UPSC Articles

ECONOMY/ GOVERNANCE

- GS-3: Indian Economy & Challenges

- GS-2: Government policies and interventions for development in various sectors and issues arising out of their design and implementation.

Expected Economic Recovery

Context: By October 2020, official data confirmed that the Indian economy had gone into a technical recession. But since then, the gross domestic product (GDP) has been clawing its way back.

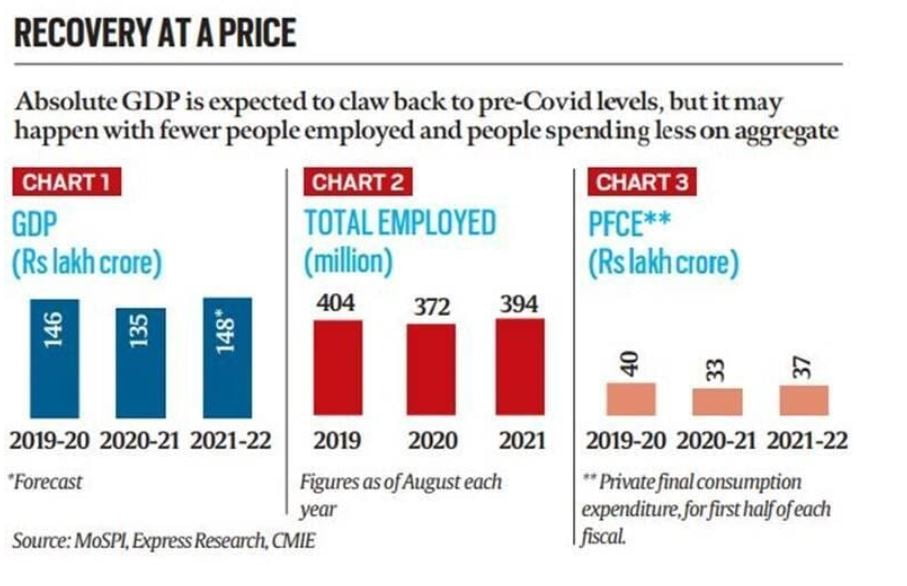

- Still, by the end of the financial year 2021-22, India’s GDP is expected to come back to the pre-Covid level. Given the severity of the second Covid wave, that is a matter of relief.

Pic courtesy: IE

K-shaped recovery

- The recovery has been K-shaped recovery. In simple terms, it means that while some sectors/ sections of the economy have registered a very fast recovery, many are still struggling.

- The entities that have done well are firms that were already in the formal sector and had the financial wherewithal to survive the repeated lockdowns and disruptions.

- In fact, many big firms in the formal economy have actually increased their market share during the Covid-19 pandemic and this has come at the cost of smaller, weaker firms that were mostly in the informal sector.

- On the face of it, this might appear to be a minor detail. But in India’s case, this shift has massive ramifications. That’s because almost 90% of all employment in India happens in the informal sector.

- When the medium, small and micro enterprises (MSMEs) lose out to their counterparts in the formal economy, it results in the same GDP being produced with fewer people in jobs.

Unemployment concerns

- That is what explains the odd nature of the challenge facing the Indian economy in 2022.

- While the GDP is expected to recover back to pre-Covid levels, the same cannot be said about total employment in the country (see the chart above).

- Not only was the total number of employed people as of August 2021 lower than the August 2019 level, the August 2019 level itself was lower than the August 2016 level — pointing to a stagnant employment situation over the past many years.

- For one, this means that even an easing of the situation will require time, because we are talking about tens of millions of unemployed people.

- Two, it requires the government to actively act in a manner that tries to address the change of shift introduced by Covid.

- Three, in the interim, such persistently high levels of unemployment can pose a challenge for social cohesion. As we witnessed in Haryana and Jharkhand, locals may demand laws to bar migrants from other states.

Private consumption slump

- Private consumption expenditure is the biggest engine of GDP growth in India. It accounts for over 55% of all GDP. If this component remains weak, sustained recovery in GDP will not be possible.

- To a great extent, it is down because of job and income losses. But in part, it also has to do with people wanting to hold back for a rainy day like in case of severe third wave.

Widening inequalities

- India stands out as a poor and very unequal country, with an affluent elite,” stated the World Inequality Report.

- While the top 10% and top 1% held respectively 57% and 22% of total national income, the bottom 50% share had gone down to 13%.

- What makes this trend even more worrisome is that higher inequalities now also come with rising poverty levels.

- A study (by Santosh Mehrotra and Jajati Parida) has found that between 2012 and 2020, India witnessed an increase in the absolute number of poor — the first such reversal in poverty alleviation since Independence.

Persistently high inflation

- Typically, there tends to be silver lining in phases when an economy is failing to create many jobs: The inflation rate stays low.

- But 2021 brought disappointment on that front as well. Between fast GDP growth in developed countries, higher crude oil prices and high domestic taxation, not to mention supply bottlenecks in different commodities, both retail and wholesale inflation stayed too high for comfort.

Indian economy: What lies ahead in 2022

Four factors that are likely to play a crucial role in how the economy shapes up in 2022:

- OMICRON: The expectation that 2022 will be the first normal year after 2019 completely depends on the impact of Omicron variant. If it turns out to be dangerous variant, then concerns about lives will yet again dominate those about livelihoods. A lot may depend again on the pace of vaccination — including the booster doses

- UNION BUDGET: Presuming no new Covid surges, the focus would shift to the Union Budget (on February 1, 2022). The government would be expected to lay out its plan to tackle high unemployment, high inflation, widening inequalities and rising poverty levels. But a lot depends on how the government sees the economic situation.

- Last year, for example, the government cut its Budget allocation for health by 10%.

- Former Chief Statistician of India Pronab Sen said, ”The government doesn’t seem to be recognising that (K-shaped recovery) at all in its pronouncements.” The government has been misdiagnosing the economy for the past five years, especially since demonetisation. That is what has resulted in formal sector firms increasing the market share at the cost of MSMEs.”

- This, in turn, gets reflected in both higher tax collections and lower employment levels.

- NPAs: Before Covid disrupted India’s economy, high levels of non-performing assets (NPAs) were one of the biggest stumbling blocks. During Covid, mandatory asset quality reviews have been suspended. But when they are re-started in 2022, it is expected to jump.

- EXTERNAL FACTORS: Several key central banks, especially the US Fed, have started tightening their monetary policy in light of the high inflation in the developed countries. This, in turn, will force India’s RBI to raise interest rates as well. To a great extent monetary tightening has already happened in India.

- If we look at the 10-year government bond yields. They have gone from 5.7% to 6.4% (since May 2020). For Indians, the silver lining is that as monetary tightening happens in the West, crude oil prices may simmer down.