IASbaba Daily Prelims Quiz

For Previous Daily Quiz (ARCHIVES) – CLICK HERE

The Current Affairs questions are based on sources like ‘The Hindu’, ‘Indian Express’ and ‘PIB’, which are very important sources for UPSC Prelims Exam. The questions are focused on both the concepts and facts. The topics covered here are generally different from what is being covered under ‘Daily Current Affairs/Daily News Analysis (DNA) and Daily Static Quiz’ to avoid duplication. The questions would be published from Monday to Saturday before 2 PM. One should not spend more than 10 minutes on this initiative.

This is a part of our recently launched, NEW INITIATIVE IASbaba’s INTEGRATED REVISION PLAN (IRP) 2020 – Road Map for the next 100 Days! FREE INITIATIVE!

We will make sure, in the next 4 months not a single day is wasted. All your energies are channelized in the right direction. Trust us! This will make a huge difference in your results this time, provided that you follow this plan sincerely every day without fail.

Gear up and Make the Best Use of this initiative.

Do remember that, “the difference between Ordinary and EXTRA-Ordinary is PRACTICE!!”

To Know More about the Initiative -> CLICK HERE

SCHEDULE/DETAILED PLAN – > CLICK HERE

Important Note:

- Don’t forget to post your marks in the comment section. Also, let us know if you enjoyed today’s test 🙂

- After completing the 5 questions, click on ‘View Questions’ to check your score, time taken and solutions.

Test-summary

0 of 5 questions completed

Questions:

- 1

- 2

- 3

- 4

- 5

Information

To view Solutions, follow these instructions:

- Click on – ‘Start Test’ button

- Solve Questions

- Click on ‘Test Summary’ button

- Click on ‘Finish Test’ button

- Now click on ‘View Questions’ button – here you will see solutions and links.

You have already completed the test before. Hence you can not start it again.

Test is loading...

You must sign in or sign up to start the test.

You have to finish following test, to start this test:

Results

0 of 5 questions answered correctly

Your time:

Time has elapsed

You have scored 0 points out of 0 points, (0)

| Average score |

|

| Your score |

|

Categories

- Not categorized 0%

| Pos. | Name | Entered on | Points | Result |

|---|---|---|---|---|

| Table is loading | ||||

| No data available | ||||

- 1

- 2

- 3

- 4

- 5

- Answered

- Review

-

Question 1 of 5

1. Question

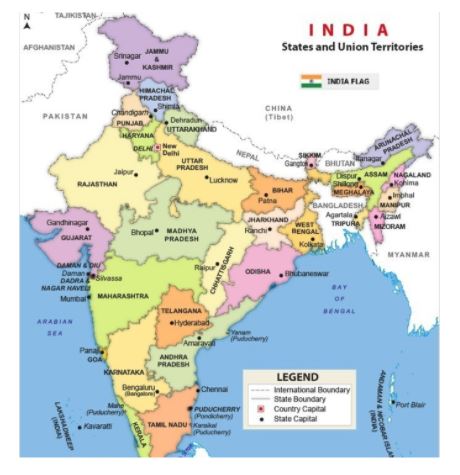

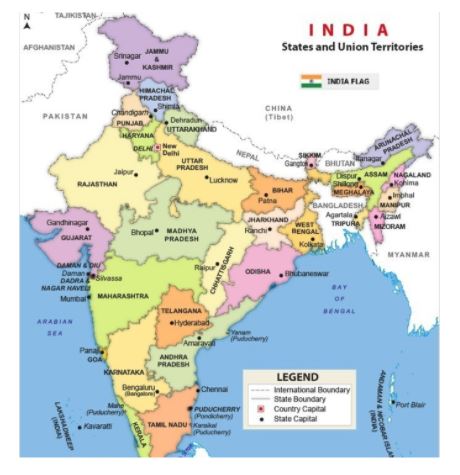

Which of the Indian states does not shares border with Bhutan?

Correct

Solution (d)

Bhutan shares borders with the Indian states of Arunachal Pradesh in its east, Sikkim in the west and Assam and West Bengal in the south.

Incorrect

Incorrect

Solution (d)

Bhutan shares borders with the Indian states of Arunachal Pradesh in its east, Sikkim in the west and Assam and West Bengal in the south.

-

Question 2 of 5

2. Question

UMANG International version does not include which of the following country?

Correct

Solution (d)

- The UMANG international version is for select countries including US, UK, Canada, Australia, UAE, Netherlands, Singapore, Australia and New Zealand, and will help Indian international students, NRIs and Indian tourists abroad to avail government of India services anytime

- The International version was launched on the completion of three years of UMANG. It was launched in collaboration with the Ministry of External Affairs.

Significance

- The application will help to take Indian culture to the world through its services. Also, the Common Services Centres are being integrated with the application.

UMANG App:

- The UMANG mobile app (Unified Mobile Application for New-age Governance) is a Government of India all-in-one single, unified, secure, multi-channel, multi-lingual, multi-service mobile app.

- It provides access to high impact services of various organizations of Centre and States. Presently it has 2000+ services.

- The aim of UMANG is to fast-track mobile governance in India.

- UMANG enables ‘Ease of Living’ for Citizens by providing easy access to a plethora of Indian government services ranging from – Healthcare, Finance, Education, Housing, Energy, Agriculture, Transport to even Utility and Employment and Skills.

- The key partners of UMANG are Employee Provident Fund Organization, Direct Benefit Transfer scheme departments, Employee State Insurance Corporation, Ministries of Health, Education, Agriculture, Animal Husbandry and Staff Selection Commission (SSC).

- UMANG was developed by the National e-Governance Division (NeGD), Ministry of Electronics & IT.

- UMANG attained ‘Best m-Government service’ award at the 6th World Government Summit held at Dubai, UAE in February 2018.

Incorrect

Solution (d)

- The UMANG international version is for select countries including US, UK, Canada, Australia, UAE, Netherlands, Singapore, Australia and New Zealand, and will help Indian international students, NRIs and Indian tourists abroad to avail government of India services anytime

- The International version was launched on the completion of three years of UMANG. It was launched in collaboration with the Ministry of External Affairs.

Significance

- The application will help to take Indian culture to the world through its services. Also, the Common Services Centres are being integrated with the application.

UMANG App:

- The UMANG mobile app (Unified Mobile Application for New-age Governance) is a Government of India all-in-one single, unified, secure, multi-channel, multi-lingual, multi-service mobile app.

- It provides access to high impact services of various organizations of Centre and States. Presently it has 2000+ services.

- The aim of UMANG is to fast-track mobile governance in India.

- UMANG enables ‘Ease of Living’ for Citizens by providing easy access to a plethora of Indian government services ranging from – Healthcare, Finance, Education, Housing, Energy, Agriculture, Transport to even Utility and Employment and Skills.

- The key partners of UMANG are Employee Provident Fund Organization, Direct Benefit Transfer scheme departments, Employee State Insurance Corporation, Ministries of Health, Education, Agriculture, Animal Husbandry and Staff Selection Commission (SSC).

- UMANG was developed by the National e-Governance Division (NeGD), Ministry of Electronics & IT.

- UMANG attained ‘Best m-Government service’ award at the 6th World Government Summit held at Dubai, UAE in February 2018.

-

Question 3 of 5

3. Question

Sentinel-6-Satellite which was launched recently is dedicated to:

Correct

Solution (a)

- Copernicus Sentinel-6 Michael Freilich satellite was launched from the Vandenberg Air Force base in California aboard a SpaceX Falcon 9 rocket.

- Jason-CS Mission: Sentinel-6-Satellite is a part of the mission dedicated to measuring changes in the global sea level. The mission is called the Jason Continuity of Service (Jason-CS) mission.

- Objective of the Mission: To measure the height of the ocean, which is a key component in understanding how the Earth’s climate is changing.

- Components: It consists of two satellites, Sentinel-6 and the other, called Sentinel-6B, to be launched in 2025.

- Joint collaboration of: The European Space Agency (ESA), National Aeronautics and Space Administration (NASA), European Organisation for the Exploitation of Meteorological Satellites (Eumetsat), the USA’s National Oceanic and Atmospheric Administration (NOAA) and the European Union (EU), with contributions from France’s National Centre for Space Studies (CNES).

- Significant in:

- Ensuring the continuity of sea-level observations.

- Understanding how the ocean stores and distributes heat, water and carbon in the climate system.

- Supporting operational oceanography, by providing improved forecasts of ocean currents, wind and wave conditions.

- Improving both short-term forecasting for weather predictions, and long term forecasting for seasonal conditions like El Niño and La Niña.

Incorrect

Solution (a)

- Copernicus Sentinel-6 Michael Freilich satellite was launched from the Vandenberg Air Force base in California aboard a SpaceX Falcon 9 rocket.

- Jason-CS Mission: Sentinel-6-Satellite is a part of the mission dedicated to measuring changes in the global sea level. The mission is called the Jason Continuity of Service (Jason-CS) mission.

- Objective of the Mission: To measure the height of the ocean, which is a key component in understanding how the Earth’s climate is changing.

- Components: It consists of two satellites, Sentinel-6 and the other, called Sentinel-6B, to be launched in 2025.

- Joint collaboration of: The European Space Agency (ESA), National Aeronautics and Space Administration (NASA), European Organisation for the Exploitation of Meteorological Satellites (Eumetsat), the USA’s National Oceanic and Atmospheric Administration (NOAA) and the European Union (EU), with contributions from France’s National Centre for Space Studies (CNES).

- Significant in:

- Ensuring the continuity of sea-level observations.

- Understanding how the ocean stores and distributes heat, water and carbon in the climate system.

- Supporting operational oceanography, by providing improved forecasts of ocean currents, wind and wave conditions.

- Improving both short-term forecasting for weather predictions, and long term forecasting for seasonal conditions like El Niño and La Niña.

-

Question 4 of 5

4. Question

Consider the following statements with respect to Masala Bonds:

- As per the RBI guidelines, the money raised through such bonds can be used for any activities by government

- Any corporate, body corporate and Indian bank is eligible to issue these bonds overseas.

Which of the above statements is/are correct?

Correct

Solution (b)

- They are rupee-denominated bonds used by Indian companies to raise funds from the overseas market in Indian rupees.

- Eligibility for Issuance:

- According to RBI, any corporate, body corporate and Indian bank is eligible to issue these bonds overseas.

- These can be issued and subscribed by a resident of such country that is a member of the financial action task force (FATF) and whose securities market regulator is a member of the International Organisation of Securities Commission (IOSCO). It can also be subscribed by multilateral and regional financial institutions where India is a member country.

- IOSCO is the international body that brings together the world’s securities regulators and is recognised as the global standard setter for the securities sector.

- Limitations:

- As per the RBI guidelines, the money raised through such bonds cannot be used for real estate activities other than for development of integrated township or affordable housing projects.

- Also, it cannot be used for investing in capital markets, purchase of land and on-lending to other entities for such activities as stated above.

- Kerala Infrastructure Investment Fund Board (KIIFB) had overstepped its legal bounds by issuing masala bonds to raise money from foreign markets in violation of Article 293 (1) of the Constitution.

Incorrect

Solution (b)

- They are rupee-denominated bonds used by Indian companies to raise funds from the overseas market in Indian rupees.

- Eligibility for Issuance:

- According to RBI, any corporate, body corporate and Indian bank is eligible to issue these bonds overseas.

- These can be issued and subscribed by a resident of such country that is a member of the financial action task force (FATF) and whose securities market regulator is a member of the International Organisation of Securities Commission (IOSCO). It can also be subscribed by multilateral and regional financial institutions where India is a member country.

- IOSCO is the international body that brings together the world’s securities regulators and is recognised as the global standard setter for the securities sector.

- Limitations:

- As per the RBI guidelines, the money raised through such bonds cannot be used for real estate activities other than for development of integrated township or affordable housing projects.

- Also, it cannot be used for investing in capital markets, purchase of land and on-lending to other entities for such activities as stated above.

- Kerala Infrastructure Investment Fund Board (KIIFB) had overstepped its legal bounds by issuing masala bonds to raise money from foreign markets in violation of Article 293 (1) of the Constitution.

-

Question 5 of 5

5. Question

Consider the following statements with respect to Floating Rate Bonds:

- These are fixed income instruments offered by the Government of India which come with a lock-in period.

- Non-Resident Indian (NRI) can also invest in the scheme.

Which of the above statements is/are correct?

Correct

Solution (a)

- FRS bonds are fixed income instruments offered by the Government of India which come with a lock-in period.

- Unlike regular bonds that pay a fixed rate of interest, floating rate bonds have a variable rate of interest.

- The rate of interest of a floating rate bond is linked to a benchmark rate and is reset at a regular interval.

- The interest rate risk is largely mitigated as these bonds will pay higher return when prevailing rates are high.

- There is no certainty of the future stream of income when investing in a floating rate bond.

- The best time to buy floating rate bonds is when rates are low and are expected to rise.

- The FRS bonds are a 100% risk free investment option as interest payments on these are guaranteed by the Government of India.

- The interest earned on FRBs will be taxed, TDS will be deducted on interest payment similar to an Fixed Deposit, the same can be claimed back while filing Income Tax returns.

- The minimum amount that a person can invest is INR 1,000 and in multiples of INR 1,000 thereof and there is no cap on investments that a person can make.

- All residents of India and Hindu Undivided Family (HUF) are eligible to invest in FRBs, However a Non-Resident Indian (NRI) cannot invest in the scheme.

- Recently, the Ministry of Finance has provided the information that the outstanding balance of ‘Government of India Floating Rate Bonds (FRB) 2020’ is repayable at par on December 21, 2020.

Incorrect

Solution (a)

- FRS bonds are fixed income instruments offered by the Government of India which come with a lock-in period.

- Unlike regular bonds that pay a fixed rate of interest, floating rate bonds have a variable rate of interest.

- The rate of interest of a floating rate bond is linked to a benchmark rate and is reset at a regular interval.

- The interest rate risk is largely mitigated as these bonds will pay higher return when prevailing rates are high.

- There is no certainty of the future stream of income when investing in a floating rate bond.

- The best time to buy floating rate bonds is when rates are low and are expected to rise.

- The FRS bonds are a 100% risk free investment option as interest payments on these are guaranteed by the Government of India.

- The interest earned on FRBs will be taxed, TDS will be deducted on interest payment similar to an Fixed Deposit, the same can be claimed back while filing Income Tax returns.

- The minimum amount that a person can invest is INR 1,000 and in multiples of INR 1,000 thereof and there is no cap on investments that a person can make.

- All residents of India and Hindu Undivided Family (HUF) are eligible to invest in FRBs, However a Non-Resident Indian (NRI) cannot invest in the scheme.

- Recently, the Ministry of Finance has provided the information that the outstanding balance of ‘Government of India Floating Rate Bonds (FRB) 2020’ is repayable at par on December 21, 2020.