UPSC Articles

ECONOMY/ GOVERNANCE

Topic:

- GS-2: Government policies and interventions for development in various sectors

- GS-3: Indian Economy and challenges with regard to resource mobilization

The Limited Liability Partnership (Amendment) Bill, 2021

In news The Limited Liability Partnership (Amendment) Bill, 2021 has been recently passed in both the Houses of the Parliament.

- The Bill seeks to amend the Limited Liability Partnership Act, 2008.

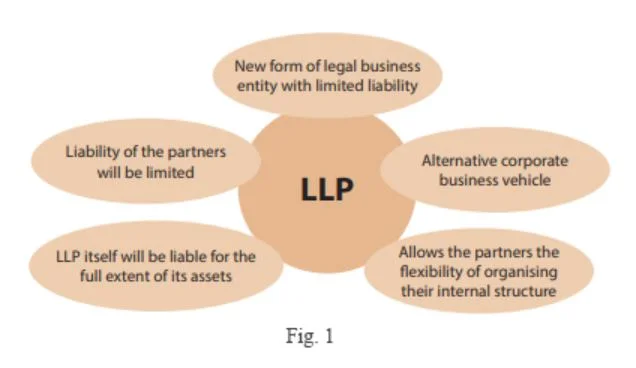

- A limited liability partnership (LLP) is a partnership in which some or all partners have limited liabilities.

- It therefore can exhibit elements of partnerships and corporations. In an LLP, each partner is not responsible or liable for another partner’s misconduct or negligence

- Under LLP, a partner’s liabilities are limited to their investment in the business.

What are Key features of the Bill?

- Certain offences decriminalised: The Bill decriminalises provisions and imposes a monetary penalty: (i) changes in partners of the LLP, (ii) change of registered office, (iii) filing of statement of account and solvency; (iv) arrangement between an LLP and its creditors or partners, and reconstruction or amalgamation of an LLP.

- Change of name of LLP: The Bill empowers the central government to allot a new name to such an LLP instead of levying a fine.

- Punishment for fraud: Under the Bill, if an LLP or its partners carry out an activity to defraud their creditors, every person party to it knowingly is punishable with maximum term of imprisonment up to five years

- Non-compliance of orders of Tribunal: Bill has removed the offence of non-compliance with an order of the National Company Law Tribunal (NCLT)

- Compounding of offences: The Bill provides that a regional director (or any officer above his rank), appointed by the central government, may compound such offences which are punishable only with a fine. The amount imposed must be within the minimum and maximum fine for the offence.

- Adjudicating Officers: Under the Bill, the central government may appoint adjudicating officers for awarding penalties under the Act. These will be central government officers not below the rank of Registrar.

- Special courts: The Bill allows the central government to establish special courts for ensuring speedy trial of offences under the Act.

- Appeals to Appellate Tribunal: Appeals against orders of the NCLT lie with the National Company Law Appellate Tribunal (NCLAT). Also, the appeals cannot be made against an order that has been passed with the consent of the parties. Appeals must be filed within 60 days (extendable by another 60 days) of the order.

- Small LLP: The Bill provides for formation of a small LLP where: (i) the contribution from partners is up to Rs 25 lakh (may be increased up to five crore rupees), (ii) turnover for the preceding financial year is up to Rs 40 lakh (may be increased up to Rs 50 crore). The central government may also notify certain LLPs as start-up LLPs.

- Standards of accounting: Under the Bill, the central government may prescribe the standards of accounting and auditing for classes of LLPs, in consultation with the National Financial Reporting Authority.

News Source: TH