UPSC Articles

ECONOMY/ GOVERNANCE

Topic: General Studies 2,3:

- Indian Economy and issues relating to planning, mobilization, of resources, growth, development.

- Government policies and interventions for development in various sectors and issues arising out of their design and implementation

Cairn Arbitration case

Context: The Permanent Court of Arbitration at The Hague has ruled that the Indian government was wrong in applying retrospective tax on Cairn. In its ruling, the international arbitration court said that Indian government must pay roughly Rs 8,000 crore in damages to Cairn.

What is the dispute all about?

- The dispute between the Indian government and Cairn relates to retrospective taxation.

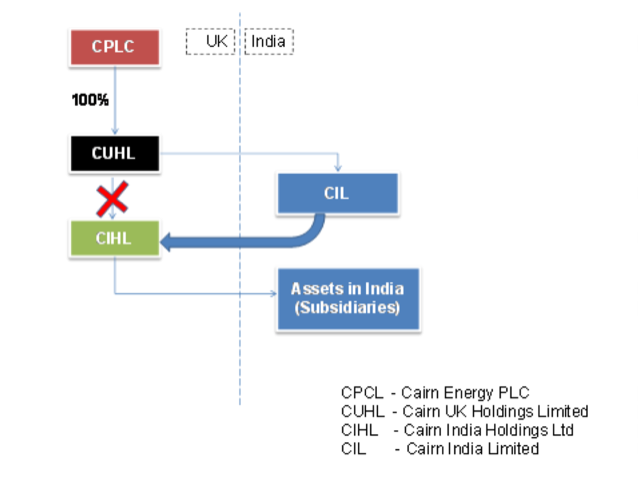

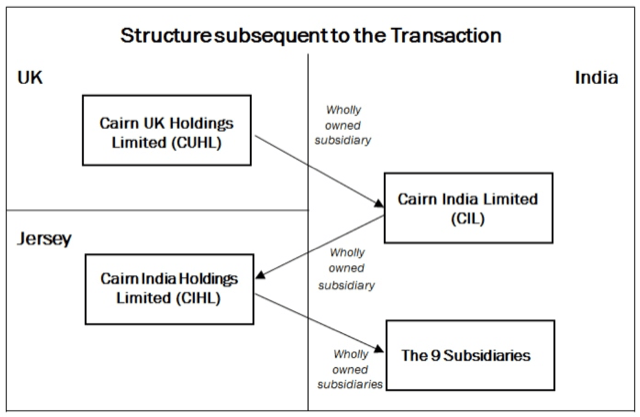

- Before 2006 (listing in BSE), the India operations of Cairn Energy were owned by a company called Cairn India Holdings Ltd (CIHL) incorporated in Jersey, UK.

- Cairn India Holdings Ltd (CIHL) was a fully owned subsidiary of Cairn UK Holdings (CUHL), in turn a fully owned subsidiary of Cairn Energy (CPLC).

- At the time of the IPO (2006), the ownership of the India assets was transferred from Cairn UK Holdings to a new company, Cairn India Ltd(CIL).

- In 2006, Cairn India Ltd. (CIL) acquired the entire share capital of Cairn India Holdings (CIHL) from Cairn UK Holdings (CUHL). In exchange, 69 per cent of the shares in Cairn India were issued to Cairn UK Holdings (CUHL). Hence, Cairn Energy (CPLC), through Cairn UK Holdings (CUHL), held 69 per cent in Cairn India.

- Later, in 2011, Cairn Energy sold Cairn India to mining billionaire Anil Agarwal’s Vedanta group, barring a minor stake of 9.8 per cent. It wanted to sell the residual stake as well but was barred by the I-T department from doing so. The government also froze payment of dividend by Cairn India to Cairn Energy.

- In 2012, government introduces retrospective tax amendment in finance bill and in 2014 the IT authorities launches a retrospective tax probe into transactions undertaken prior to IPO.

What were the objections by IT Authorities?

- The Income Tax authorities then contented that Cairn UK had made capital gains and slapped it with a tax demand of Rs 24,500 crore.

- Owing to different interpretations of capital gains, the company refused to pay the tax, which prompted cases being filed at the Income Tax Appellate Tribunal (ITAT) and the High Court.

- While Cairn had lost the case at ITAT, a case on the valuation of capital gains is still pending before the Delhi High court.

- In 2015, Cairn’s claim was brought under the terms of the UK-India Bilateral Investment Treaty, the legal seat of the tribunal was the Netherlands, and the proceedings were under the registry of the Permanent Court of Arbitration.

What has the arbitration court said?

- The Permanent Court of Arbitration at The Hague has maintained that the Cairn tax issue is not a tax dispute but a tax-related investment dispute and, hence, it falls under its jurisdiction.

- India’s demand in past taxes, it said, was in breach of fair treatment under the UK-India Bilateral Investment Treaty.

- The tribunal ordered the government to return the value of shares it had sold, dividends seized and tax refunds withheld to recover the tax demand.

- The government was asked to compensate Cairn “for the total harm suffered” together with interest and cost of arbitration.

What has been the government response?

- The Solicitor General of India has opined that an “arbitral tribunal can’t render a law passed by a sovereign Parliament ineffective,

- While senior government functionaries have asserted India’s sovereign taxation rights “can’t be subservient to bilateral investment treaties,” PM Modi had assured global investors that “concerns over retrospective taxation would be taken care of”.

- Also, Finance minister Nirmala Sitharaman has on record said that, “we won’t use retrospective taxation for income generation”.

- The verdict came barely three months after India lost arbitration to Vodafone Plc over the retrospective tax legislation amendment.

Connecting the dots:

- Vodafone case: Click here