UPSC Articles

The Central Bank of Sri Lanka (CBSL) settled a $400 million currency swap facility from the RBI

Part of: GS Prelims and GS- II – International relations & GS – III – Economy

In news

- The Central Bank of Sri Lanka (CBSL) settled a $400 million currency swap facility from the RBI.

- The two countries had agreed upon meeting the terms.

Key takeaways

- The CBSL obtained the swap facility on July 31, 2020, for an initial period of three months, to cope with the severe economic impact of the pandemic.

- Subsequently, the RBI provided a three-month rollover at CBSL’s request, until February 1, 2021.

- A further extension would require Sri Lanka to have a successfully negotiated staff-level agreement for an IMF programme, which Sri Lanka does not have at present.

Important value additions

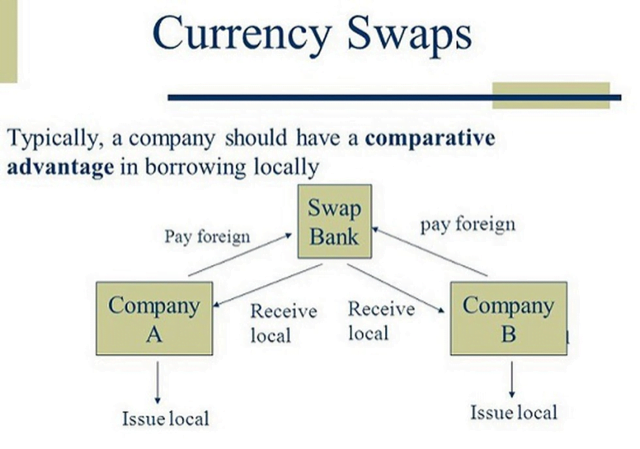

- Currency swap agreements involve trade in local currencies, where countries pay for imports and exports at pre-determined rates of exchange without the involvement of a third country currency like the US dollar.

- It reduces the risk of volatility against the third currency and does away with the charges involved in multiple currency exchanges.