UPSC Articles

ECONOMY

Topic: General Studies 3:

- Indian Economy and issues relating to planning, mobilization, of resources, growth, development and employment.

- Government policies and interventions for development in various sectors.

To sustain growth, India needs fiscal stimulus

Context:

We are aware that the impact of COVID-19 will debilitate or weaken the global as well as the Indian economies.

- Various institutions have assessed India’s growth prospects for 2020-21 ranging from 0.8% (Fitch) to 4.0% (Asian Development Bank).

- IMF has projected India’s growth at 1.9%, China’s at 1.2%, and the global growth at (-) 3.0%.

India was already facing a persistent economic downslide before it slid into the novel coronavirus crisis.

- There was a sustained fall in the saving and investment rates especially with unutilised capacity in the industrial sector.

- 2019-20 Centre’s gross tax revenues also showed contraction.

All these trends would continue to trouble the Indian economy in this crisis.

2019-20 India’s economic growth

- Central Statistics Office (CSO) had estimated gross value added (GVA) growth of about 4.9% for 2019-20.

- IMF’s GDP growth estimate for 2019-20 is at 4.2%.

- However, India may show real GVA growth of 4.4% for 2019-20.

India’s growth prospects for 2020-21

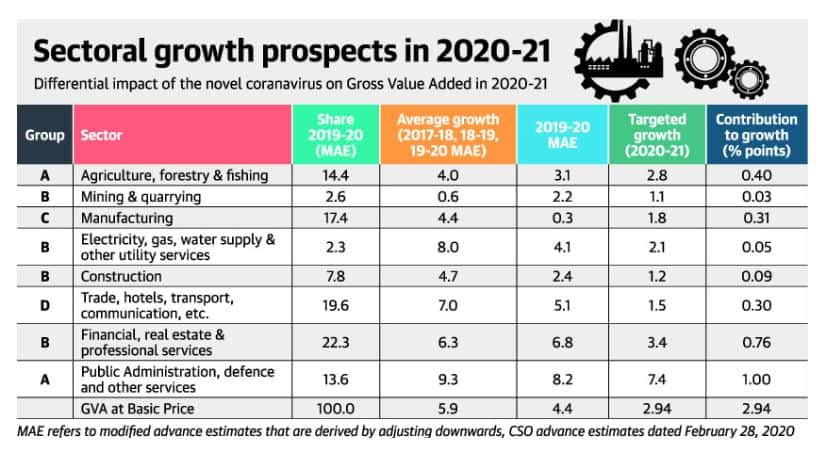

- GVA is divided into eight broad sectors (as shown in fig/table below) and all the sectors have been disrupted.

Source: The Hindu

Group A sectors

- This group comprises of two sectors – agriculture and allied sectors, and public administration, defence and other services.

- Total contribution to growth is expected to be highest as the sectors under this group have suffered only limited disruption.

Agriculture and allied sectors

- In the case of agriculture, rabi crop is currently being harvested and a good monsoon is predicted later in the year.

- Despite some labour shortage issues, this sector may show near-normal performance.

Public and defence sector

- This sector has been nearly fully active, especially with the health services at the forefront of the COVID-19 fight.

Group B sectors

- This group comprises four sectors which may suffer average disruption.

- These sectors are mining and quarrying, electricity, gas, water supply and other utility services, construction, and financial, real estate and professional services.

Group C sectors

- Manufacturing sector has suffered significantly. However, it is feasible to stimulate this sector by supporting demand.

- This sector requires strong policy support.

Group D sectors

- This group is likely to suffer maximum disruption.

- This includes, trade, hotels, restaurants, travel and tourism under the broad group of “Trade, Hotels, Transport, Storage and Communications”.

Note: Considering these four groups together, a GVA growth of 2.9% is estimated for 2020-21.

Measures taken:

- Monetary policy initiatives – RBI has reduced the repo rate to 4.4%, the reverse repo rate to 3.75%, and cash reserve ratio to 3%.

- RBI has also opened several special financing facilities.

- The Centre has announced a relief package of ₹1.7-lakh crore.

- Now, these measures need to be supplemented by an appropriate fiscal stimulus.

What measures are required?

The actual growth outcome for India would depend on 3 important areas –

- the speed at which the economy is opened up;

- the time it takes to contain the spread of virus, and,

- the government’s policy support.

Need for Fiscal Stimulus

Fiscal stimulus can be of three types:

- relief expenditure for protecting the poor and the marginalised;

- demand-supporting expenditure for increasing personal disposable incomes or government’s purchases of goods and services, including expanded health-care expenditure imposed by the novel coronavirus, and,

- bailouts for industry and financial institutions.

Way ahead:

- Centre’s budgeted fiscal deficit of 3.5% of GDP may have to be enhanced substantially and provide for a stimulus.

- Expenditure on construction of hospitals, roads and other infrastructure and purchase of health-related equipment and medicines require prioritisation. These expenditures will have high multiplier effects.

- Similar initiatives may be undertaken by the State governments under their respective Fiscal Responsibility Legislation/Law and to provide for the shortfall in their revenues and some stimulus.

Connecting the dots:

- Do you think India needs a strong fiscal stimulus when already its fiscal deficit poses a major challenge?

- Which sector needs major policy support and why? What measures are needed?