The Big Picture- RSTV, UPSC Articles

Global Markets and Economy

Archives

TOPIC: General Studies 2

- Global pandemic – COVID-19 & Global Economy

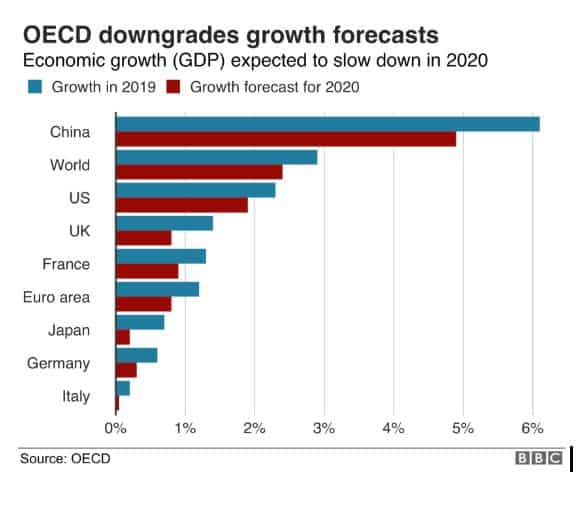

In News: The global economy that was already struggling to overcome the economic slowdown due to the trade war between US and China has received another jolt in the form of the coronavirus pandemic. The crisis in the economy has been manifested amply in the stock markets which have witnessed deep falls across the board.

The world is officially staring at a recession, economic output in June 2020 quarter is going to shrink, and growth for FY21 will be sharply lower — these will take a toll on corporate earnings as well as stock prices.

The stock and bond markets have entered a period of extreme volatility. IMF has warned that the world faces its worst recession since the Great Depression of the 1930s – but stock markets appear to be fixated on a potential recovery. IMF slashed its growth forecasts dramatically, saying it expects the global economy to shrink by 3% this year, rather than expand by 3.3% as it thought back in January.

Impact of COVID-19 on global stock markets and the economy

- Stock Markets: Big shifts in stock markets, where shares in companies are bought and sold, can affect many investments in pensions or individual savings accounts (ISAs).

- Global Companies: The FTSE, Dow Jones Industrial Average and the Nikkei have all seen huge falls since the outbreak began on 31 December. The Dow and the FTSE recently saw their biggest one day declines since 1987.

- Banking: Investors fear the spread of the coronavirus will destroy economic growth and that government action may not be enough to stop the decline.

- In response, central banks in many countries, including the United Kingdom, have slashed interest rates. That should, in theory, make borrowing cheaper and encourage spending to boost the economy.

- While banks have built up strong capital and liquidity buffers since the 2007-2009 financial crisis, the potential for a long and severe downturn will put those buffers to the test

- Global markets recovered some ground after the US Senate passed a $2 trillion (£1.7tn) coronavirus aid bill to help workers and businesses. But some analysts have warned that they could be volatile until the pandemic is contained.

- Unemployment in the United States: The number of people filing for unemployment hit a record high, signalling an end to a decade of expansion for one of the world’s largest economies.

- Real estate sector in US: Tenants are struggling to pay their landlords, and is a point of potential stress for banks who account for as much as 70% of lending to that sector.

What about the ‘less’ risky investments?

- When a crisis hits, investors often choose less risky investments. Gold is traditionally considered a “safe haven” for investment in times of uncertainty. But even the price of gold tumbled briefly in March, as investors were fearful about a global recession.

- Oil has slumped to prices not seen since June 2001. The oil price had already been affected by a row between OPEC, the group of oil producers, and Russia. Coronavirus has driven the price down further.

What is the situation in China, where the coronavirus first appeared?

- Industrial production, sales and investment all fell in the first two months of the year, compared with the same period in 2019.

- Restrictions have affected the supply chains of big companies such as industrial equipment manufacturer JCB and carmaker Nissan.

- Shops and car dealerships have all reported a fall in demand.

Note: China makes up a third of manufacturing globally, and is the world’s largest exporter of goods.

What is the situation in India?

Investor sentiment in India is so low that despite relatively lower cases, Indian market has fared worst among global peers.

- Indian stock market has lost 26 per cent in dollar terms between February 1 and April 9, compared with a fall of 20 per cent and 14 per cent in the European and US markets.

- Emerging markets, reflected by the MSCI EM index, declined 15 per cent during the same period.

- China, where the coronavirus originated, has been least affected, with just 3 per cent fall in the stock market between February 1 and April 9.

- While the US and other EMs have lost around 15% since February 1, India has eroded around 25%.

However, the RBI has expressed hope that recent monetary and fiscal measures will mitigate the impact of COVID-19 on domestic demand and spur growth once the normalcy is restored.

- Observing that it was difficult to make growth projections at this point of time, the Reserve Bank in its Monetary Policy Report said the lockdown following the outbreak of COVID-19 and expected contraction in global outlook would weigh heavily on the growth outlook.

- The RBI noted that the bumper rabi harvest and higher food prices during 2019-20 provided conducive conditions for the strengthening of rural demand, the transmission of past reductions in the policy rate to bank lending rates has been improving, and reductions in the tax rates and measures to boost rural and infrastructure spending were directed at boosting domestic demand more generally.

- The RBI further said the sharp reduction in international crude oil prices, if sustained, could improve the country’s terms of trade, but the gain from this channel is not expected to offset the drag from the shutdown and loss of external demand.

- The impact of COVID-19 on inflation is ambiguous, with a possible decline in food prices likely to be offset by potential cost-push increases in prices of non-food items due to supply disruptions.

Global Markets and Economy – The Big Picture – RSTV IAS UPSC

To mitigate Covid-19’s economic fallout, UNCTAD has proposed the following steps:

- A $1 trillion liquidity injection for those being left behind through reallocating existing special drawing rights at the International Monetary Fund

- A debt jubilee for distressed economies under which another $1 trillion dollars of debts owed by developing countries should be cancelled this year

- A $500 billion Marshall Plan for health recovery funded from some of the missing official development assistance long-promised but not delivered by development partners.

COVID-19 will continue to effect the markets, but we should all collectively remain vigilant as we navigate through this period of uncertainty together.

Note: Global Financial Stability Report is by IMF

Connecting the Dots:

- COVID-19 hangs over the future, like a spectre. Comment.

- What will the impact of COVID-19 be on India’s growth? Explain.