IASbaba's Daily Current Affairs Analysis

IAS UPSC Prelims and Mains Exam – 11th June 2020

Archives

(PRELIMS + MAINS FOCUS)

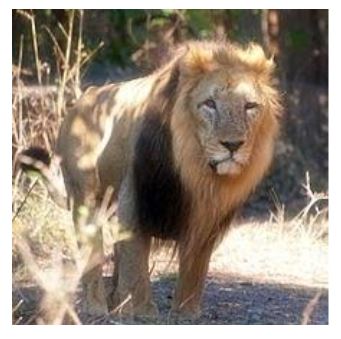

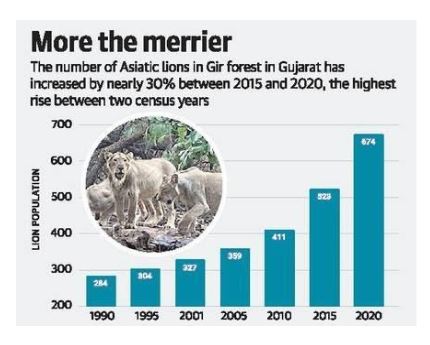

Rise in Asiatic Lions’ population reported

Part of: GS-Prelims and GS-III – Environment; Biodiversity

In News:

- According to June 5, 2020 census, the number of Asiatic lions have now risen by 29% over five years to an estimated 674 in the Gir forest region and other areas of coastal Saurashtra, Gujarat.

- During 2015, their population was 523 lions.

- Geographically, distribution area has also increased by 36%.

Important value additions

Asiatic Lion

- It is a Panthera leo leo population in India.

- Its current range is restricted to the Gir National Park and environs in the Indian state of Gujarat.

- It is one of five pantherine cats inhabiting India. Others are:

- Bengal tiger

- Indian leopard

- Snow leopard

- Clouded leopard

- It is also known as the “Indian lion” and the “Persian lion”.

- Status:

- Listed in Schedule I of Wildlife (Protection) Act 1972

- Appendix I of CITES

- Endangered on IUCN Red List.

- It is slightly smaller than African lions.

- The most striking morphological character is a longitudinal fold of skin running along belly of Asiatic Lions.

Image source: Click here

Image source: The Hindu

Rise in India’s Forex Reserves

Part of: GS-Prelims and GS-III – Economy

In News:

- India’s foreign exchange reserves are rising and will reach $500 billion mark soon.

- In the month of May, forex reserves jumped by $12.4 billion to an all-time high of $493.48 billion.

Key takeaways

- The major reason forex reserves are rising despite the slowdown in the economy is the rise in investment in foreign portfolio investors (FPIs) and foreign direct investments (FDIs).

- Besides, the fall in crude oil prices has brought down the oil import bill.

Important value additions

Foreign Exchange Reserves

- These are assets held on reserve by a central bank in foreign currencies, which can include bonds, treasury bills and other government securities.

- Most foreign exchange reserves are held in U.S. dollars.

- These assets are held to ensure that the central bank has backup funds if the national currency rapidly devalues or becomes altogether insolvent.

- It is an important component of the Balance of Payment and an essential element in the analysis of an economy’s external position.

India’s Forex Reserve

- It includes

- Foreign Currency Assets(FCA)

- Gold reserves

- Special Drawing Rights

- Reserve position with the International Monetary Fund (IMF)

- FCAs:

- Assets that are valued based on a currency other than the country’s own currency.

- It is the largest component of the forex reserve.

- It is expressed in dollar terms.

- Special drawing rights (SDR)

- It is an international reserve asset, created by the IMF in 1969 to supplement its member countries’ official reserves.

- It is neither a currency nor a claim on the IMF.

- The value of the SDR is calculated from a weighted basket of major currencies, including the U.S. Dollar, the Euro, Japanese Yen, Chinese Yuan, and British Pound.

- Reserve position with the International Monetary Fund (IMF)

- It implies a portion of the required quota of currency each member country must provide to the International Monetary Fund (IMF) that can be utilized for its own purposes.

- It is basically an emergency account that IMF members can access at any time without agreeing to conditions or paying a service fee.

- India’s FOREX is governed by RBI under RBI Act,1934.

- The level of foreign exchange reserves is largely the outcome of the RBI’s intervention in the foreign exchange market.

Draft Frameworks for ‘Sale of Loan Exposures’ and ‘Securitisation of Standard Assets’ released by RBI

Part of: GS-Prelims and GS-III – Economy

In News:

- RBI has released draft Frameworks for ‘Sale of Loan Exposures’ and ‘Securitisation of Standard Assets’ recently.

Key takeaways

- These draft guidelines are applicable to:

- Scheduled Commercial Banks (excluding Regional Rural Banks)

- All India Financial Institutions (NABARD, NHB, EXIM Bank, and SIDBI)

- All Non-Banking Financial Companies (NBFCs) including Housing Finance Companies (HFCs).

- Salient features of draft guidelines:

- Only transactions that result in multiple tranches of securities being issued reflecting different credit risks will be treated as securitisation transactions.

- Two capital measurement approaches have been proposed: Securitisation External Ratings Based Approach (SEC-ERBA) and Securitisation Standardised Approach (SEC-SA).

- A special case of securitisation, called Simple, Transparent and Comparable (STC) securitisations, has also been prescribed.

- The definition of securitisation has been modified to allow single asset securitisations.

- Securitisation of exposures purchased from other lenders has been allowed.

- Standard Assets would be allowed to be sold by lenders through assignment or a loan participation contract.

- The Stressed Assets, however, would be allowed to be sold only through assignment or novation.

Ordinance approved to amend Essential Commodities Act, 1955

Part of: GS-Prelims and GS-II – Policies and interventions

In News:

- The Union Cabinet has recently approved an ordinance to amend The Essential Commodities Act, 1955, to deregulate commodities such as cereals, pulses, oilseeds, edible oils, onion and potatoes.

- The ordinance has introduced a new subsection (1A) in Section 3 of the Act.

Important value additions

- There is no specific definition of essential commodities in The EC Act.

- Section 2(A) of the act states that an “essential commodity” means a commodity specified in the “Schedule” of this Act.

- The Act gives powers to the central government to add or remove a commodity in the “Schedule.”

- The Centre, if it is satisfied that it is necessary to do so in public interest, can notify an item as essential, in consultation with state governments.

- By declaring a commodity as essential, the government can control the production, supply, and distribution of that commodity, and impose a stock limit.

Turant Customs : flagship programme launched

Part of: GS-Prelims and GS-III – Economy

In News:

- Central Board of Indirect Taxes and Customs (CBIC) launched its flagship programme Turant Customs at Bengaluru and Chennai.

Key takeaways

- Importers will now get their goods cleared from Customs after a faceless assessment which will be done remotely by the Customs officers located outside the port of import.

- Now, the goods imported at Chennai may be assessed by the Customs officers located at Bengaluru and vice versa.

- It will be the first phase of the All India roll out which would get completed by 31st December, 2020.

- The first phase will cover imports of Mechanical, Electrical and Electronics machineries at the ports, airports of Bengaluru and Chennai.

- It will benefit the importers by eliminating routine interface with the Customs officers and providing uniformity in assessment across the country.

Important value additions

The Central Board of Indirect Taxes and Customs (CBIC)

- It is the nodal national agency responsible for administering:

- Customs

- GST

- Central Excise

- Service Tax

- Narcotics in India.

- It comes under the Department of Revenue, Ministry of Finance.

Ratings agency Moody’s Investors Service downgrades India’s sovereign ratings

Part of: GS-Prelims and GS-III – Economy; Investment

In News:

- Recently, ratings agency Moody’s Investors Service downgraded India’s sovereign ratings from Baa2 to Baa3.

Key takeaways

- Reasons for the downgrade:

- Slow reform momentum

- Constrained policy effectiveness

- Slower growth compared to India’s potential

- The downgrade is not driven by the impact of the pandemic.

- Baa3 is the lowest investment grade in Moody’s rating ladder.

- Moody’s had upgraded the country’s rating to Baa2 in November 2017.

- According to Moody, India’s real GDP growth rate will contract by 4% in 2020-21 due to the shock from the coronavirus pandemic and related lockdown measures.

- It expects the economy to grow 8.7% next financial year and closer to 6% in the subsequent year.

Important value additions

Credit Rating

- It is a quantified assessment of the creditworthiness of a borrower.

- It can be assigned to any entity that seeks to borrow money—an individual, corporation, state or provincial authority, or sovereign government.

- A sovereign credit rating is an independent assessment of the creditworthiness of a country or sovereign entity.

- It can give investors insights into the level of risk associated with investing in the debt of a particular country, including any political risk.

- Obtaining good sovereign credit rating is usually essential for developing countries in order to access funding in international bond markets.

- The Big Three Credit Rating Agencies:

- Fitch Ratings

- Moody’s Investors Service and

- Standard & Poor’s (S&P)

- In India, there are six credit rating agencies registered under Securities and Exchange Board of India (SEBI):

- CRISIL

- ICRA

- CARE

- SMERA

- Fitch India

- Brickwork Ratings.

Allowing non-profit organisations to list on social stock exchanges recommended

Part of: GS-Prelims and GS-II – Statutory bodies & GS-III – Economy

In News:

- A working group constituted by the Securities and Exchange Board of India (SEBI) on social stock exchanges (SSE) has recommended allowing non-profit organisations to directly list on such platforms along with certain tax incentives to encourage participation on the platform.

Keytakeaways

- The idea of a SSE for listing of social enterprise and voluntary organisations was mooted by the Indian Finance Minister during the Union Budget 2019-20.

- Recommendations:

- Direct listing for non-profit organisations through issuance of bonds.

- A range of funding avenues, including some of the existing mechanisms such as Social Venture Funds (SVFs) under Alternative Investment Funds (AIFs).

- A new minimum reporting standard for organisations that raise funds on social stock exchanges.

- Allowing for-profit social enterprises to list on the platform but with enhanced reporting requirements.

- SSE can be housed within the existing Exchanges like the Bombay Stock Exchange and the National Stock Exchange.

Important value additions

The Securities and Exchange Board of India (SEBI)

- It is the regulator of the securities and commodity market in India owned by the Government of India.

- It was established in 1988 and given statutory status through the SEBI Act, 1992.

- SEBI is responsible to the needs of three groups:

- Issuers of securities

- Investors

- Market intermediaries

- Functions:

- Quasi-legislative – drafts regulations

- Quasi-judicial – passes rulings and orders

- Quasi-executive – conducts investigation and enforcement action

- Powers:

- To approve by−laws of Securities exchanges.

- To require the Securities exchange to amend their by−laws.

- Inspect the books of accounts and call for periodical returns from recognised Securities exchanges.

- Inspect the books of accounts of financial intermediaries.

- Compel certain companies to list their shares in one or more Securities exchanges.

- Registration of Brokers and sub-brokers

Miscellaneous

Aguada Fenix

- A 3,000-years-old Mayan temple has been discovered in Mexico through laser mapping technique.

- The temple site is called Aquada Fenix in Mexico.

- It is 4,600 feet long and up to 50 feet high, making it the ancient civilisation’s oldest and largest monument.

- It was built between 800 BC and 1,000 BC.

- One of the most remarkable revelations from the find was the complete lack of stone sculptures related to rulers and elites, such as colossal heads and thrones, that are commonly seen in other Mayan temples.

- This suggests that the people who built it were more egalitarian than later generations of Mayans.

(MAINS FOCUS)

INTERNATIONAL/ ECONOMY

Topic: General Studies 2:

- Bilateral, regional and global groupings and agreements involving India and/or affecting India’s interests.

- Important International institutions, agencies and fora- their structure, mandate.

An unravelling of the Group of Seven

Context: The 46th G7 summit, scheduled in US in mid-June 2020, has been postponed by the host, U.S. President Donald Trump.

U.S. President Donald Trump announced that he would like to expand G-7 to a G-11, by adding India, Russia, South Korea and Australia.

Brief History of G7

- The G7 emerged as a restricted club of the rich democracies in the early 1970s.

- The quadrupling of oil prices just after the 1973 Arab-Israeli War, when members of the OPEC imposed an embargo against Canada, Japan, the Netherlands, and the United States, shocked their economies.

- Although the French were spared the embargo, the fear of it made France to invite finance ministers of the US, Germany, Japan, Italy, and UK, for an informal discussion on global issues.

- This transformed into a G7 Summit of the heads of government with the inclusion of Canada in 1976.

- It does not have a permanent headquarter and the decisions taken by leaders during annual summits are non-binding.

- On the initiative of U.S. President Bill Clinton and British PM Tony Blair, the G7 became the G8, with the Russian Federation joining the club in 1998.

- However, in 2014, Russia was suspended from the group after the annexation of Crimea and tensions in Ukraine.

Criticisms of G7

- The G7 has not been successful with respect to contemporary issues, such as the

- COVID-19 pandemic: They have failed to perform vigilance functions through WHO

- Climate change: The G7 countries account for 59% of historic global CO2 emissions (from 1850 to 2010) but has not yet announced any plan of action to phase out all fossil fuels and subsidies

- The challenge of the ISIS: Three of the G7 countries, France, Germany, and the U.K., were among the top 10 countries contributing volunteers to this terrorist organisation

- The crisis of state collapse in West Asia due to external intervention (particularly by US) has led to largest refugee crisis in recent times

- The G7 failed to head off the economic downturn of 2007-08, which led to the rise of the G20.

- In the short span of its existence, the G20 has provided a degree of confidence, by promoting open markets, and stimulus, preventing a collapse of the global financial system

Economic Circumstances forces G7 expansion

- When constituted, the G7 countries accounted for close to two-thirds of global GDP, however, they now account for less than a third of global GDP on a purchasing power parity (PPP) basis, and less than half on market exchange rates (MER) basis.

- The seven largest emerging economies (E7, or “Emerging 7”), comprising Brazil, China, India, Indonesia, Mexico, Russia and Turkey, account for over a third of global GDP on PPP terms, and over a quarter on MER basis.

- By 2050, six of the seven of the world’s best performing economies will be China, India, the United States, Indonesia, Brazil, and Russia.

- Hence, economic circumstances necessitate change in composition of G7, else it will lose its relevance

Way Ahead

- Relevance: Any new international mechanism (G10 or G11) will have value only if it focuses on key global issues.

- Rule of law: There is a need to push for observing international law and preventing the retreat from liberal values.

- Global public health and the revival of growth and trade in a sustainable way (that also reduces the inequalities among and within nations) which is a huge challenge needs to be addressed effectively by the new international mechanism

- Prepare for future pandemic: An immediate concern is to ensure effective implementation of the 1975 Biological Weapons Convention

- Focus of India:

- First order priority should include international trade, climate change, the COVID-19 crisis and counter-terrorism

- India should contribute to peace and stability in Iran, Afghanistan, the Gulf and West Asia

- It should also coordinate with other like-minded countries to reduce tensions in the Korean Peninsula and the South China Sea.

Connecting the dots:

- G20 and its utility for India

- Criticism of UN and WHO

AGRICULTURE/ ECONOMY/ GOVERNANCE

Topic: General Studies 2,3:

- Government policies and interventions for development in various sectors

- Indian Economy and issues relating to planning, mobilization, of resources

Reorienting India’s food basket

Context: Covid-19 – a zoonotic disease– has brought into sharp focus the need to reorient our food basket.

Advantages of Pulses Cultivation

- Protein Source: Pulses are a great source of protein for Indians, especially vegetarians

- Helps achieve Sustainable Development Goals: Pulses fits well with SDG-12 (responsible consumption and production) rather than meat based food

- Water efficiency of the crop: One-hectare millimetre of water can produce 12.5 kg of Bengal gram while it can produce only 7 kg of wheat and 2.5 kg of paddy.

- Improves Soil Health by fixing nitrogen in the soil.

- Suitable for Post-COVID world: Plant-based nutrition(pulses) will be seen as a more sustainable system of production and consumption from the environment and nutrition(protein) viewpoint especially in post-COVID world

- Future Demand Potential: Increasing population, improved incomes and enhanced awareness about nutrition has boosted demand for pulses in the last two decades

Pulse Cultivation in India

- Red gram and Bengal gram (chana) account for most of India’s pulse production, followed by black gram and green gram.

- In 2010, pulse cultivation accounted for 26 million ha (mha) with an annual production of 16 million tons (mt) and annual import of 4 mt.

- In 2016, pulse cultivation accounted for 30 mha and imports increased to 6.3 mt

- The MSP for pulses has increased every year. Similarly, tur dal support price increased from Rs 46.25/kg in 2015 to Rs 58/kg this year

- Although these support prices provided relief for the farmers, on many occasions, the market price was less than the support price, especially when large-scale imports took place

- By 2030, when our population crosses 150 crore, the estimated demand for pulses will be 33 mt

Way Ahead

- Increased Acreage: There is a need to convert some of the acreages under cereals to grow pulses. This will help bring greater balance to the crop portfolio, especially considering the changing food basket.

- Improve Productivity: If we have to meet the demand requirements of 2030 and avoid imports, our current yields of 835kg/ha have to go up by at least 30% in this decade.

- Increase R&D: There is a need to take up projects that increase yields, protein content and make our red gram varieties more tolerant to the dreaded pod borer, which causes 50% yield losses

- Use of Bt Technology: Farmers use heavy doses of pesticides to control the pod borer in red gram and the diseases in black gram and green gram. There is a strong case to use Bt technology, used in cotton to control the same insect

- Smooth regulatory progress to fast track projects that are in various stages of development of new seeds

- Micro-irrigation tool like Hose Reel technology-based irrigation system could be perfectly suited for these crops

- Private investments could be encouraged in genomics area through strong PPP projects to find useful genes that can help these crops to resist pests, diseases and water stress conditions.

- Encouraging farmers to grow pulses as mixed crops with sugar cane and to bring 1.2 mha of additional cultivation of pulses in rice fallow lands.

- Market Reforms: While the new e-NAM is expected to help, there is a need to make more efforts in setting up village-level primary processing and grading centres.

- Long-term and predictable policy environment for import and export of pulses is required as sudden decisions to import can land the farmers in distress.

- Inclusion in Welfare schemes: Pulses need to be included in PDS and in the mid-day meals to improve nutrition standards

Connecting the dots:

- Green Revolution 2.0

- Tur Dal price hike in 2015 and measures taken by government

(TEST YOUR KNOWLEDGE)

Model questions: (You can now post your answers in comment section)

Note:

- Correct answers of today’s questions will be provided in next day’s DNA section. Kindly refer to it and update your answers.

- Comments Up-voted by IASbaba are also the “correct answers”.

Q.1 Which of the following is correct about Asiatic lion?

- It is listed in the Schedule II of Wildlife Protection Act 1972.

- It is given status of critically endangered on IUCN Red list.

- It is slightly smaller than African lion.

- It is found only in the Gir National Park.

Q.2 Which of the following is included in India’s Forex Reserves?

- Foreign currency assets

- Gold reserves

- Special Drawing Rights

- Reserve position with the International Monetary Fund

Select the correct code:

- 1, 2 and 3 only

- 2 and 3 only

- 1 and 4 only

- 1, 2, 3 and 4

Q.3 Consider the following statements regarding Central Board of Indirect taxes and Customs:

- It is responsible for administering customs, GST and narcotics in India.

- It comes under Ministry of Finance.

Which of the above is/are correct?

- 1 only

- 2 only

- Both 1 and 2

- Neither 1 nor 2

Q.4 Recently India’s sovereign rating was downgraded from Baa2 to Baa3. Consider the following about the credit rating:

- It can be assigned only to countries.

- It can give investors insights into the level of risk associated with investing in the debt of a particular country.

Which of the above is/are correct?

- 1 only

- 2 only

- Both 1 and 2

- Neither 1 nor 2

ANSWERS FOR 10th June 2020 TEST YOUR KNOWLEDGE (TYK)

| 1 | C |

| 2 | D |

| 3 | B |

| 4 | C |

| 5 | C |

Must Read

About migrant labour crisis:

About doping & need to keep sports clean:

About bureaucracy by an IAS officer: