UPSC Articles

NBFCs to get more lending room

Part of: GS Prelims –Economy and GS-III Banking sector

In news:

- The government is debating a mechanism to get credit flowing by providing support to non-banking finance companies (NBFCs) amid a growing realisation that financial sector stress has impacted demand and stalled economic recovery.

- The options that have been deliberated ahead of the February 1 budget include a plan akin to the Troubled Asset Relief Program (TARP) that the US put in place after the subprime mortgage crisis that sparked the financial crisis of 2007-08.

From Prelims Point of view

NBFC :

- Non-Banking Financial Company (NBFC) refers to a financial institution. NBFC is a type of company engaged in the business of receiving loans and advances, acquisition of stocks or shares, leasing, hire-purchase, insurance business, chit business under Companies Act 2013.

- The main business activity of the NBFCs is to raise capital funds from public depositors and investors and then lend to borrowers as per the rules and regulations prescribed by the Reserve Bank of India.

- NBFCs are becoming alternative to the banking and financial sector.

- In NBFC there is a requirement of minimum net owned fund of Rs. 2 Crore.

Read more about NBFC here : https://iasbaba.com/2019/02/daily-current-affairs-ias-upsc-prelims-and-mains-exam-04th-february-2019/#NBFCs_and_its_significance

Troubled Asset Relief Program (TARP) :

- TARP, expanded as the Troubled Asset Relief Program was an innovative measure launched by the U.S. Treasury in order to stabilize the financial system of the country, restore the growth of economy and prevent foreclosures during the wake of the financial crisis that struck the US in 2008.

- The Troubled Asset Relief Program (TARP) is a program of the United States government to purchase toxic assets and equity from financial institutions to strengthen its financial sector

Miscellaneous Topics For Prelims

Stagflation :

Stagflation is an economic scenario where an economy faces both high inflation and low growth (and high unemployment) at the same time. (Former Prime Minister Manmohan Singh had warned about the imminent risk of stagflation facing the economy)

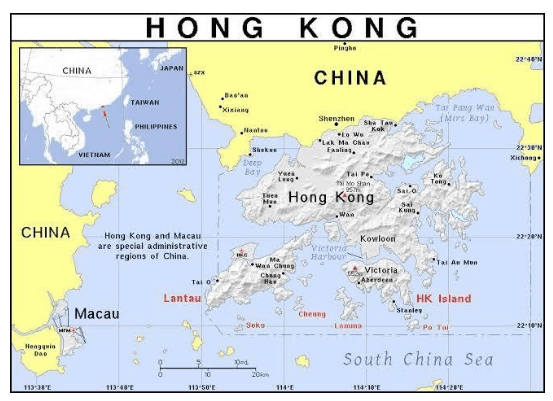

Hong Kong Crisis :

Daily Current Affairs IAS | UPSC Prelims and Mains Exam – 20th January 2020

Niranjan Bhat committee:

- The Supreme Court has, forms committee to draft mediation law

- The panel, to be headed by mediator Niranjan Bhat, will recommend a code of conduct for mediators

Gig economy

- A labour market characterized by the prevalence of short-term contracts or freelance work as opposed to permanent jobs.