Question Compilation, TLP-UPSC Mains Answer Writing

For Previous TLP (ARCHIVES) – CLICK HERE

SYNOPSIS [7th JULY,2021] Day 128: IASbaba’s TLP (Phase 1): UPSC Mains Answer Writing (General Studies)

1. What are land banks? What purpose do they serve? Examine their potential in India.

Approach

The candidate first needs to define what is land bank.In next part address what is the purpose of setting up of land banks and in last write what are its potential in India.Make use of recent initiatives by Indian government and states government to substantiate your arguments

Introduction

Land banking is the practice of aggregating parcels or blocks of land at current market rates or lower, for future sale or development. Recently Indian authorities have identified land parcels across the country and are developing a land pool to woo companies moving out of China after the pandemic that originated in the country. The land parcels identified by the authorities are spread across the country in states such as Gujarat, Maharashtra, Tamil Nadu and Andhra Pradesh.

Body

Inordinate delay in land acquisition has been one of the biggest obstacles in India’s bid to emerge as a major industrial nation, with several foreign companies, including Posco and Saudi Aramco, facing the brunt of a myriad of rules and regulations. Land acquisition has also resulted in large-scale protests against an SEZ in Nandigram, a Tata Motors plant in Singur (both are in West Bengal) and Vedanta’s bauxite mining proposal in Odisha’s Niyamgiri.Therefore the government has recently launched GIS enabled land banking portal which has all the information on the parcel of land available to the logistics which the area will facilitate.

Purpose of Land Banks:

- Building land banks allows government to offer land to private investors right away, rather than having to wait for the lengthy process of land acquisition each time an investor wants land.

- It helps to save critical time required for the start of the business and helps to improve ‘ease of doing businesses’.

- It also saves cost of land acquisition as land rates get disproportionately raised after the announcement of project.

- Investors also like to know that the land is acquired and available, and that they won’t run into political problems down the road.

- Making land readily available for economic activities sounds like a rational move.

Potential of Land Banks in India:

- Land use patterns and fragmentation of holdings is a key issue. The proportion of land that is available for industry (i.e. not suitable for cultivation) is around 23% in the country. Land Bank can provide required pieces of land to industries in homogeneous fashion.

- The problem of low availability of land suitable for industry is accentuated by the ever increasing pressure on land due to increase in population. It creates necessity of Land banks.

- India’s urban areas have huge areas of unutilized land parcels which can be utilized for affordable housing projects.

- Land bank can generate source of revenue for government as many public sector entities has huge tracts of land lying idle. Eg. Railways.

- Voluntary buying of land by government through online portal avoids forcible acquisition of land. Eg. Model followed by Haryana state government.

- Since land ownerships in vast swathes of India are fragmented and disorganised, direct acquisition remains a critical challenge, more so for private companies. The land bank becomes a key initiative of the government, as it intends to undertake structural reforms in factors of production to enable greater manufacturing and reverse a Covid-induced slide in growth.

Issues with land bank:

- Land Bank is an easy option for creation of industrial enclaves but land acquisition in many states have been done without following due process requirements laid down in laws such as the Land Acquisition Act, 2013 (LARR) and the Forest Rights Act, 2006 (FRA). Eg. Return of acquired land from POSCO in Odisha was not transferred to earlier owners but put in state Land Bank.

- Shift of cultivable lands into land bank for industrial purpose could create threat to food security of India.

- Common lands over which communities had traditional rights have been set aside as part of land banks and once that is done it becomes even more difficult for communities to claim rights over it under laws such as the Forest Rights Act (FRA).

- Supreme Court asked states why much of the land bought for special economic zones is lying idle this shows how creating land banks and not utilising them goes against the purpose and may harm interests of marginal workers who benefited from the land parcel.

- There is lack of computerised land data in each state which leads to discrepancies on paper and ground data on the land parcel which often leads to long legal battles .

Conclusion

India has historically been lagging in the level of industrialisation which a society needs.This has led to problems of disguised employment in agriculture, agrarian distress, lack of employment, poverty and overall socioeconomic backwardness.Therefore the pandemic is great opportunity to put a major thrust on reforms which will bring more investment and lead to new jobs and industries.Therefore the land banks scheme being brought by Union government with other reforms such as product linked incentive scheme and laboratories reforms will help India achieve its industrialisation targets.

2. Lands reforms were implemented to bring about a change in economic conditions of the poor and downtrodden in country, but did it serve the intended purpose? Examine

Approach

Define in brief what is meant by land reforms.In next part address what were their objectives with what were the successes of this process.In next part write failures of land reforms and give a balanced conclusion with reform based agenda.

Introduction

In a narrow sense, land reform means the distribution of surplus land to small farmers and landless tillers, accrued as a result of the implementation of the ceiling on agricultural holdings. More broadly, it includes regulation of ownership, operation, leasing, sales, and inheritance of land. The Land Reforms of the independent India had four components: The Abolition of the Intermediaries, Tenancy Reforms, Fixing Ceilings on Landholdings ,Consolidation of Landholdings.

Body

Need for land reform in India

- Several important issues confronted the government and stood as a challenge in front of independent India and land reforms was one at the centre stage with its potential to reduce poverty and grant livelihood to millions.

- Land was concentrated in the hands of a few and there was a proliferation of intermediaries who had no vested interest in self-cultivation. Leasing out land was a common practice.

- The tenancy contracts were expropriate in nature and tenant exploitation was almost everywhere.

- Land records were in extremely bad shape giving rise to a mass of litigation.

- One problem of agriculture was that the land was fragmented into very small parts which was inconvenient for commercial farming.

- It resulted in inefficient use of soil, capital, and labour in the form of boundary lands and boundary disputes.

Objectives of Land Reforms

- Restructuring of agrarian relations to achieve an egalitarian structure.As the land was concentrated in hands of few wealthy families and larger population was marginal farmer,it became imperative for equality to reduce this unequal land distribution.

- Elimination of exploitation in land relations.The relationship with tenants was such exploitative that tenants hardly survived after sharing the produce with land owner.It resulted into abject poverty and malnutrition of entire families.Also it incentivised bonded labour as there was no other source of income.

- Actualisation of the goal of “land to the tiller”.Land to tiller was a long held objective of the national movement and therefore it was natural that after independence this needed to be fulfilled

- Improvement of socio-economic conditions of the rural poor by widening their land base.Land was the only source of livelihood as industrial development was not promoted by colonial government.

- Increasing agricultural production and productivity.Land to tiller would also bring new energy and purpose in agriculture which will increase production.

- Infusion of a great measure of equality in local institutions.Ownership of land served as structural inequality in rural society.Therefore the distribution of land was envisaged for democratisation of rural society and local institutions.

Successes of land reforms

- The National Commission of Agriculture remarked that “the essence of present situation is that Indian agriculture is in the stage of transition from predominantly semi-feudaI oriented agriculture characterised by large scale leading out of land and subsistence farming to a commercialized agriculture increasingly assuming the character of market oriented farming.”

- Concentration of Land with Big Landowners:The concentration of land in the hands of big landowners has not undergone any change during the last four decades. It means disparities have not been reduced in the distribution of land holdings but it has enhanced the disparities in property ownership at village level.

- End of Feudalism:According to report of National Commission, “as a result of land reform the feudal and semi- fedual classes have lost their domination over the agrarian Indian economy.” Moreover, the decline of semi-feudalistic relations had led to develop the agriculture on commercial lines.

- Growth of Agricultural Labour:Another striking feature of land reforms is that it has led to the rapid growth of landless agricultural labourers. This constitutes about 25 per cent of the agricultural population in the country. This class is still subject to various types of economic bondages and social oppressions.

- Emergence of Modern Entrepreneurs:Another important feature of the agrarian structure is the emergence of modern entrepreneurs during the last four decades. They are drawn largely from the ranks of ex-feudal landlords, proper strata of privileged tenants and bigger ryots and money lenders. Moreover, the growth of commercialisation has improved the technique of production.

- Leasing of Land owners:One of the important impact of land reforms is that it has paved the way to change the subsistence farming into commercial farming. Commercial and modern agriculture has led to leasing of land by big farmers from small cultivators.

Failures of Land reforms in India

- The land ceiling legislation has had a twin effect in destroying the agricultural landholdings in India. Firstly, the legislation has not been implemented well due to which the land given to poor farmers is so negligible that they cannot possibly sustain their families and their lives off of it.

- Secondly, by taking away land from the bigger landlord, the agriculture has become fragmented and the efficiency that can be achieved on a bigger farm by employing modern machinery and technology has been seriously reduced.

- About 5 percent of farmers hold about 32 percent of farmland and a large farmer (owner of around 43 acres) owns 45 times the size of land that a marginal farmer (owner of around 0.96 acres) owns.This shows gross inequality and failure of land reforms.

This overall failure of land reforms is a primary reason for low productivity, disguised labour, class divide and lack of democracy in villages, abject poverty of marginal and landless farmers, entrenchment of caste.

Conclusion

The pace of implementation of land reform measures has been slow. The objective of social justice has, however, been achieved to a considerable degree. Land reform has a great role in the rural agrarian economy that is dominated by land and agriculture. New and innovative land reform measures should be adopted with new vigour to eradicate rural poverty. Modern land reforms measures such as land record digitisation must be accomplished at the earliest.

3. What is a loan guarantee scheme? How does it operate? What are its pros and cons as an economic instrument? Discuss.

Approach

In introduction the candidate needs to mention the basics of the loan guarantee scheme and contextualise to Indian scheme recently launched.In next part address the directives of question which are operation of scheme and positives and negatives of the scheme.

Introduction

A credit guarantee scheme provides third-party credit risk mitigation to lenders through the absorption of a portion of the lender’s losses on the loans made to SMEs in case of default, typically in return for a fee. The Emergency Credit Line Guarantee Scheme (ECLGS) if Indian government has been formulated as a specific response to the unprecedented situation caused by COVID-19 and the consequent lockdown, which has severely impacted manufacturing and other activities in the MSME sector.

Body

Credit markets for small and medium size enterprises (SMEs) are characterized by market failures and imperfections. Up to 68% of formal SMEs in emerging markets are either unserved or underserved by financial institutions, with a resulting credit gap estimated to be close to $1 trillion. Public credit guarantee schemes (CGSs) are a common form of government intervention to unlock finance for small and medium enterprises (SMEs). More than half of all countries in the world have a CGS for SMEs and the number is growing.

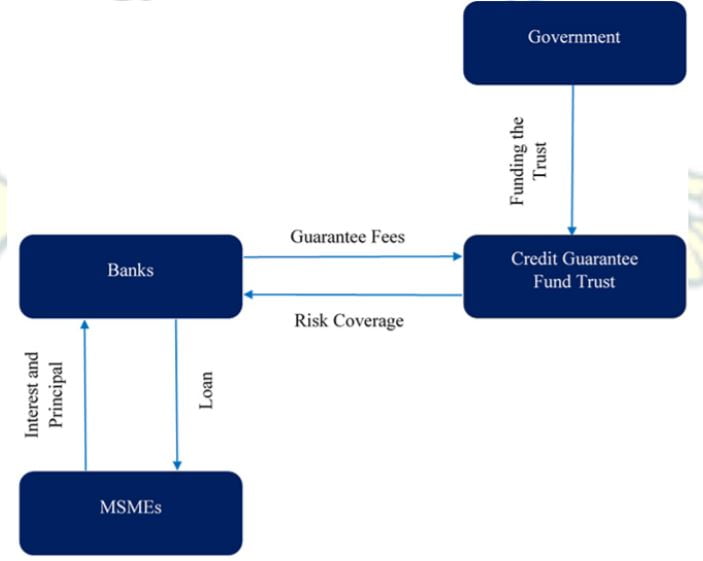

Fig . Working of loan guarantee schemes

Working of public credit(Loan) guarantee scheme

- In a public credit guarantee scheme, a third party—a credit guarantee trust—plays the key role: it covers a certain percentage of risk coverage in case of default by the borrower, and in return, the credit guarantee trust charges the guarantee fee to the lender.

- The partial or full default risk coverage of the loan reduces the lender’s exposure to credit loss– even when there is no change in the amount of default nor even a probability of default.

- The credit loss risk coverage acts as default insurance for the lenders. The decrease in expected credit losses pushes the lenders to reduce the collateral loan requirements as the recoverability of the loan portfolio increases.

- Moreover, the scheme encourages the lender to offer credit to corporations that would otherwise not get credit without the credit guarantee. With a credit risk coverage, an MSME would get credit with preferred terms such as lower interest rate, long duration, and higher amount of loans.

Benefits of Loan guarantee scheme

- The Scheme has been formulated as a specific response to the unprecedented situation caused by COVID-19 and the consequent lockdown, which has severely impacted manufacturing and other activities in the MSME sector.

- In view of the critical role of the MSME sector in the economy and in providing employment, the proposed Scheme is expected to provide much needed relief to the sector by incentivizing MLIs to provide additional credit of up to Rs.3 lakh crore to the sector at low cost, thereby enabling MSMEs to meet their operational liabilities and restart their businesses.

- By supporting MSMEs to continue functioning during the current unprecedented situation, the Scheme is also expected to have a positive impact on the economy and support its revival.

- It will help banks to revive the credit growth in the economy which will lead to better investment.

- Unemployment will be reduced as msme sectors who are largest employers will be back to production which will revive labour demand.

- Msme need not go to bankruptcy and can have easy loans with government guarantee.

- The credit worthiness of Msme and other essential sectors will not be affected.

Drawbacks of loan guarantee scheme

- Inequitable distribution of funds – 80% of the total borrowers received only 30% of the total loan amount.This shows that the largeer players are cornering the benefits .

- lower than average utilisation rates for smaller borrowers this shows that either there is lack of information on the scheme or the scheme has failed to evoke a positive response in borrowers.

- Share of loans taken by manufacturing firms is the lowest, with less liquidity benefits. This shows that in face of less demand in the market the manufacturing firms are not keen to increase their leverage.

- Further the scheme addresses only short term credit requirements ,while the longterm issues which affects the msme remains entrenched.

- Another issue raised by MSMEs is that the Scheme is beneficial for existing customers and not the first-time borrowers.

- Further, whilst the loans extended are collateral-free, the Scheme provides that the loans shall rank second charge with the existing credit facilities, which involve documentation, payment of registration fee and stamp duty charges.This shows duplication of the entire process

Conclusion

The Scheme provides credit availability to MSMEs and small businesses to meet their operational liabilities and revive their businesses which got affected due to two months’ countrywide lockdown. It will bring a positive impact on the economy and will mitigate the distress caused by the Corona pandemic.Further to make it more impactful the government and RBI should work together to address the issues highlighted by the msme sector for better uptake of the scheme across the sector.