IASbaba's Daily Current Affairs Analysis, IASbaba's Daily Current Affairs Jan 2017, National, UPSC

IASbaba’s Daily Current Affairs – 16th January 2017

Archives

NATIONAL

TOPIC:General Studies 2

- Separation of powers between various organs, dispute redressal mechanisms and institutions.

- Statutory, regulatory and various quasi-judicial bodies

RBI, Ministry of Finance and Autonomy

In news: the demonetisation decision has once again floated the much debated topic of diminishing autonomy of the central bank and overpowering by the government

Background

- The decision of scrapping 86% of the currency in circulation was mostly welcomed due to its advertisement as ‘a move to remove black money and counterfeit notes from the economy.’

- However, its implementation has been largely criticised, the poor and the lower class of the society found themselves devoid of cash, affecting the agriculture and MSMEs the most, lack of financial inclusion through bank linakages etc.

- Two months after such a policy decision, the autonomy of the central bank of India — the Reserve Bank of India — was touted to be compromisedas it supported the government’s decision.

The loss of autonomy?

- The initial suggestion to demonetize Rs. 1,000 and Rs. 500 currency notes came from the government. It then advised RBI to take the call on demonetization and the RBI board signed off on it before the public announcement. Thereafter, RBI came under lot of flak by accepting government’s decision of demonetisation.

- Its role in the decision making process and its preparedness came under question with the central bank putting out at least 60 notifications in the first 50 days, some often reversing earlier decisions.

- Later, there was protest from the RBI Union on operational “mismanagement” in the exercise and Government impinging its autonomy by appointing an official for currency coordination.They mentioned RBI Act 1934 which empowers RBI to regulate the issue of bank notes and hence needs no interference from the government.

- This made the Ministry of finance release a statement saying“the government fully respects the independence and autonomy of the Reserve Bank of India”. The employees unions represent the masses and hence they were assured that RBI is independent.

Within limits

- Section 26(2) of the RBI Act says that on recommendation of the RBI’s central board, the government may, by notification in the Gazette of India, declare that with effect from a date specified in the notification, any series of bank notes of any denomination shall cease to be legal tender.

- Hence, when RBI Board decided forwithdrawal of Rs. 1,000 and Rs. 500 notes from the system, there was nothing illegal.

- Section 7 of the RBI Act empowers the government to give directions to the central bank governor in matters of public interest, which is what the government did with demonetisation.

- The only areas where government should be prevented from interfering are issuing a licence, investigation and setting policy rates.

Decision in public interest

- The important question which arises is that if demonetization was “necessary in the public interest”.

- As RBI was in support of the demonetisation move with the government and both believed that this decision was for the greater good of the public and the long-term gains will more than compensate for the short-term pains, there is the opinion of RBI’s independence being compromised.

- Had RBI not been convinced about the efficacy of the move, even then it couldn’t have probably stopped it as Section 7 of the Act provides that the government can “direct” the central bank.

- The debate is that had if RBI opposed government and still government would go against RBI by going ahead with demonetisation, the appearance of it being autonomous would have been upheld.

History keeps repeating

- Though demonetisation has portrayed a picture of erosion of RBI’s autonomy, the truth is that its autonomy was getting eroded before demonetisation.

- The history of central banking in India is replete with many incidences of friction between RBI and government.

- Previous RBI GovernorsY V Reddy (2003-2008) fought on more on specific issues while Subbarao (2008-2013) fought on broader policy issues.

- Many a time, the fights were downplayed as creative tensions but they were not so when they actually took place.

- Though autonomy deals with the RBI’s powers to set monetary policy rates, it has authority over debt issuance, currency issuance and regulating the banking sector.

- But in recent times, the authority is being challenged by making attempts to create a separate debt management agency, an independent payments regulator and inflation targeting framework. Few instances:

- The government planned to create sovereign wealth funds and use of foreign exchange reserves for infrastructure development.

- Earlier, finance ministry issued an ordinance empowering the finance ministry to resolve all disputes between the regulators through Financial Stability and Development Council.This was not acceptable to RBI as existence of such council shall make the public doubtful about independence of regulators.

- The central bank and finance ministries had lot of duel wrt to interest rates.

- RBI has also resisted government pressure on making the central bank’s staff regulations statutory in character.Currently, the staff regulations are governed by the RBI’s administrative decisions but once they become statutory, the approval of the government would be mandatory.

Conclusion

RBI and Ministry of Finance have debated over several issues. Such debates were restricted to certain segments of economy and they did not have the kind of impact on entire nation of 1.3 billion people which demonetisation envisages to have.

Had RBI not a supporter of demonetisation and still had to go ahead with it, it would have been a different perspective of fighting to maintain autonomy. But if RBI is convinced of demonetisation’s success, there shouldn’t be doubts on its autonomy. There can be instances when RBI and government can be on same page, for sake of public interest. Can’t it be?

Connecting the dots:

- What do you understand by ‘RBI’s autonomy being compromised’? Substantiate your answer with suitable examples.

ECONOMY

TOPIC: General Studies 3

- Indian Economy and issues relating to planning, mobilization of resources, growth, development and employment.

- Effects of liberalization on the economy, changes in industrial policy and their effects on industrial growth.

Reforms in India’s Foreign Trade Policy

Introduction

The global economy is undergoing a major transition whether it is from the point of view of the producer or the consumer. This major change is occurring due to the rapid technological and socio-economic changes that are occurring. Technological changes have led to major innovations and faster obsolescence of existing products. Earlier, the developing economies had more time to adapt and evolve with the changes in the environment. However, the availability of time is a luxury nowadays which is not easily available.

Consumers are defining consumption patterns globally and owing to their technological literacy skills, they are able to adapt to the new products and technologies at a rapid rate. As a result of the above changes and use of artificial intelligence in production processes, there is need for the emerging economies to reorient their trade policies in a manner that keeps pace with this quick evolution.

India’s Trade Policy – Problems

- India’s trade policy has a major limitation wherein it focuses on incentivising businesses after exports have taken place. As a result the trade promotion incentives do not target emerging firms to attain export competitiveness but reward already successful exporters to improve their margins.

- The trade policy does not have provisions for interventions focussing on value-addition and employment generation. This implies that the policy is not working on long term structural measures but more towards short term result oriented measures which are not sustainable in the long run.

- Trade promotion is still restricted to traditional trade fair type activities. No doubt that these activities are important for promotion and business development, but a change of approach is required in this age of growing internet and mobile technology which requires activities to be more network oriented.

- Absence of institutions which can provide support for new product development and their placement in the global market in a selfless manner. These institutions can be used for ancillary activities such as development of prototypes, research and development etc.

- India’s trade policy also suffers from an archaic design. The trade policy and negotiations over emphasis on tariffs which are not very important for market access gains. Trade today is guided by various other factors such as technical and quality standards.

- India has not been successful in tapping the potential that the huge domestic markets and the economies of scale offer to attract foreign direct investment and technology transfers. This is observed based on trends which show that MNCs attracted by the size of the Indian consumer base often do not expand operations in India.

- Investors have to face a combination of high transaction and input costs, supply-side constraints, and infrastructure deficits which is a major obstacle in setting up and operations of industries. As a result international investors also show reluctance in setting up and expanding business in India.

Reforms in India’s Trade Policy

India has to overcome the existing limitations in the trade policy. Simultaneously it also has to gear up for the upcoming changes in technology and socio economic setup to meet the rapidly evolving needs and demands of consumers and producers India needs to bring changes as suggested below.

- India should restructure in a manner where it is able to move human resources and capital from under-performing or dying sectors and re-employ them in more competitive activities.

- The trade policy should be on which adequately rewards value-addition and promotes employment in more productive sectors.

- To match the pace of changes taking place, India should promote investment in innovation and new product development and also help such products find a global market.

- Fair market access for Indian products subject to stringent technological and quality standards in global markets is also essential.

- The huge Indian markets and the domestic economies of scale that they offer should be tapped efficiently to attract FDI in productive sectors.

- Indian firms should be assisted and aided to be able to meet the quality and technical standards defined by government regulators or as a result of the competition in the market. Trade agreements and other institutional solutions can be used to reduce the cost of complying with these standards. This will also help in empowerment of the Small and Medium Enterprises (SME).

Conclusion

The challenges posed by changes in technology and global consumer preferences are changing the pattern of FDI-led outsourcing and reducing the future FDI-led export growth.

The governments measures in areas of administrative changes through ease of doing business reforms and infrastructure development might help in reviving the potential of FDI in economic growth.

A review of the overall trade strategy is the need of the hour for India. The changes have to be made in terms of trade promotion schemes and activities and the design of trade agreements and negotiating priorities. These measures will determine India’s ability to undertake structural change and push for longer-term competitiveness.

Connecting the dots

- Consumer preferences and production techniques are undergoing a major change in the recent times. Discuss how these changes are impacting the trade patterns and how India needs to restructure its trade policy in the light of these changes.

MUST READ

Drowned by state failure

Smoking e-cigarettes is injurious to health

From plate to plough: Growth amidst gloom

Crack the cocoon

Your not-so-secret ballot

Water as a force for peace

Turning taxpayers into customers

The misery buried under agri data

MINDMAPS

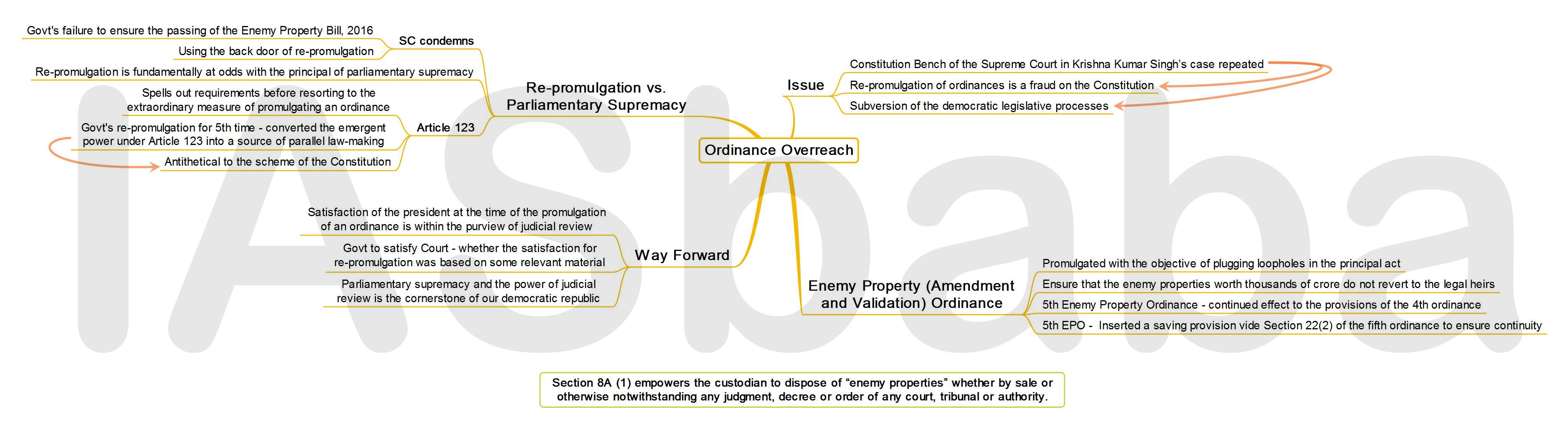

Ordinance Overreach