IASbaba's Daily Current Affairs Analysis

IAS UPSC Prelims and Mains Exam – 19th December 2019

Archives

(PRELIMS + MAINS FOCUS)

National Company Law Appellate Tribunal (NCLAT): ReinstatesCyrus Mistry as Tata Sons Chairman

Part of: GS Prelims and GS Mains II – Polity; GS –III – Corporate Governance

In News

- NCLAT along with reinstating Cyrus Mistry (who was removed by the Board of Tata Sons) as Chairman of Tata Sons, also ordered to Tata Sons to go back from ‘private company’ to ‘public company’

Value Addition: About NCLAT

- NCLAT was constituted under Section 410 of the Companies Act, 2013.

- NCLAT is the Appellate Tribunal for hearing appeals against the orders passed by –

-

- National Company Law Tribunal(s) NCLT(s) under Section 61 of the Insolvency and Bankruptcy Code, 2016 (IBC)

- Insolvency and Bankruptcy Board of India (IBBI) under Section 202 and Section 211 of IBC.

- Competition Commission of India (CCI) – as per the amendment brought to Section 410 of the Companies Act, 2013

GST Council: Votes for first time to tax all lotteries at 28%

Part of: GS Prelims and GS Mains III – Economy; GS-II- Federalism

In News

- GST Council broke its tradition of taking decision by consensus and for first time voted for a proposal to tax all lotteries at a uniform rate at 28% (21-7 in favour)

Do You Know?

- In the first eight months of this financial year, only about 50% of GST collection targets (₹6,63,343 crore) and 60% of compensation cess collection targets have been achieved.

- The GST Council is a constitutional body established under Article 279A of Indian Constitution

- The GST Council is chaired by the Union Finance Minister.

- Its other members are the Union State Minister of Revenue or Finance and Ministers in-charge of Finance or Taxation of all the States.

- Voting Rights

- Centre: One third of total votes cast

- States: Two-thirds of the total votes cast (Each state, big or small, will have equal vote)

- For any proposal to be cleared by the council, it has to get 75 per cent of the vote.

Mahadayi Project: Goa gets relief

Part of: GS Prelims and GS Mains II- Federalism

In News

- Union Environment Ministry kept in suspension its letter issued to Karnataka which had stated no environmental clearance was required for Kalasa Banduri Project.

About Kalasa Banduri project

- The project involves diverting water from Mahadayi river, the lifeline of Goa, into the Malaprabha river.

- The Kalasa Banduri project is aimed at providing drinking water to three important districts of north Karnataka — Belagavi, Gadag and Dharwad — which go parched in summer due to acute water scarcity.

- Mahadayi river originates from a cluster of 30 springs at Bhimgad in the Western Ghats in the Belgaum district of Karnataka. Then it enters Goa and finally drains in Arabian sea.

- Goa state capital Panaji lies on the banks of Mandovi

- Mahadayi Water Tribunal (MWT) Award in 2018:Karnataka has been allocated 13.5tmcft of water, Goa has been 24tmcft while Maharashtra has been allocated 1.3tmcft.

Sahitya Academy: Shashi Tharoor wins Akademi’s 2019 award for English

Part of: GS Prelims and GS-I – Culture

In News

- Sahitya Akademi award established in 1954, is a literary honour that is conferred annually by Sahitya Akademi, India’s National Academy of letters.

- Award is presented to the most outstanding books of literary merit published in any of the twenty-four major Indian languages recognized by the Akademi (including English).

- Sahitya Akademi award is the second highest literary honour by the Government of India, after Jananpith award.

- The Award in the form of an engraved copper-plaque, and cash prize of Rs. 1,00,000/-

- The author must be of Indian Nationality.Indian film-maker Satyajit Ray is the designer of the plaque awarded by the Sahitya Akademi.

Joint River Commission: Bangladesh gives a miss

Part of: GS Prelims and GS-II- International Affairs

In News

- Bangladesh has not sent a delegation for the Joint River Commission (JRC) meeting with India which casts doubt over progress of Feni river water sharing agreement

- Bangladesh had agreed to let India withdraw 1.82 cusecs from the Feni river to supply the border town of Sabroom in the northeastern State of Tripurafor drinking water purposes

- Feni River is a trans-boundary river that originates in Tripura and flows through Sabroom town and then enters Bangladesh.

(MAINS FOCUS)

ECONOMY

TOPIC: General Studies 3:

- Indian Economy and issues relating to planning, mobilization of resources, growth, development and employment.

Indian economy is losing its growth momentum (Part 2)

Daily Current Affairs IAS | UPSC Prelims and Mains Exam – 19th December 2019

Before reading this read part 1 : Link

| GDP = C + G + I + (NX)

In other words, four drivers determine a country’s GDP. These are: C – the total expenditure (demand) by private individuals G – the total expenditure (demand) by the Government I – the total expenditure (demand) on investments made businesses in the country NX – the net effect of imports and exports |

Derailed Indian economy in 2016 and 2017

| Two reasons & 4 Balance sheets problem

1. The unresolved TBS problem 2. The fall of NBFCs and the real estate sector Together, they make for the Four Balance Sheet Challenge for the Indian economy |

Reason for the failure of NBFCs : collapse of ILFS in 2018, with Rs 90,000 crores of debt

Reason 1 : NBFCs relied on raising short-term funds ,This leads to a situation called an asset-liability mismatch. For example, an NBFC raises money by selling 6-month debt papers and on-lends this as a car loan with a tenure of 5 years. This leads to a situation where the NBFC has to roll over (or renew) the 6-month debt paper or raise fresh loans to repay the debt paper. In good times, this happens as a matter of course. But when times are tough, this cycle is broken.

Reason 2 : The cycle was broken by a default of some firms of the IL&FS group. There were fears that this would turn out to be a contagion. Simply put, banks, mutual funds and their investors were afraid that more such entities wouldn’t default. As this fear took hold, many institutions refused to give money to NBFCs. The cost of funds rose by as much as 150 basis points for NBFCs.

Impacts of the NBFCs Failure on Indian economy :

- NBFCs are playing an increasingly important part in the economy. Their share of credit has increased because they were lending in sectors where banks refused to go or did not want to go.

- Now that NBFCs are finding it difficult to raise money or having to pay a huge cost for doing so, this will choke the flow of credit to the economy.

- It will hit the MSME sector which is already suffering from the twin blows of demonetisation and the goods and services tax.

- It will hit consumption demand in the economy( consumption was the primary engine driving the economy).

- A reduction in credit further adds to economic slowdown pressures, which are already visible.

- Slowdown in credit could lead to another pile of non-performing assets in sectors such as commercial real estate and infrastructure, which could have economy-wide knockdown effects

Real estate story:

- Builders launched numerous projects since the start of mid-2000s in the hope that these flats would be sold

- But after the Global Financial Crisis, the demand for flats as well as bank funding for builders collapsed.

- The NBFCs took the lead in lending to the real estate sector.

- By June-end 2019, the real estate sector reached a breaking point with close to 10 lakh unsold units (as against an annual demand of just 2 lakh units) in just the top 8 cities in the country.

- Real estate sector was unable to pay back to the NBFCs , which, in turn, started defaulting.

Conclusion:

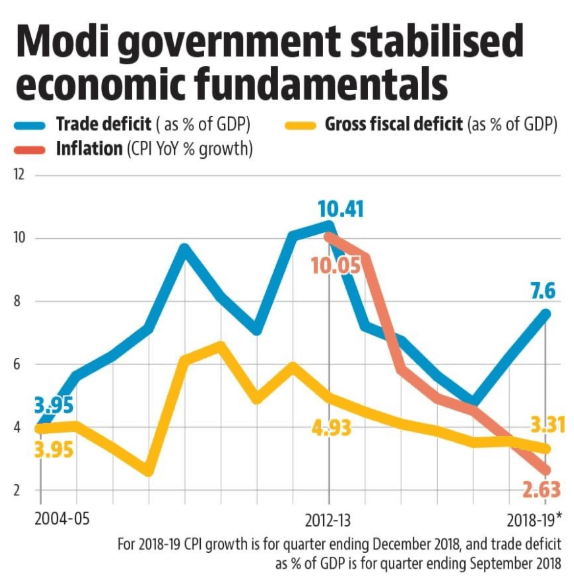

- India’s GDP has been affected by different factors at different times.

- After Global Financial Crisis, private consumption bailed India out. However, this component – “C” – has become progressively weaker since 2017 and is today the main worry.

- G or government spending bailed out the GDP but at the cost of hiding the true fiscal deficit.

- The “I” or business investment component has been weak since the GFC

- sharp repo rate cuts and corporate tax cuts appear ineffective in the short term.

- The net exports or “NX” component has remained weak all through since the GFC

Connecting the dots:

- Do you think Demonetisation and GST contributed to Indian Economic distress?

- How do you think Indian economy can be recovered from the distress?

POLITY

TOPIC: General Studies 2:

- Important aspects of governance, transparency and accountability, e governance- applications, models, successes, limitations, and potential; citizens charters, transparency & accountability and institutional and other measures.

Right to information: ‘Abuse’ of RTI

Daily Current Affairs IAS | UPSC Prelims and Mains Exam – 19th December 2019

Context:

- Chief Justice of India said the unbridled use of the Right to Information (RTI) Act had created a sense of “paralysis and fear” in the government.

- Paralysis and fear about this Act (RTI). People are not taking decisions

- CJI said time had come to lay down guidelines on the use of the RTI. Guidelines should be put in place to check the locus of the RTI applicant and put a “filter” on the kind of requests made under the 2005 Act.

| Justice Bobde said :

The court was not against the exercise of the right to information. “But it cannot be an unrivalled right. There is the serious problem of people filing RTI requests with malafide intentions, people set up by rivals,” he said. The RTI Act had become a source of criminal intimidation by people with an axe to grind. “Criminal intimidation is a nice word for ‘blackmail’,” Justice Bobde said. |

Genesis of RTI:

- 1975, in State of Uttar Pradesh vs Raj Narain “The people of this country have a right to know every public act, everything that is done in a public way by their public functionaries. They are entitled to know the particulars of every public transaction in all its bearing. Their right to know, which is derived from the concept of freedom of speech, though not absolute, is a factor which should make one wary when secrecy is claimed for transactions which can at any rate have no repercussion on public security.”

- It observed, “Voters’ (little man-citizens’) right to know antecedents including criminal past of his candidate contesting election for MP or MLA is much more fundamental and basic for survival of democracy.

RTI Act

- An applicant making request for information shall not be required to give any reason for requesting the information or any other personal details except those that may be necessary for contacting him.

- “The information which cannot be denied to the Parliament or a State Legislature shall not be denied to any person ”Bhagat Singh vs CIC in 2007, then Delhi High Court Justice Ravindra Bhat (now a Supreme Court judge) observed: “Access to information, under Section 3 of the Act, is the rule and exemptions under Section 8, the exception.

- Section 8 being a restriction on this fundamental right, must therefore be strictly construed. It should not be interpreted in manner as to shadow the very right itself.”

SC Judgements:

Jayantilal N Mistry vs Reserve Bank of India

|

DAV College Trust and Managin vs Director of Public Instructions

|

Central Board of Secondary Education (CBSE) & Anr vs Aditya Bandhopadhyay and Others in 2011

SC : “The nation does not want a scenario where 75% of the staff of public authorities spends 75% of their time in collecting and furnishing information to applicants instead of discharging their regular duties” |

Girish Ramchandra Deshpande vs Central Information Commission & Ors in October 2012

|

Conclusion:

- A Transparency Audit report submitted to the Central Information Commission (CIC) in November 2018 sought feedback from 2,092 PAs under the CIC to evaluate implementation of Section 4 of the Act. Only 838 (40%) responded and even here, 35% of the PAs fared poorly with little transparency in parameters such as organisation and functions, budget and programme, e-governance, and other information disclosures.

- The other key misgiving with RTI implementation has been the persisting problem of vacancies in the CIC and State commissions — the CIC has four vacancies and 33,000 pending cases. After the top court’s directions, this lacuna should be addressed by governments quickly.

(TEST YOUR KNOWLEDGE)

Model questions: (You can now post your answers in comment section)

Note:

- Correct answers of today’s questions will be provided in next day’s DNA section. Kindly refer to it and update your answers.

- Comments Up-voted by IASbaba are also the “correct answers”.

Q.1) National Company Law Appellate Tribunal (NCLAT) can hear appeals against the orders passed by which of the following bodies?

- National Company Law Tribunals

- Competition Commission of India

- Insolvency and Bankruptcy Board of India

Select the correct answer from codes given below.

- 1 only

- 1 and 2 only

- 1 and 3 only

- 1,2 and 3

Q.2) Consider the following statements about GST Council

- GST Council is a constitutional body established under Article 279A of Indian Constitution headed by Union Finance Minister

- Centre has 25% voting power while all the States combined have 75% voting power and for any proposal to be cleared it has to get 66% per cent of the vote.

Which of the statement(s) given above is/are correct?

- 1 only

- 2 only

- Both 1 and 2

- Neither 1 nor 2

Q.3) Consider the following statements about Mahadayi River

- Goa state capital Panaji lies on the banks of this river

- The Kalasa Banduri project is planned across this river so as to provide drinking water to Northern Karnataka region

Which of the statement(s) given above is/are correct?

- Only 1

- Only 2

- Both 1 and 2

- Neither 1 nor 2

Q.4) Feni is a transboundary river between which two countries?

- India and Nepal

- India and Bhutan

- India and Pakistan

- India and Bangladesh

ANSWERS FOR 18 DEC 2019 TEST YOUR KNOWLEDGE (TYK)

| 1 | C |

| 2 | A |

| 3 | C |

| 4 | D |

| 5 | A |

MUST READ

Quick, not hasty: On Kuldeep Singh Sengar conviction

The last bastions of secular India

Trump cards in the impeachment deck

Are fears over the Citizenship (Amendment) Act misplaced?

Growth as well as a low-carbon economy

Institutional clash, not democracy, in Pak

Students who protest against discriminatory laws are real patriots. They offer hope for future

Discrimination, not justice: Hope this generation does a better job of navigating the struggle than the one that came before