Steps have been taken by regulators over the years to address abuses of power. The standards of corporate governance need to be extremely high and the interests of minority investors need to be safeguarded in the best possible manner to attract investments from across the world and prevent any untimely flight of capital. Fortunately, the 2016 Ease of Doing Business report from the World Bank ranks India at No. 13 in the world on the ‘protecting minority investors’ yardstick, while we rank a lowly 130 on the overall index.

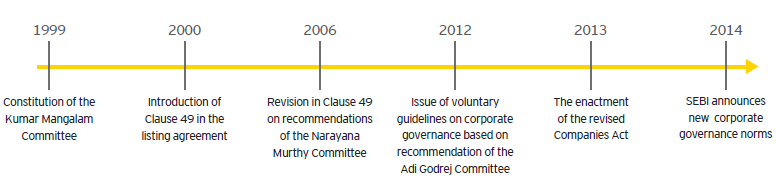

The focus of the regulators on governance standards requires companies to make a concerted effort to ascertain compliance and presents an opportunity to align with the global standards and deliver incremental gains for their stakeholders. These efforts have been going on since about two decades as represented below:

Connecting the dots :

- Explain with examples how poor corporate governance reflects upon the ethics, human values and attitude of those responsible for running and managing corporate organisations

- Define corporate governance. Discuss it’s significance and various measures taken to ensure effective corporate governance in India.

ECONOMY/ENERGY

TOPIC:

General Studies 3

- Infrastructure: Energy

- Indian Economy and issues relating to planning, mobilization of resources, growth, development and employment.

General Studies 2

- Government policies and interventions for development in various sectors and issues arising out of their design and implementation.

Turning India’s power surplus into a boon

- For last few months, low consumption of power in the country has resulted in low plant load factor and surplus of coal at the pithead and at the power plants.

- This is because a good monsoon has lowered agricultural consumption of electricity and cheaper hydropower has replaced thermal power in the grid as bountiful rains ensured ample waters in the reservoirs.

- Due to this factors and its implications, the experts and analysts have been questioning the efficient utilisation of additional capacity that is being added to the grid.

- This is so because India is adding capacity, not only in the traditional thermal and hydro but also in the renewable sector, in which there is a target of 175 GW of capacity by 2022.

Challenges and solutions

Per capita availability and reliability

- India’s per capita consumption remains among the lowest in the developing world. This reflects that power consumption is going to grow in the future and the current situation shows low purchasing power of the consumers at present.

- Apart from low purchasing power, there are connectivity and reliability issues. These, though are being sought to address at a fast pace. (GVAs have been appointed for monitoring of new connections)

Discoms

- The woes of distribution companies (discoms), which are not buying power because of their debts and inability to recover costs from consumers, are being overcome through the Ujwal Discom Assurance Yojana (UDAY).

Viability of plants

- A low plant load factor threatens the viability of power plants. Thus, India has to bring out creative solutions to deal with the current situation.

- India is not the only country which faces such challenges. Many countries have overcome this situation by having competing facilities in two-three fuels, with the grid switching over from one fuel to another depending on the price of the fuel and the market demand.

- Coal competes with fuels such as natural gas and nuclear and the consumer is offered different options.

- In country like India, where capital has other competing demands, investment in the power sector could be made more profitable with the adoption of a slew of measures that increase the consumption of electricity as it offers elasticity of use and could be utilized to replace fuels in other sectors.

Examples of countries with better use of power

Ecuador

- Ecuador has invested in hydropower in the last few years due to which it has become power surplus now.

- It is efficiently using the excess power by replacing gas stoves with electric stoves for cooking in households. This brings down the consumption of natural gas which it imports.

- India can take a cue from such models and encourage the use of electricity for cooking during the surplus season for which there can be a special tariff which could be lower than comparative LPG prices.

- In addition, electricity can replace imported kerosene and thus have a positive impact on overall LPG and kerosene imports.

China

- In city of Guilin, China, majority of two-wheelers being used are electric vehicles. This is because China restricts the use of traditional two-wheelers in several cities in order to reduce pollution.

- As a result, China is the global leader in the electric two-wheelers market, with an estimated stock of 200 million units.

- India also has a target of having six million electric vehicles by 2020. This should be increased and power companies could be guided to take a special interest in their promotion.

- Cities like Ahmedabad, Vadodara and Pune, which are known for their liking for two-wheelers, could become the hubs for the adoption of electric vehicles.

- For this, electric charging facilities for vehicles can be provided in major cities and on highways. Lower tariff could be offered for ‘off-peak’ recharge of vehicles.

- Again, China has encouraged use of electric buses in public transport with it being a global leader with a fleet of 1,70,000 buses.

- In India, Smart cities and cities planned under the proposed industrial corridors should incorporate infrastructure for electric vehicles in their plans.

- Also, Indian Railways could fast-track its electrification programme so that it lowers its diesel consumption.

Conclusion

- If these measures are taken, they would have many beneficial effects.

- Adoption of electricity for cooking instead of LPG, LNG or kerosene would lower our imports of these fuels.

- Similarly, a jump in the use of electric vehicles will lower the rise in demand of petroleum imports. This will help in meeting the Paris 2015 commitments.

- Faster electrification may even lower consumption of refined petroleum products, thereby contributing to the target of lowering imports of these products by 10% set by Prime Minister.

- Lower demand by India, the fourth largest importer of crude oil, will have a salutary effect on the market price of crude oil and will contribute to enhancing the energy security of the country.

- India has made good progress in selling power.

- In 2013, India started exporting 500 MW of power to Bangladesh, which has been augmented further by commencing export of another 100 MW from Palatana, Tripura in 2016.

- Power exports to Nepal are set to increase following the completion of the construction of the Muzaffarpur-Dhalkebar transmission line, once the transmission infrastructure on the Nepalese side is strengthened.

- In the case of Sri Lanka, an undersea cable will allow India to export power to them.

- India has made a good beginning by commencing export of 3 MW to the border towns of Myanmar, which could be scaled up by constructing a better transmission infrastructure.

- A pan Asia-Pacific grid in the long run will help balance the surplus and shortages in the region.

- Surplus power could lower the demand for imported petroleum products and increase the consumption of domestically produced coal. 175 GW renewable energy target by 2022 will be a welcome addition to our energy mix and help replace fossil fuel further.

- Thus, the power surplus situation can be converted into a boon.

Connecting the dots:

- India is going to be a power surplus country. How can it effectively use its surplus asset? Substantiate.

- Power in India is going to be sufficient for all of its population. What are possible changes that can domestically increase use of power and simultaneously made affordable? Discuss.

MUST READ

The pivot through Kabul

Case against a uniform asylum law

Securing the skies

Bitter Medicine

India and Nepal relations