IASbaba's Daily Current Affairs Analysis, IASbaba's Daily Current Affairs Nov 2016, National, UPSC

Archives

IASbaba’s Daily Current Affairs – 9th November, 2016

ECONOMY/NATIONAL

TOPIC:

General Studies 3

- Indian Economy and issues relating to planning, mobilization of resources, growth, development and employment

- Inclusive growth and issues arising from it.

General Studies 2

- Government policies and interventions for development in various sectors and issues arising out of their design and implementation

Demonetisation- Reasons and effects

In a so called master stroke by PM Modi, the Rs. 500 and Rs.1000 denominations will now be out of circulation from the Indian economy. Let us look at various nitty-gritty of this policy decision.

No more a legal tender

- A legal tender is any acceptable currency in a country. The denominations are declared by the government.

- In India, different values of the Indian rupees are legal tender. The Reserve Bank of India (RBI) Act and the Indian Coinage Act specify which bank notes and coins will be legal tenders.

- The Central government under Section 26(2) of the RBI Act has the authority to declare currency as not valid legal tender. This is generally done on the advice of the central board of directors of the RBI.

- Section 24 of the RBI Act empowers the Central government to issue bank notes of any value, as long as it is Rs.10,000 or below. Hence, there is no amendment in law required for any changes in legal tender.

- Recently, the Central government has declared that Rs.500 and Rs.1,000 will not be accepted as currency notes, thus these two denominations are no longer legal tender. Hence, these notes have no value.

- It means that people cannot use existing Rs. 500 and Rs. 1,000 currency notes for monetary exchanges.

- Also, the central government is set to introduce two new currency notes of value Rs.500 and Rs. 2,000.

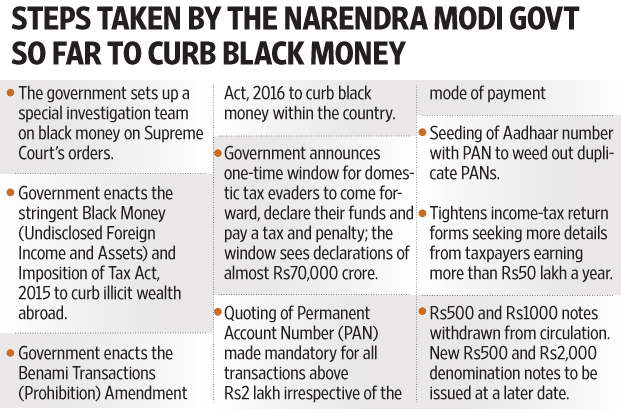

Continued efforts to harm parallel economy

- The decision comes in the backdrop of curbing the challenge posed by corruption and black money.

Picture credit: http://www.livemint.com/r/LiveMint/Period2/2016/11/09/Photos/Processed/w_black_money.jpg

- And now, the five hundred rupee and thousand rupee currency notes presently in use will no longer be legal tender.

- However, there is no restriction of any kind on non-cash payments by cheques, demand drafts, debit or credit cards and electronic fund transfer.

Reason behind such decision

- The honest citizens want that government fights against corruption, black money, benami property, terrorism and counterfeiting.

- The magnitude of cash in circulation is directly linked to the level of corruption.

- Between 2011 and 2016, the circulation of all currency notes, from the lowest to the highest denomination, grew about 40%.

- In the same period, the circulation of Rs 500 denomination and Rs 1000 denomination currency notes increased by 76% and 109% respectively.

- But, the size of Indian economy during this period expanded by only 30%.

- So obviously there has been a disproportionately high usage of high denomination currency notes

- Inflation becomes worse through the deployment of cash earned in corrupt ways. It has a direct effect on the purchasing power of the poor and the middle class.

- In purchase of land or a house, apart from cheque, a large amount of cash is demanded.

- Thus, misuse of cash has led to artificial increase in the cost of goods and services like houses, land, higher education, health care and so on.

Effects of the move

- As per RBI’s latest annual report, Rs. 500 and Rs.1000 denominations account for over 86% of the total Rs 16.42 lakh crore value of bank notes in circulation as on March 31, 2016.

- Incidentally, the decision comes close on the heels of the expiry of the September 30 deadline of the black money disclosure scheme under which income and assets worth Rs 65,250 crore were declared.

- With almost 60% of the economy estimated to be a cash economy, the decision is likely to be quite disruptive in the short-term.

- India is a cash-based economy, hence the circulation of fake rupees continues to be a menace. The fake notes are used for anti-national and illegal activities. Thus, it is now expected to contain the rising incidence of fake notes and black money.

- The decision is also expected to severely impact sectors that deal with unaccounted money such as real estate, stock market and gems and jewellery.

- However, it will also hit the livelihood and savings of neighbourhood vegetable vendors who borrow overnight funds from moneylenders, kirana stores, small traders and even the labour class.

- There will be temporary glitches occurring due to the transient nature of replacing the currency but the RBI is already ready with new currency notes of Rs. 500 and Rs. 2000 to meet the requirements in upcoming weeks and days.

- In addition, the government has made clear that the now defunct two denominations in bank accounts will not enjoy immunity from tax and the law of the land will apply on source of such money.

Effect on real estate

- The sector is known to be a safe haven for converting stock of black money into white, especially in high-value transactions. High-value property deals and more specifically resale transactions involve large amounts of undisclosed cash transactions.

- Thus, there is expected to be a slowdown in transactions, which will further affect the performance of real estate companies.

- However, lower interest rates have brought some hope for the sector. A slightly better outcome is if prices decline which sees a revival in demand from buyers who don’t conceal their income from the tax authorities.

Effect on markets

- The Sensex is made up of very large companies which may not be impacted as much by the demonetization process.

- The largest impact of the government’s move will be in the unorganised sector, which isn’t represented in the markets.

Effect on voter base

- The decision may affect the current ruling majority party’s key support base—traders, small and middle-level businessmen. However, many feel that traditional party supporters like lower/middle class will not find it tough to account for or exchange the currency. The real fear will be for those who have unaccounted money.

- As per analysts, with assembly elections due in five states over the next six months (Uttar Pradesh, Punjab, Uttarakhand, Goa and Manipur all go to polls), the move is risky and brave.

- Elections attract cash, and the move means “campaigning is going to be a big headache for political parties”

Thus, this move is expected to bring more transactions under tax net, both direct and indirect taxes would move up, more digital transactions will take place and reduction in parallel economy will increase the size of formal economy as more people will disclose income and pay taxes. This will make India a more tax-complaint society.

Connecting the dots:

- What is the rationale behind demonetization of two currency notes? How will it affect economy and people? Analyse.

- What are various measures taken by government to curb corruption and disclose black money? Critically evaluate the effect of such actions.

GOVERNANCE

TOPIC: General Studies 2

- Statutory, regulatory and various quasi-judicial bodies

- Important aspects of governance, transparency and accountability, e-governance- applications, models, successes, limitations, and potential; citizens charters, transparency & accountability and institutional and other measures.

Appraisal of Autonomous Bodies – Rationale and Methodology

The News

The government has decided has decided to ask Niti Aayog to review the performance of autonomous bodies that have mushroomed over the years with little oversight. These include more than 500 autonomous bodies such as University Grants Commission (UGC), Jawahar Lal Nehru University (JNU), Delhi Development Authority (DDA), Prasar Bharati and many more.

Expenditure Management Commission (EMC)

Expenditure Management Commission (EMC) headed by former Reserve Bank of India (RBI) governor Bimal Jalan had observed that these agencies were incurring expenditure to the tone of over Rs 60,000 Crores annually. The Prime Minister’s Office (PMO) has set up a high-powered committee headed by Niti Aayog vice-chairman Arvind Panagariya to look into the EMC’s recommendations. A few recommendations made by the EMC were:

- Streamlining of expenditure,

- Review of grants made to autonomous bodies, and

- Linking a part of the grants to the performance of the bodies.

Precedents

The United Kingdom (UK) had undertaken review of its 900 odd autonomous bodies. On the basis of the review, the number was pruned by 285 institutions, resulting in annual savings of around $2 billion.

Atal Bihari Vajpayee government had also set up Expenditure Reforms Commission for similar reforms. However, the bureaucracy has in most instances come up with arguments justifying continuation of the system.

Rationale

This move can also be seen as an opening for unwarranted, unwelcome, targeted interference in the matter of autonomous public institutions. However, this could be an important and constructive initiative due to the following reasons:

- Lack of oversight over the years

- Increasing number of such autonomous bodies which has risen from a mere 35 in 1955 to 691 in 2016

- Increasing and wasteful expenditure incurred by these bodies

- Growing irrelevance in the current socio-economic set up

- Owing to the specific significance of these autonomous bodies:

- These are critical interface between the state and the market or the state and the public.

- They include some of the key channels for publicly funded scientific and industrial research and innovation, teaching and training institutions.

- Responsible for sectoral initiatives to develop and deepen market infrastructure in areas that will be important for creating more geographically dispersed employment.

Dos and Don’ts – What not to do

- Avoid misuse of power:

It has to be ensured that the reviews are carried out in a manner convenient to the agencies. Review of finances and information requests should not provide the reviewer with powers to harass and annoy.

- Rigidity in approach:

The span of such institutions is very widespread and hence the range of institutions and their mandates will require discretion to be used in reviews. Further, there cannot be a universally applicable approach to review all the bodies or all sectors.

- Benchmarking/ Criterion:

The criterion to select and review the agencies cannot be fixed. Much of the review for potential savings will have to be done on a case-by-case basis, both in terms of choices of entities to focus on and criteria for separating waste from performance in the ones that are chosen.

Dos and Don’ts – What to do

- Clarity of terms of review:

Stating the terms of the review up front and sticking to them. It will add clarity and avoid a feeling of harassment and animosity.

- Clarity of principles:

Clarifying the principles used as basis to identify institutions for closer scrutiny, the definition of poor performance and performance criteria that will be used.

- Sharing of Workload:

Sharing the workload and the power to identify poor performance with Union ministries that autonomous bodies are attached to, with peer institutions to identify potential savings, and with the institutions themselves will improve the outcomes. This will also reduce the workload of Niti Aayog and ensure the completion of the task in a timely and effective manner.

- Voluntary change of status:

Allow institutions to opt out from being an autonomous body to operate at a more fiscal and administrative arms-length distance from the state. This could help in narrowing down the review exercise and also increase the public sector savings.

Conclusion

The review of these bodies is essential not only from the viewpoint of saving a lot of money but rather more crucial due to their role and how to leverage their hybrid structure. In the past little has been done to implement such recommendations. At times the bureaucracy has been a hurdle in this exercise. Hence, it is the need of the hour to go ahead with this review and ensure constructive rationalization of the autonomous agencies

Connecting the dots

- Critically analyse the role of various autonomous bodies working in India. Support your analysis with a case study.

- Recently, the government has decided to review the performance autonomous bodies that have mushroomed over the years. Analyse the need for such a step and suggest a strategy to ensure an effective review.

MUST READ

The politics of perceptions

All about Tipu Sultan

Not a corporate sinecure

Commercial apps will soon be able to strike open data gold

The arhar solution to pollution

Faith in equality

A duty of tolerance

Paddy stubble management: Zero biomass power plant in 3 years

Towards a new fiscal policy framework

Narendra Modi embraces cashless economy, maybe a bit too fast

India’s moment in the Suez Canal crisis