All India Radio

PM Garib Kalyan Yojana, 2016

Search 18th December 2016 http://www.newsonair.com/Main_Audio_Bulletins_Search.aspx

TOPIC: General Studies 2

- Government policies and interventions for development in various sectors and issues arising out of their design and implementation.

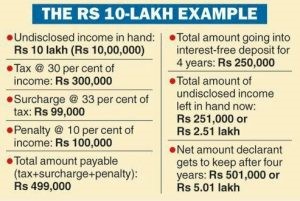

Government came out with PM Garib Kalyan Yojana where black money can be declared to government at 50% tax rate (30% tax, 10% penalty and 33% Pradhan Mantri Garib Kalyan cess on tax). 25% of the declared income will be locked in for four years under PMGKY and given back without any interest on it.

Key features

- income declared under it will not be included in the total income of the declarant under the Income-tax (IT) Act

- Declarations made under it will be kept confidential and shall not be admissible as evidence under any Act (ex. Wealth-tax Act, Central Excise Act, Companies Act etc.)

- But, declarant will have no immunity under Criminal Acts mentioned in section 199-O of the Scheme.

- Not declaring undisclosed income under the PMGKY will attract a fine of 77.25% if the income is shown in tax returns.

Picture Credit: https://www.bemoneyaware.com/blog/wp-content/uploads/2016/12/Pradhan-Mantri-Garib-Kalyan-Yojana-example.jpg

PMGKY is another opportunity to declare the black money and convert it into white after initiation of Income Declaration Scheme (IDS).

- IDS offered a four-month window to make declaration till September 30 where the first instalment of 25% tax was to be paid by November 2016 and taxpayers were allowed to make the payment for tax and penalty in three instalments by September 30, 2017.

- Under this scheme, more than 64000 people did income declaration and government got Rs. 65000 cr.

This shows that government is serious about tackling black money and is providing people opportunity to disclose it with minimum punishment.

Why PMGKY?

Demonetisation is a good measure to unearth black money as most of it was in form of Rs. 500 and Rs. 1000. It was hoped that with demonetisation, more such income will be declared after IDS. However, the reality was different. Various money laundering activities were observed during the initial period of demonetisation. People were depositing their black money in others’ bank accounts, converting money into gold etc. People became scared that if they come out on their own with bulk of their demonetised notes, they may face criminal penalties.

Hence, keeping such sentiments in mind, government gave another opportunity to disclose income and be a part of progressive India.

However, government has observed that hoarding of new currency could not be stopped and also, reports of fake currencies have emerged from few pockets. Thus it might not be possible to completely do away with black money being generated and imported.

Tax rates

The income disclosure schemes have higher rates than normal income tax. They also add additional revenues to the government in a fiscal year. But, nowhere a person honestly paying taxes should feel that he is not in an advantageous position by paying regular taxes. Thus, whenever such income disclosure schemes are brought up, it should be noted that the highest tax rate is 30% and penalised tax rate is 50% so that honest don’t start dissuading tax.

Hence, the tax rates are not high if they are paid honestly.

How to stop black money generation?

- Many believe that tax evasion started when taxes were very high as 98%. So they started evading taxes by not disclosing income. But, as and when there are less tax rates, there is more compliance seen and felt that doesn’t cost much to be a part of system. So, tax rates should be kept low and be wide based.

- People should not feel incentivised through such income disclosure schemes. Every time government brings out attractive, medium tax rate punishments on black money, people don’t feel penalised and hence they continue to evade taxes by waiting for more lucrative scheme to be announced!

Conclusion

Many people have misused Jan Dhan Accounts and siphoned off money in illegal ways. They all are being monitored under IT scanner. Those caught foe depositing money in other people’s account illegally will be charged under money laundering act and face jail term.

The money collected under PMGKY will be invested in rural infrastructure including roads, electricity etc. it is important to bring rural India in foreground and make it part of inclusive growth. The 2011 census says that 6.4 lakh villages need better roads, electricity, healthcare, education etc. to bring in development. It is for the first time in 70years that government has thought of putting tax structure for rural development. Schemes like PM Swarojgar Yojana, Gram Sadak Yojana also get a boost with money coming from such scheme.

Thus, the developments in rural India will connect it to latest developments of urban India and make advancement in health, education, IT more reachable to them.

The citizens should consider paying taxes as their fundamental duty and be a part of developing India and reduce gap between urban and rural India.

Connecting the dots:

- What is PM Garib Kalyan Yojana? Does it contribute in development of rural economy