IASbaba's Daily Current Affairs Analysis

IASbaba’s Daily Current Affairs (Prelims + Mains Focus)- 1st February 2018

Archives

(PRELIMS+MAINS FOCUS)

Allahabad High Court judge Shukla to be impeached

Part of: (Mains and Prelims) General Studies- II: Governance and Polity

In News:

Chief Justice of India Dipak Misra recommended the removal of Justice Shri Narayan Shukla of the Allahabad High Court.

- A three-judge panel examined the role of Justice SN Shukla in the medical admissions scam. In their report to the Chief Justice of India, the panel recommended the judge’s removal after he refused to step down.

- The role of Justice Shukla came under scanner after he permitted a private medical college to admit students despite a government ban.

Understanding Basics: (Important for Prelims)

Removal of High Court Judge

- A judge of a high court can be removed from his office by an order of the President.

- The President can issue the removal order only after an address by the Parliament has been presented to him in the same session for such removal.

- The address must be supported by a special majority of each House of Parliament (i.e., a majority of the total membership of that House and majority of not less than two-thirds of the members of that House present and voting).

- The grounds of removal are two—proved misbehaviour or incapacity.

Thus, a judge of a high court can be removed in the same manner and on the same grounds as a judge of the Supreme Court.

Do you know?

The procedure relating to the removal of a judge of the High Court by the process of impeachment is regulated by The Judges Enquiry Act (1968).

- A removal motion should be signed by 100 members (in the case of Lok Sabha) or 50 members (in the case of Rajya Sabha) and it is to be given to the Speaker/Chairman.

- The Speaker/Chairman may admit the motion or refuse to admit it.

- If it is admitted, then the Speaker/Chairman is to constitute a three-member committee to investigate into the charges.

- The committee should consist of

- the chief justice or a judge of the Supreme Court,

- a chief justice of a high court, and

- a distinguished jurist.

- The committee should consist of

- If the committee finds the judge to be guilty of misbehaviour or suffering from an incapacity, the House can take up the consideration of the motion.

- After the motion is passed by each House of Parliament by special majority, an address is presented to the president for removal of the judge.

- Finally, the president passes an order removing the judge.

It is interesting to know that no judge of a high court has been impeached so far.

Things to do:

- Know the appointment of judges of High Court and Supreme Court and related articles (Refer Indian Polity by Laxmikant or D.D.Basu)

Article link: http://www.thehindu.com/news/national/allahabad-high-court-judge-shukla-to-be-impeached/article22598457.ece

’Supermoon Trilogy’: Super Blue Blood Moon

Part of: General Studies- I and III: Space; Science and Technology

In News:

- January 31 witnessed a rare three lunar phenomenon: A supermoon, a blue moon and a blood moon.

- This was the first time all three events occurred simultaneously since 1866 – more than 150 years ago.

- This phenomenon was visible in large parts of the US, north-eastern Europe, Russia, Asia, the Indian Ocean, the Pacific, and Australia.

Pic link: https://d39gegkjaqduz9.cloudfront.net/TH/2018/02/01/CNI/Chennai/TH/5_01/205bf5bf_b7b57471_1_mr.jpg

Do you know?

- The next blue moon total lunar eclipse won’t be until December 31, 2028, according to NASA.

Terms explained: (Important for Prelims and Mains)

Blue moon, supermoon and blood moon coincided on a total lunar eclipse day, also called “Chandra Grahan”.

Lunar eclipse

- The lunar eclipse is a phenomenon that occurs when the Earth, moon and sun are in perfect alignment, blanketing the moon in the Earth’s shadow.

- In total lunar eclipse, the direct sunlight is completely blocked by the earth’s shadow.

Blue Moon

- “Blue Moon” is the term used when a second full moon in a calendar month. Jan 31 witnessed first lunar eclipse of the year and had second full moon in the month. This is called “Blue Moon”. In addition, the moon will appear crimson in colour.

Blood Moon

- During total lunar eclipse, when the moon gets shadowed by earth, the sunlight passes through the earth’s atmosphere and breaks down. The red part of the sunlight gets least refracted, giving moon the tinge of orangish red. This is called “Blood Moon”.

Supermoon

- When the eclipse happened, the moon was close to earth by 60,000 km against the average distance between the moon and the earth. The moon appeared brighter and bigger. This is called “supermoon”.

INS Karanj boosts Navy’s firepower

Part of: (Prelims) Defence, Security

Key pointers:

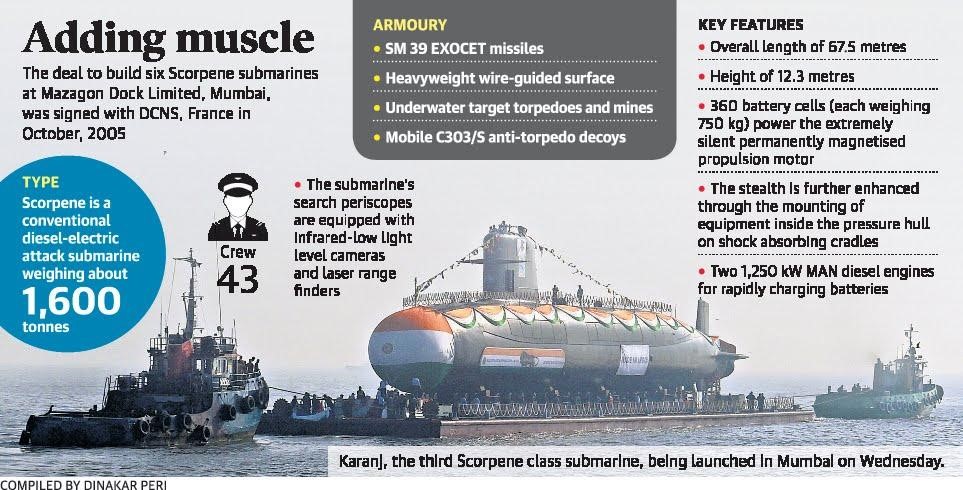

- INS Karanj, Navy’s third state-of-the-art Scorpene class submarine was launched recently.

- The new submarine is named after the earlier Kalvari class INS Karanj, which was decommissioned in 2003.

- Earlier launches – two Scorpene submarines — INS Kalavari and INS Khanderi.

- Pending launches – remaining three submarines — Vela, Vagir and Vagsheer.

Link: https://d39gegkjaqduz9.cloudfront.net/TH/2018/02/01/CNI/Chennai/TH/5_09/abb62ae0_1849643_101_mr.jpg

Do you know?

- Six Scorpene class submarines are being built under Project 75 by the Mazagon Dock Shipbuilders Limited (MDSL), Mumbai.

- India and France collaboration ($3.75 billion technology transfer)

- Programme has been delayed by four years due to construction delays.

- The Scorpene class is the Navy’s first modern conventional submarine series in almost two decades, since INS Sindhushastra was procured from Russia in July 2000.

- The entire project is expected to be completed by 2020.

Things to do:

- Know about Project 75

- Basic specs of all 6 Scorpene class submarines

Article link: Click here

(MAINS FOCUS)

NATIONAL/SECURITY

TOPIC: General Studies 2 and 3:

- Government policies and interventions for development in various sectors and issues arising out of their design and implementation.

- Welfare schemes for vulnerable sections of the population by the Centre and States and the performance of these schemes.

- Aadhar and related security issues; Right to Privacy.

Aadhar: Good, Bad And Ugly?

Introduction:

From food rations to marriage certificates, entrance exams to train ticket concessions, mobile phone cards to banking, Indians are now being asked to produce a 12-digit Aadhaar number to access both government and private sector services.

India’s Unique Identification project is the world’s largest biometrics-based identity programme. Initially, the project had a limited aim – to stop theft and pilferage from India’s social welfare programmes by correctly identifying the beneficiaries using their biometrics. But now, the use of Aadhaar is expanding into newer areas, including business applications.

The below article makes a quick comparison between India’s Aadhar and US’s Social Security Number (SSN)

US’s Social Security Number (SSN)

The United States enacted the landmark Social Security Act in 1935, giving birth to the Social Security Number (SSN).

When the Act was introduced, American conservatives of the 1930s criticized the initiative, declaring – “Never in the history of the world has any measure been brought in here so insidiously designed as to prevent business recovery, to enslave workers, and … opens the door and invites the entrance into a political field of a power so vast, so powerful, as to threaten the integrity of our institutions….”

Christian fundamentalists joined the crusade by proclaiming that SSN was the very Mark of the Beast prophesied in Revelation 13:17: “…no man might buy or sell, save he that had the mark, or the name of the beast, or the number of his name.”

Crux:

- Even when the US introduced SSN, there were intense debates whether the Act was highly contentious.

- Conservatives were involved in actions of deliberately arousing public fear or alarm about harmful impacts of SSN.

- However, they failed to impress the American public and Social Security was introduced.

Over the years Social Security and its counterpart, Medicare, have become the only safety nets for a majority of America’s elderly. SSN has been overused for purposes that it was not intended for.

There are many instances of leakage of information linked to it, nonetheless it continues to be the backbone of citizen interactions with the state. None has come up with a better alternative.

India’s scenario:

Eighty-three years later, i.e. today, Indian activists opposing Aadhaar can be compared with that of American conservatives of the 1930s.

There are arguments like: “Aadhaar tends to terrorise citizens with the country becoming a totalitarian regime; ” and “it is a ‘giant electronic mesh’ and will turn the country ‘into a surveillance state.”

However, there is one important difference: The opposition to Social Security was informed by right-wing ideology, which saw it as the harbinger of socialism and an existential threat to America’s capitalist enterprise.

In stark contrast, the movement against Aadhaar is led by a small group of Left-leaning activists, who are well known for advocating more and more government in people’s lives (the public distribution system, rural employment guarantee, food security, and so on), but who are now arguing in the same breath for the citizens’ right to be left alone.

The biometric difference

There is another crucial difference between the SSN and Aadhaar: biometrics.

Critics argue that – Unlike other personal information that one can change at will to protect one’s privacy, one can’t change one’s fingerprints.

However, one of the learned Supreme Court justices observed recently, Google and other social media, mobile operators, and our own voter lists have a lot more immediately damaging personal information that one has no real control over. (Have you ever tried to delete highly personal and sometimes libellous information that show up when you Google your own name?)

Another Justice observed –

“So Indian’s who wholeheartedly link ID’s like SSN to everything in foreign countries and give all kind of Bio metrics to obtain visa’s of many countries without caring about their personal information being compromised and protesting in their own country against this strong anti corruption move. So is it like some fractions of Indians want India to remain corrupt and at the same time, blame India from Developed country that India is Corrupt??”

Besides, none of the examples of Aadhaar data breaches that have been reported involves fingerprints or iris scans. So, the argument that biometrics somehow make a more compelling case against Aadhaar simply does not hold water.

In fact, in a nation with the world’s largest safety net programmes, historically largest levels of leakages, and systemic fraud in every past ID programme, it is indeed the biometrics that bring credibility to Aadhaar as a national ID.

So, what is the future?

On the one side, we have a well-organised group of anti-Aadhaar activists who can take full credit for catapulting the privacy debate on to the national stage, but who have not offered a single viable alternative tool to better administer the nation’s massive subsidy regime.

On the other side, we have a government at the Centre whose party opposed Aadhaar prior to the elections, but upon taking over the reins quickly realised the power of a single national ID in effectively administering welfare schemes; and which has been much more internally unified than the previous government in its determination to make the best use of Aadhaar.

And we have the UIDAI, which has consistently shown its seriousness in addressing data security and privacy issues; is poised to add more layers of security, such as virtual Aadhaar ids; is taking an active part in crafting a national data privacy law.

In the middle is the Supreme Court, now hearing detailed arguments from both sides, trying to deliberate where the nation should draw the line between personal privacy and the national interest.

Conclusion:

Mandating Aadhaar for all government schemes and subsidies, and allowing it as a tool to prevent money laundering and terrorism are the most logical places to draw that line.

And, lighting the fire under the government to quickly enact a comprehensive national data privacy law, which enshrines internationally accepted principles of privacy, must be the citizens’ insurance policy to prevent mass surveillance and other excessive use of Aadhaar, like in the case of the SSN – should be the next immediate action.

PS: (The above article has less content to directly pick for Mains but will help to have different dimensions and assessment, comparing Aadhar with US’s SSN)

Connecting the dots:

- Are privacy concerns over Aadhar valid? Critically examine.

- Should Aadhaar be made compulsory for availing the benefits of government schemes? Examine in the light of the recent SC judgement in this regard.

ECONOMY

TOPIC: General Studies 2 and 3:

- Government policies and interventions for development in various sectors and issues arising out of their design and implementation.

- Indian Economy and issues relating to planning, mobilization of resources, growth, development and employment.

Payments Bank: Making it a success

Background:

In late 2015, when the Reserve Bank of India gave ‘in principle’ approval to 11 companies to form what we call payments bank.

The model was hailed as a game-changer as it was meant to deepen access to formal financial services in unbanked and under-banked areas and further the agenda of financial inclusion for all.

Two years down the line, the model is attracting severe criticism from all corners, questioning the very feasibility of the model. Recently, India’s first payments bank was charged with opening accounts without requisite approvals and custom consent as well as reporting losses for 2016-17.

What is Payments Bank?

A payments bank is like any other bank, but it operates on a smaller scale without involving any credit risk.

It can carry out most banking operations but can’t advance loans or issue credit cards.

It can accept demand deposits (up to Rs 1 lakh), offer remittance services, mobile payments/transfers/purchases and other banking services like ATM/debit cards, net banking and third-party fund transfers.

Financial Inclusion still a challenge:

- The idea of financial inclusion, particularly in developing markets, has always met with challenges pertaining to accessibility and affordability.

- The RBI and the Government have tackled these challenges in numerous ways and have made substantial progress.

- But problems remain in reaching out to those who are most vulnerable, namely, the illiterate, low-income and rural population.

- As of 2017, 37 per cent of the Indian adult population remain excluded from the formal financial system; 21 per cent of those included do not actively use their bank accounts.

The idea of payments banks:

The goal was to broaden the reach of payments and other financial services to small businesses, low-income households and vulnerable populations.

The USP was the fact that people could open a bank account almost at their doorsteps with the help of an agent, could make transactions using their phones and had the facility to make deposits of up to Rs. 1 lakh.

On the face of it, the model was a win-win for both consumers and financial service providers, thereby tackling the problems of accessibility and affordability.

Issues:

There are multiple issues the payments bank is facing-

- Little awareness about the model among last mile consumers.

- Dearth of incentives among last mile agents to promote the product and services of a payment bank.

- Agents reported lack of administrative and technical support from the payment banks, and limited training on the features of the product, terms and conditions and its benefits.

- In terms of the levels of awareness, both the last mile customers and the agents seemed to know little about the product and did not have an understanding of the uses of the product, leading to low consumer awareness and subsequent low demand for the product.

Way forward:

Payment banks need to intensify their efforts and try different approaches.

- There is significant potential for the product to expand into rural areas, given the low density of bank branches and ATMs in these geographies.

- So, payment banks need to heavily invest in marketing, especially in rural areas.

- Compensate agents substantially — ideally, above and beyond the commission-based compensation structure — to motivate them to spend time with customers in explaining the benefits of the product.

- Payment banks need to explain the features and uses of the product to their agents such that they can effectively transfer this knowledge to the consumer.

- Currently, agents themselves do not seem sufficiently familiar with the product features.

- Empowering retail agents- There needs to be more involvement by payment banks throughout every part of the process.

- Payment banks must take a holistic approach, investing heavily in agent training and handholding their agents in the short run to reap longer-term benefits.

- Agents, in turn, must also provide continued support to customers in terms of assisting them in the uses of the product and resolving problems.

Conclusion:

A one-time introduction is not likely to be enough for payments bank. Adequate steps must be taken to make it a success.

Connecting the dots:

- What are payments bank? How far has the model been successful in deepening financial inclusion in India? Discuss.

- Recent surveys and news report that Payments bank aren’t functioning as was supposed to be. Discuss the reasons. Also suggest measures to make it a success.

MUST READ

For a clean judiciary

The de-urbanization of India’s manufacturing

The rot in higher education is deep and wide

Catalysing science