UPSC Articles

ECONOMY

TOPIC:General Studies 3:

- changes in industrial policy and their effects on industrial growth

New insolvency Bill (Inslovancy and Bankruptsy Code Amendment Bill 2019)

Daily Current Affairs IAS | UPSC Prelims and Mains Exam – 13th December 2019

Context:

The Union cabinet, chaired by Prime Minister Narendra Modi, cleared amendments to the Insolvency and Bankruptcy Code (IBC)

Why Amendment?

- To ease the insolvency resolution process ( streamlining of the insolvency resolution process)

Features:

- The licenses, permits, concessions and clearances cannot be terminated or suspended during the moratorium period for the corporate debtors

- Bill seeks to protect last-mile funding to corporate debtors to prevent their insolvency, in case the company goes into corporate insolvency resolution process or liquidation.

- Successful bidders will be provided more immunity against any risk of criminal proceedings for offences committed by previous promoters of companies concerned.

- Cabinet approved Partial Credit Guarantee Scheme for purchase of high-rated pooled assets from financially sound non-banking financial companies (NBFCs) – also known as shadow banks – by state-run banks.

- Easier lending rules are aimed at enabling NBFCs to get better access to funds. NBFCs have been key drivers of lending growth in India, with their consolidated balance sheet worth Rs 28.8 lakh crore ($400 billion) in 2018-19, according to RBI data

- The bill also proposes a threshold for financial creditors to prevent frivolous triggering of corporate insolvency.( bankruptcy is not invoked for small amounts)

- Replaces laws such as the Sick Industrial Companies Act (SICA Act) and the Securitisation and Reconstruction of Financial Assets and Enforcement of Securities Interest Act (SARFAESI Act), shifting the control of recovery process to creditors from borrowers.

Esp for Real estate

- New threshold for allowing home buyers and certain category of financial creditors for initiating corporate insolvency resolution plan (CIRP).

- It has been stipulated that at least 100 home buyers or 10 per cent of home buyers in a project, whichever is lower, are required for moving an insolvency petition against real estate developer

Do you know?

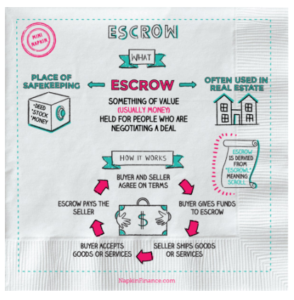

- Last mile financing: is a mode of funding normally used for unlocking projects that have come to a halt due to some reason which commonly includes cash being tied up in escrow accounts.

- Last mile financing is increasingly becoming popular as an option for developers that have exhausted other funding options towards the closing phase of a project already under-way.

Daily Current Affairs IAS | UPSC Prelims and Mains Exam – 13th December 2019

Merits:

- Approval by the cabinet to provide immunity to successful bidders under IBC is a great boost to IBC

- This is a positive and timely step and will increase confidence among prospective buyers of stressed assets

- This is expected to incentivise the provision of last mile funding to companies to prevent their insolvency, whilst at the same time provide such creditors a fall back protection of priority of payment should the company become insolvent.

- The amendments are aimed at providing more protection to bidders participating in the recovery proceedings and in turn boosting investor confidence in the country’s financial system.

- Boosts Investment in financially-distressed sectors.

- Strengthens the country’s financial sector, marred by huge bad assets and bank frauds, to support economic growth

Way forward:

- Debts that would be eligible for this priority are to be notified. Such debt will have priority of payment in both resolution and liquidation processes under the Insolvency and Bankruptcy Code.

Criticisms:

- Cross border insolvency framework did not make it to the Bill.

Conclusions:

- This will help companies that need last mile funding to access a wider pool of capital that caters to this requirement and should also enable such funding on competitive terms.

Connecting the dots:

- Do you think NBFCs have been key drivers of lending growth in India?