UPSC Articles

ECONOMY

Topic: General Studies 3:

- Indian Economy and issues relating to planning, mobilization, of resources, growth, development and employment.

Financing the Pandemic rescue package

When COVID-19 cases began to increase, the Government of India (GoI) announced a 21-day national lockdown and a ₹1.7-lakh crore rescue package.

Challenges

- There are expectations of further such packages (aimed at businesses & middle class) and the challenges of financing these relief measures.

- Also, the financing strategy should be to raise long-term funds at cost effective rates, with flexible repayment terms.

How can government fund its relief packages?

- Utilizing the availability of unused resources in the state disaster relief fund to the tune of ₹60,000 crore

- Issuing of GDP-linked bonds

- Indian rupee denominated 25-year GDP-linked bonds that are callable from, say, the fifth year

- The interest on a GDP-linked bond is correlated to the GDP growth rate and is subject to a cap

- The issuer, the GoI, is liable to pay a lower coupon during years of slower growth and vice-versa.

- Precedence: Costa Rica, Bulgaria and Bosnia-Herzegovina issued such GDP-linked bonds in the 1990s, from whose experience India could learn

- Prerequisite: Publishing reliable and timely GDP data

- Utilizing the resources of Public Sector Enterprises(PSEs)

-

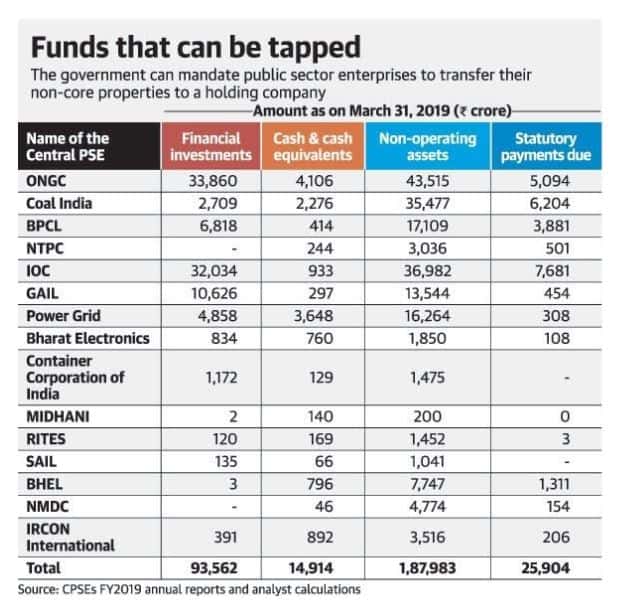

- Paying dues to GoI: The 15 largest non-financial central PSEs (CPSEs) owe the government ₹25,904 crore as of end-March 2019

- Using cash and bank deposits of these 15 CPSEs (₹64,253 crore) that is in excess of their operating requirements, to increase dividend to government

- Monetization of non-core assets of these CPSEs as they generally yield 200 basis points lower than the returns on their core businesses.

- Forming Public sector bank holding company (‘Holdco’) along the lines of Singapore’s Temasek Holdings to enable PSEs to monetise their non-core assets at remunerative prices

- Securitization of ₹30,168 crore loans that CPSEs have extended to employees, vendors and associates – to ensure that associated businesses remain liquid

Pic Source: The Hindu

Should government also tap the RBI resources?

- RBI has allocated ₹1 lakh crore to carry out long-term repo operations and has reduced the repo rates by 75 basis points to 4.4% to help banks augment their liquidity in the wake of pandemic

- Government already enjoys handsome dividends pay-outs by RBI

- During the five years ending on June 30, 2019, the RBI paid the GoI 100% of its net disposable income

- In FY2019 dividends from RBI more than trebled to ₹1.76 lakh crore from ₹50,000 crore in FY2018.

- The Bimal Jalan panel constituted in 2019 to review the RBI’s economic capital framework opined that:

- The RBI may pay interim dividends only under exceptional circumstances

- The unrealised gains in the valuation of RBI’s assets ought to be used as risk buffers against market risks and may not be paid as dividends

- Therefore, it is in India’s self-interest to allow a robust and independent RBI to defend the financial sector’s stability

Conclusion

The GoI may finance the COVID-19 rescue package by issuing GDP-linked bonds, tapping PSEs’ excess liquidity and monetising non-core assets

Connecting the dots:

- Different types of Investment Models

- Impact on the disinvestment plans of GoI