UPSC Articles

INTERNATIONAL/ ECONOMY

- GS-2: Effect of policies and politics of developed and developing countries on India’s interests

Pandora Papers

What is Pandora Papers?

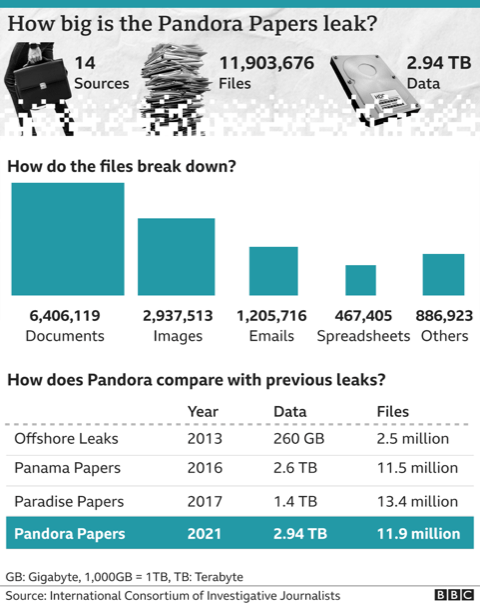

- The Pandora Papers is a leak of almost 12 million documents and files that reveals hidden wealth, tax avoidance and, in some cases, money laundering by some of the world’s rich and powerful.

- The data was obtained by the International Consortium of Investigative Journalists in Washington DC, which has been working with more than 140 media organisations and more than 600 journalists from 117 countries on its biggest ever global investigation.

- The ICIJ has also said that the “data trove covers more than 330 politicians and 130 Forbes billionaires, as well as celebrities, drug dealers, royal family members and leaders of religious groups around the world”.

Is this the first time that such financial papers have been leaked?

- Since at least 2008, files indicating the manipulations by the rich have been stolen from financial institutions.

- In 2008, a former employee of the LGT Bank of Liechtenstein offered information to tax authorities.

- Again in 2008, Hervé Falciani obtained confidential data on HSBC bank accounts from remote servers and gave the data to then French Finance Minister Christine Lagarde, who then passed it on to the various governments, including India.

- In 2017, the Paradise Papers were leaked out mostly from the more than 100-year-old offshore law firm, Appleby, which operates globally.

- In 2016, the Panama Papers were obtained by hacking the server of the Panamanian financial firm, Mossack Fonseca.

- The leaked documents from Luxembourg, the “Luxembourg Leaks”, appeared in 2014.

The modus operandi

- The leaked papers now and even earlier have exposed the international financial architecture and illicit financial flows.

- For instance, Panama Papers highlighted the template used in other tax havens. The Pandora Papers once again confirm this pattern.

- Tax havens enable the rich to hide the true ownership of assets by using: trusts, shell companies and the process of ‘layering’.

- The process of layering involves moving funds from one shell-company in one tax haven to another in another tax haven and liquidating the previous company. This way, money is moved through several tax havens to the ultimate destination.

- Since the trail is erased at each step, it becomes difficult for authorities to track the flow of funds.

- Financial firms offer their services to work this out for the rich. They provide ready-made shell companies with directors, create trusts and ‘layer’ the movement of funds. Only the moneyed can afford these services.

- It appears that most of the rich in the world use such manipulations to lower their tax liability even if their income is legally earned. Even citizens of countries with low tax rates use tax havens.

Implications

- Rise of Tax Havens: Over the three decades, tax havens have enabled capital to become highly mobile, forcing nations to lower tax rates to attract capital. This has led to the ‘race to the bottom’,

- Impairs Welfare Provision of Government: Layering of money through tax havens results in a shortage of resources with governments to provide public goods, etc., in turn adversely impacting the poor.

- Legally correct but morally wrong: Strictly speaking, not all the activity being exposed by the Pandora Papers may be illegal, however, it is morally wrong for the rich to evade taxes which could have otherwise the poor people.

- Complex Legal Process: The authorities will have to prove if the law of the land has been violated in each of these revelations. Each country will have to conduct its investigations and prove what part of the activity broke any of their laws.

- In the United Kingdom, the laws regarding financial dealings are very favourable to the rich and their manipulations.

- Misplaced Focus on Unorganised Sector: Indian Government’s focus on the unorganised sector as the source of black income generation is also misplaced since data indicate that it is the organised sector that has been the real culprit and also spirits out a part of its black incomes through Tax Havens & layering.

Conclusion

- An interesting recent development (October 8) has been the agreement among almost 140 countries to levy a 15% minimum tax rate on corporates. Though it is a long shot, this may dent the international financial architecture.

- Other steps needed to tackle the curse of illicit financial flows are ending banking secrecy and a Tobin tax on transactions.

Connecting the dots:

- Global Minimum Corporate Tax

- Base Erosion and Profit Sharing (BEPS)